$SPY Trader 📊 Vol Chaser 📊 Liquidity Maker *Not financial advice*

2 subscribers

How to get URL link on X (Twitter) App

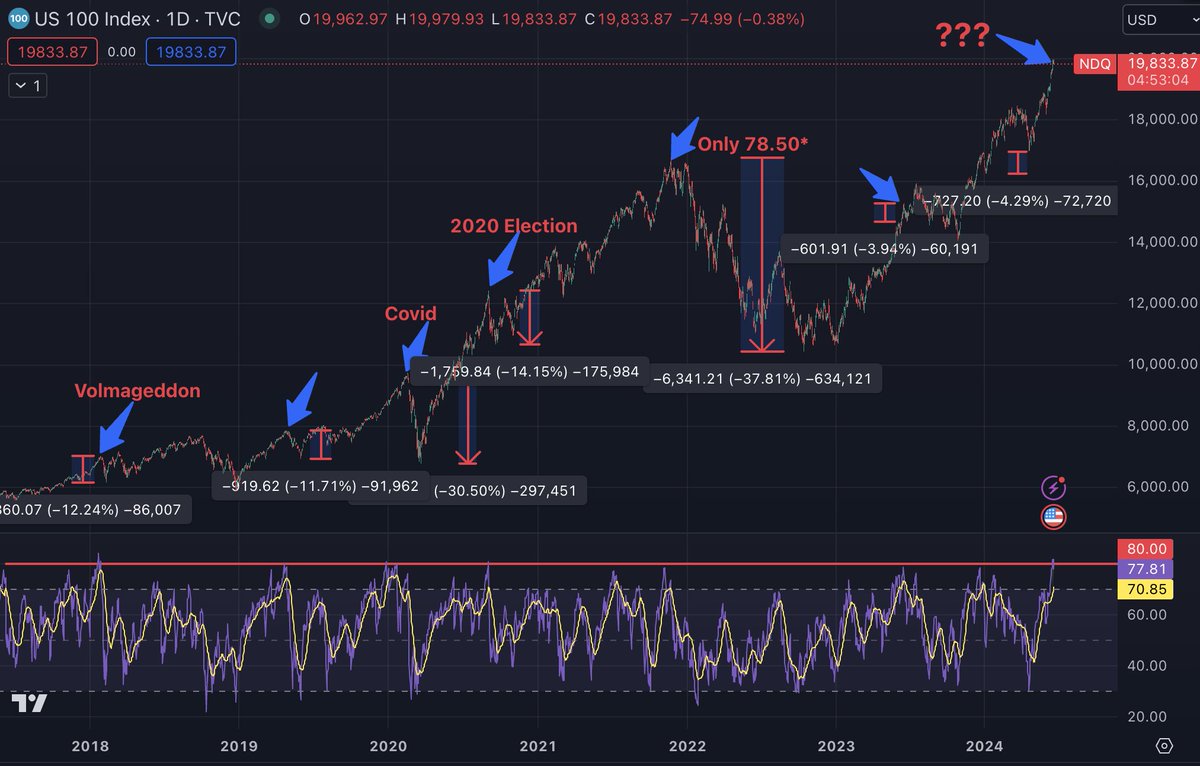

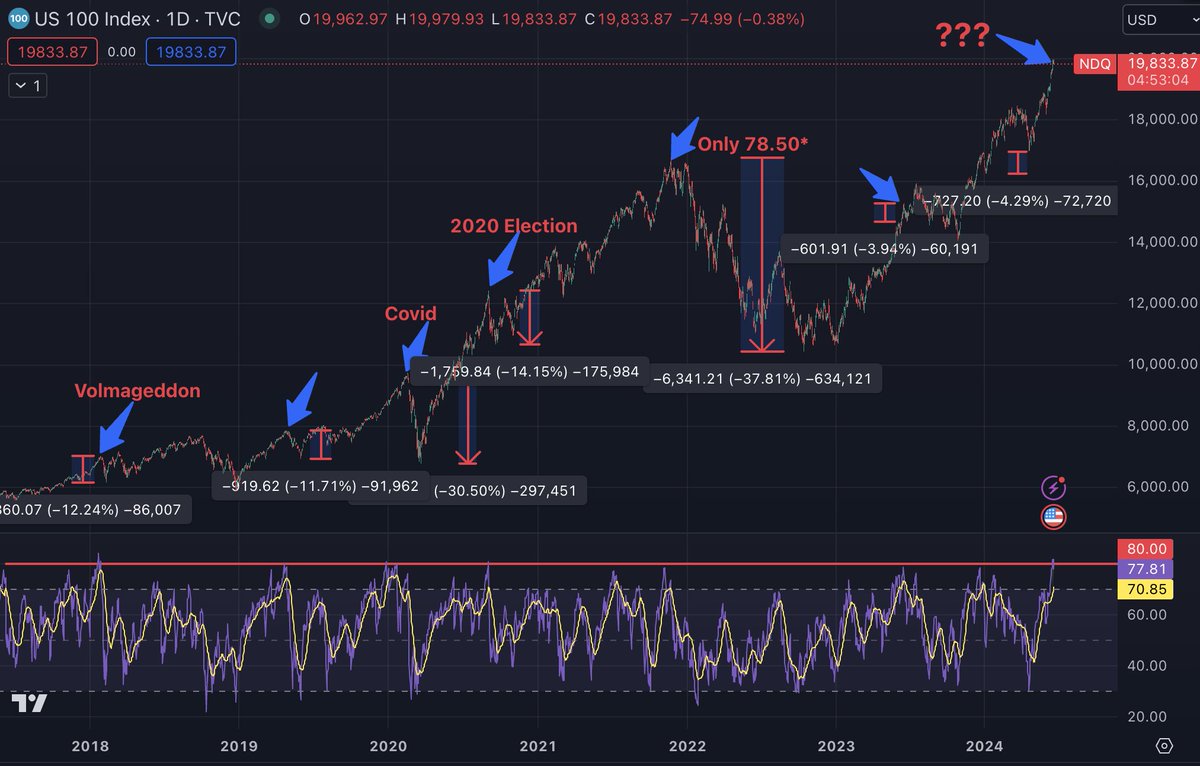

First off, since this rally has been very aggressive, it is important to not rush to short just because of one variable

First off, since this rally has been very aggressive, it is important to not rush to short just because of one variable

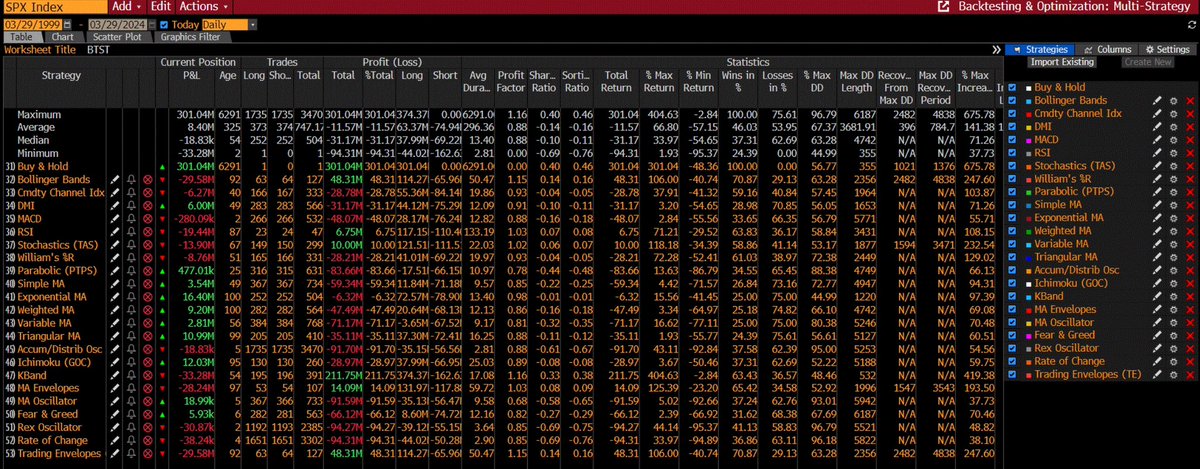

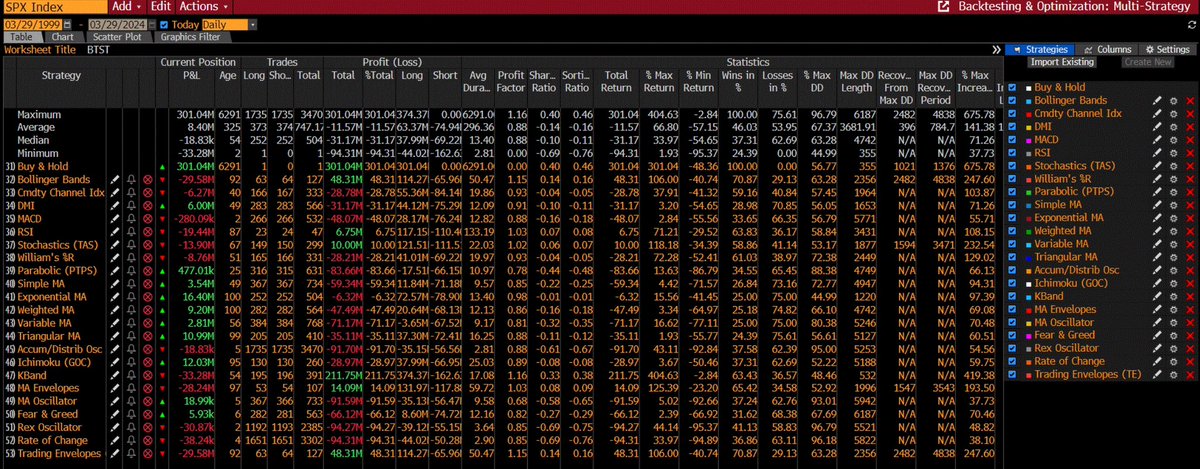

Bollinger Bands had a ‘whopping’ 70% success rate on $SPX, much higher than the other indicators

Bollinger Bands had a ‘whopping’ 70% success rate on $SPX, much higher than the other indicators

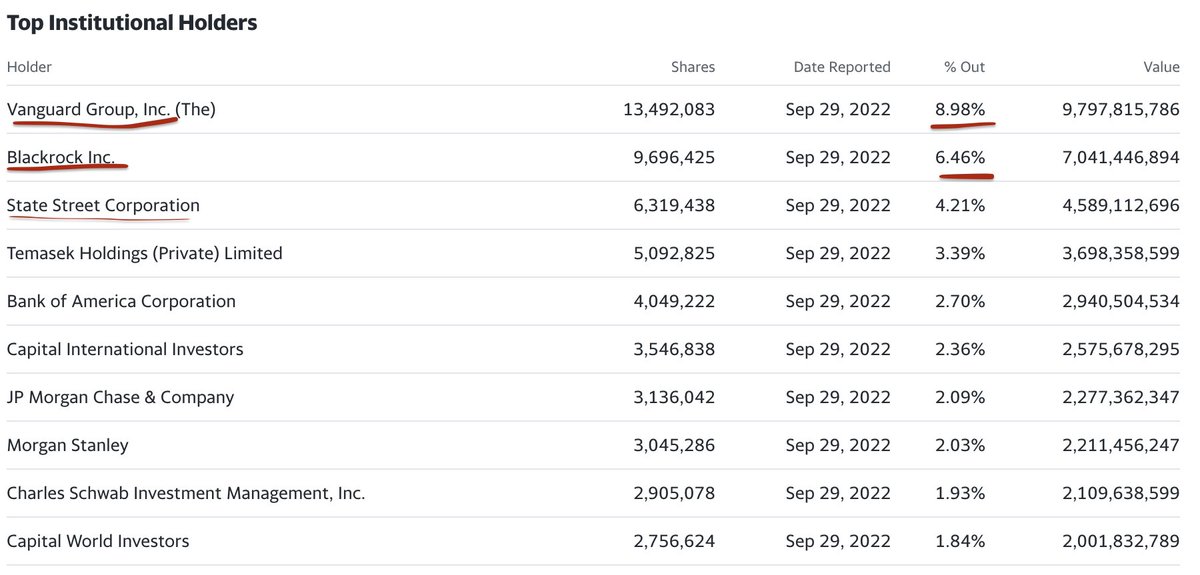

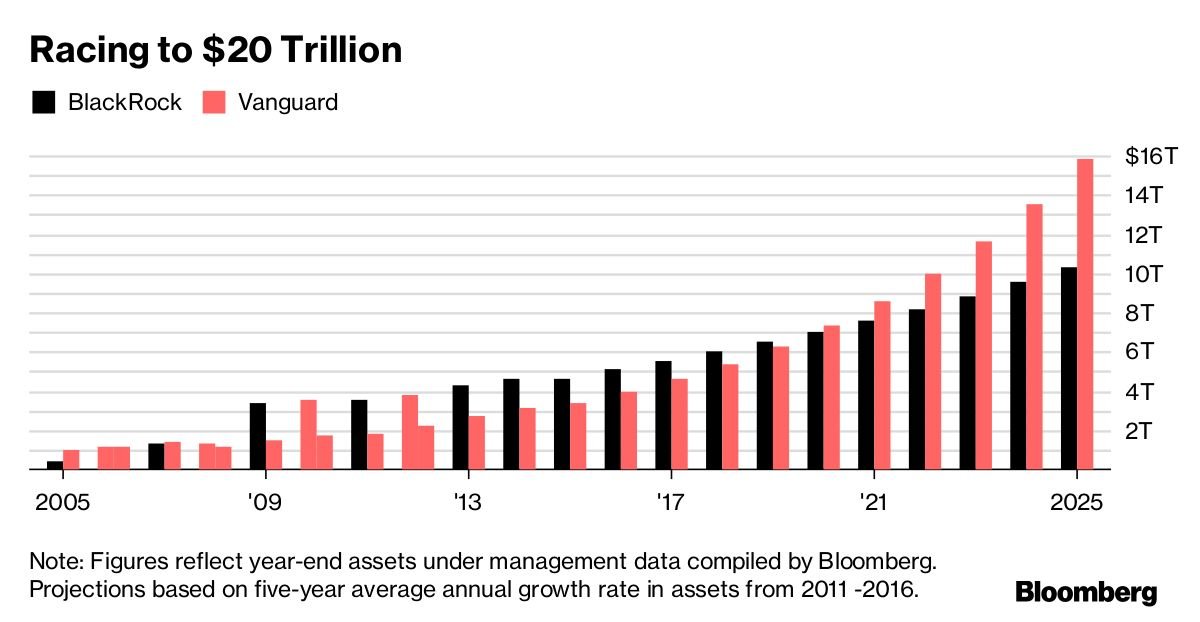

As the Fed began its historic purchases of corporate bonds/exchange-traded funds during the Covid Crisis, almost half of the Fed’s purchases went into BlackRock funds

As the Fed began its historic purchases of corporate bonds/exchange-traded funds during the Covid Crisis, almost half of the Fed’s purchases went into BlackRock funds