Detailed Analysis on the business of Gujarat Fluorochemicals Ltd

#GFL 🧪🧪

CMP - ₹3109

Like and retweet for maximum reach!!

#GFL 🧪🧪

CMP - ₹3109

Like and retweet for maximum reach!!

1. COMPANY OVERVIEW

Gujarat Fluorochemicals Ltd is a part of the INOXGFL group with headquarters in Noida, India. The company began its operations in 1989 with India’s largest refrigerant gas manufacturing unit at Ranjitnagar, Gujarat. The company further expanded into

Gujarat Fluorochemicals Ltd is a part of the INOXGFL group with headquarters in Noida, India. The company began its operations in 1989 with India’s largest refrigerant gas manufacturing unit at Ranjitnagar, Gujarat. The company further expanded into

manufacturing of Fluorospecialty products to cater to the rise in global demand from the pharmaceutical and agrochemical industry. In 2007, GFL commissioned the world’s most technologically advanced and integrated facility for PTFE manufacturing at Dahej with an initial capacity

of 6000 MTPA. This plant marked the entry of GFL into the fluoropolymers business. As of now, the company has the widest portfolio of fluoropolymer products and is the largest fluoropolymer player in India. The company has 3 manufacturing facilities, a captive fluorspar mine in

Morocco, offices and warehouses in Europe and USA and a marketing network which is spread across the world

2. BUSINESS SEGMENTS

The company has 3 main business segments:

i)Bulk Chemicals

ii)Fluoropolymers

iii)Fluorospecialties

The company has 3 main business segments:

i)Bulk Chemicals

ii)Fluoropolymers

iii)Fluorospecialties

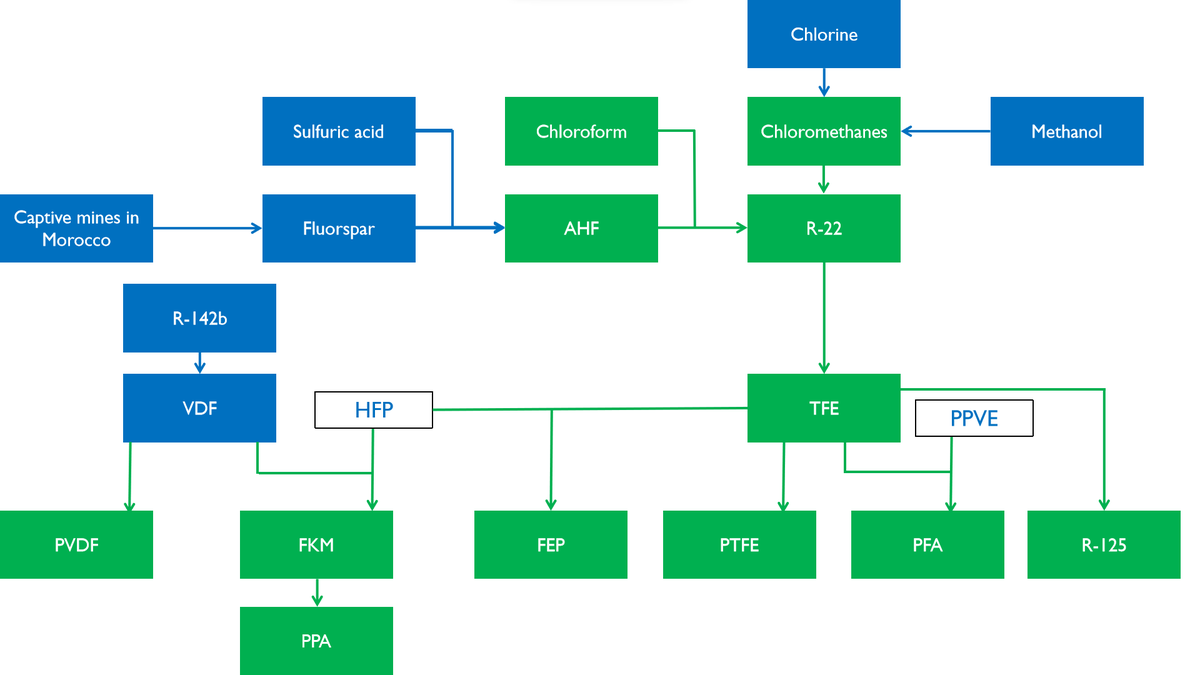

The bulk chemicals contain caustic soda, chloromethanes and refrigerant gases. The company has the second largest chloromethane capacity in India after SRF which has a capacity of 1,90,000 MTPA. In refrigerant gases, the company produces R-22,R-410A which is a blend of R-32 and

R-125 in a ratio of 1:1,R-125 which is made using tetrafluoroethylene with a capacity of 5000 MTPA and R-142b which the company earlier imported and now it makes it in-house. The gases R-22 and R-142b act as backward integration for polytetrafluoroethylene and polyvinylidene

fluoride which are 2 of the major products in the company’s fluoropolymer product portfolio of PTFE,PVDF,FKM,FEP and PFA. The image below summarizes the business of GFL

3. BUSINESS PERFORMANCE OF GFL

GFL reduced the contribution of refrigerant gases from 23% in 2011 to 9% in 2022.This shift was because of the conditions laid out by the Kyoto and Montreal Protocol and also the shift of focus of the company’s management from the refrigerants

GFL reduced the contribution of refrigerant gases from 23% in 2011 to 9% in 2022.This shift was because of the conditions laid out by the Kyoto and Montreal Protocol and also the shift of focus of the company’s management from the refrigerants

business to the high value business of Fluoropolymers which started with the entry of the company in PTFE manufacturing in 2007.R-22 which is produced by the company acts as a backward integration for PTFE and the company uses majority of it’s R-22 production which is nearly 75%

as a feedstock for PTFE and the remaining is sold in the market. The company manufactures R-125 which is made from R-22 at a capacity of 5000 tons. The company imports R-32 and produces R-410 a which is a HFC blend of R-125 and R-32 in the ratio of 1:1. However, as mentioned in

a 2021 Equity Research Report, GFL did not achieve much success with R-410A as compared to it’s peer SRF and the revenue growth of R-410 a was impacted by aggressive Chinese pricing. GFL also missed the opportunity of R-134a which SRF manufactures in-house.

The image below summarizes the performance of the refrigerant gas and fluoropolymer business of GFL over time

4. CHARACTERISTICS OF FLUOROPOLYMER BUSINESS

The following are the characteristics of the fluoropolymer business:

i)Highly capex intensive

ii)Restricted access to technology and key raw materials

iii)The approval for the developed grades by the customer is a fairly long cycle and

The following are the characteristics of the fluoropolymer business:

i)Highly capex intensive

ii)Restricted access to technology and key raw materials

iii)The approval for the developed grades by the customer is a fairly long cycle and

may take somewhere around 6 months to 1 year. The high value PTFE products business along with the long customer approvals makes this a sticky business as there only two or three players who are developing high value PTFE grades

The above characteristics show that this business is a high entry barriers and other players cannot enter this business on a standalone basis

GFL is the only established player in the fluoropolymer business in India. The image shown below is the value chain of GFL

GFL is the only established player in the fluoropolymer business in India. The image shown below is the value chain of GFL

The level of integration along with the technological expertise which GFL has achieved since it’s entry into the fluoropolymer business in 2007 is in itself a major entry barrier which is clearly seen in their value chain

5. FUTURE OUTLOOK

i) REFRIGERANTS

-The company plans to expand its Anhydrous HF capacity from 120tpd to 220tpd, which will help supply key starting raw materials for fluoropolymer, ref-gas, and battery chemicals. It has a TFE capacity of 36 ktpa post debottlenecking in TFE-3,

i) REFRIGERANTS

-The company plans to expand its Anhydrous HF capacity from 120tpd to 220tpd, which will help supply key starting raw materials for fluoropolymer, ref-gas, and battery chemicals. It has a TFE capacity of 36 ktpa post debottlenecking in TFE-3,

which will take care of the requirements for PTFE, PFA, R-125, and other product

-The company expects to start its Vinylidene Chloride (VDC) plant by FY23-end, which means it will buy Vinyl Chloride Monomer (bulk commodity to manufacture R-142B, a key feedstock for FKM and PVDF)

-The company expects to start its Vinylidene Chloride (VDC) plant by FY23-end, which means it will buy Vinyl Chloride Monomer (bulk commodity to manufacture R-142B, a key feedstock for FKM and PVDF)

It plans to reach around 30 ktpa capacity in R-142b.The company used to import R-142b earlier. The Morocco mine currently produces 2000 TPM fluorspar, and the company is planning to expand production to 4000 TPM, which will take care of around 35% of GFL’s expanded capacity

requirement

-The company plans to use R-142b majorly for the backward integration of PVDF as of now. If they find a good price point in the market, they may sell this product in the market going forward

