Notice 2023-11: Temp relief provided to banks under Model 1 #FATCA IGAs who can't provide SSN numbers of #Americansabroad ("preexisting accounts only") if the gov joins banks in taking specific steps to educate individuals about FATCA + @citizenshiptax. home.kpmg/us/en/home/ins…

Purpose of Notice 2023-11 is to ensure that banks in a Model 1 #FATCA jurisdiction won't be deemed to be "non-compliant" with the IGA if they can't provide a US SSN for "pre-existing accounts". The notice can be accessed and read in its entirety here ... irs.gov/pub/irs-drop/n…

Step 1: The relief is available to the banks in a Model 1 #FATCA IGA jurisdiction and ONLY if the government of the jurisdiction commits to engaging with (1) individual US citizens (2) the banks and (3) US Treasury to facilitate compliance.

Step 2: Assuming Step 1 (above) has been met, the individual banks must comply with the procedures outlined in .03 (annual requests along with DOB) and .04 (meets specific guidelines for the annual requests). .03 describes what the FFI is required to do ....

Step 2 contd: .04 prescribes that the guidelines for the annual requests for US SSNs must include specific information that educates US citizens about #FATCA and/or educates them about how to renounce US citizenship using the 2019 "Relief Procedures For Former Citizens".

US Treasury makes clear that renunciation (in conjunction with 2019 relief procedures) is an option 4 #Americansabroad who don't want to comply with #FATCA. But, "Relief Procedures" available only to those who have never filed a 1040 + net worth < 2 mill. citizenshipsolutions.ca/tag/relief-pro…

The exclusions from the 2019 Relief Procedures For Former Citizens are described in 2023-11 as follows ...

In addition, it is VERY important to understand that the "relief" provided in 2023-11 applies ONLY to "preexisting accounts" (accounts in existence when the #FATCA IGA was signed). This does narrow the application of the relief ...

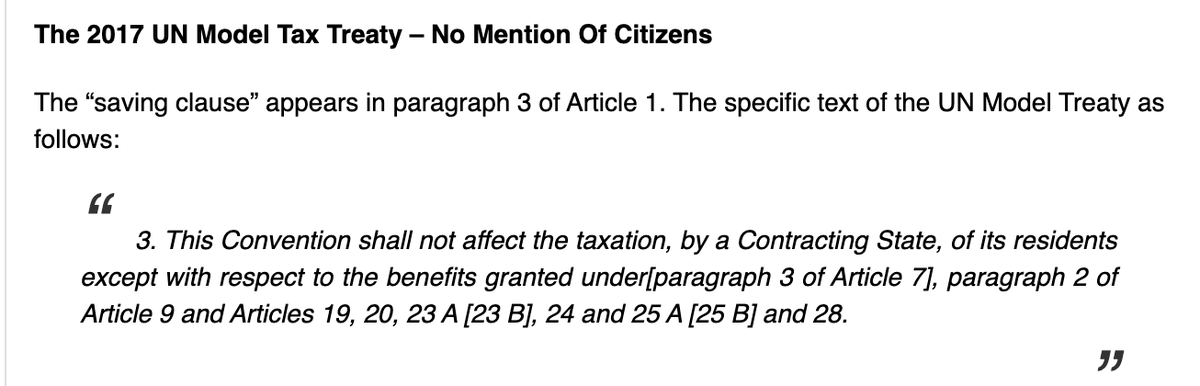

Conc: #FATCA Notice 2023-11 = a message that US intends to enforce @citizenshiptax on #Americansabroad with @taxresidency in other countries. Only when US severs citizenship from @taxresidency will the problems of ALL #Americansabroad be solved, all the time in ALL circumstances.

Notice 2023-11 is intended to provide "temporary" relief for the FFIs (banks). It is NOT intended to provide any relief for individual US citizens who continue to be nothing but trouble for the banks. If you were a bank would you want to be dependent on the "relief" from the US?

@threadreaderapp unroll

#FATCA Notice 2023-11 provides comfort that US will NOT notify France of "Significant Non-Compliance" under IGA Article 5 if bank can't provide SSNs for "pre-existing" accounts. This means only that the bank won't be sanctioned bc of those specific US citizens who don't have SSN

#FATCA 2023-11 provides NO relief for individual US citizens. At best, .05 requires the Model 1 IGA jurisdiction to "(3) Encourage FFIs ... to not discriminate against U.S. citizens that do not provide a U.S. TIN". Perhaps banks are required under local law to provide accounts?

While providing relief to banks and no relief to US citizens, Notice 2023-11 directs significant escalation on #FATCA enforcement against individuals by engaging the Model 1 IGA jurisdiction directly. Will the French gov start FATCA awareness campaigns?

A suggested ad per #FATCA Notice 2023-11, from all the Model 1 IGA jurisdictions directly to their residents ...

Digging deeper... Under #FATCA IGAs a FFI that fails to receive SSN can be deemed to be in "Significant Non-Compliance" under Article 5, resulting in a requirement that the FFI be REQUIRED to close account. Notice 2023-11 means that FFI would not be REQUIRED to close the account.

To put it another way: The effect of #FATCA Notice 2023-11 is that the FFI's are not (temporarily) REQUIRED to close the account of a US citizen without an SSN. But (subject to local law) they are permitted to close the account under the rules. How will the banks/gov respond?

• • •

Missing some Tweet in this thread? You can try to

force a refresh