Last Trade Day of 2022:

Open your Daily ES chart.

ESH2022 for Tradingview users.

Open your Daily ES chart.

ESH2022 for Tradingview users.

ESH2023 for Tradingview users, that is.

That precision can slip in and out from time to time Folks. lol

That precision can slip in and out from time to time Folks. lol

It is the final trading day of the year, it could create an Inside Day on the Daily range. This is when the Daily High is lower than Yesterday's High or Previous Trading Day High and the Daily Low is Higher than Yesterday's Low or Previous Trading Day Low...

I want you to think about how the final financial market trading day might impact the positions in the market that are being held and how taxable income might be a factor for positions being closed before today's close.

Who's been making money this past quarter? Bull or Bears?

Who's been making money this past quarter? Bull or Bears?

Which Liquidity stands the best chance of being engaged?

Buyside or Sellside?

Using what we noted on the respective charts... study the open at 9:30 ET and keep in mind 9:45 report too.

Avoid trading... just observe how Price delivers now.

Buyside or Sellside?

Using what we noted on the respective charts... study the open at 9:30 ET and keep in mind 9:45 report too.

Avoid trading... just observe how Price delivers now.

If you post a trade, you failed.

You are encouraged to screenshot observations throughout the morning session that you feel is salient to the analysis points we noted here.

Potential reactions, potential draws on liquidity... do not be afraid to share your observations.

Just refrain from pushing an entry.

Potential reactions, potential draws on liquidity... do not be afraid to share your observations.

Just refrain from pushing an entry.

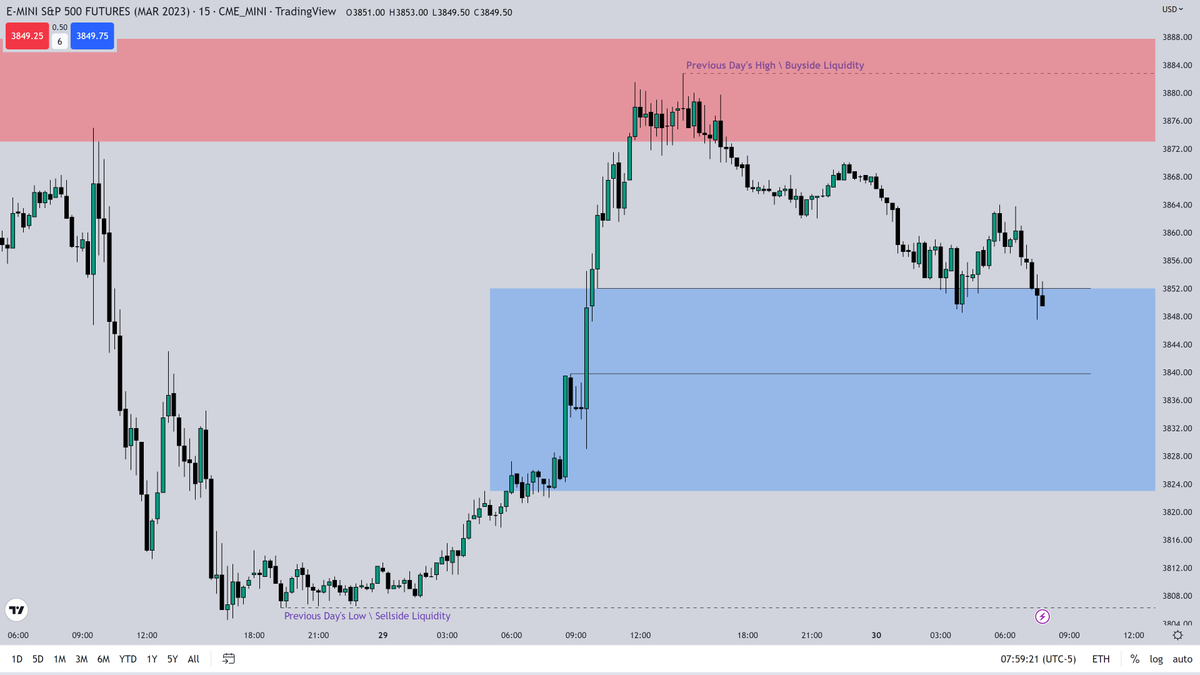

This is all I will have on my chart for the AM Session. Everything will unfold based on what I have here.

We do not try to predict before 9:30 ET Open which levels, FVG or Liquidity it wants. We wait for TIME to be a factor, then look at how they manipulate Price at 9:30 Open.

We do not try to predict before 9:30 ET Open which levels, FVG or Liquidity it wants. We wait for TIME to be a factor, then look at how they manipulate Price at 9:30 Open.

Your objective it to Tape Reader this morning and anticipate a 5 handle move. Not an entry, not a live trade or Demo.

Just observe a minor 5 handle move that "would" deliver if you had been in it... but you will not be.

This is Tape Reading. Got it?

Just observe a minor 5 handle move that "would" deliver if you had been in it... but you will not be.

This is Tape Reading. Got it?

What is a 5 handle move?

i.e. - 3864 to 3859 that is a 5 handle move or 20 "ticks".

i.e. - 3864 to 3859 that is a 5 handle move or 20 "ticks".

Just a move such as this one, is enough to make a career. You do not need to trade 100 handles like I show you I do in my trades.

5 handles per day... is "enough" to build up from.

5 handles per day... is "enough" to build up from.

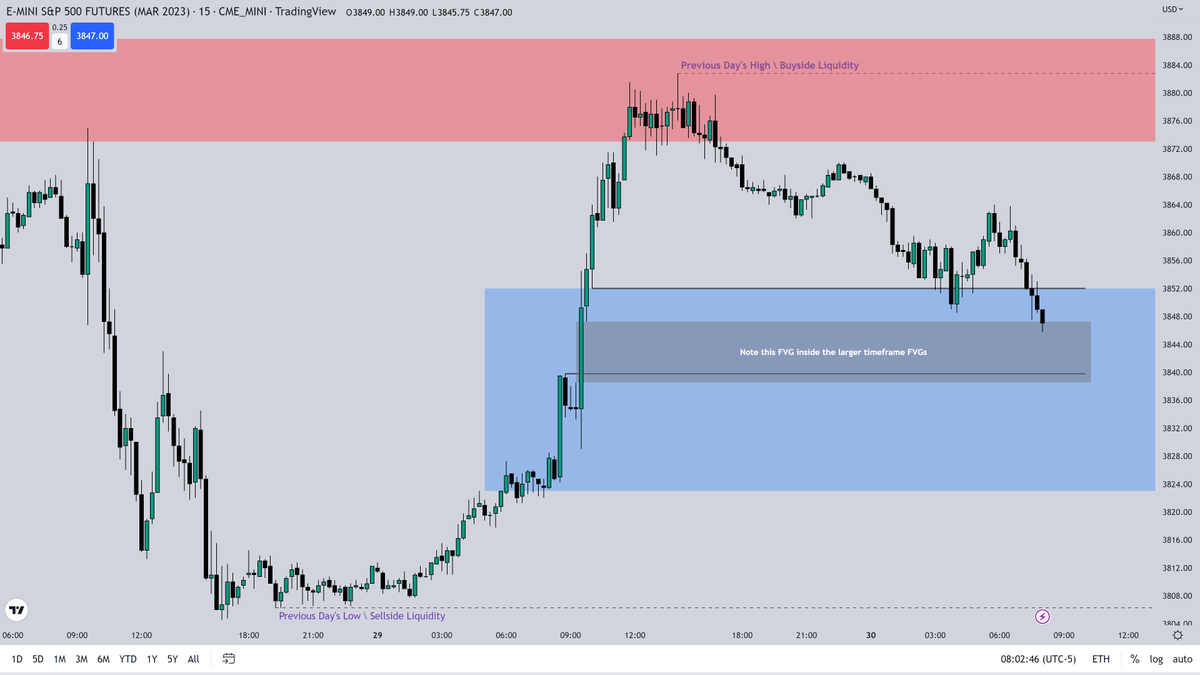

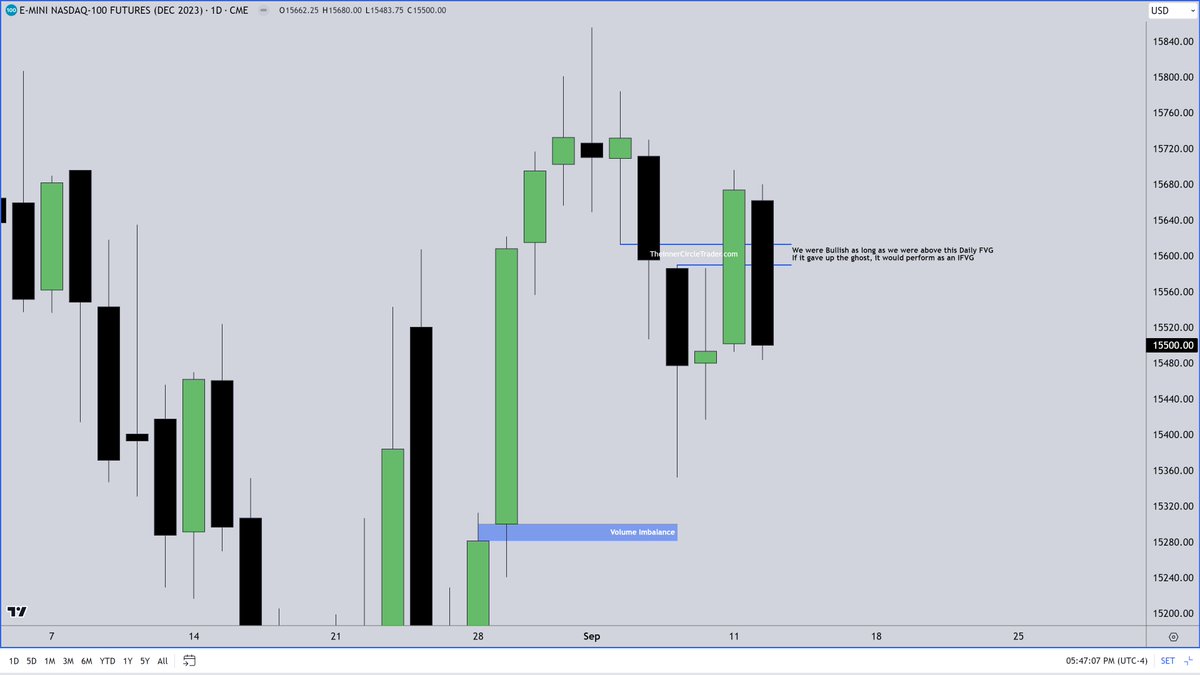

Do you see the Volume Imbalance?

The Algorithm repriced to the Volume Imbalance.

Note from where it repriced from.

The Middle of the Yellow FVG.

Screenshot this.

Note from where it repriced from.

The Middle of the Yellow FVG.

Screenshot this.

Train your eye to see what the 5 handle range looks like in comparison to live market delivery and in the price swings.

We do not try to catch every swing or minor fluctuation.

We do not try to catch every swing or minor fluctuation.