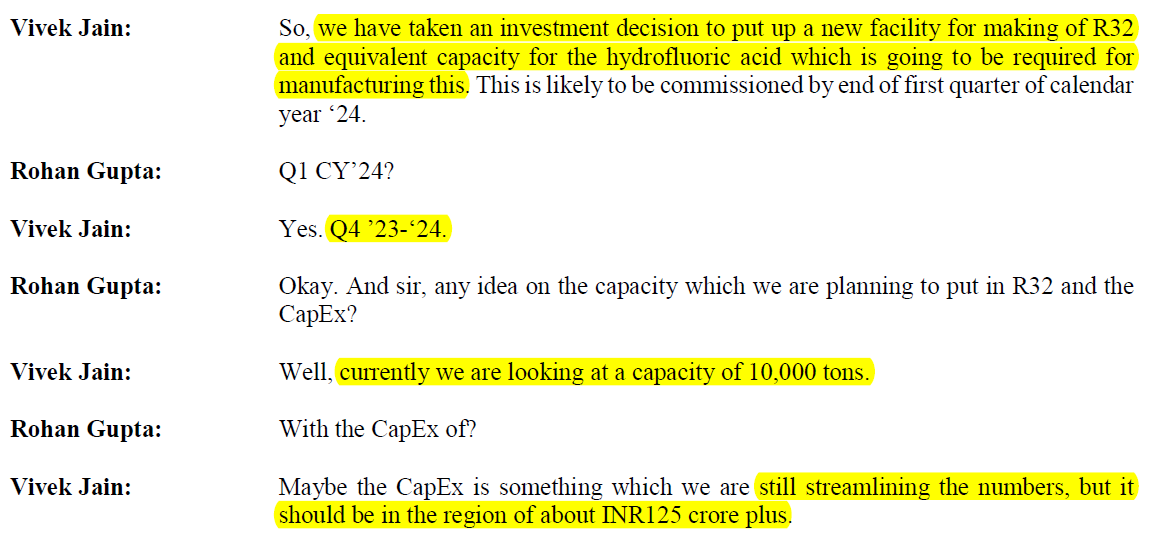

-The company has planned to setup a manufacturing facility for R-32 which it

-The company plans to use R-142b majorly for the backward integration of PVDF as of now. If they find a good price point in the market, they may sell this product in the market going forward

-The company has planned to setup a manufacturing facility for R-32 which it

was importing earlier and an equivalent capacity for hydrofluoric acid. The total capex plan would be more than Rs 125 crore towards setting up a 10000 tons plant of R-32.The company expects to commission this plant in Q4FY24

ii) GFL PLAN FOR NEW AGE VERTICALS

-In the years 2019 to 2021, GFL has substantially enlarged its basket of fluoropolymers offering by commercializing various grades and expanding capacities of FKM, PFA, FEP, PVDF and PTFE and is in the process of commercializing a couple more

-In the years 2019 to 2021, GFL has substantially enlarged its basket of fluoropolymers offering by commercializing various grades and expanding capacities of FKM, PFA, FEP, PVDF and PTFE and is in the process of commercializing a couple more

in the next 2-3 years

-In FY22, the company has announced a capex plan of around Rs 3000 crores for 2022-24.This capacity expansion plan is for battery chemicals, new fluoropolymers, PTFE, backward integration and other allied infrastructure. The company also plans to setup

-In FY22, the company has announced a capex plan of around Rs 3000 crores for 2022-24.This capacity expansion plan is for battery chemicals, new fluoropolymers, PTFE, backward integration and other allied infrastructure. The company also plans to setup

India’s first PVDF solar film project which is expected to be commissioned in FY23

-The company is also planning to add PVDF capacity of 10,000 MTPA for the battery grade applications in the next 2 to 3 years. PVDF will find major applications going forward in the binders for EV

-The company is also planning to add PVDF capacity of 10,000 MTPA for the battery grade applications in the next 2 to 3 years. PVDF will find major applications going forward in the binders for EV

batteries, films for Solar panels, Proton Exchange Membranes(PEM) for hydrogen electrolyser and fuel cells in the future

iii) ENTRY OF SRF INTO FLUOROPOLYMERS

-SRF announced a capex of Rs 424 crore to set up a manufacturing facility for PTFE along with R-22 which acts as the backward integration for PTFE. The company plans to be cost competitive to GFL by doing this backward integration. The

-SRF announced a capex of Rs 424 crore to set up a manufacturing facility for PTFE along with R-22 which acts as the backward integration for PTFE. The company plans to be cost competitive to GFL by doing this backward integration. The

company plans to manufacture 4 grades initially out of which 2 will be commodity grade and the remaining will be specialty grade

-The company plans to commercialize their new PTFE plant in Q3FY23 and once they have approvals for their products, they plan to begin

-The company plans to commercialize their new PTFE plant in Q3FY23 and once they have approvals for their products, they plan to begin

supplying from Q4FY23.

-The company also has plans to enter other fluoropolymers like PVDF and FKM which find applications in Lithium ion batteries and semiconductors. It will face tough competition from GFL in Indian market and other fluoropolymer players in the foreign market

-The company also has plans to enter other fluoropolymers like PVDF and FKM which find applications in Lithium ion batteries and semiconductors. It will face tough competition from GFL in Indian market and other fluoropolymer players in the foreign market

who already have a wide portfolio of fluoropolymers. The fluoropolymer business is a high entry barrier business as it takes time to develop the technology and the level of forward and backward integration required to get a low cost structure required in fluoropolymer production

Check out the New Year Offer on the Micro Cap Club membership:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh