Advent International is buying a controlling stake in #Suven Pharma🧪💊

Here is all you need to know about the deal

Like and retweet for maximum reach

Here is all you need to know about the deal

Like and retweet for maximum reach

-Advent has proposed to buy up to 50.1% stake from the promoters. They have additionally made an open offer to buy 26% stake from minority shareholders. The price for both is ₹495/share.

-The promoters have said that they were not able to put a succession plan in place and this seemed like a good opportunity to keep adding value to the company.

-It will take 5-6 months to close the deal. The promoters will be left with a 9.9% stake and will have an 18 month

-It will take 5-6 months to close the deal. The promoters will be left with a 9.9% stake and will have an 18 month

lock-in. The management has said that Advent’s reach and resources will provide them with opportunities to grow the business at a much faster rate

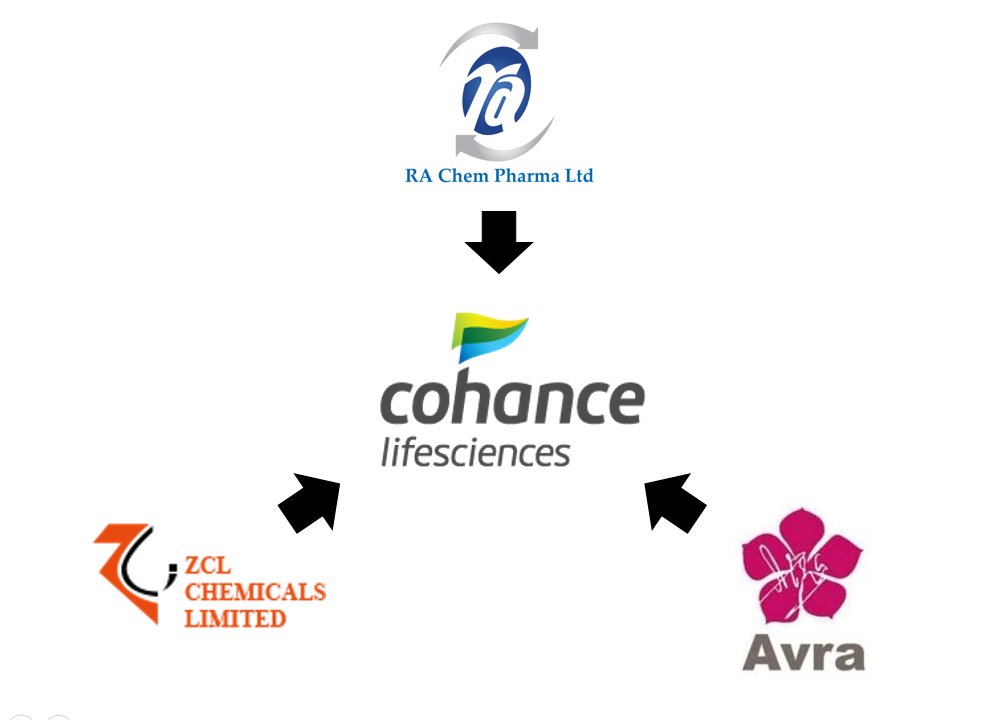

-Post acquiring a controlling stake, Advent plans to merge Suven with another one of their portfolio companies - Cohance Lifesciences

-Post acquiring a controlling stake, Advent plans to merge Suven with another one of their portfolio companies - Cohance Lifesciences

They are looking to build the third largest CDMO firm in India.

-Venkat Jasti will continue to run the business until the merger happens and will then transition to a strategy and advisory role

-Venkat Jasti will continue to run the business until the merger happens and will then transition to a strategy and advisory role

-Cohance is a platform that was created by Advent by merging 3 companies - RA Chem Pharma, ZCL Chemicals Limited, Avra Synthesis. Together, these 3 companies are involved in CDMO, CRO, Generic API , Formulations and Biologics

-They are expecting to realize some synergies in the combined entity. Suven is looking to enter in Drug Life Cycle Management and can use Cohance’s facilities for this. They will be offering innovators a comprehensive portfolio of services which includes CRO, CDMO and Drug Life

Cycle Management.

-Shweta Jalan, head of Advent International in India said that Cohance has a much wider set of global innovators in its client base. They have invested heavily in capacity and have spare capacity that can be used to service Suven’s clients

-Shweta Jalan, head of Advent International in India said that Cohance has a much wider set of global innovators in its client base. They have invested heavily in capacity and have spare capacity that can be used to service Suven’s clients

-The combined entity will have 11 manufacturing facilities. Suven has 5 manufacturing facilities including their R&D center at Jeedimetla and the new formulations facility they acquired this year from Casper Pharma. So Cohance will be bringing 6 manufacturing facilities.

-The companies are also of similar size. Suven Pharma had revenues of ₹1320 Cr in FY22 and 44% margins whereas Cohance had ₹1280 Cr revenues and 28% margins. The combined entity will have margins over 30%

-Both companies have minimal debt so the combined entity will have a healthy balance sheet

To get a better understanding of Suven Pharma's business, check out the detailed analysis:

https://twitter.com/ValueEducator/status/1606519699575304195

Micro Cap Club:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh