The last thread of the day (% of 2022) -

The global BoP surplus is dominated by China, Russia and the Gulf, proxied by Saudi Arabia --

They collectively run a huge surplus. I can account for most of the associated financial flow, but not all --

The global BoP surplus is dominated by China, Russia and the Gulf, proxied by Saudi Arabia --

They collectively run a huge surplus. I can account for most of the associated financial flow, but not all --

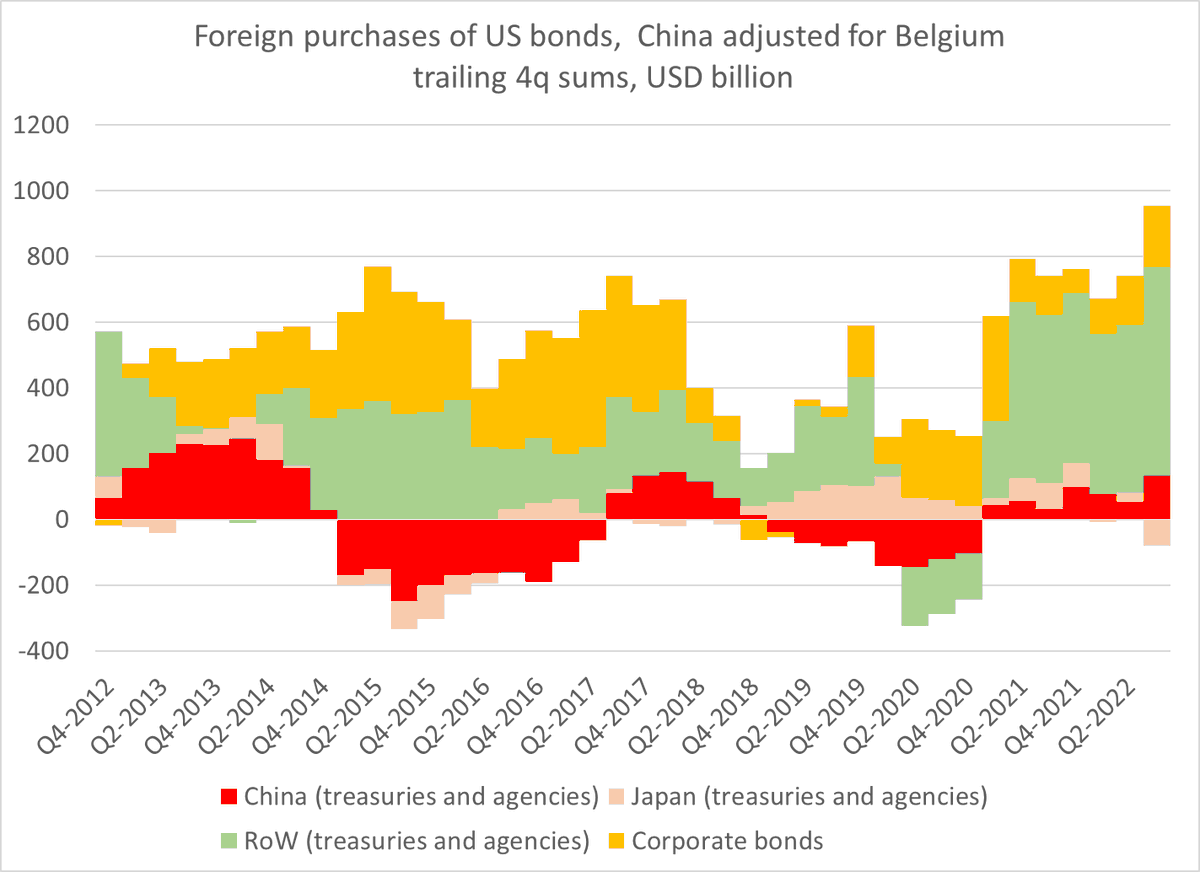

Compared to the past, a relatively low share of their combined surplus is showing up as central bank reserves ($100b of a bit over $800 -- which would rise to a trillion if all of the GCC is included), and thus the direct flow into global (and US) bonds is modest

The Russian and Saudi surplus is almost all going into the international banking system (with some equity purchases by the Saudi PIF) --

But at least in q3 the large bond purchases of the Chinese state banks seem to appear in the global data ...

But at least in q3 the large bond purchases of the Chinese state banks seem to appear in the global data ...

So, if my adjustment for the euroclear account (Belgian treasuries = China) is correct, I can account a portion of the large financial flow from the world's big autocracies to the world's biggest democracy.

That is the net flow needed for the '22 global BoP to balance!

That is the net flow needed for the '22 global BoP to balance!

• • •

Missing some Tweet in this thread? You can try to

force a refresh