Real-life claim

The customer suffered deductions of 48K on a 1 L claim in an employer policy

1.07 L Bill 👉🏻 45K deduction 👉🏻 56K claim received

Reason:

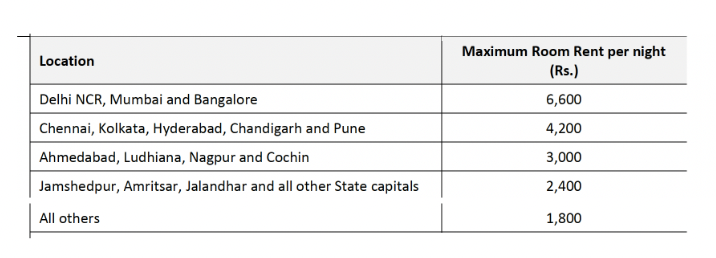

1. Room Rent limit of Rs. 1800 for a hospital in Thane (4Km away from Mumbai limits)

2. 20% Copay

#CompanyCoverNotEnough

The customer suffered deductions of 48K on a 1 L claim in an employer policy

1.07 L Bill 👉🏻 45K deduction 👉🏻 56K claim received

Reason:

1. Room Rent limit of Rs. 1800 for a hospital in Thane (4Km away from Mumbai limits)

2. 20% Copay

#CompanyCoverNotEnough

That's precisely the reason why @BeshakIN we recommend people should never solely depend on employer insurance.

a. You are not in control of the terms.

b. It's linked to your employment.

c. It can become super difficult to get a comprehensive cover once you have an illness.

a. You are not in control of the terms.

b. It's linked to your employment.

c. It can become super difficult to get a comprehensive cover once you have an illness.

For people who work in fancy startups with fancy policies today that have zero limits, and conditions, please note that all policies start fancy because the founder wants to give everything, and the insurer is also excited

Only till losses creep in after a few years.

Only till losses creep in after a few years.

Once the insurer starts seeing losses during renewals, renewal premiums are brutally hiked.

That's when your company's CFO steps in and has to cut benefits to keep costs within defined budgets.

That's when policies like the one we see in the first tweet get designed.

That's when your company's CFO steps in and has to cut benefits to keep costs within defined budgets.

That's when policies like the one we see in the first tweet get designed.

Side note:

If you are a founder of a startup and want to introduce health insurance as a benefit, I would strongly recommend you set pragmatic limits on the benefits, right in the beginning.

This will ensure you don't shock your team with sudden curtailment in benefits later.

If you are a founder of a startup and want to introduce health insurance as a benefit, I would strongly recommend you set pragmatic limits on the benefits, right in the beginning.

This will ensure you don't shock your team with sudden curtailment in benefits later.

🙌🏻 Thank you for the response to this tweet.

If you are ever looking for free 1-to-1 professional consultation for insurance from industry experts, do hit us at beshak.org

If you are ever looking for free 1-to-1 professional consultation for insurance from industry experts, do hit us at beshak.org

• • •

Missing some Tweet in this thread? You can try to

force a refresh