𝗡𝗶𝗳𝘁𝘆-𝗕𝗮𝗻𝗸𝗻𝗶𝗳𝘁𝘆 𝗢𝗽𝘁𝗶𝗼𝗻 𝗕𝘂𝘆𝗶𝗻𝗴 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆

Complete Backtest and Indicator link

🧵 A Thread 🧵

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

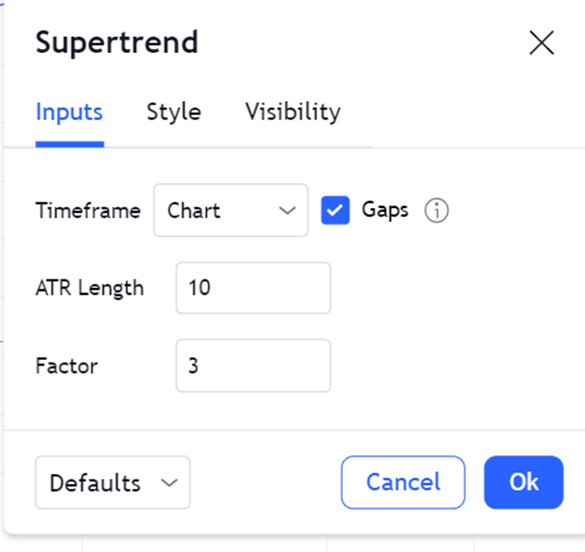

🔸 Supertrend and MA Settings

[3/18]

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 in.tradingview.com/script/B11r9V4…

[4/18]

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 in.tradingview.com/script/B11r9V4…

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

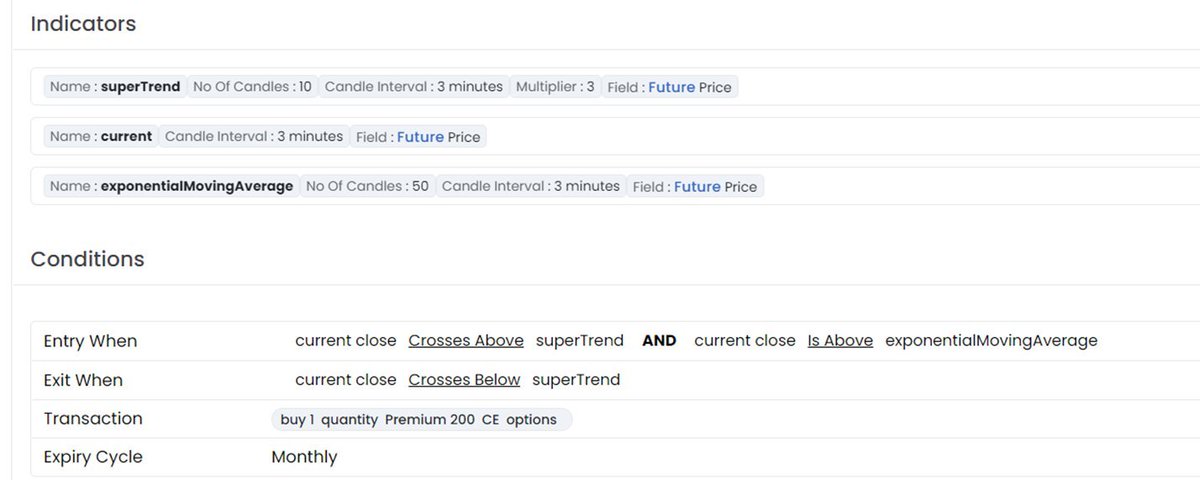

𝗖𝗘 𝗕𝘂𝘆 𝗥𝘂𝗹𝗲𝘀

🔸 Time Frame:3 min

🔸 Buy only when

🔸 Banknifty/Nifty is above 50 ema

🔸 Supertrend gives buy and candle closes above Supertrend

🔸 Enter on next candle opening

🔸 Take Entry only from 9:20 to 3:00 pm

🔸 Universal exit at 3:00

🔸 Premium Range 200

[6/18]

🔸 Time Frame:3 min

🔸 Buy only when

🔸 Banknifty/Nifty is above 50 ema

🔸 Supertrend gives buy and candle closes above Supertrend

🔸 Enter on next candle opening

🔸 Take Entry only from 9:20 to 3:00 pm

🔸 Universal exit at 3:00

🔸 Premium Range 200

[6/18]

𝗘𝘅𝗶𝘁 𝗥𝘂𝗹𝗲𝘀

🔸 Banknifty/Nifty Closing Below Supertrend

🔸 No Target or Stoploss

🔸 Ride the trend till it lasts

Capital : 25000 Per lot for buying including Drawdown

[7/18]

🔸 Banknifty/Nifty Closing Below Supertrend

🔸 No Target or Stoploss

🔸 Ride the trend till it lasts

Capital : 25000 Per lot for buying including Drawdown

[7/18]

