We just discovered Caroline Ellison and Gary Wang turned on @SBF_FTX, rattling him out to the Feds. The SEC’s civil (non-criminal) complaint is built on their participation and gives us our first “insider’s account” of the FTX disaster.

I’ve given you 12 key takeaways below:👇🧵

I’ve given you 12 key takeaways below:👇🧵

1. It is what we thought:

• SBF lied

• Wang built a back door to FTX for Alameda to sweep funds

• Caroline ran Alameda (Sam’s personal fund)

• Sam invested in real estate, politicians, and venture capital 😅

• SBF lied

• Wang built a back door to FTX for Alameda to sweep funds

• Caroline ran Alameda (Sam’s personal fund)

• Sam invested in real estate, politicians, and venture capital 😅

2. 💥 Sam told me to do it

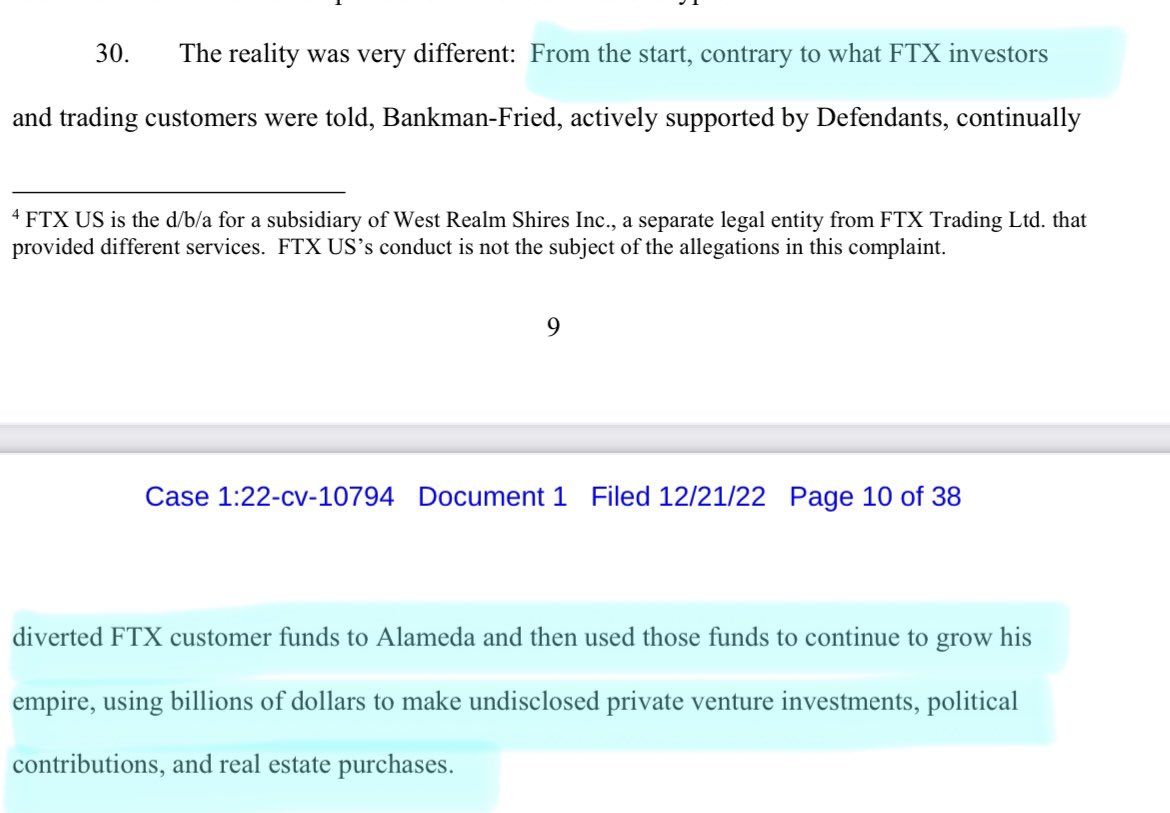

Caroline says Sam directed her to take customer funds from FTX in exchange for the made-up $FTT shitcoin. (In green highlight) This directly contradicts Sam’s repeated “I didn’t know” statements.

Caroline is wisely throwing Sam under the bus. twitter.com/i/web/status/1…

Caroline says Sam directed her to take customer funds from FTX in exchange for the made-up $FTT shitcoin. (In green highlight) This directly contradicts Sam’s repeated “I didn’t know” statements.

Caroline is wisely throwing Sam under the bus. twitter.com/i/web/status/1…

3. May 2022: Shit Hits the Fan

Despite already having “borrowed” billions and billions of FTX customer assets, by May, when crypto went bump in the night, Alameda (Sam) couldn’t fulfill its borrower obligations.

Sam ordered Caroline to take even more FTX customer money.

Despite already having “borrowed” billions and billions of FTX customer assets, by May, when crypto went bump in the night, Alameda (Sam) couldn’t fulfill its borrower obligations.

Sam ordered Caroline to take even more FTX customer money.

4. “Brazen, Multi-Year Scheme”

The violations peaked in 2022, but began years ago…from the start of FTX. This wasn’t a recent accident. It was a multi-year fraud.

The violations peaked in 2022, but began years ago…from the start of FTX. This wasn’t a recent accident. It was a multi-year fraud.

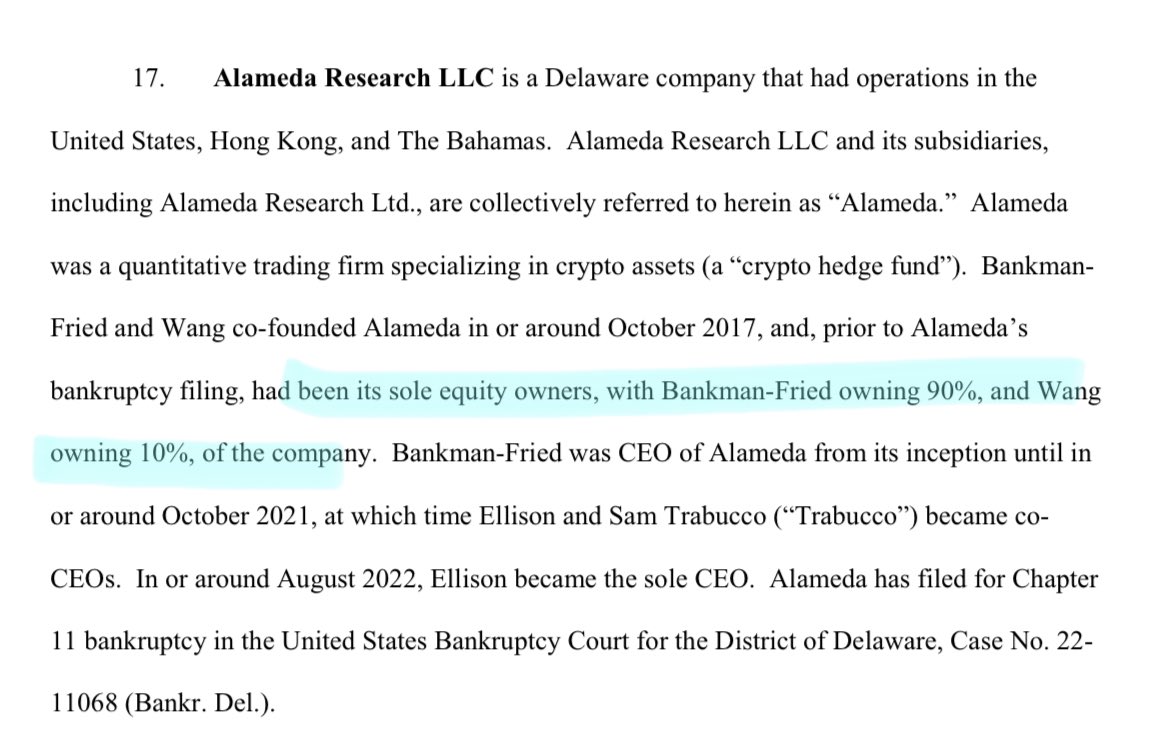

5. Sam and Gary Own 100% of Alameda

Anytime someone says “Alameda,” just substitute “Sam.”

Sam owns 90% of Alameda and Gary 10%. Alameda has no clients - all that money is Sam and Gary’s, stolen fair and square.

Anytime someone says “Alameda,” just substitute “Sam.”

Sam owns 90% of Alameda and Gary 10%. Alameda has no clients - all that money is Sam and Gary’s, stolen fair and square.

6. Sam was ALWAYS in Control

Even after naming Caroline and Sam Trabucco as Co-CEOs of Alameda in 2021, Sam remained in absolute control.

