Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

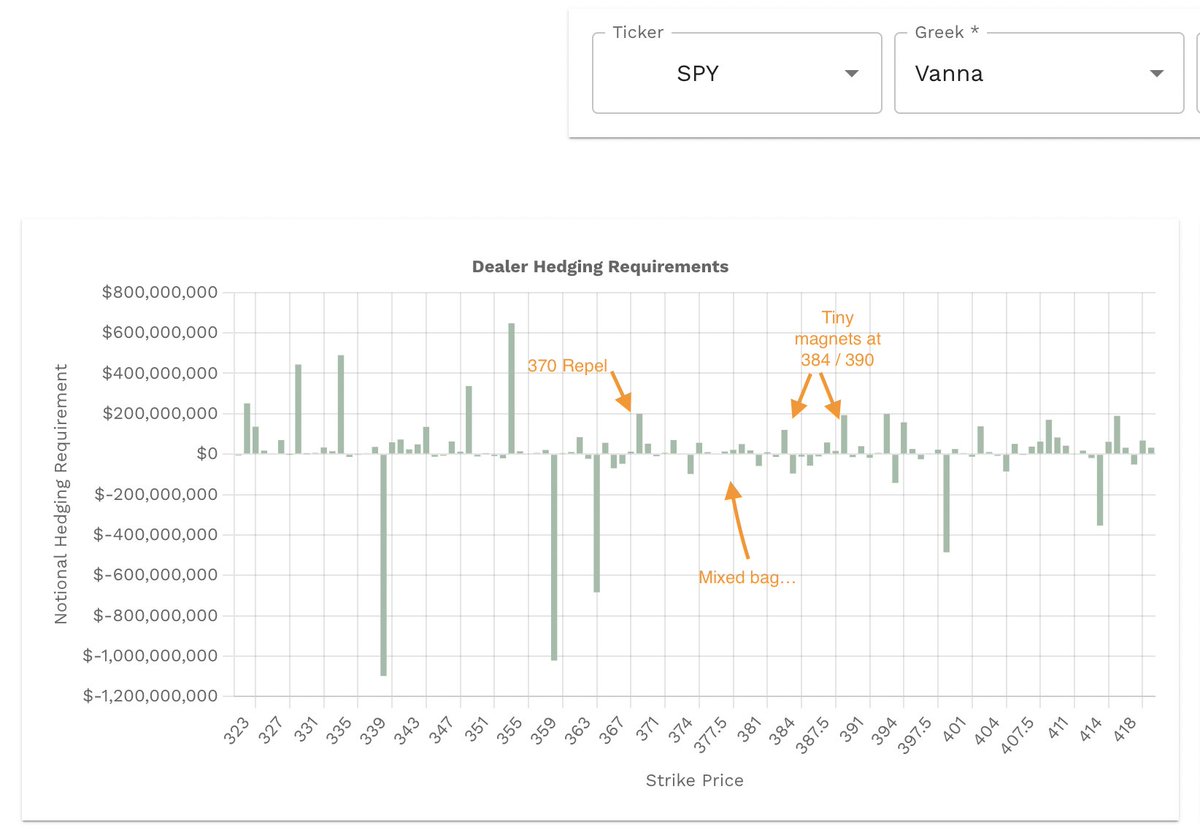

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps Vol.land. The $SPX Vanna impact is minimal at these levels. Gamma is cluttered, with small amounts of support/resistance scattered in this zone. Could indicate more of a range day.

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Vanna/Gamma also a bit of a choppy mess. Scattered weak levels in this zone. The 3-day Deltas indicate highest probability of staying in a range.

@Tradytics Dark Pools help paint the the picture further. Lower DP volume and mixed sentiment help indicate a potential fixed range as well.

Now, take a look at 5-day market net flow and delta positioning across the market. Puts continue to accumulate, most likely for downside protection. Market wide deltas remain bearish, however negative deltas have diminished slightly.

Lastly, we need to make sure we keep all the upcoming macro number releases in mind as they are the big fundamental drivers of the market. We have jobless claims tomorrow but the big one is PCE on Friday. This may indicate why there is a lack of participation.

I find that CPI gets more attention than PCE when it comes to macro numbers, however PCE is very important and pertains to businesses. Worth a read if you're unfamiliar.

bls.gov/osmr/research-….

bls.gov/osmr/research-….

With PCE on Friday and the dealer/dark pool structure looking like this, I wouldn't be surprised to see consolidation within $SPY $380 - $390 until Friday. These times can be the trickiest to trade.

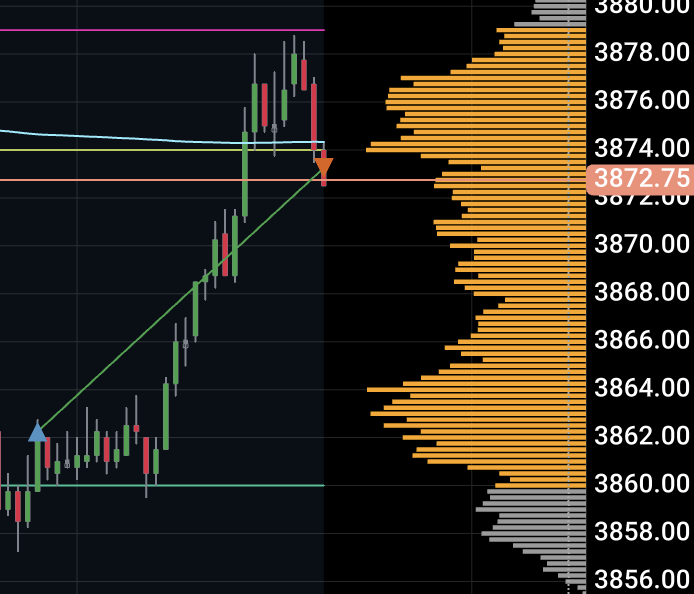

On $ES, I'm looking to make my money within the first couple hours. Would love to see a retest of Asia/London highs, however if we don't get it, will look for new opportunities.

If you are interested in viewing & using this data plus more with hundreds of other assets, use coupon code FattyTrades for discounts with Vol.land, Tradytics, Sonarlabs indicators & Elite Trader Fund funded futures accounts!

• • •

Missing some Tweet in this thread? You can try to

force a refresh