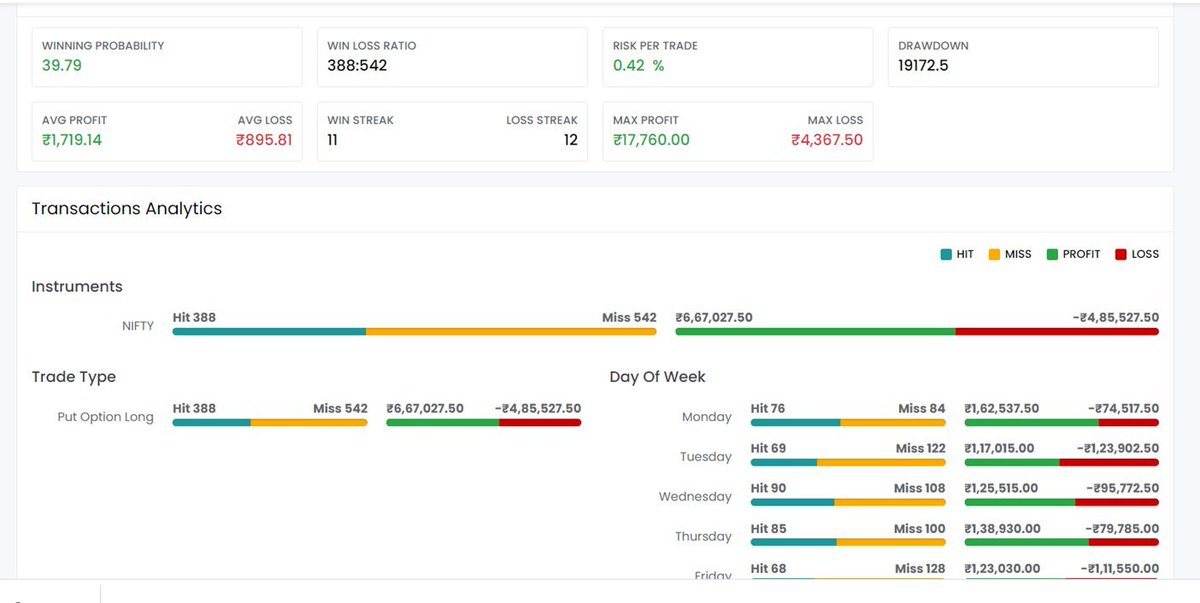

𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗕𝗮𝗰𝗸𝘁𝗲𝘀𝘁 𝗳𝗼𝗿 𝗡𝗶𝗳𝘁𝘆:

🔸 Equity Curve

🔸 Profit and loss : Year and Month wise

🔸 Stoploss and Risk Reward Ratio

[8/18]

🔸 Equity Curve

🔸 Profit and loss : Year and Month wise

🔸 Stoploss and Risk Reward Ratio

[8/18]

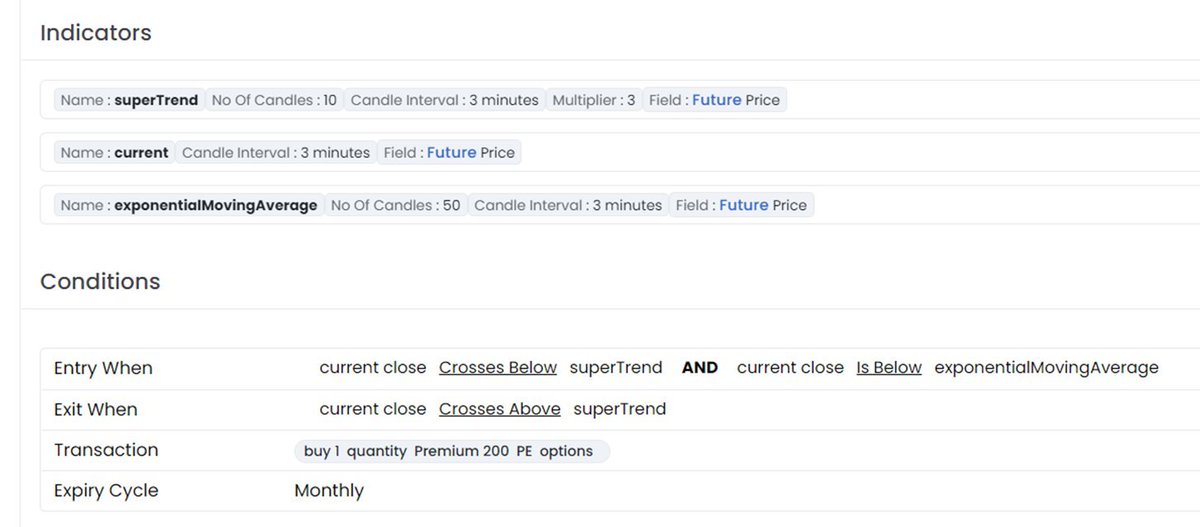

𝗣𝗘 𝗕𝘂𝘆 𝗥𝘂𝗹𝗲

🔸 Time Frame: 3 min

🔸 Sell only when

🔸 Banknifty/Nifty is Below 21 ema

🔸 Supertrend gives Sell and candle closes below supertrend

🔸 Enter on next candle opening

🔸 Take Entry only from 9:20 to 3:00

🔸 Universal exit at 3:00 opening candle

[9/18]

