2022 was a sad and dramatic year. Energy was a main battlefront in the economic war of attrition between Russia and the pro-Ukrainian coalition.

A (highly selective) month-by-month recap 🧵

A (highly selective) month-by-month recap 🧵

PRELUDE - SUMMER 2021

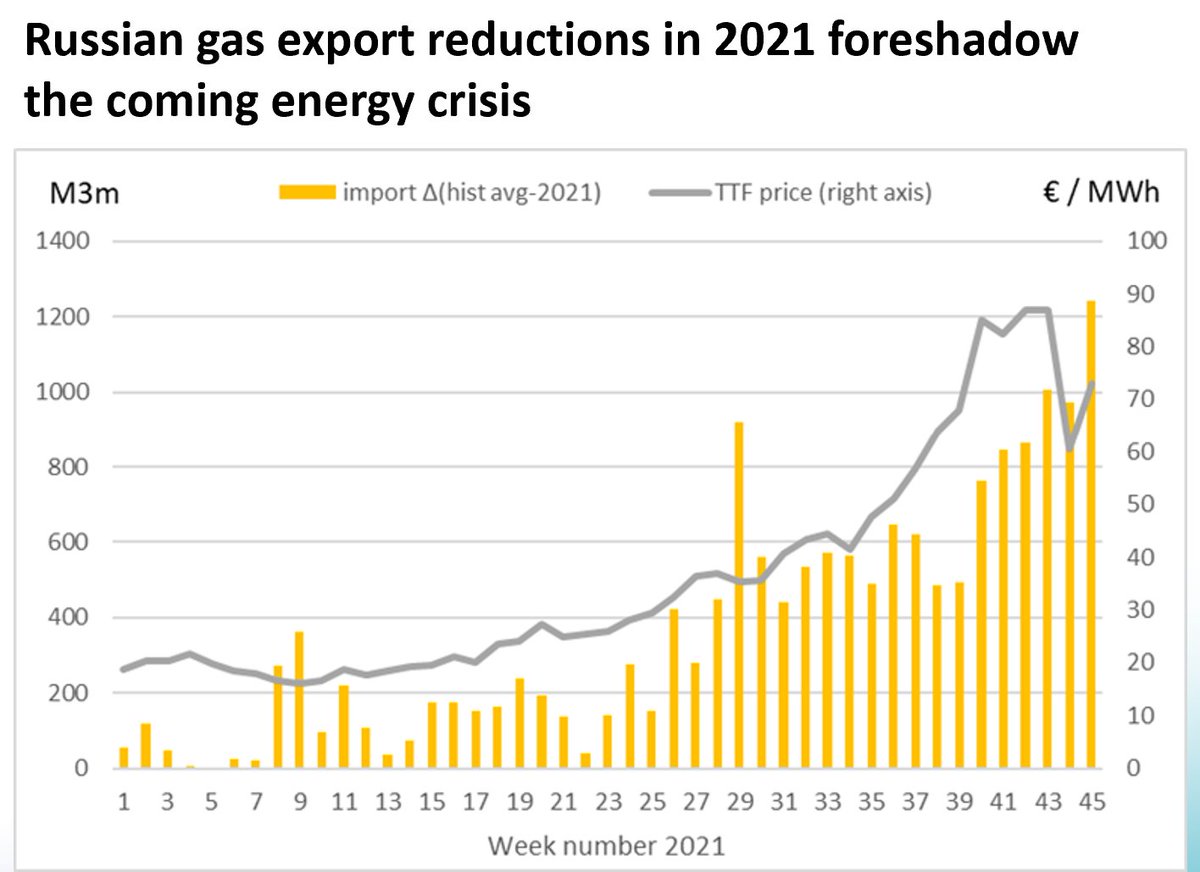

Russian manipulation of European natural gas markets started in summer 2021. Gazprom’s withholding of supplies marked the beginning of an energy crisis with substantially rising prices.

Russian manipulation of European natural gas markets started in summer 2021. Gazprom’s withholding of supplies marked the beginning of an energy crisis with substantially rising prices.

JANUARY 2022

While Russia concentrated more troops around Ukraine, it also ensured that EU gas storages remained empty, while teasing supplies through NordStream2.

While Russia concentrated more troops around Ukraine, it also ensured that EU gas storages remained empty, while teasing supplies through NordStream2.

FEBRUARY 2022

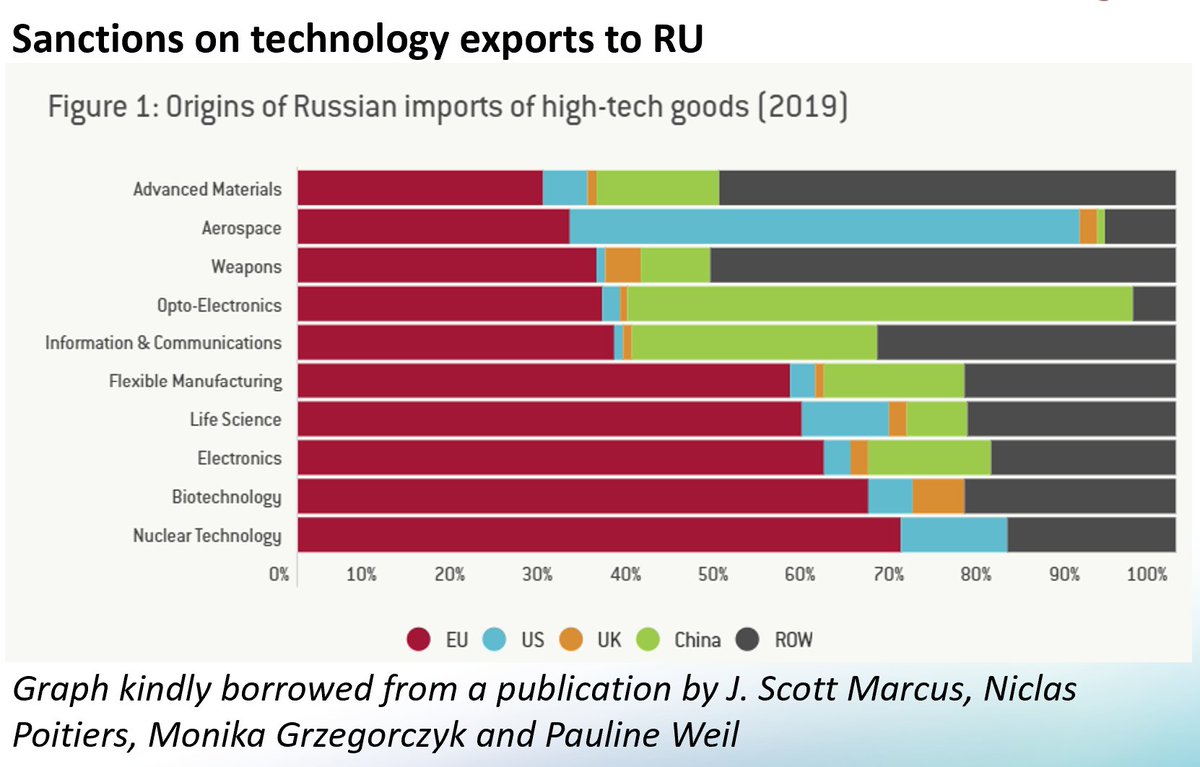

-After Feb24th, EU&US imposed technology-export sanctions that undermine the long-term prospects of Russia’s energy sector.

-But, RU banks involved in energy trading were excluded from financial sanctions by the West.

-After Feb24th, EU&US imposed technology-export sanctions that undermine the long-term prospects of Russia’s energy sector.

-But, RU banks involved in energy trading were excluded from financial sanctions by the West.

MARCH 2022

-US&UK announced bans on RU oil, coal and gas.

-To frustrate Western financial sanctions, RU demanded payments for gas in RUB. PL refused – and imports through Yamal stopped on 29Mar.

-US&UK announced bans on RU oil, coal and gas.

-To frustrate Western financial sanctions, RU demanded payments for gas in RUB. PL refused – and imports through Yamal stopped on 29Mar.

APRIL 2022

The 5th EU sanction package bans imports of RU coal that represented more than half of the EU-imports by that time.

The 5th EU sanction package bans imports of RU coal that represented more than half of the EU-imports by that time.

MAY 2022

- around ½ of French nuclear reactors are offline sending 1Q23 peak-futures to 1000€/MWh.

- The European Commission published REPowerEU – acknowledging the need for faster RES deployment

- around ½ of French nuclear reactors are offline sending 1Q23 peak-futures to 1000€/MWh.

- The European Commission published REPowerEU – acknowledging the need for faster RES deployment

JUNE 2022

-The 6th sanctions package on oil, oil products and related services was agreed to become active in Dec/Feb.

-On 14Jun Gazprom claimed that #NordStream1 was partly constrained (SiemensEnergy turbine in Canada)

-The 6th sanctions package on oil, oil products and related services was agreed to become active in Dec/Feb.

-On 14Jun Gazprom claimed that #NordStream1 was partly constrained (SiemensEnergy turbine in Canada)

JULY 2022

Summer droughts and problems on the French nuclear fleet force the European power sector to rely more on coal and gas.

Both wind and solar contribute to ease the situation.

Summer droughts and problems on the French nuclear fleet force the European power sector to rely more on coal and gas.

Both wind and solar contribute to ease the situation.

AUGUST 2022

The coal embargo kicks in.

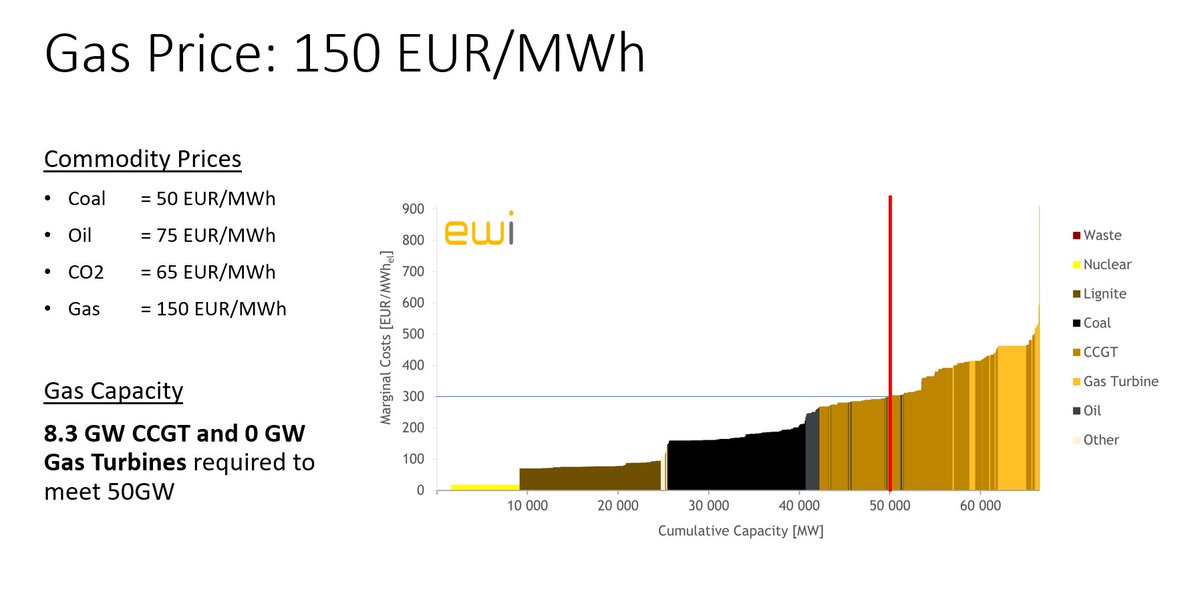

After Gazprom announces further maintenance works on NordStream1 the TTF-price peaks at more than 340 EUR/MWh by the end of the month.

The coal embargo kicks in.

After Gazprom announces further maintenance works on NordStream1 the TTF-price peaks at more than 340 EUR/MWh by the end of the month.

SEPTEMBER 2022

-On the 2nd the G7 confirmed the price cap on Russian oil.

-On the 3rd Gazprom indefinitely suspended flows through NordStream

-On the 26th both branches of NS1 and one branch of NS2 were destroyed.

-On the 2nd the G7 confirmed the price cap on Russian oil.

-On the 3rd Gazprom indefinitely suspended flows through NordStream

-On the 26th both branches of NS1 and one branch of NS2 were destroyed.

OCTOBER 2022

Strong gas demand reduction thanks to warm weather and behavioral change muted worries over the winter-supply situation.

Strong gas demand reduction thanks to warm weather and behavioral change muted worries over the winter-supply situation.

NOVEMBER 2022

The energy policy debate shifts 𝗳𝗿𝗼𝗺 𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆 𝘁𝗼 𝗮𝗳𝗳𝗼𝗿𝗱𝗮𝗯𝗶𝗹𝗶𝘁𝘆. As not all MS can fiscally shield consumers against skyrocketing energy cost, calls for market interventions get louder.

The energy policy debate shifts 𝗳𝗿𝗼𝗺 𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆 𝘁𝗼 𝗮𝗳𝗳𝗼𝗿𝗱𝗮𝗯𝗶𝗹𝗶𝘁𝘆. As not all MS can fiscally shield consumers against skyrocketing energy cost, calls for market interventions get louder.

DECEMBER 2022

-Price 𝗰𝗮𝗽 for all RU crude oil exports and EU embargo on imports of RU crude kicks in.

-EU sets 𝗰𝗮𝗽 for the TTF-gas price (180 €/MWh)

-Price 𝗰𝗮𝗽 for all RU crude oil exports and EU embargo on imports of RU crude kicks in.

-EU sets 𝗰𝗮𝗽 for the TTF-gas price (180 €/MWh)

Please allow us to wish you a happy Christmas and relaxing end to what was a sad and dramatic year.

We are looking forward to a more positive 2023.

We are looking forward to a more positive 2023.

• • •

Missing some Tweet in this thread? You can try to

force a refresh