daily dose of biotech & healthcare commentary • founder @sleuthinsights • building software for the bioeconomy

2 subscribers

How to get URL link on X (Twitter) App

Inherent product instability / decay requires systems optimized for speed. This means rapid processing, shipping and deployment of fragile or radioactive materials. It also means special procedures and infrastructure are needed from production to delivery

Inherent product instability / decay requires systems optimized for speed. This means rapid processing, shipping and deployment of fragile or radioactive materials. It also means special procedures and infrastructure are needed from production to delivery

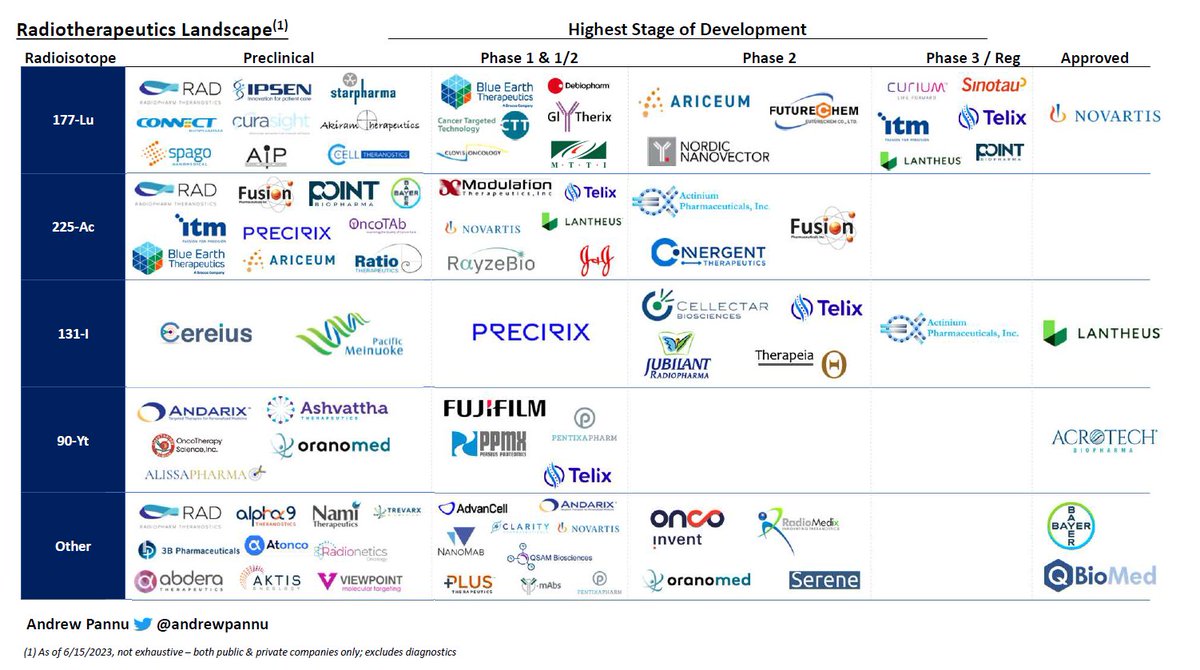

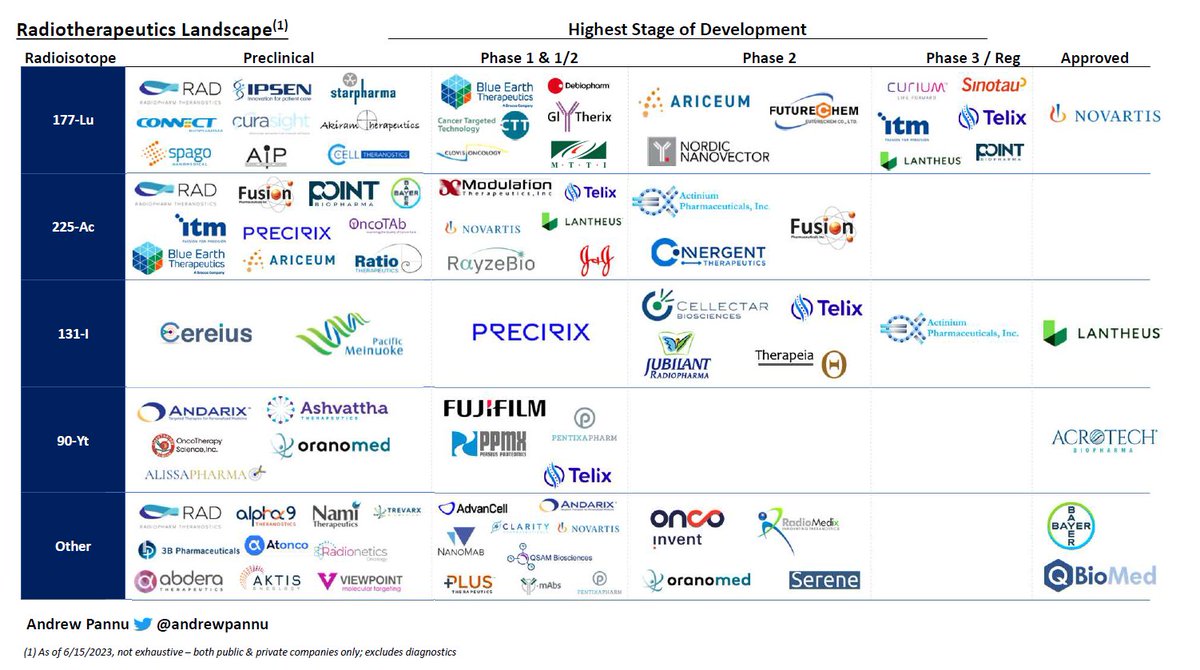

The analysis above is just a sample of the overall activity in the space - there are 450+ programs across 200+ companies, the vast majority of which are very early (~60% are preclinical and majority of clinical assets are in Ph 1/2). This also excludes gene editing approaches.

The analysis above is just a sample of the overall activity in the space - there are 450+ programs across 200+ companies, the vast majority of which are very early (~60% are preclinical and majority of clinical assets are in Ph 1/2). This also excludes gene editing approaches.

Obesity refresher:

Obesity refresher:

In the context of therapeutics, gene editing is the insertion, deletion or replacement of sections of a patient's DNA to treat disease

In the context of therapeutics, gene editing is the insertion, deletion or replacement of sections of a patient's DNA to treat disease

What was once a dormant space has seen rapid growth over the past few years

What was once a dormant space has seen rapid growth over the past few years

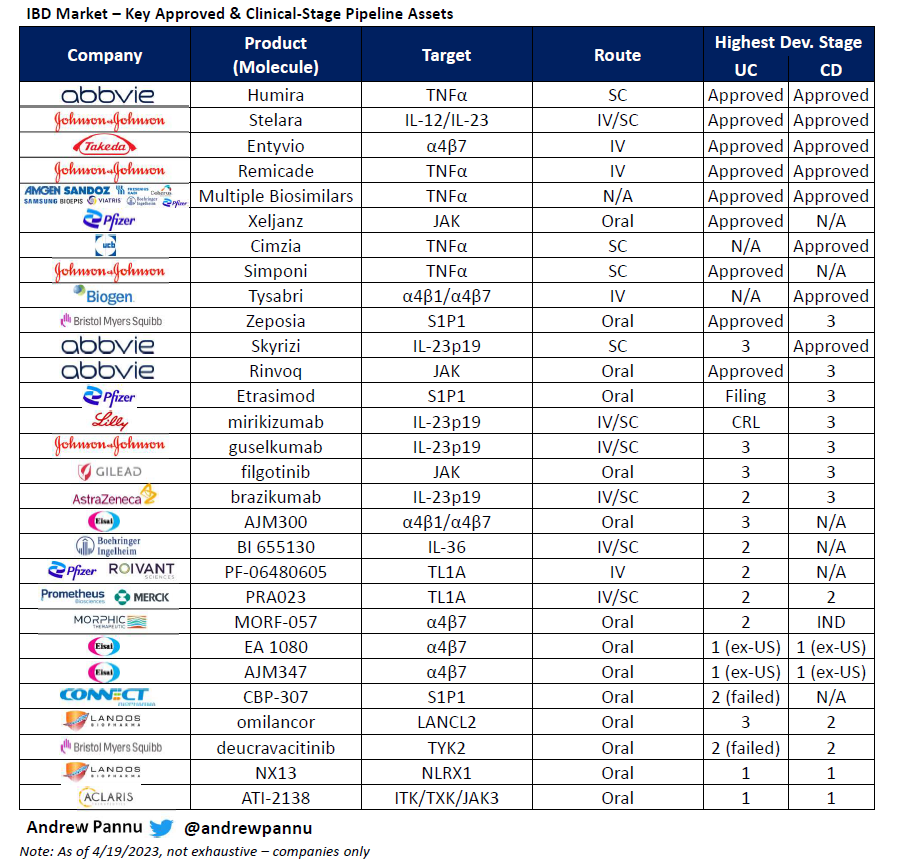

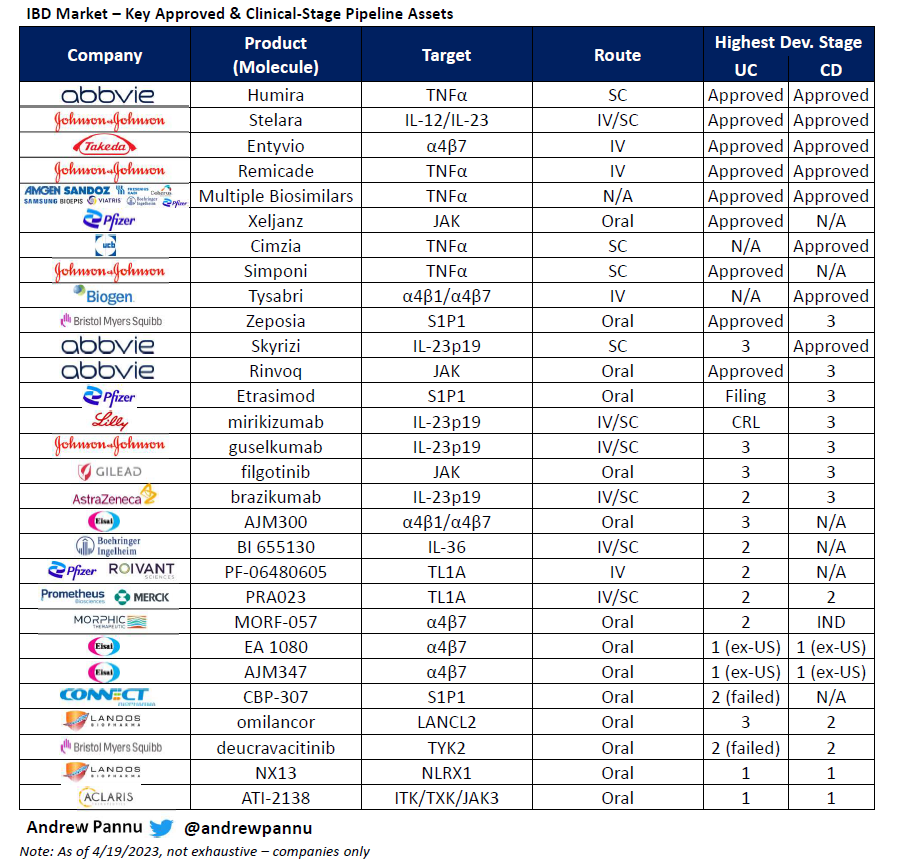

IBD (inflammatory bowel diseases) are recurrent, chronic inflammatory conditions of the GI track

IBD (inflammatory bowel diseases) are recurrent, chronic inflammatory conditions of the GI track

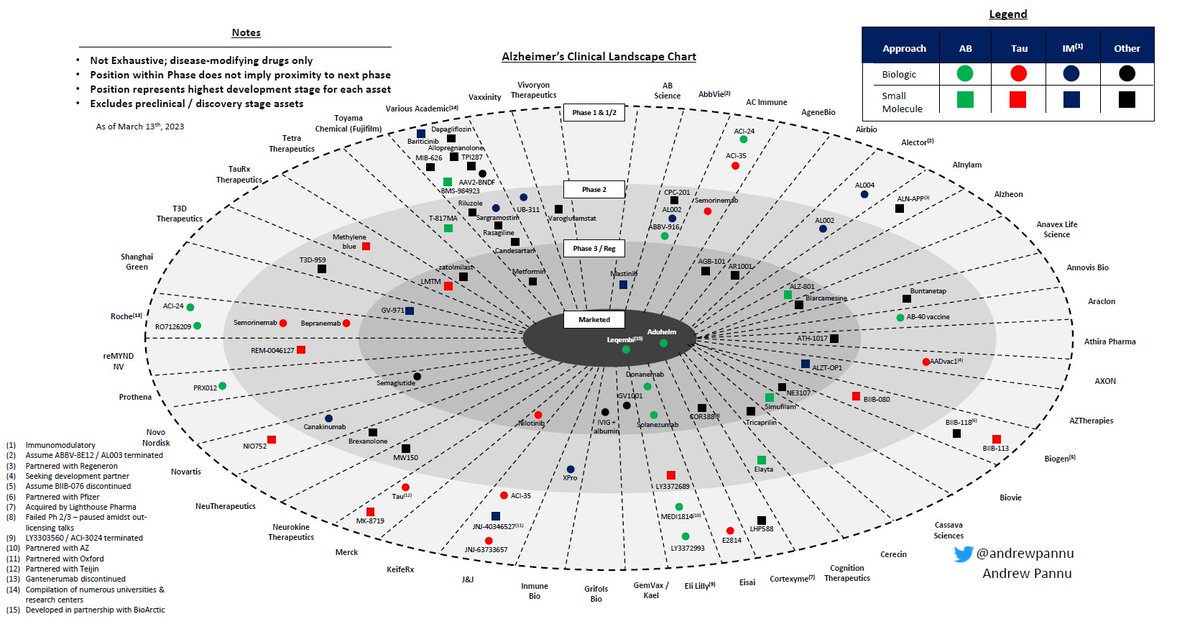

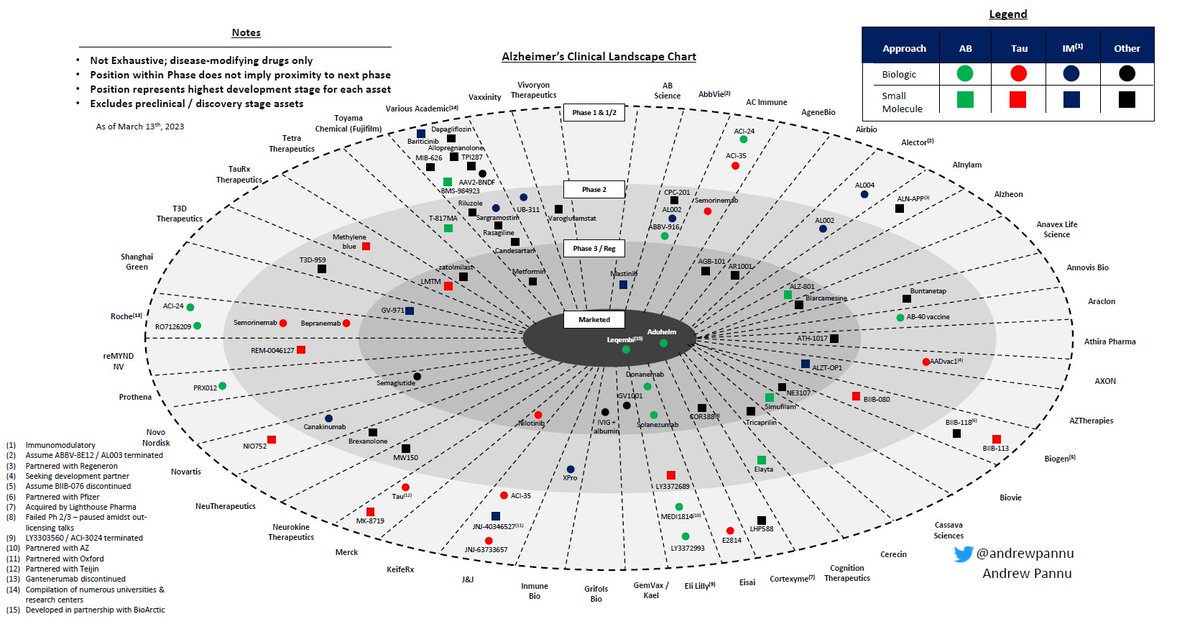

Alzheimer's disease (AD) is a progressive neurological disorder that destroys brain cells, resulting in dementia

Alzheimer's disease (AD) is a progressive neurological disorder that destroys brain cells, resulting in dementia

