Accounting is the language of business.

But it’s FILLED with incoherent jargon.

Here are 9 of the most confusing terms explained in plain English:

But it’s FILLED with incoherent jargon.

Here are 9 of the most confusing terms explained in plain English:

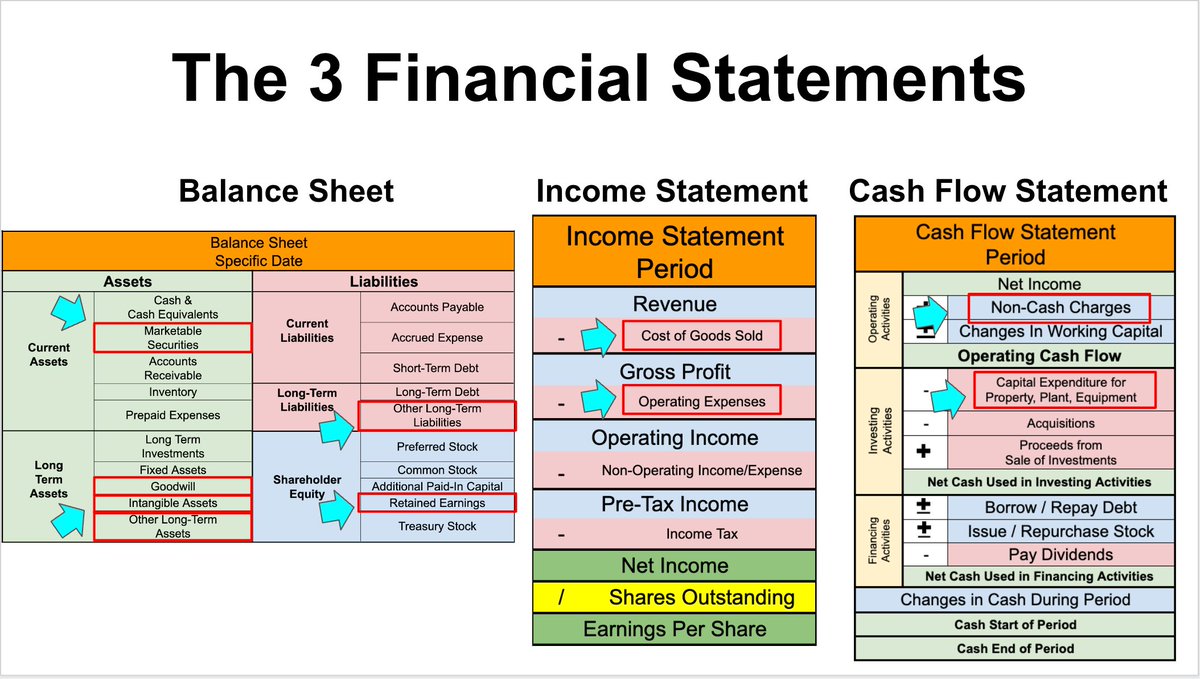

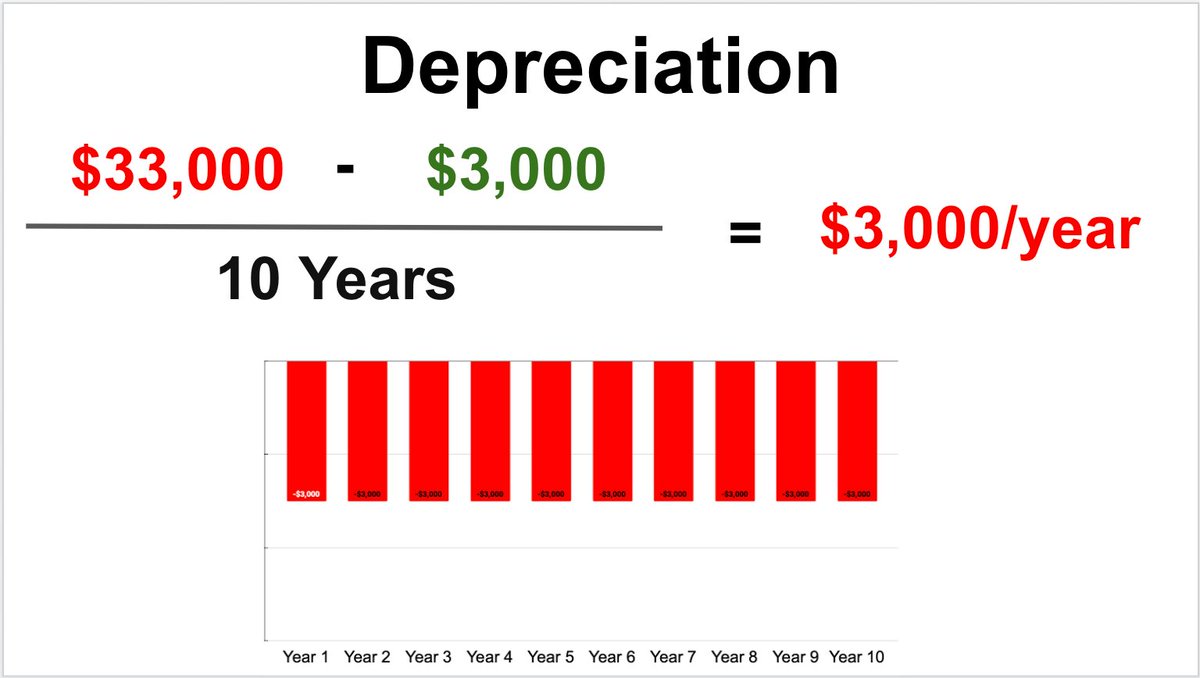

1: Depreciation

Found on: Income Statement & Cash Flow Statement

Definition: The accounting process of writing down the value of an asset over time.

Found on: Income Statement & Cash Flow Statement

Definition: The accounting process of writing down the value of an asset over time.

Plain English: You buy a car for $33,000.

10 years later, you sell it for $3,000.

The value of the car depreciated by $3,000/per year.

10 years later, you sell it for $3,000.

The value of the car depreciated by $3,000/per year.

2: Amortization

Found on: Income Statement & Cash Flow Statement

Definition: An accounting technique used to periodically lower

1) the book value of a loan or,

2) an intangible asset over a period of time.

Found on: Income Statement & Cash Flow Statement

Definition: An accounting technique used to periodically lower

1) the book value of a loan or,

2) an intangible asset over a period of time.

Plain English:

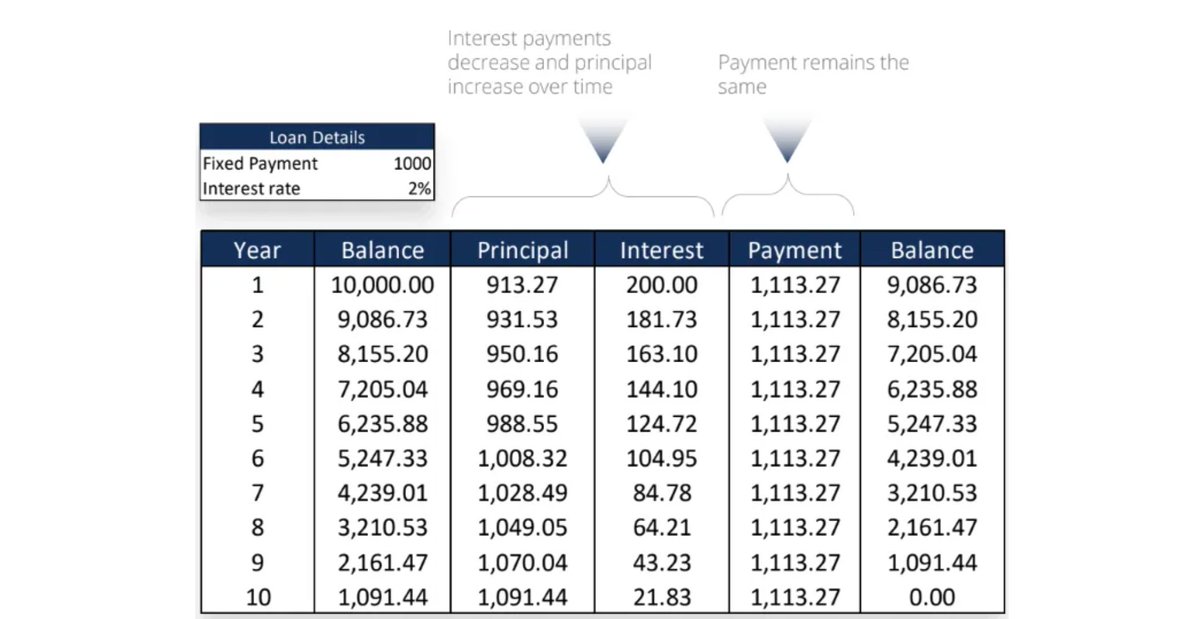

You loan a friend $10,000 for 10 years at 2% interest.

The payment is $1,113.27/year.

Each time a payment is made, the remaining balance is amortized (reduced).

You loan a friend $10,000 for 10 years at 2% interest.

The payment is $1,113.27/year.

Each time a payment is made, the remaining balance is amortized (reduced).

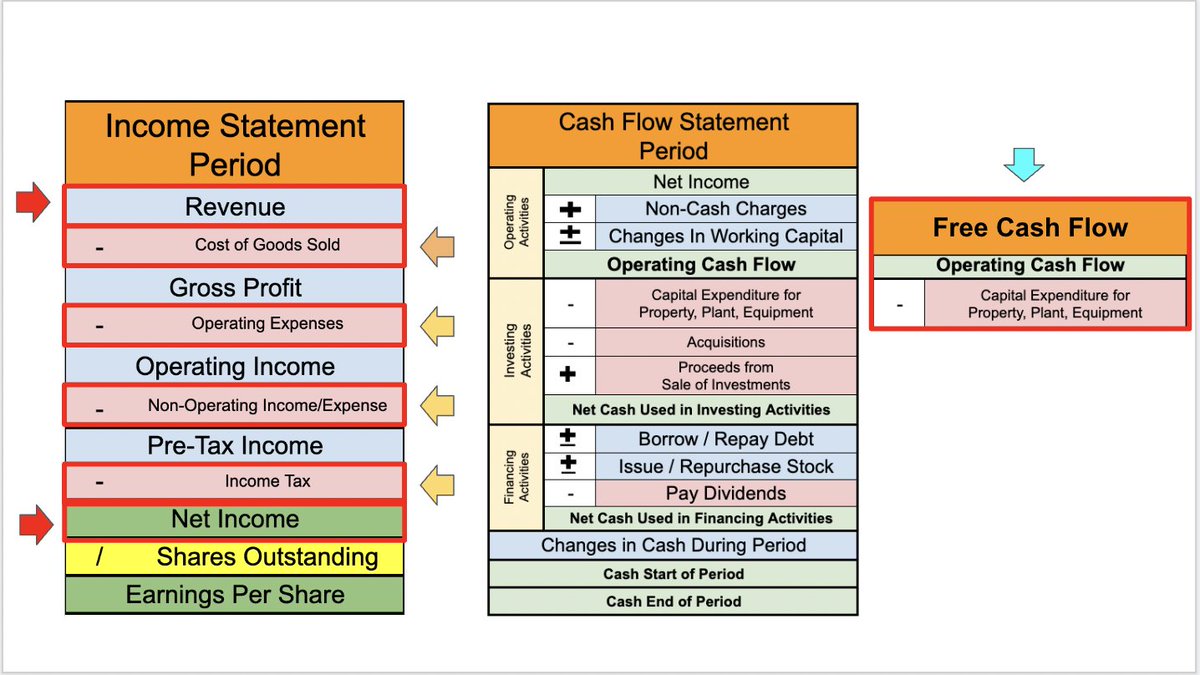

3: Capital Expenditure (Capex)

Found on: Cash Flow Statement

Definition: Funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment.

Found on: Cash Flow Statement

Definition: Funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment.

Plain English: @Tesla just built Giga-Berlin, a massive new car factory in Europe.

All of Tesla’s costs to buy the property, construct the building, and fill it with equipment are capital expenditures.

All of Tesla’s costs to buy the property, construct the building, and fill it with equipment are capital expenditures.

4: Deferred Revenue (Unearned Revenue)

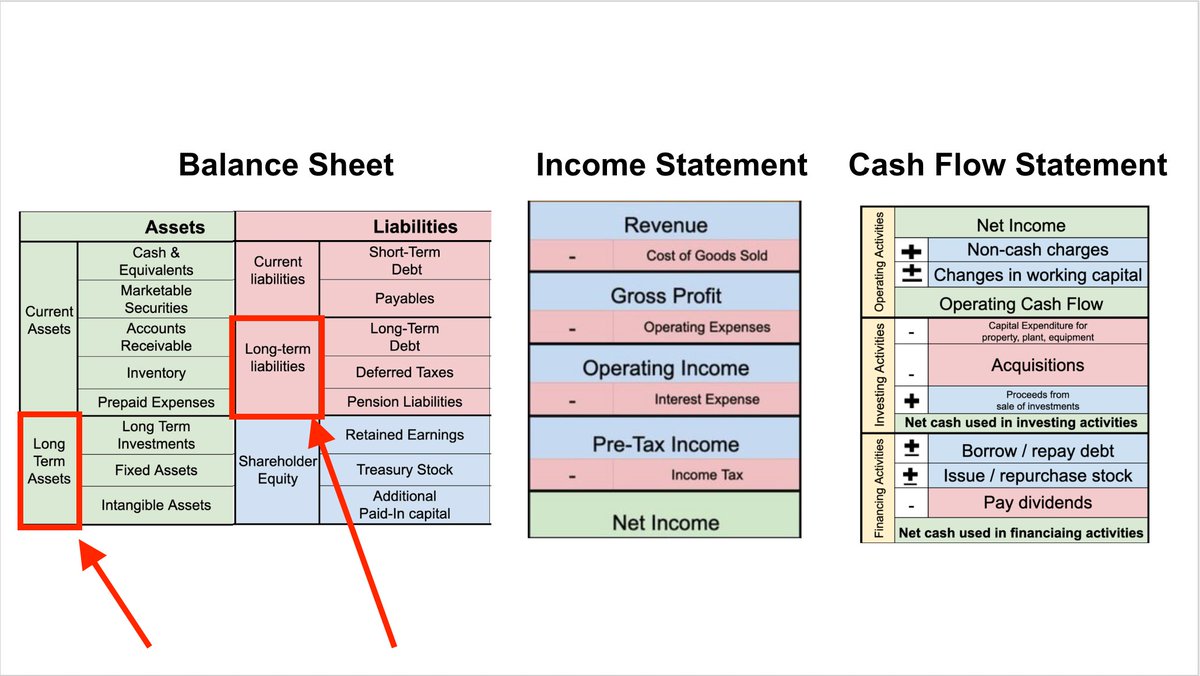

Found on: Balance Sheet | Liabilities, Current & Long-term

Definition: A prepayment for a good or service by a customer that has yet to be delivered.

Found on: Balance Sheet | Liabilities, Current & Long-term

Definition: A prepayment for a good or service by a customer that has yet to be delivered.

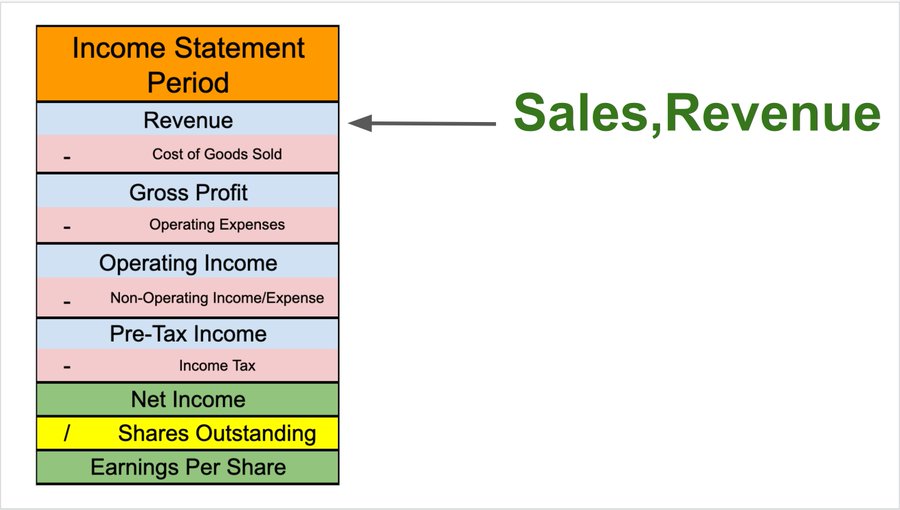

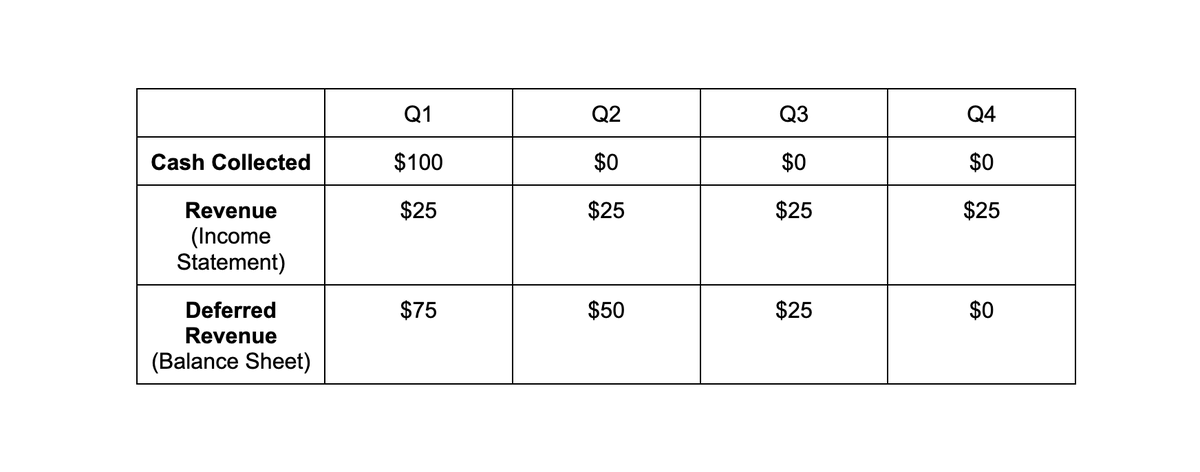

Plain English: A company sells a 1-year magazine subscription in Q1 for $100.

They collect the $100 upfront, but they can’t count it all as revenue until the magazines are delivered.

Deferred revenue is a liability that is gradually reduced as the magazines are delivered.

They collect the $100 upfront, but they can’t count it all as revenue until the magazines are delivered.

Deferred revenue is a liability that is gradually reduced as the magazines are delivered.

