Detailed Analysis on #Repro India - A Negative Working Capital Business📚📕📖

CMP - ₹385

Like and retweet for maximum reach!!

CMP - ₹385

Like and retweet for maximum reach!!

-Repro India Limited provides integrated print solutions to publishers and corporations.

-It aggregates content from publishers and archives it in a custom-built digital warehouse; content is listed online and then accessed on-demand when an order is placed through an e-Retail

-It aggregates content from publishers and archives it in a custom-built digital warehouse; content is listed online and then accessed on-demand when an order is placed through an e-Retail

channel; it is finally produced, fulfilled and delivered ‘just-in-time’ to the end user – in India and across the world.

-The company helps publishers do everything in between in terms of content adaptation, modification, enrichment, printing of books, fulfilment, etc.

-The company helps publishers do everything in between in terms of content adaptation, modification, enrichment, printing of books, fulfilment, etc.

-The global book market is valued at USD 132 bn in FY22. The total book market in India is valued at USD 6.4 bn in FY22. The online channel of the book market in India, is at USD 1.74 bn in FY22 which is 27% of books sold in India.

-3 key disruptions in the Book Market across the

-3 key disruptions in the Book Market across the

globe are

a) Traditionally books were sold through retailers, bookstores, which is changing to e-commerce;

b) Offset printing where minimum quantity has to be printed is replaced by digital printing where even one copy can be printed;

c) Printed books are changing to e-books

a) Traditionally books were sold through retailers, bookstores, which is changing to e-commerce;

b) Offset printing where minimum quantity has to be printed is replaced by digital printing where even one copy can be printed;

c) Printed books are changing to e-books

-Repro’s business is divided into two segment, printing and distribution

-Repro’s printing business consists of long run Printing, where large volume of copies are printed, and Digital Printing, where shorter lots are printed (Reel based printing) and even ONE BOOK can be

-Repro’s printing business consists of long run Printing, where large volume of copies are printed, and Digital Printing, where shorter lots are printed (Reel based printing) and even ONE BOOK can be

printed (Sheet based Printing)

-Distribution business is done through its subsidiary, Repro Books Limited, the company sell books through online e commerce channels, in form e books, and global distribution of Indian titles via Ingram partnership.

-Repro has a unique business

-Distribution business is done through its subsidiary, Repro Books Limited, the company sell books through online e commerce channels, in form e books, and global distribution of Indian titles via Ingram partnership.

-Repro has a unique business

model of Print on Demand.

-In this model, Repro first aggregates titles (books on various topics from different authors) from publishers. It has a partnership with Ingram, world’s largest content aggregator.

-In this model, Repro first aggregates titles (books on various topics from different authors) from publishers. It has a partnership with Ingram, world’s largest content aggregator.

-It also has 6.39 lakhs titles from 422 direct publishers in addition to 100 lakhs titles from Ingram tie up.

-Repro has tied with Amazon, Flipkart, Paytm, Infibeam, rediff, Snapdeal, etc. for online e commerce sales.

-Once Repro aggregate Titles, they have printing rights. These titles are stored in digital format.

-Repro then lists the titles in e-commerce sites like Amazon

-Once Repro aggregate Titles, they have printing rights. These titles are stored in digital format.

-Repro then lists the titles in e-commerce sites like Amazon

and Flipkart. Whenever the orders are received, for even one copy, repro can print, bind, pack and dispatch within minutes and deliver to customers in 24-48 hours. Repro Prints after demand is generated

- Lead time is shortest for repro when compared to other distributors, as

- Lead time is shortest for repro when compared to other distributors, as

they import international titles from publishers. Repro on the other hand print copies in its facility in Haryana and Bhiwandi, in India.

-Repro India is the only company with a Print on Demand facility in India.

-Repro India is the only company with a Print on Demand facility in India.

Unlike the traditional set up, this Print on demand model involves • Zero up-front investment • Zero inventory • Zero forecasting • Zero freight costs • Zero returns • Zero obsolescence • Zero warehousing costs • Zero loss in sales.

-Company gets money twice a week from Amazon. Whereas, the company pays to the publisher at the end of month or 45 days. This is a kind of working capital negative business.

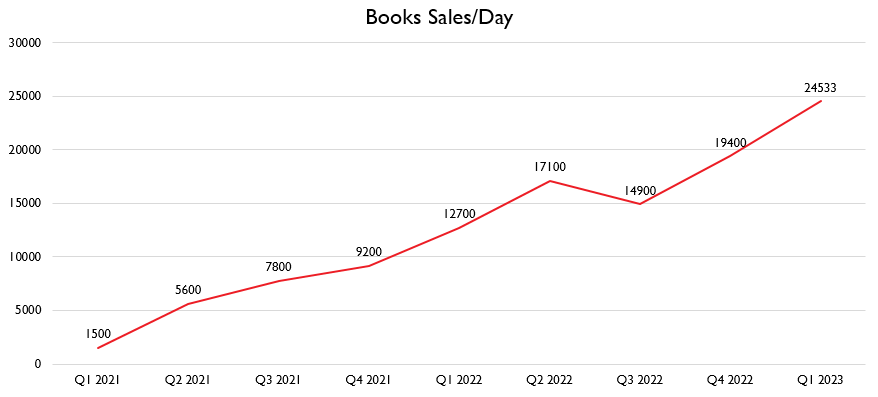

-Average books sales per day has risen exponentially from 1500 in Q1 2021 to 24500 in Q1 2023. There is a strong recovery in book sales post covid.

-The company also provides Rapples E-books solutions in more than 10 schools across CBSE, ICSE, MSEB, etc. Rapples is a Digital Education Software through E books. Software contains e books from all publishers. The solution also provides Student and teacher performance matrixes

and other mechanisms

-With Ingram tie-up, Repro can also take publishers’ books to the world through the Ingram Global Connect programme. Ingram’s reach of over 39,000 global distribution partners – both e-tail and physical.

-With Ingram tie-up, Repro can also take publishers’ books to the world through the Ingram Global Connect programme. Ingram’s reach of over 39,000 global distribution partners – both e-tail and physical.

-Book Bundling is a school specific program where Repro is bundling books required for the school for the particular grades and the students get the books delivered at home through Amazon.

-Repro India distributes e-books across multiple channels like Amazon Kindle, Retail, Online Marketplaces and over 300 international channels.

-Repro has offset printing plants in Surat, Navi Mumbai, Bhiwandi, and Chennai which can produce a million books daily. Two Print on

-Repro has offset printing plants in Surat, Navi Mumbai, Bhiwandi, and Chennai which can produce a million books daily. Two Print on

-Demand plants in Haryana and Bhiwandi can print and bind 24000 and 12000 books per day respectively.

-Digital business is recovery faster than its traditional business. Almost 50% of its business comes from digital business. Digital Business is at a break-even level in the

-Digital business is recovery faster than its traditional business. Almost 50% of its business comes from digital business. Digital Business is at a break-even level in the

current quarter. This segment will contribute to EBITDA from the coming quarters. At a bigger scale, this segment will generate higher margins compared to traditional business.

-The company has a presence in 22 countries across Africa, where they print educational books for the Government as well as schools in large volumes. The company generated 26% from exports market in FY 2022

-Repro is seeing strong recovery with an improving Covid situation and easing restrictions. Q1 2023 revenue is almost at pre covid level and net profit is positive 0.17 crores. Net profit has broken even after 8 quarters of losses.

-Revenue in FY 18 has reduced because the company was accepting only secure business and increased spending in newer businesses. In FY 19 Online e retail sales witnessed a robust growth. However revenue started declining from Q4 FY 2020 because of covid.

Repro’s EBITDA and EBITDA Margin were negative in FY 21 because of covid. Margins are expected to improve with increasing sales in digital business.

Micro Cap Club:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh