22 Crypto Lessons Learned in 2022 (avoid these costly mistakes):

Locking Tokens isn't Worth it

ve style locking mechanisms became popular in DeFi

You lock your tokens up for a while, and you gain extra yield or utility in exchange

Some people watched their locked tokens go down by -90% in the bear market

I prefer keeping my tokens liquid

ve style locking mechanisms became popular in DeFi

You lock your tokens up for a while, and you gain extra yield or utility in exchange

Some people watched their locked tokens go down by -90% in the bear market

I prefer keeping my tokens liquid

There's no "Smart Money"

All the "smartest" people in the room didn't know shit (3AC, Alameda, VCs)

Chess skills, MIT degrees, and cheat codes weren't enough to stop greed and bad risk management

Don't invest in a project just because a big name backs them

All the "smartest" people in the room didn't know shit (3AC, Alameda, VCs)

Chess skills, MIT degrees, and cheat codes weren't enough to stop greed and bad risk management

Don't invest in a project just because a big name backs them

Nothing's Too Big to Fail

• 3AC

• FTX

• Luna

There was a feeling that if things collapsed, a larger company would come bail them out

1) There weren't any government bailouts

2) There's no fund big enough to rescue some of these companies

The companies were big and failed

• 3AC

• FTX

• Luna

There was a feeling that if things collapsed, a larger company would come bail them out

1) There weren't any government bailouts

2) There's no fund big enough to rescue some of these companies

The companies were big and failed

Question the Treasury Practices

A protocol's treasury is its life blood - no money means no more protocol

1) 3AC secretly managed a few protocol treasuries

2) Some founders were secretly trading with their treasuries

Bad treasury management practices ruined good projects

A protocol's treasury is its life blood - no money means no more protocol

1) 3AC secretly managed a few protocol treasuries

2) Some founders were secretly trading with their treasuries

Bad treasury management practices ruined good projects

Are Protocols Built for the Bear?

Bull market's easy, but not every protocol can survive a crypto winter.

Ask:

1) Is their treasury diversified outside of its native token?

2) Do they have enough runway to survive 2+ years?

3) Are their costs reasonable?

Bull market's easy, but not every protocol can survive a crypto winter.

Ask:

1) Is their treasury diversified outside of its native token?

2) Do they have enough runway to survive 2+ years?

3) Are their costs reasonable?

Protect Yourself if There's Insolvency Rumours

• "steady lads"

• "the chance of FTX insolvency is near 0%"

Bank run? None of your concern

When shit's about to hit the fan, protect your funds. No one else is going to do it for you

• "steady lads"

• "the chance of FTX insolvency is near 0%"

Bank run? None of your concern

When shit's about to hit the fan, protect your funds. No one else is going to do it for you

https://twitter.com/thedefiedge/status/1589606651358810113

Cult of Personalities

"Power tends to corrupt; absolute power corrupts absolutely"

Every single main character fell this year

• Daniele Sesta

• Do Kwon

• Zhu Su

• SBF

You can ride with them on the way up but get off the 🚀 before the inevitable crash

"Power tends to corrupt; absolute power corrupts absolutely"

Every single main character fell this year

• Daniele Sesta

• Do Kwon

• Zhu Su

• SBF

You can ride with them on the way up but get off the 🚀 before the inevitable crash

Algorithmic Stablecoins Remain a Pipedream

• UST collapsed

• Bean Exploited

• FEI / USN shutdown

• USDN / USDD are trading below its peg

People will keep trying to make these experiments work

I rather hold fiat backed stablecoins and watch the algocoins from far away

• UST collapsed

• Bean Exploited

• FEI / USN shutdown

• USDN / USDD are trading below its peg

People will keep trying to make these experiments work

I rather hold fiat backed stablecoins and watch the algocoins from far away

Cross-chain Bridges are Dangerous

Vitalik warned us about security issues with cross chain bridges

• Axie's Ronin Bridge ($624m)

• Solana's Wormhole ($326m)

• Harmony Bridge ($100m)

• Nomad Bridge ($190m)

You're adding on additional risk when using a cross-chain bridge

Vitalik warned us about security issues with cross chain bridges

• Axie's Ronin Bridge ($624m)

• Solana's Wormhole ($326m)

• Harmony Bridge ($100m)

• Nomad Bridge ($190m)

You're adding on additional risk when using a cross-chain bridge

There's No Such Thing as Free Yield

• 20% Anchor UST

• 5% Bitcoin Yield through CeFi

Companies marketed these products as if they were as safe as banks

The yield came at the cost of high risk (-100%)

It's perfectly fine to hold coins in cold storage & not earn any yield

• 20% Anchor UST

• 5% Bitcoin Yield through CeFi

Companies marketed these products as if they were as safe as banks

The yield came at the cost of high risk (-100%)

It's perfectly fine to hold coins in cold storage & not earn any yield

Crypto's Still Tied to Macro

Ethereum's merge was one of the biggest technological achievements in Crypto

Unfortunately, the macro headwinds were too strong for ETH to fly away

The fed's policies and interest rate decisions dictate Crypto's marketcap for now

Ethereum's merge was one of the biggest technological achievements in Crypto

Unfortunately, the macro headwinds were too strong for ETH to fly away

The fed's policies and interest rate decisions dictate Crypto's marketcap for now

Be Careful of Halo Effects

• SBF was on the cover of Forbes

• FTX bailed out BlockFi / Voyager

• FTX sponsored Arenas and A-list athletes

The Halo Effect meant people weren't doing their due diligence

Nobody asks the tough questions if you throw enough money around

• SBF was on the cover of Forbes

• FTX bailed out BlockFi / Voyager

• FTX sponsored Arenas and A-list athletes

The Halo Effect meant people weren't doing their due diligence

Nobody asks the tough questions if you throw enough money around

Don't Try to Time the Exact Tops or Bottoms

You'll never have perfect timing, and trying to time things can be detrimental

A simpler strategy is to DCA out in a bull market, and DCA in during a bear market

Keep it simple

You'll never have perfect timing, and trying to time things can be detrimental

A simpler strategy is to DCA out in a bull market, and DCA in during a bear market

Keep it simple

Bear Market Plays

There are still some plays in a bear market.

We saw the real yield narrative take off around the Summer. People early to GMX and GNS were heavily rewarded.

There are fewer narratives in the bear - being sidelined until the macro improves works too.

There are still some plays in a bear market.

We saw the real yield narrative take off around the Summer. People early to GMX and GNS were heavily rewarded.

There are fewer narratives in the bear - being sidelined until the macro improves works too.

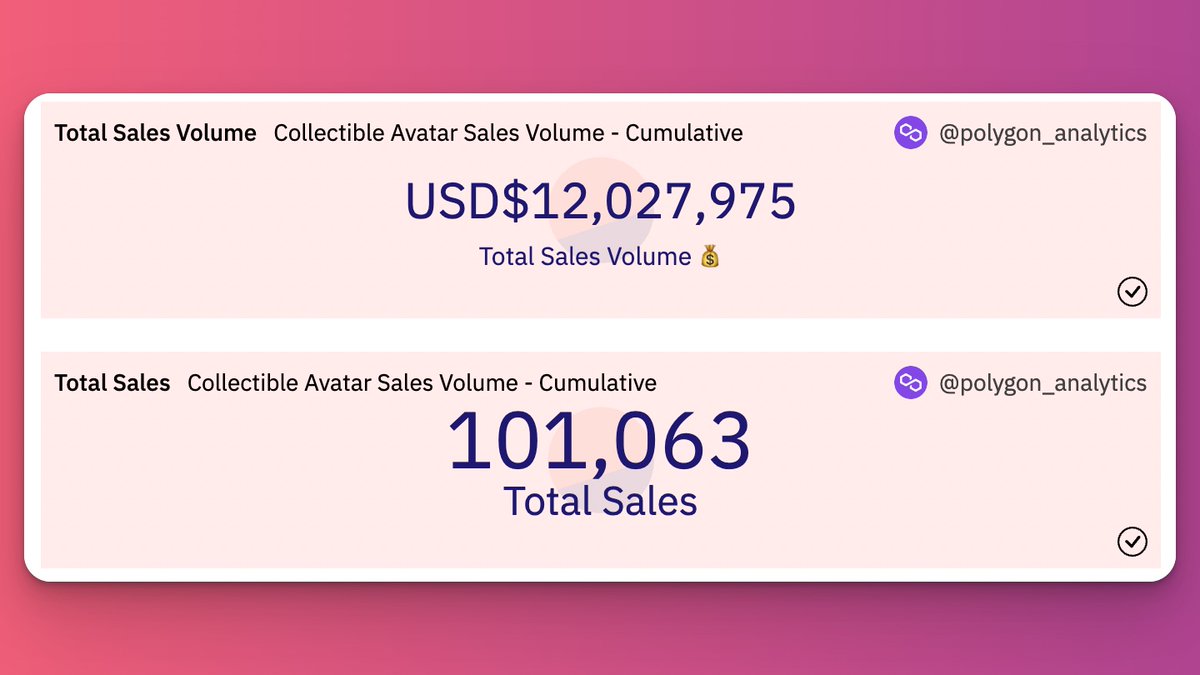

Adoption Happens when Crypto's Invisible

Most people on Reddit HATE anything related to Crypto

Yet Reddit's "Collectible Avatars" sold out

The key is to deliver value while making the crypto part invisible and frictionless

Most people on Reddit HATE anything related to Crypto

Yet Reddit's "Collectible Avatars" sold out

The key is to deliver value while making the crypto part invisible and frictionless

ETH Layer 2s are Here to Stay

Ethereum Layer 2s are siphoning TVL from Alt L1s

(Both Arbitrum and Optimism are in the top 10)

zk rollups such as Starknet and zkSync are coming.

The future seems to be a battle between ETH layer 2s and app chains

Ethereum Layer 2s are siphoning TVL from Alt L1s

(Both Arbitrum and Optimism are in the top 10)

zk rollups such as Starknet and zkSync are coming.

The future seems to be a battle between ETH layer 2s and app chains

Extended Cycles Theories

Historically, Crypto operates in 4-year cycles.

Near the end of the cycle, you'll see people try to extend it.

• S2F charts

• The "Supercycle"

• Bitcoin Lengthening Theory

People are financially incentivized to make you think it'll last longer.

Historically, Crypto operates in 4-year cycles.

Near the end of the cycle, you'll see people try to extend it.

• S2F charts

• The "Supercycle"

• Bitcoin Lengthening Theory

People are financially incentivized to make you think it'll last longer.

If You Don't Know the Source of Yield, You're the Source

Do you remember all those node projects? No one could answer where the yield was coming from

The yield was from newer entrants

Make sure you understand how value is generated before investing

Do you remember all those node projects? No one could answer where the yield was coming from

The yield was from newer entrants

Make sure you understand how value is generated before investing

History Doesn't Repeat Itself, but it Often Rhymes

• Mt. Gox → FTX

• Bitconnect → Terra Luna

We'll have exchanges collapse in the next cycle

We'll have a new class of cult leaders

It's hard to change human nature

It's up to us to warn the next generation

• Mt. Gox → FTX

• Bitconnect → Terra Luna

We'll have exchanges collapse in the next cycle

We'll have a new class of cult leaders

It's hard to change human nature

It's up to us to warn the next generation

Seek the FUD

It can feel like an echo chamber when a token's hot.

The mob mentality makes it hard to have honest discussions.

• They attack your character

• They dig up any old tweets that can be used against you

Seek the FUD when you're investing

It can feel like an echo chamber when a token's hot.

The mob mentality makes it hard to have honest discussions.

• They attack your character

• They dig up any old tweets that can be used against you

Seek the FUD when you're investing

https://twitter.com/gametheorizing/status/1599384220325277700

People Failed - DeFi Didn't

The biggest diasters this year were failures by people: greed, risk management, fraud, and bad decision making.

When CeFi companies were insolvent, DeFi loans were the first one they paid back.

Trust code instead of humans

The biggest diasters this year were failures by people: greed, risk management, fraud, and bad decision making.

When CeFi companies were insolvent, DeFi loans were the first one they paid back.

Trust code instead of humans

Finally...Not Your Keys, Not Your Coins

It looks like we'll have to learn this lesson every single cycle.

Any coins on an exchange is an "IOU."

A token isn't yours unless a hardware wallet secures it.

(I'm using a Ledger Nano X now, but eager to try out the new Stax)

It looks like we'll have to learn this lesson every single cycle.

Any coins on an exchange is an "IOU."

A token isn't yours unless a hardware wallet secures it.

(I'm using a Ledger Nano X now, but eager to try out the new Stax)

The craziest year in Crypto (so far)

These are some of the lessons I've learned.

It's a little FTX / Luna heavy because they affected the industry the most in 2022.

Share some of your biggest lessons this year in the comments!

These are some of the lessons I've learned.

It's a little FTX / Luna heavy because they affected the industry the most in 2022.

Share some of your biggest lessons this year in the comments!

1. I took a few months off from writing threads, but I'm back now. Make sure you're following @thedefiedge so you don't miss out on my future ones.

2. If you like Tweets like this, sign up for my weekly newsletter for exclusive content

Subscribe here: TheDeFiEdge.com

2. If you like Tweets like this, sign up for my weekly newsletter for exclusive content

Subscribe here: TheDeFiEdge.com

Bonus

As DeFi becomes more complex, the number of ways we can get fucked keeps getting more creative.

• Liquidation Cascades

• The DFK Jewel Exploit

• Insider, non-obvious exploits

• "Highly Profitable Trading Strategies"

• Slow rugs (High salaries and lack of updates)

As DeFi becomes more complex, the number of ways we can get fucked keeps getting more creative.

• Liquidation Cascades

• The DFK Jewel Exploit

• Insider, non-obvious exploits

• "Highly Profitable Trading Strategies"

• Slow rugs (High salaries and lack of updates)

• • •

Missing some Tweet in this thread? You can try to

force a refresh