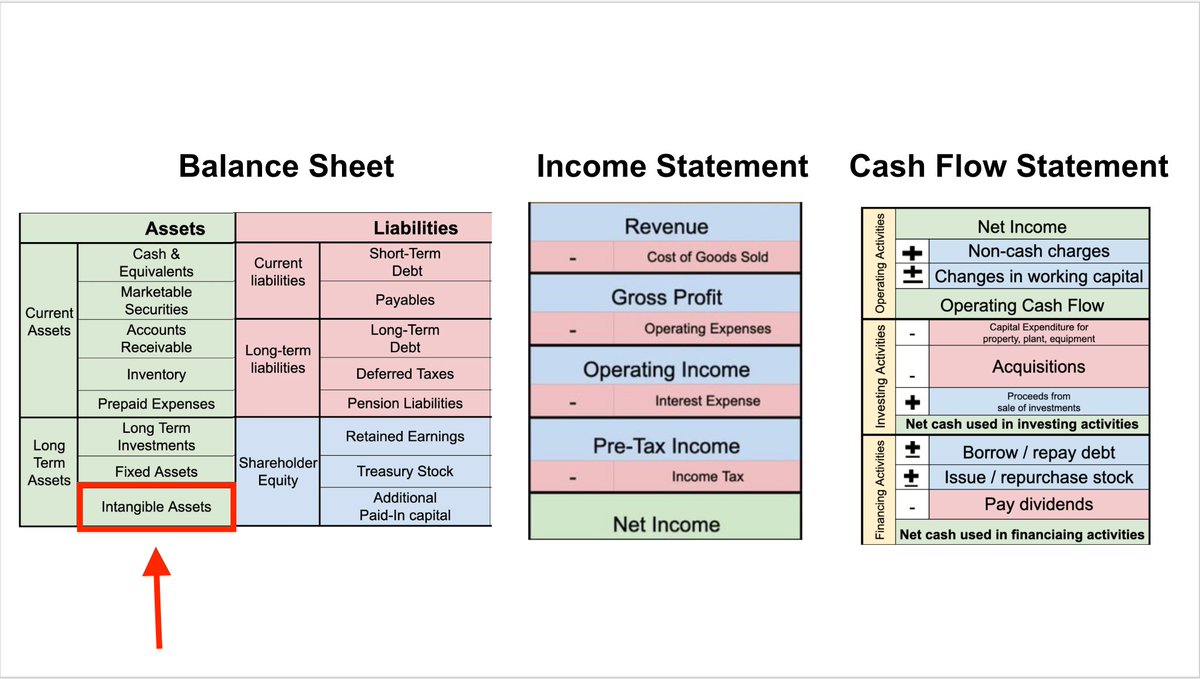

5: Goodwill

Found on: Balance Sheet

Definition: The premium paid over the fair market value for an acquisition.

Found on: Balance Sheet

Definition: The premium paid over the fair market value for an acquisition.

Plain English:

Feroldi Foods acquires Stoffel Coffee for $100,000.

The fair market value for Stoffel Coffee's assets & liabilities at the time of the acquisition is only $40,000.

That extra $60,000 has to be accounted for. It is stored as “Goodwill” on the new balance sheet

Feroldi Foods acquires Stoffel Coffee for $100,000.

The fair market value for Stoffel Coffee's assets & liabilities at the time of the acquisition is only $40,000.

That extra $60,000 has to be accounted for. It is stored as “Goodwill” on the new balance sheet

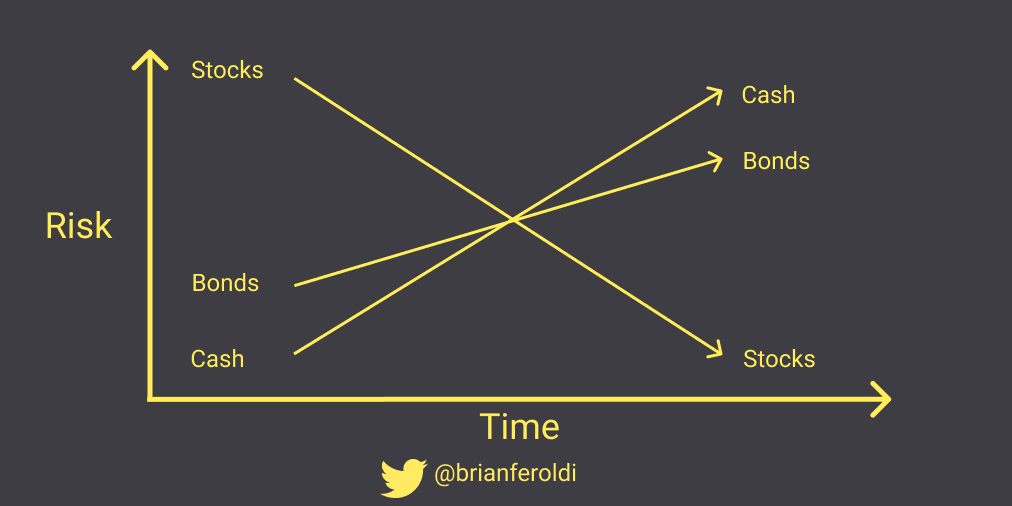

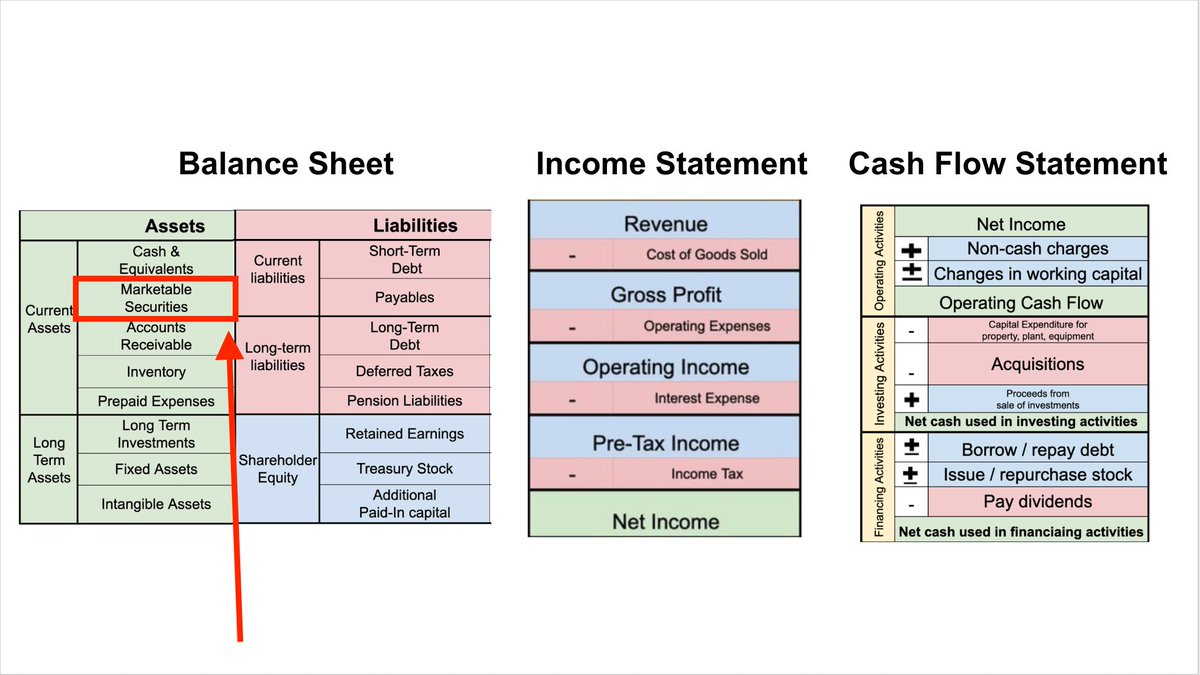

6: Marketable Securities

Found on: Balance Sheet

Definition: any unrestricted financial instrument that can be bought or sold on a public stock exchange or a public bond exchange.

Found on: Balance Sheet

Definition: any unrestricted financial instrument that can be bought or sold on a public stock exchange or a public bond exchange.

Plain English: Checking accounts don’t pay much interest.

Some companies keep some of their cash in stocks, bonds, or money market funds to earn a higher return.

Marketable Securities are the value of all securities that can be quickly converted into cash.

Some companies keep some of their cash in stocks, bonds, or money market funds to earn a higher return.

Marketable Securities are the value of all securities that can be quickly converted into cash.

7 & 8: Operating Lease Right-of-Use / Operating Lease Liability

Found on: Balance Sheet

Definition: a lease agreement in which the lessor provides the lessee with the right to use an asset for an agreed-upon period of time.

Found on: Balance Sheet

Definition: a lease agreement in which the lessor provides the lessee with the right to use an asset for an agreed-upon period of time.

Plain English: A company signs a contract to lease a building for 10 years at $1 million per year.

The company has to report $10 million as an asset (Operating Lease Right-of-Use) and $10 million as a liability (Operating Lease Liability).

The company has to report $10 million as an asset (Operating Lease Right-of-Use) and $10 million as a liability (Operating Lease Liability).

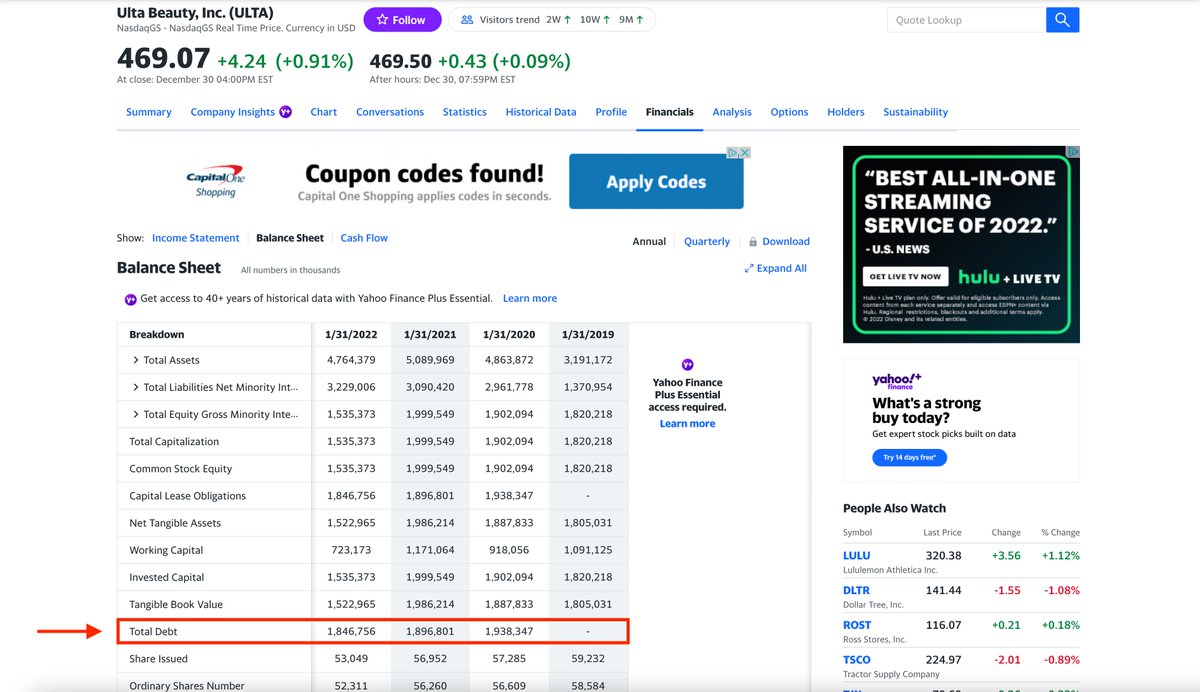

Note: Some financial websites count Operating Lease Liabilities as debt.

Ex: Yahoo finance says $ULTA has $1.8 billion in debt

In reality, it’s not debt.

It’s an Operating Lease Liability (that is offset by the Operating Lease Right-of-Use asset)

Ex: Yahoo finance says $ULTA has $1.8 billion in debt

In reality, it’s not debt.

It’s an Operating Lease Liability (that is offset by the Operating Lease Right-of-Use asset)

9: Retained Earnings

Found on: Balance Sheet

Definition: the cumulative net earnings a business has generated after it has paid out dividends to its shareholders.

Found on: Balance Sheet

Definition: the cumulative net earnings a business has generated after it has paid out dividends to its shareholders.

Plain English:

The grand total of all of the profits that a company business has generated over its lifetime, minus its loses and dividends paid out to shareholders.

The grand total of all of the profits that a company business has generated over its lifetime, minus its loses and dividends paid out to shareholders.

Learning accounting is an incredibly useful business skill, but it's filled with jargon + nuance.

@Brian_Stoffel_ and I are teaching a live course in January that explains accounting in plain English.

Interested? DM me for a coupon code.

maven.com/brian-feroldi/…

@Brian_Stoffel_ and I are teaching a live course in January that explains accounting in plain English.

Interested? DM me for a coupon code.

maven.com/brian-feroldi/…

Want to keep learning for free?

You'll love this other thread that I wrote on accounting:

You'll love this other thread that I wrote on accounting:

https://twitter.com/BrianFeroldi/status/1608116845411958784

• • •

Missing some Tweet in this thread? You can try to

force a refresh