🔸 Time Frame: 3 min

🔸 Sell only when

🔸 Banknifty/Nifty is Below 21 ema

🔸 Supertrend gives Sell and candle closes below supertrend

🔸 Enter on next candle opening

🔸 Take Entry only from 9:20 to 3:00

🔸 Universal exit at 3:00 opening candle

[9/18]

Exit Rules

🔸 Banknifty/Nifty Closing Below Supertrend

🔸 No Target or Stoploss

🔸 Ride the trend till it lasts

🔸 Capital : 35000 Per lot for buying including Drawdown

[10/18]

🔸 Banknifty/Nifty Closing Below Supertrend

🔸 No Target or Stoploss

🔸 Ride the trend till it lasts

🔸 Capital : 35000 Per lot for buying including Drawdown

[10/18]

Strategy Backtest on Nifty:

🔸 Equity Curve

🔸 Profit and loss : Year and Month wise

🔸 Stoploss and Risk Reward Ratio

[11/18]

🔸 Equity Curve

🔸 Profit and loss : Year and Month wise

🔸 Stoploss and Risk Reward Ratio

[11/18]

𝗪𝗵𝗲𝗻 𝗻𝗼𝘁 𝘁𝗼 𝘁𝗿𝗮𝗱𝗲?

🔸 We only take trades when supertrend has given short signal and the that time banknifty/nifty should be below 50 ema

🔸 If supertrend gives sell signal and banknifty/nifty is above 50 ema and then goes below it , we are not shorting it

[12/18]

🔸 We only take trades when supertrend has given short signal and the that time banknifty/nifty should be below 50 ema

🔸 If supertrend gives sell signal and banknifty/nifty is above 50 ema and then goes below it , we are not shorting it

[12/18]

𝘋𝘦𝘵𝘢𝘪𝘭𝘦𝘥 𝘠𝘰𝘶𝘵𝘶𝘣𝘦 𝘝𝘪𝘥𝘦𝘰 𝘓𝘪𝘯𝘬 ( 𝗗𝗼𝗻𝘁 𝗠𝗶𝘀𝘀 ! )

𝗣𝗿𝗼𝘀 of Stratgegy

🔸 High Returns in trending Markets

🔸 500% returns (pre taxes) in 3 years

🔸 Can be automated , no need to sit in front of screen

🔸 Easy to find and execute trades

🔸 Higher number of lots will reduce brokerage cost

[14/18]

🔸 High Returns in trending Markets

🔸 500% returns (pre taxes) in 3 years

🔸 Can be automated , no need to sit in front of screen

🔸 Easy to find and execute trades

🔸 Higher number of lots will reduce brokerage cost

[14/18]

𝗖𝗼𝗻𝘀 of the Strategy

🔸 High drawdown (50+%) from equity curve high

🔸 Many months drawdown period

🔸 Brokerage will be high% of profits in case of 1 lot

🔸 Strategy as a single cannot be scaled as expectancy is less

🔸 No of Trades would be high in sideways market

[15/18]

🔸 High drawdown (50+%) from equity curve high

🔸 Many months drawdown period

🔸 Brokerage will be high% of profits in case of 1 lot

🔸 Strategy as a single cannot be scaled as expectancy is less

🔸 No of Trades would be high in sideways market

[15/18]

The above Backtest is for Nifty and for Banknifty backtest PDF will be shared in Telegram Below :

t.me/Techno_Charts

t.me/Techno_Charts

𝙎𝙬𝙞𝙣𝙜 𝙏𝙧𝙖𝙙𝙞𝙣𝙜 𝙈𝙚𝙣𝙩𝙤𝙧𝙨𝙝𝙞𝙥

To learn more about " How to Pick Stocks For 50-100% Returns "

Join our 4 Week Mentorship program with upto 12 Hours of Live Sessions !

Payment Link : rpy.club/g/rhZQwO97TG

You will be sent joining link to your WhatsApp

To learn more about " How to Pick Stocks For 50-100% Returns "

Join our 4 Week Mentorship program with upto 12 Hours of Live Sessions !

Payment Link : rpy.club/g/rhZQwO97TG

You will be sent joining link to your WhatsApp

Mentoship Program Feedback :

What Mentees have to say : #𝗙𝗲𝗲𝗱𝗯𝗮𝗰𝗸

LINK FOR ENQUIRY: wa.link/si4jn4

Payment Link : rpy.club/g/rhZQwO97TG

What Mentees have to say : #𝗙𝗲𝗲𝗱𝗯𝗮𝗰𝗸

LINK FOR ENQUIRY: wa.link/si4jn4

Payment Link : rpy.club/g/rhZQwO97TG

• • •

Missing some Tweet in this thread? You can try to

force a refresh