The 2 Companies that Own the Entire World (Pt 1)

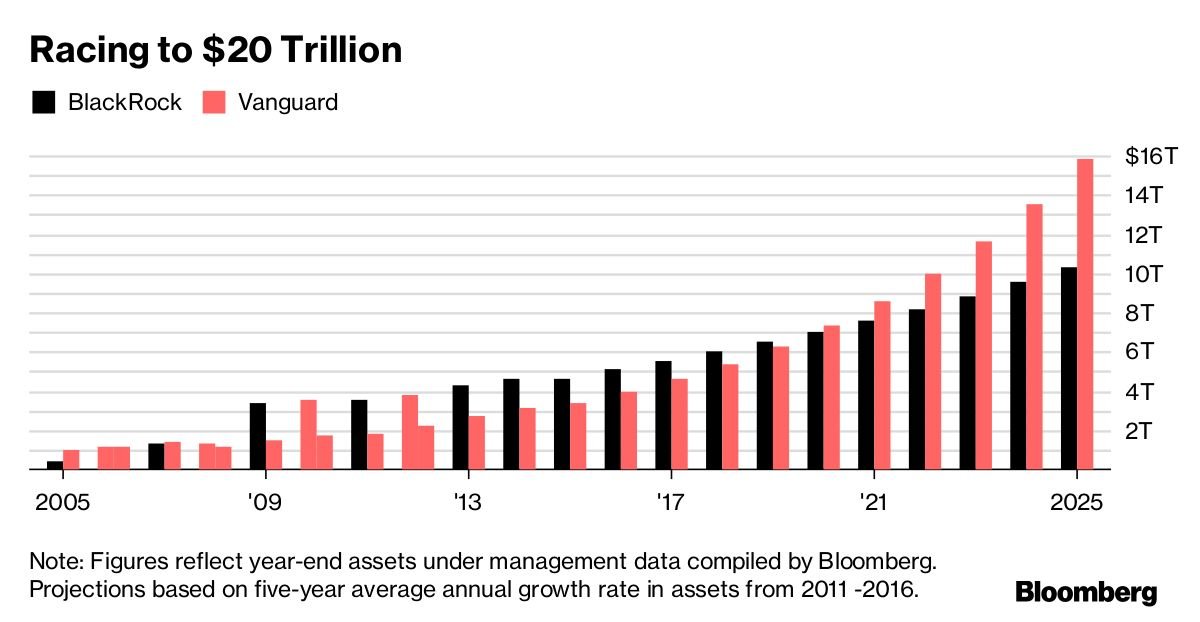

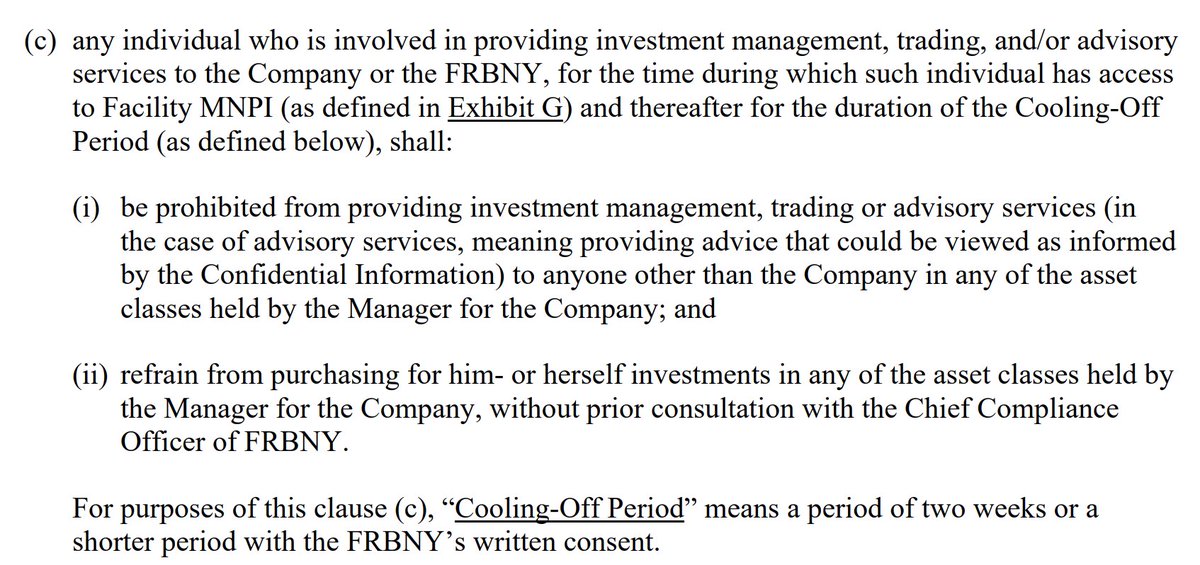

BlackRock and Vanguard have created one of the greatest monopolies in history

They played the system so good that the government cannot even break them up

Here’s how they did it 👇

BlackRock and Vanguard have created one of the greatest monopolies in history

They played the system so good that the government cannot even break them up

Here’s how they did it 👇

First, you need a basic understanding of 'voting rights'

This is the right of a shareholder of a corporation to vote on matters of corporate policy, including decisions on the makeup of the board of directors, making substantial changes in the corporation's operations, etc...

This is the right of a shareholder of a corporation to vote on matters of corporate policy, including decisions on the makeup of the board of directors, making substantial changes in the corporation's operations, etc...

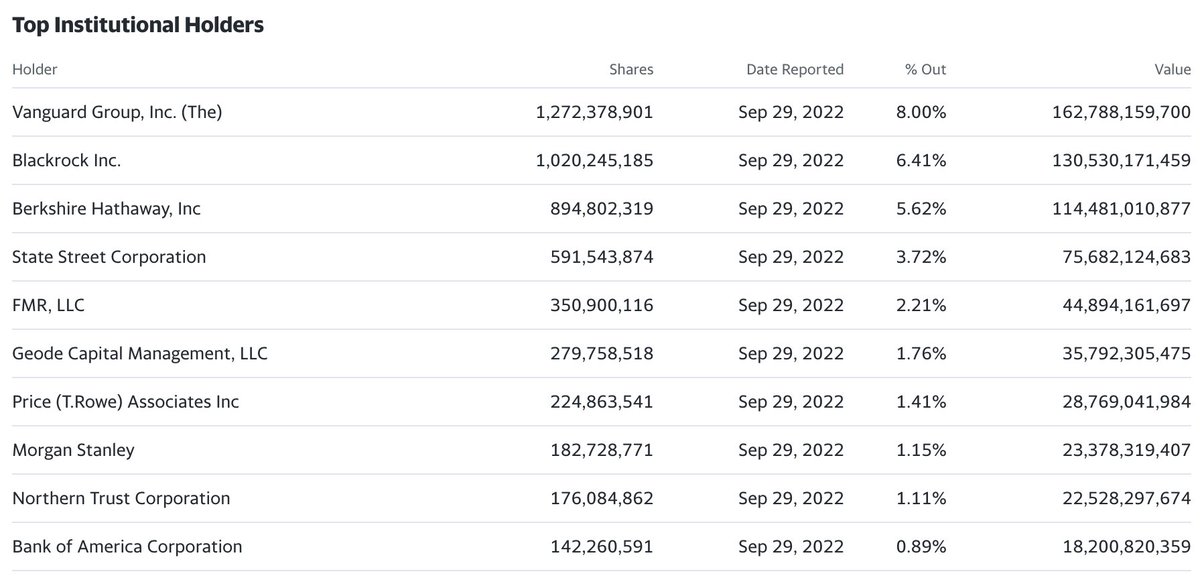

Unlike the single vote right that individuals commonly possess in democratic governments, the number of votes a shareholder has corresponds to the number of shares they own.

Aka: The power goes to the those who own the most stock

Aka: The power goes to the those who own the most stock

The Reuters Fact Check team wrote an article stating:

"BlackRock and Vanguard do not 'own' all the biggest corporations in the world. They invest trillions of dollars into leading companies on behalf of their clients, who ultimately own the shares."

Who are their clients then?

"BlackRock and Vanguard do not 'own' all the biggest corporations in the world. They invest trillions of dollars into leading companies on behalf of their clients, who ultimately own the shares."

Who are their clients then?

