Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps Vol.land. The $SPX dealer involvement is still very light. See screenshots for small impacts various Vanna/Gamma levels will have.

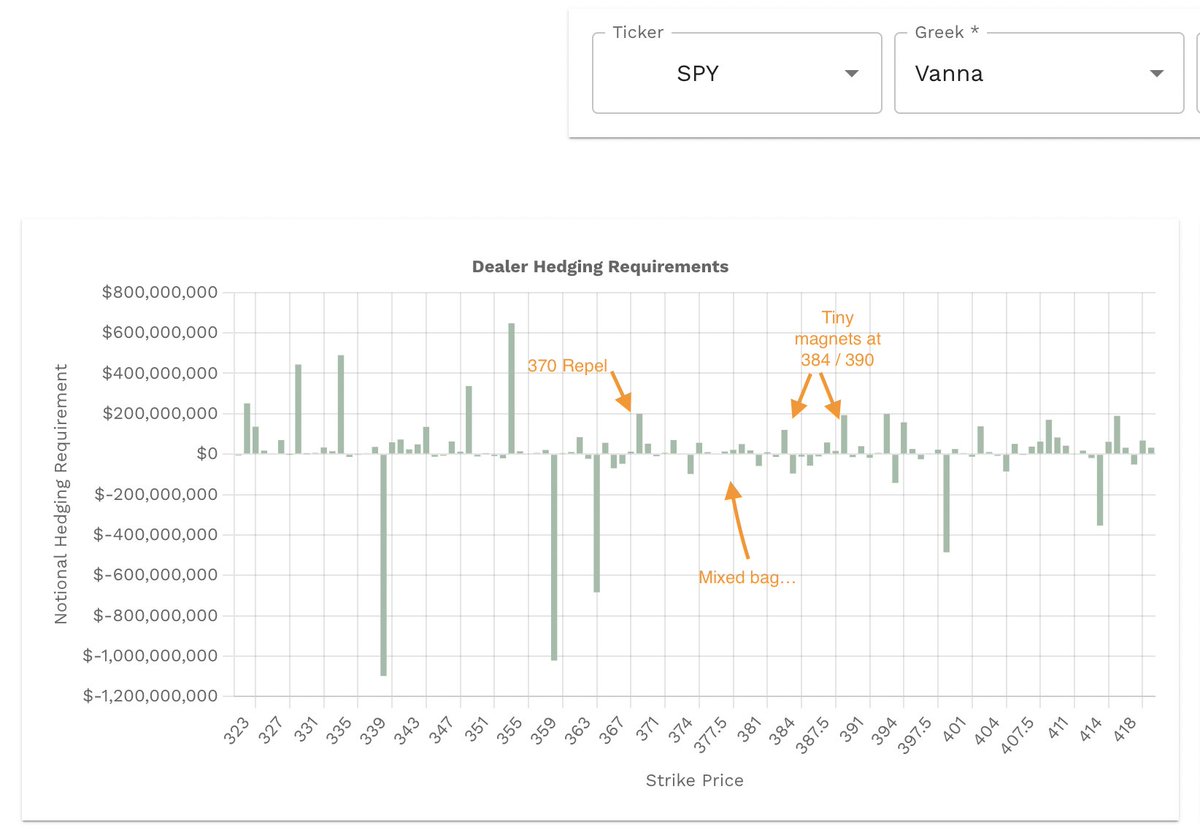

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Vanna/Gamma also very light. See screenshots for small impacts. The delta correlations indicate range. The 15-day delta momentum flipped bearish (-0.05679).

@Tradytics $SPY Dark Pools help paint the the picture further. Sig prints "magnet" prints occurred @ $380.6. Lots so support around there with overall sentiment from block trades being bearish. DP Density shows ~$380 as very cluttered.

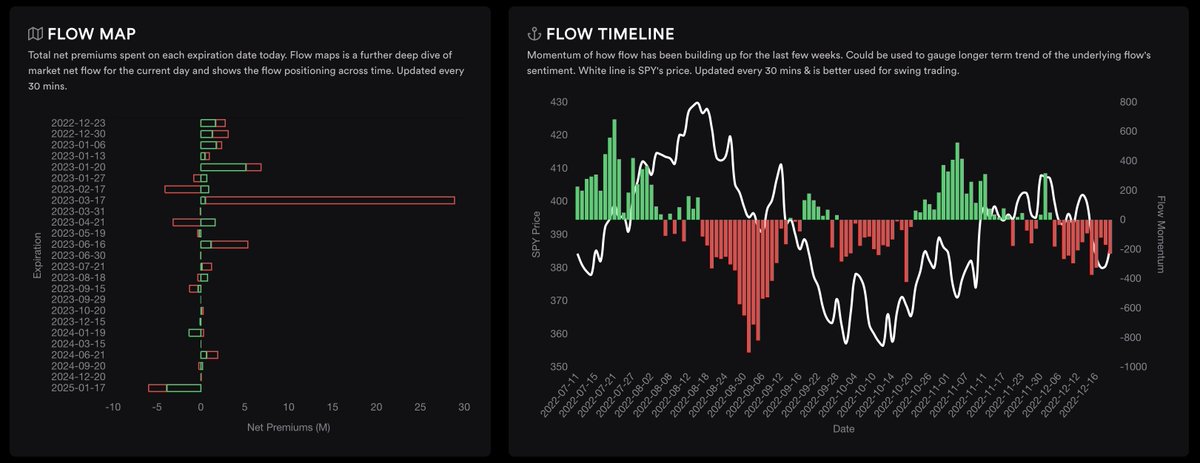

Now, take a look at 5-day market net flow and delta positioning across the market. Puts continue to accumulate, most likely for downside protection. Market wide deltas shifted down as well. Flow divergences also showing mostly bearish.

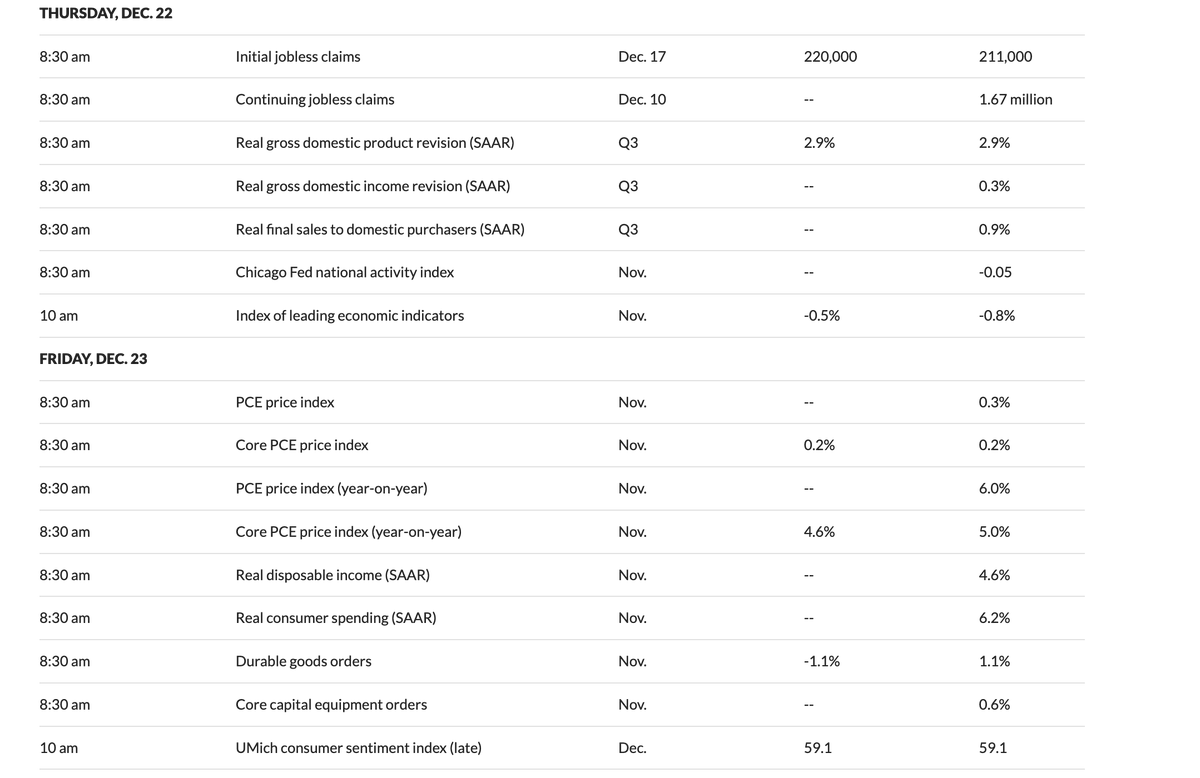

Lastly, we need to make sure we keep all the upcoming macro number releases in mind as they are the big fundamental drivers of the market. We had jobless claims this morning, with PCE tomorrow. Jobless claims caused a nice sell off that is still going on $ES / $NQ.

As of now I am currently holding short positions on $NQ and will watch for a bottom on $SPY potentially around $380 - $381. At this point we just need to play the trend until we see a bottoming patterns emerge that get retested and hold.

If you are interested in viewing & using this data plus more with hundreds of other assets, use coupon code "FattyTrades" for discounts with Vol.land, Tradytics, Sonarlabs indicators & Elite Trader Fund funded futures accounts!

• • •

Missing some Tweet in this thread? You can try to

force a refresh