In my thoughts, I would see the Red lined FVG as a inversion level or sorts. If Price explores above that, we would likely seek higher Premium Arrays. While below it, we monitor the Low of the Yellow FVG and the Lower FVG low not as Next Draw On Liquidity.

This is the boring stuff you needed to do to learn how to find precision entries. Yes it requires work, patience and time doing it.

The uncertainty must be embraced... the fog lifts over time. I promise. :)

The uncertainty must be embraced... the fog lifts over time. I promise. :)

20 minutes until the 9:30 Opening Bell.

Sit back and relax... let Price tell us the narrative.

Sit back and relax... let Price tell us the narrative.

Less than 5 minutes until volatility comes in...

Cherrypicking like a Motha... huh?

Now consider what I outlined this morning.

5 handles was your objective.

I literally draw your charts for you for the actual Algorithmic points of reference.

Did I delete any tweets before I go on?

5 handles was your objective.

I literally draw your charts for you for the actual Algorithmic points of reference.

Did I delete any tweets before I go on?

note those Relative Equal Highs on your chart

Did you get prompted about my Volume Imbalance real time before the fact?

Did we have the Draw On Liquidity noted well in advance? What is your Low of the morning so far?

For your edification...

No need to have the levels hit for target, take the 5 handle bag and run.

*Note the entry and exit candles. Probably "Luck".

No need to have the levels hit for target, take the 5 handle bag and run.

*Note the entry and exit candles. Probably "Luck".

Now laugh with me when they say I cherrypick.

Come get wrecked... 2023.

Come get wrecked... 2023.

3864...

• • •

Missing some Tweet in this thread? You can try to

force a refresh