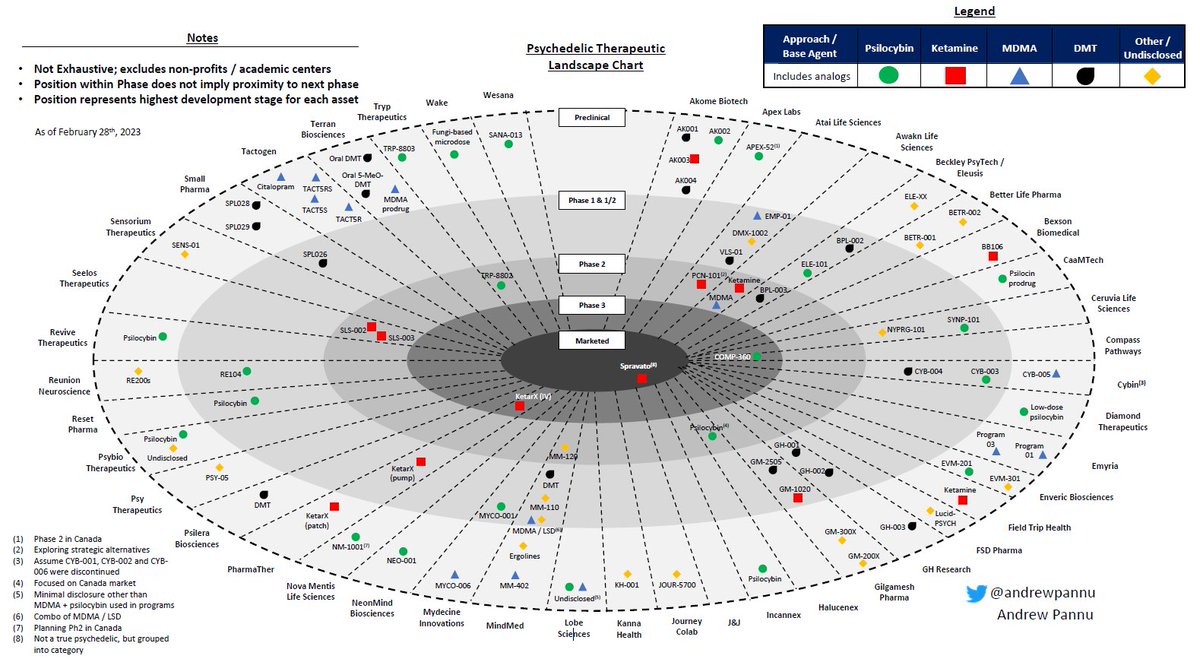

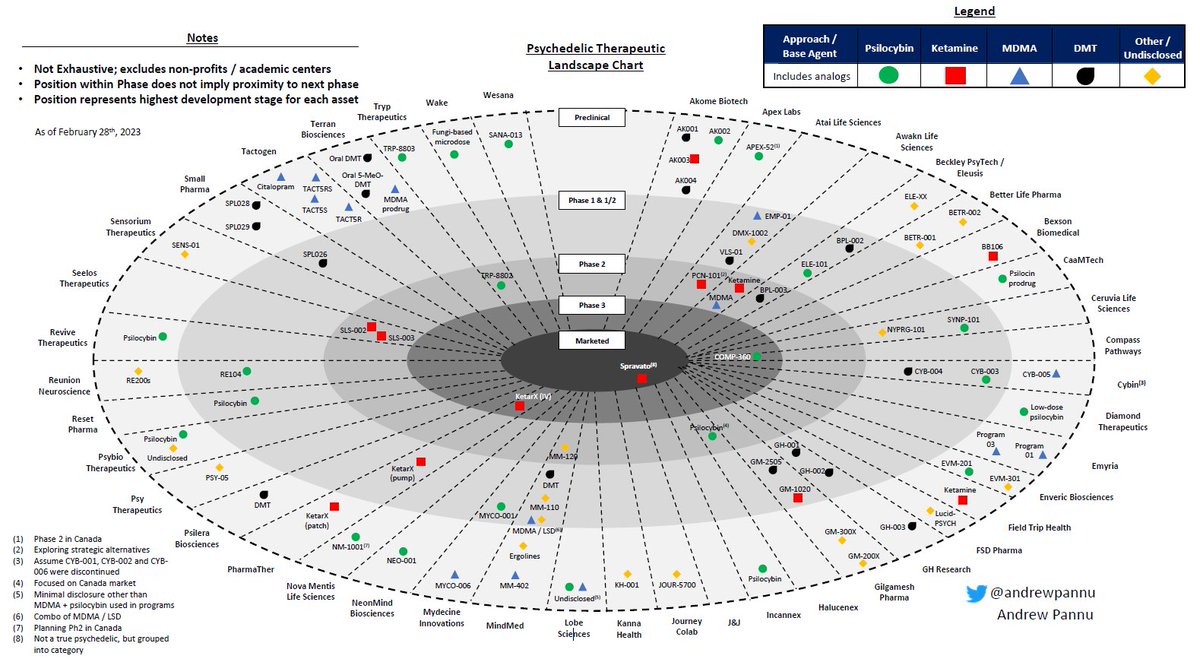

First, let's define psychedelics

First, let's define psychedelics

The above analysis is not exhaustive: there are >350 developmental gene therapies across >115 companies

The above analysis is not exhaustive: there are >350 developmental gene therapies across >115 companies

Obesity primer:

Obesity primer:

I pulled together the initial list above based on big pharma exposure to the NASH / metabolic space and then gave each a score based on these criteria:

I pulled together the initial list above based on big pharma exposure to the NASH / metabolic space and then gave each a score based on these criteria:

After Gilead / Kite (2017) and Celgene / Juno (2018), M&A has been slow, aided by a robust IPO market from 2019-2021

After Gilead / Kite (2017) and Celgene / Juno (2018), M&A has been slow, aided by a robust IPO market from 2019-2021

Keep in mind, this is not the entire cell therapy landscape, but a good snapshot of clinical progress & key assets

Keep in mind, this is not the entire cell therapy landscape, but a good snapshot of clinical progress & key assets