Obesity Market Overview

A deep dive into the unmet need, competitive landscape and future of treatment:

A deep dive into the unmet need, competitive landscape and future of treatment:

Obesity primer:

• Defined as BMI >30kg/m^2

• >750M patients globally, including ~40% of US adults --> expected to increase to 1B people / ~50% of US adults by 2030

• Linked to 1/5 US adult deaths

However, just ~2% of people (15M) are on anti-obesity medications (AOM)

• Defined as BMI >30kg/m^2

• >750M patients globally, including ~40% of US adults --> expected to increase to 1B people / ~50% of US adults by 2030

• Linked to 1/5 US adult deaths

However, just ~2% of people (15M) are on anti-obesity medications (AOM)

Obesity is the leading risk factor for diabetes & other metabolic diseases

For years, bariatric surgery was the primary interventional treatment (25-30% weight loss) as opposed to 1st gen drugs (5-8% weight loss)

Emerging therapies have closed this efficacy gap

For years, bariatric surgery was the primary interventional treatment (25-30% weight loss) as opposed to 1st gen drugs (5-8% weight loss)

Emerging therapies have closed this efficacy gap

Beginning with Wegovy's approval ($NVO) in June 2021, the AOM market has taken off

The TAM is estimated to be >$30B, with new launches expanding the market rather than cannibalizing share

Below chart shows consensus sales est. for Wegovy & Mounjaro to 2027

The TAM is estimated to be >$30B, with new launches expanding the market rather than cannibalizing share

Below chart shows consensus sales est. for Wegovy & Mounjaro to 2027

A key driver of growth has been viral social media videos

Stats across notable platforms:

#Mounjaro: >1B views

#Wegovy: >200M views

This has driven off-label usage for Mounjaro, which is not yet approved for obesity ($LLY stated ~33% of scripts are diabetes-naive patients)

Stats across notable platforms:

#Mounjaro: >1B views

#Wegovy: >200M views

This has driven off-label usage for Mounjaro, which is not yet approved for obesity ($LLY stated ~33% of scripts are diabetes-naive patients)

Also driving off-label use has been an ongoing supply shortage of Wegovy due to manufacturing issues

$NVO said they have enough supply to re-launch all doses & meet 2023 demand, but there are concerns about a FDA warning letter & shutdown of their CMO Catalent's Brussels site

$NVO said they have enough supply to re-launch all doses & meet 2023 demand, but there are concerns about a FDA warning letter & shutdown of their CMO Catalent's Brussels site

Looking at the landscape, $LLY and $NVO are the market leaders, but a few next-gen agents are in early-stage trials, including $AMGN's AMG-133

Given the disease complexity & patient heterogeneity, it's likely this market gets stratified by severity, comorbidities and biomarkers

Given the disease complexity & patient heterogeneity, it's likely this market gets stratified by severity, comorbidities and biomarkers

As the space gets increasingly crowded, differentiation beyond efficacy & safety will be important:

• Dosing convenience (i.e. less frequent injections or oral)

• Weight loss kinetics (slope of weight loss)

• Data in sub-populations

• Dosing convenience (i.e. less frequent injections or oral)

• Weight loss kinetics (slope of weight loss)

• Data in sub-populations

Payors have not said much about coverage decisions, which have historically been a challenge in this market, albeit with less effective drugs

With so many eligible patients, payor budgets could be stretched in the near-term

We will likely see restrictions & step-throughs

With so many eligible patients, payor budgets could be stretched in the near-term

We will likely see restrictions & step-throughs

The CDC estimates the annual medical cost of obesity for US adults to be >$170B, excluding indirect costs

$LLY and $NVO have argued AOMs can reduce long-term costs & improve outcomes by preventing downstream metabolic & CV disease

$LLY and $NVO have argued AOMs can reduce long-term costs & improve outcomes by preventing downstream metabolic & CV disease

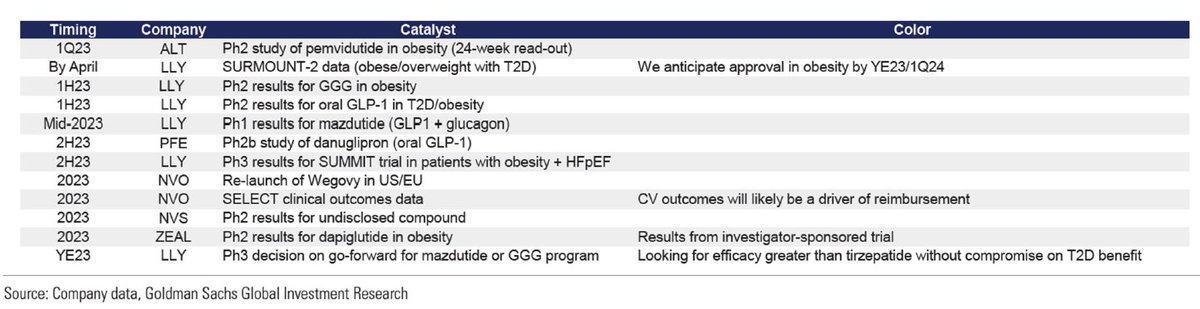

Critical to this argument will be the 2023 trial readouts measuring CV outcomes benefits:

• $NVO SELECT trial

• $LLY SUMMIT trial

~60% of payors polled felt positive readouts would improve coverage meaningfully, although not overnight

Source for catalysts: GS

• $NVO SELECT trial

• $LLY SUMMIT trial

~60% of payors polled felt positive readouts would improve coverage meaningfully, although not overnight

Source for catalysts: GS

The reimbursement dynamic here is similar to curative modalities such as cell & gene therapy

With patients switching insurance every few years, paying for preventative care does not mean reaping the benefits of future health

I wrote about this here: andrewpannu.com/why-the-shift-…

With patients switching insurance every few years, paying for preventative care does not mean reaping the benefits of future health

I wrote about this here: andrewpannu.com/why-the-shift-…

This analysis has been focused on general (polygenic) obesity, but there is a separate pipeline for various genetically-driven obesities (monogenetic obesity)

One player in this space is $RYTM which launched Imcivree for patients with 3 genetic deficiencies (POMC, PCSK1, LEPR)

One player in this space is $RYTM which launched Imcivree for patients with 3 genetic deficiencies (POMC, PCSK1, LEPR)

Overall, this market will be one to watch in 2023 & beyond as a driver of an industry rebound

That's all - if you enjoyed this, follow me @andrewpannu for more biotech charts, musings and breakdowns and consider sharing the below with your audience

https://twitter.com/andrewpannu/status/1608102244716535808

• • •

Missing some Tweet in this thread? You can try to

force a refresh