He frequently communicated with Alameda peeps and had full access to its books and records.

Alameda *IS* Sam, so this makes sense.

Even after naming Caroline and Sam Trabucco as Co-CEOs of Alameda in 2021, Sam remained in absolute control.

He frequently communicated with Alameda peeps and had full access to its books and records.

Alameda *IS* Sam, so this makes sense.

7. Alameda (Sam) was Exempted from FTX’s Risk Management Process

As has been widely discussed, FTX had a decent risk-engine, it just didn’t apply to its biggest user: Sam himself (via Alameda).

At least Sam posted high-quality SamCoins - $FTT - as collateral. 😅

As has been widely discussed, FTX had a decent risk-engine, it just didn’t apply to its biggest user: Sam himself (via Alameda).

At least Sam posted high-quality SamCoins - $FTT - as collateral. 😅

8. Sam CREATED Alameda’s Deal and Took Actions to Hurt FTX

Over $8 BILLION of customer funds were wired by customers DIRECTLY TO ALAMEDA rather than FTX.

Eight. Billion.

This was a de facto loan. Sam ensured Alameda (Sam) did NOT have to pay FTX interest on that money.

Over $8 BILLION of customer funds were wired by customers DIRECTLY TO ALAMEDA rather than FTX.

Eight. Billion.

This was a de facto loan. Sam ensured Alameda (Sam) did NOT have to pay FTX interest on that money.

9. Securities Fraud

Among the many frauds Sam et al committed was the securities fraud.

The SEC frowns on poorly written footnotes. Imagine how it treats you lying to would-be investors about your fraud to raise fresh equity.

“Fraud squared,” or something.

Among the many frauds Sam et al committed was the securities fraud.

The SEC frowns on poorly written footnotes. Imagine how it treats you lying to would-be investors about your fraud to raise fresh equity.

“Fraud squared,” or something.

10. Magic Money in a Box was a “Security”😬

SamCoins, ShitCoins, Web3 “tokens,” magic beans. Call em what you want, but they’re entirely fabricated from dreams.

And Sam lied about them.

A lot.

And they “manipulated” the price of $FTT.

And the SEC declares it a security.👀

SamCoins, ShitCoins, Web3 “tokens,” magic beans. Call em what you want, but they’re entirely fabricated from dreams.

And Sam lied about them.

A lot.

And they “manipulated” the price of $FTT.

And the SEC declares it a security.👀

Quick Aside (unrelated to FTX): if tokens are securities, many, MANY people broke the law. Entrepreneurs, promoters, and - yikes! - prominent venture capitalists. I’d watch out here. We may see VCs in handcuffs…

11. Undocumented Personal Loans in the Billions

If you have your fund “borrow” customer brokerage assets, then “lend” those from your fund to yourself, but you don’t document the loan, is it even a loan? Doesn’t that just make it money laundering?

Say it with me: “RICO.”

If you have your fund “borrow” customer brokerage assets, then “lend” those from your fund to yourself, but you don’t document the loan, is it even a loan? Doesn’t that just make it money laundering?

Say it with me: “RICO.”

12. FTX Customers Withdrew $5 Billion in ONE DAY 😮

It also had history’s all-time least surprising $8 billion shortfall. Oops!

It also had history’s all-time least surprising $8 billion shortfall. Oops!

End:

That’s the SEC civil complaint summary - the criminal complaints will have more.

The most fascinating part to me is the implications beyond FTX’s shores (see the “Quick Aside” before #11).

If you enjoyed, please Like, RT, & Follow.

Here’s an earlier FTX thread. 🙏

That’s the SEC civil complaint summary - the criminal complaints will have more.

The most fascinating part to me is the implications beyond FTX’s shores (see the “Quick Aside” before #11).

If you enjoyed, please Like, RT, & Follow.

Here’s an earlier FTX thread. 🙏

https://twitter.com/compound248/status/1598446656634191872

Source to SEC complaint:

sec.gov/litigation/com…

sec.gov/litigation/com…

Here’s what the US Souther District of New York had to say on the matter:

https://twitter.com/compound248/status/1605749962372964352

Dude 2500x’d his wealth in the last 3-weeks. Legend.

https://twitter.com/compound248/status/1606002085832466433

Too many people think this is real:

https://twitter.com/compound248/status/1606005290754838535

• • •

Missing some Tweet in this thread? You can try to

force a refresh