Let’s dig even deeper🤔

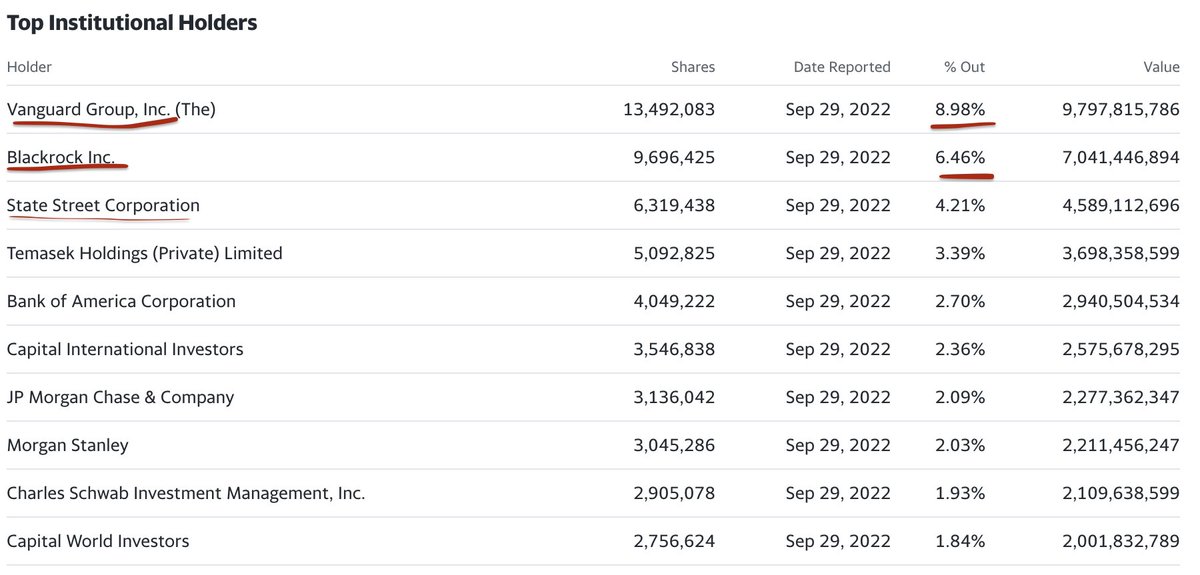

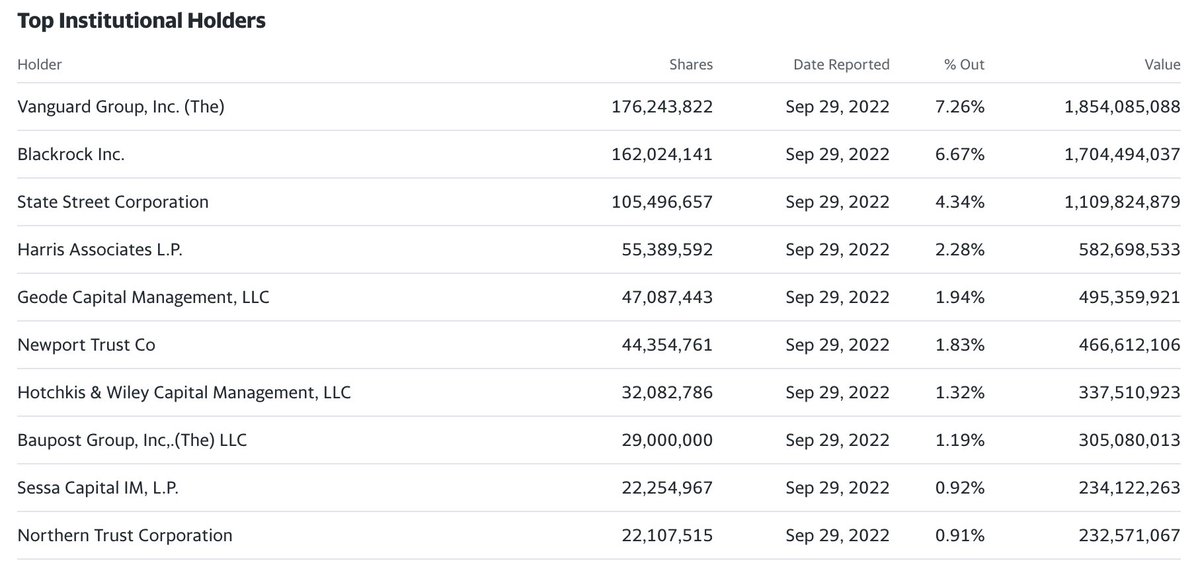

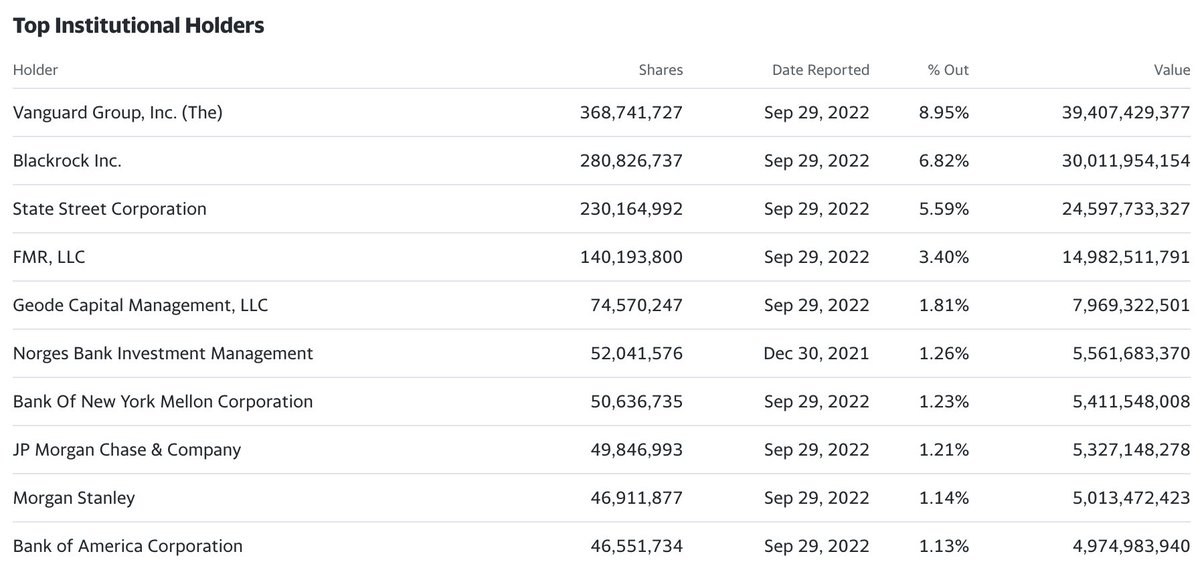

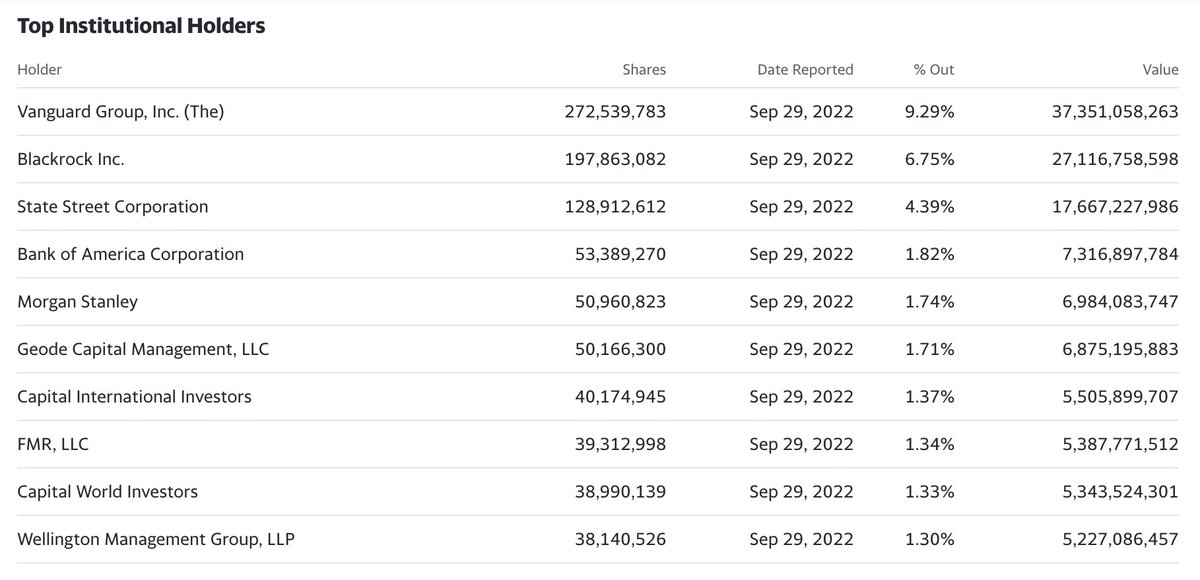

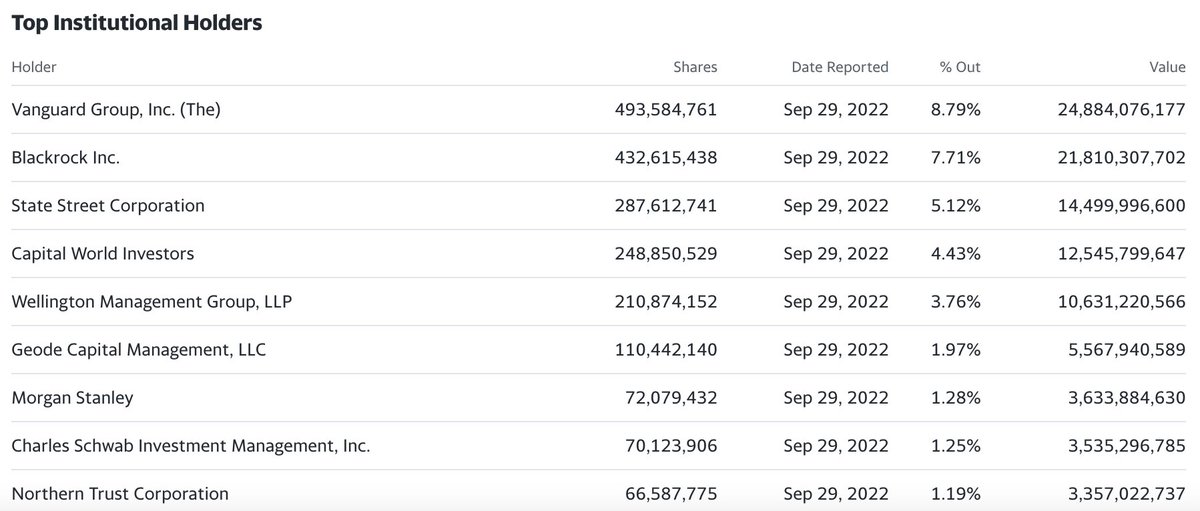

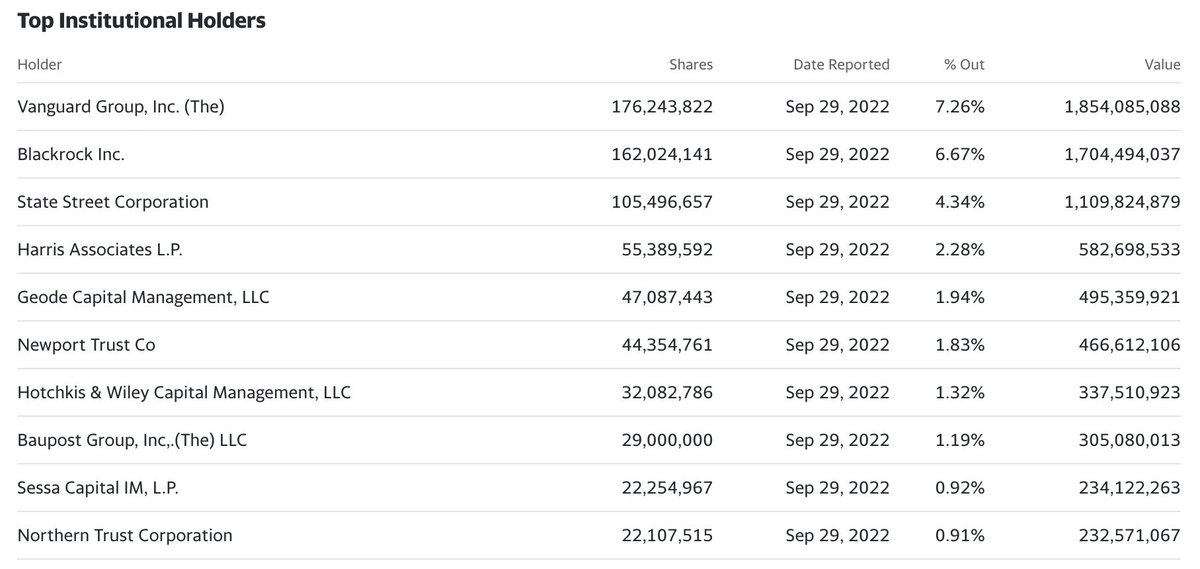

The majority of the companies listed under “Top Institutional Holders” are also owned by BlackRock and Vanguard

Everything around you is linked to these 2 companies

BlackRock and Vanguard own Big Pharma, via Pfizer $PFE, Johnson & Johnson $JNJ, $UNH...

The majority of the companies listed under “Top Institutional Holders” are also owned by BlackRock and Vanguard

Everything around you is linked to these 2 companies

BlackRock and Vanguard own Big Pharma, via Pfizer $PFE, Johnson & Johnson $JNJ, $UNH...

They own the food you consume, via companies such as Pepsi $PEP

Pepsi owns Lay's, Quaker, Gatorade, 7UP, Doritos, Cheetos Ruffles Etc…

Pepsi owns Lay's, Quaker, Gatorade, 7UP, Doritos, Cheetos Ruffles Etc…

If there is a certain agenda they want to push, they can prohibit opposition through their voting power

Because they own a substantial share of all the major companies in the US, it is in each company's fiduciary duty to make decisions in the shareholder's best interest (Them)

Because they own a substantial share of all the major companies in the US, it is in each company's fiduciary duty to make decisions in the shareholder's best interest (Them)

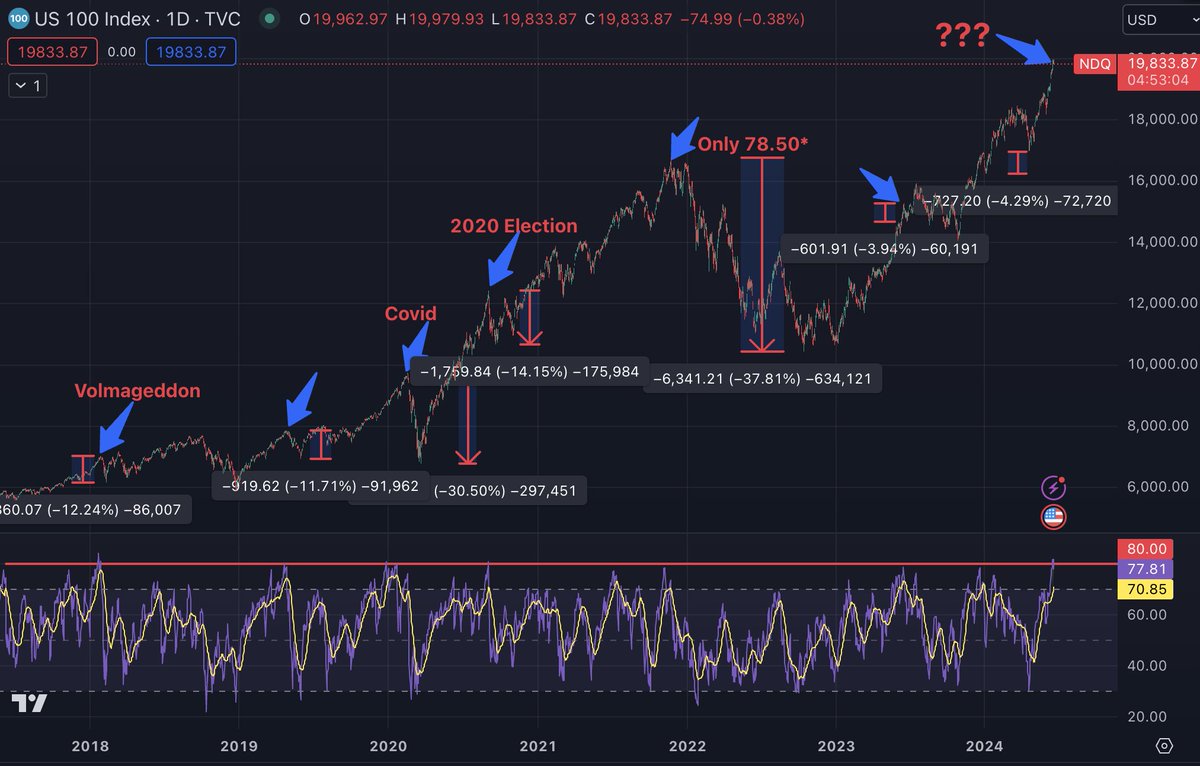

The obvious reaction is: “Well if they are so powerful, then why hasn’t the government broken them up?”

They can’t

The government relies on both of these companies to prop up the entire economic system

And that is what I will explain in-depth tomorrow. See you then.

They can’t

The government relies on both of these companies to prop up the entire economic system

And that is what I will explain in-depth tomorrow. See you then.

• • •

Missing some Tweet in this thread? You can try to

force a refresh