Public market performance of AI-enabled drug developers (a subset of the #TechBio space)

How they've performed (and why they've struggled):

How they've performed (and why they've struggled):

Following several high-profile IPOs, shares of AI-enabled drug developers (AIDD) briefly peaked in Q1'21, before underperforming every quarter thereafter

Collective underperformance of this group:

vs. XBI: (~52%)

vs. NBI (~69%)

vs. S&P (~74%)

What happened?

Collective underperformance of this group:

vs. XBI: (~52%)

vs. NBI (~69%)

vs. S&P (~74%)

What happened?

Given the entire subsector has moved downwards in tandem, we can first look at macro factors:

(1) Generalist and retail investors fled the space: if we use the ARK Genomic Revolution ETF as a proxy for retail sentiment, we see a strong correlation with AIDD performance

(1) Generalist and retail investors fled the space: if we use the ARK Genomic Revolution ETF as a proxy for retail sentiment, we see a strong correlation with AIDD performance

A market downturn will cause investors to reduce their risk profile, and thus earlier stage and platform-driven stories will lose favor vs. late-stage, product-driven companies

We saw this de-risking happen across all industries, not just biotech (Source: Atlas Venture)

We saw this de-risking happen across all industries, not just biotech (Source: Atlas Venture)

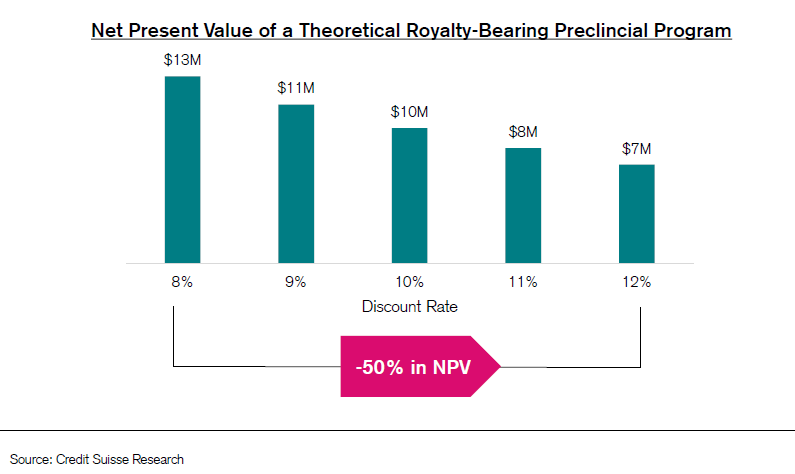

(2) Rising interest rates: due to being earlier-stage, the majority of value will be realized far in the future

As a result, these names are highly sensitive to rising rates as their future cash flows are discounted to present value at a higher factor

As a result, these names are highly sensitive to rising rates as their future cash flows are discounted to present value at a higher factor

(3) Lack of data-driven catalysts and uncertainty on how to value these relatively unvalidated platforms

These companies went public at huge valuations with preclinical or early clinical programs - as is common in biotech, no news is bad news, so investors turned elsewhere

These companies went public at huge valuations with preclinical or early clinical programs - as is common in biotech, no news is bad news, so investors turned elsewhere

$RLAY and $SDGR performed better than their peers likely because they were easier to value:

- $RLAY - Solid Ph1. data

- $SDGR - >$150M in rev, high growth DD platform

Of note, drug discovery enablers w/o proprietary programs (i.e. $ABSI, $EVO and $ABCL) led the way down

- $RLAY - Solid Ph1. data

- $SDGR - >$150M in rev, high growth DD platform

Of note, drug discovery enablers w/o proprietary programs (i.e. $ABSI, $EVO and $ABCL) led the way down

(4) Jack of all trades, master of none

These companies lack a clear ownership base which introduces long-term stability issues

The engineering / tech-driven approach creates a lot of platform risk for traditional bio funds that prefer first-in-class / best-in-class assets

These companies lack a clear ownership base which introduces long-term stability issues

The engineering / tech-driven approach creates a lot of platform risk for traditional bio funds that prefer first-in-class / best-in-class assets

But, the inherent biological risk, binary clinical trial outcomes and long revenue cycles can deter tech investors

So who should own this as a core portfolio position for the long haul?

With more public biotech co's than ever before to pick from, that can be a tough question

So who should own this as a core portfolio position for the long haul?

With more public biotech co's than ever before to pick from, that can be a tough question

High-conviction anchor investors are critical to provide a low cost of capital for long-term R&D & value creation (Bruce @LifeSciVC has flagged this before)

Below case study of Seagen / Baker Bros illustrates this - BB always stepped up for FOs & when the stock was declining

Below case study of Seagen / Baker Bros illustrates this - BB always stepped up for FOs & when the stock was declining

@LifeSciVC (5) Investors are awaiting more PoC

The focus for AIDD the past few years has been on laying down tech infrastructure, securing partnerships and growing proprietary data sets

Over the next 12-24 months, several catalysts are expected that could generate excitement

Source: MS

The focus for AIDD the past few years has been on laying down tech infrastructure, securing partnerships and growing proprietary data sets

Over the next 12-24 months, several catalysts are expected that could generate excitement

Source: MS

@LifeSciVC Investors will closely monitor these readouts to assess platform PoC and differentiation

Positive results will readthrough to the space

The quality, quantity and success of big pharma partnerships will also remain an important proxy

Positive results will readthrough to the space

The quality, quantity and success of big pharma partnerships will also remain an important proxy

https://twitter.com/andrewpannu/status/1602028967934021636?s=20&t=7RnsCxHryN3ucS1wuNYlFw

@LifeSciVC While the space certainly went through a period of being "over-hyped", it would be a mistake to dismiss it altogether

Most platforms, drug programs and companies are too early to draw firm conclusions

Recall Amara's Law tells us to think long-term with new tech

Most platforms, drug programs and companies are too early to draw firm conclusions

Recall Amara's Law tells us to think long-term with new tech

@LifeSciVC Quick plug: If you're interested in learning more about the #TechBio space, consider checking out the Decoding TechBio substack from @patricksmalone, @ameekapadia & the rest of the team

A great weekly summary & balanced perspective on everything happening in the space

A great weekly summary & balanced perspective on everything happening in the space

@LifeSciVC @patricksmalone @ameekapadia That's all for now - I plan to do a deep-dive on how to value these and other #TechBio companies in the future

If you enjoyed this, follow me @andrewpannu for more biotech charts, musings and breakdowns

If you enjoyed this, follow me @andrewpannu for more biotech charts, musings and breakdowns

• • •

Missing some Tweet in this thread? You can try to

force a refresh