Excellent article by @HelenBurggraf explaining that the new Argentina IGA (like previous #FATCA IGAs) is NOT reciprocal. An earlier and lengthy expose explaining in detail why #FATCA IGAs are NOT and likely will never be reciprocal agreements is here ... citizenshipsolutions.ca/2022/07/24/the…

https://twitter.com/helenburggraf/status/1608497878196183041

The remarks from Ambassador Stanley are clearly designed to suggest the US Argentina #FATCA IGA is "reciprocal". Whether by accident or design this statement is not accurate.

It is useful to examine the exact text of the US Argentina #FATCA IGA to determine what Argentina is required to do and what the US is required to do and decide whether the agreement is reciprocal. home.treasury.gov/system/files/1…

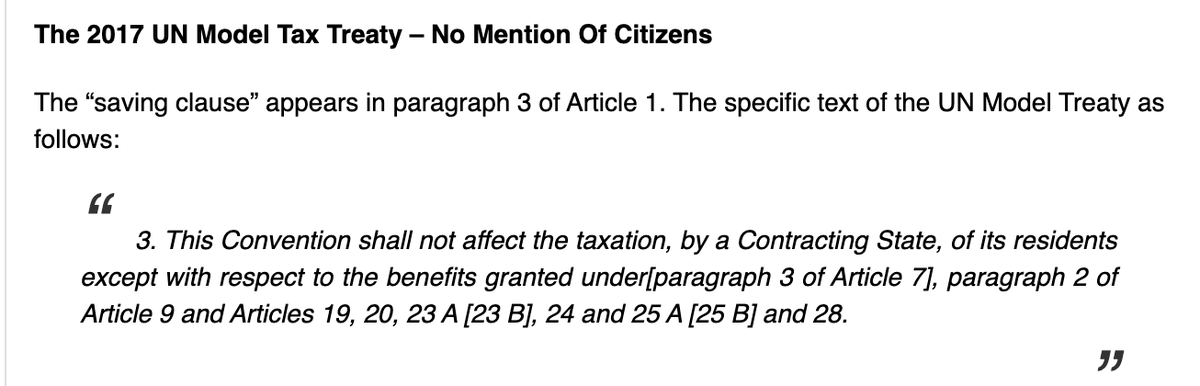

Beginning with par 2 of Article 6 (on pg 14) where the agreement specifically states equal/equivalent levels of information are NOT required in the current #FATCA agreement. The US is not required to give as much as it is entitled to get. Here is the original source.

Beginning with "Reportable Accounts. Notice that an Argentine Account is based on "residence" in Argentina. A US account is based on US citizenship regardless of residence. Note also that there must be "activity" in an Argentine account to qualify as reportable (not true for US).

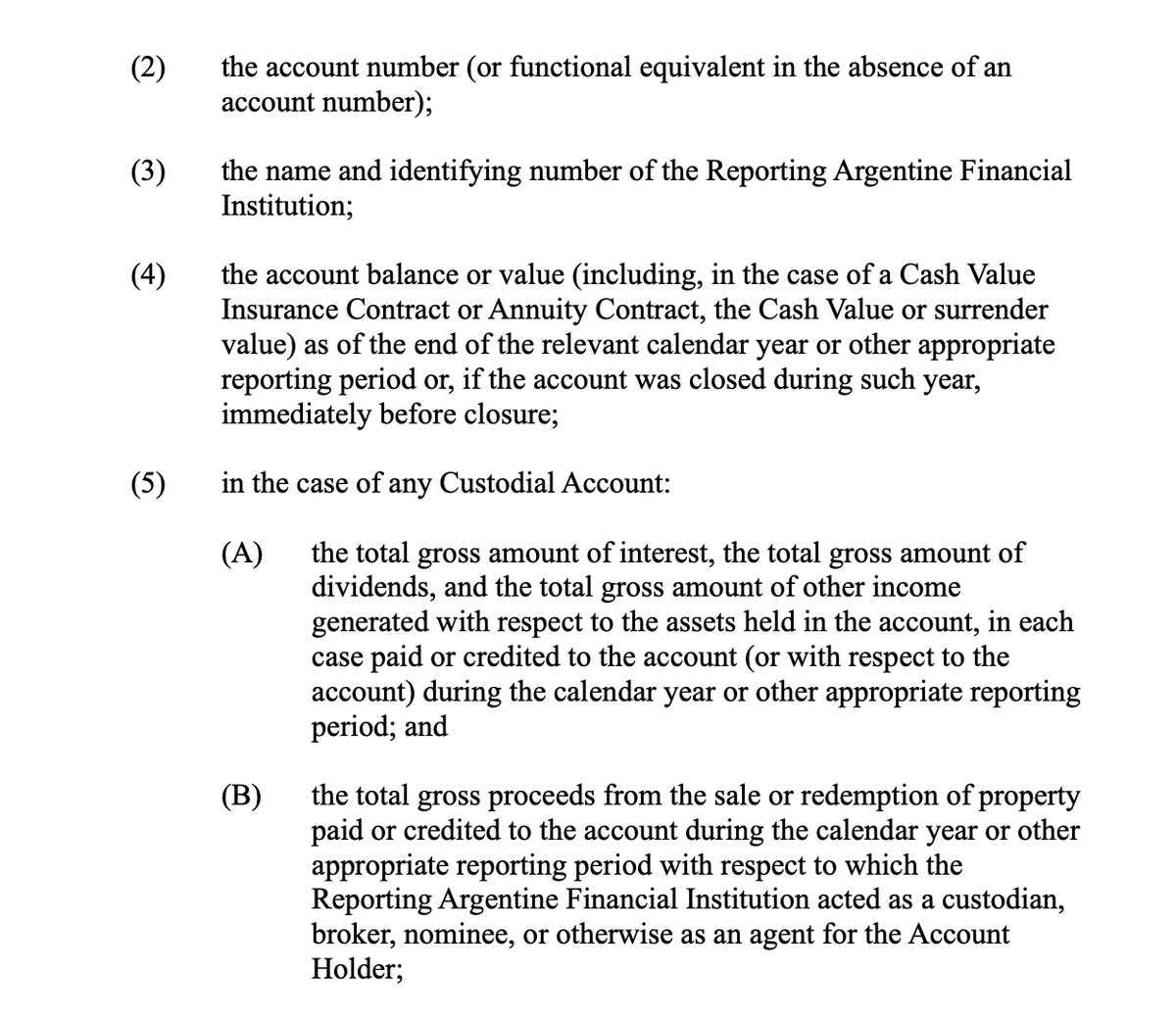

Here is what Argentina is required to report to the US (3 screenshots of information) under the #FATCA IGA. Note that Argentina is reporting on residents of Argentina to the US (where they are not residents). Compare this to what the US gives Argentina.

Here is what US is required to report to Argentina (1 screenshot of info) under the #FATCA IGA. Note US is reporting on residents of Argentina to Argentina. Compare this to what the Argentina gives the US. Journalists should read the "agreements" and not listen to gov statements!

Suggest those who oppose #FATCA IGAs take the time to read and understand these agreements and NOT rely on government statements and third party commentators. It's takes time to understand them, but it's worth it! (All Model 1s and Model 2s are the same.) home.treasury.gov/policy-issues/…

In summary, yes there is more to it, but this thread has been an attempt to give you the #FATCA IGA "Bare Necessities" (an important principle for living) ...

@Threaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh