Ive done ya'll a horribe disservice - ima gun try to fix that.

#BONDS and #CURRENCIES thread.

I hope this helps.

🧵👇

#BONDS and #CURRENCIES thread.

I hope this helps.

🧵👇

jPan by far is the biggest holder of USA debt.

ticdata.treasury.gov/Publish/mfh.txt

yes other central banks can buy each others dog doo.

ticdata.treasury.gov/Publish/mfh.txt

yes other central banks can buy each others dog doo.

But central banks can also buy their OWN dog doo

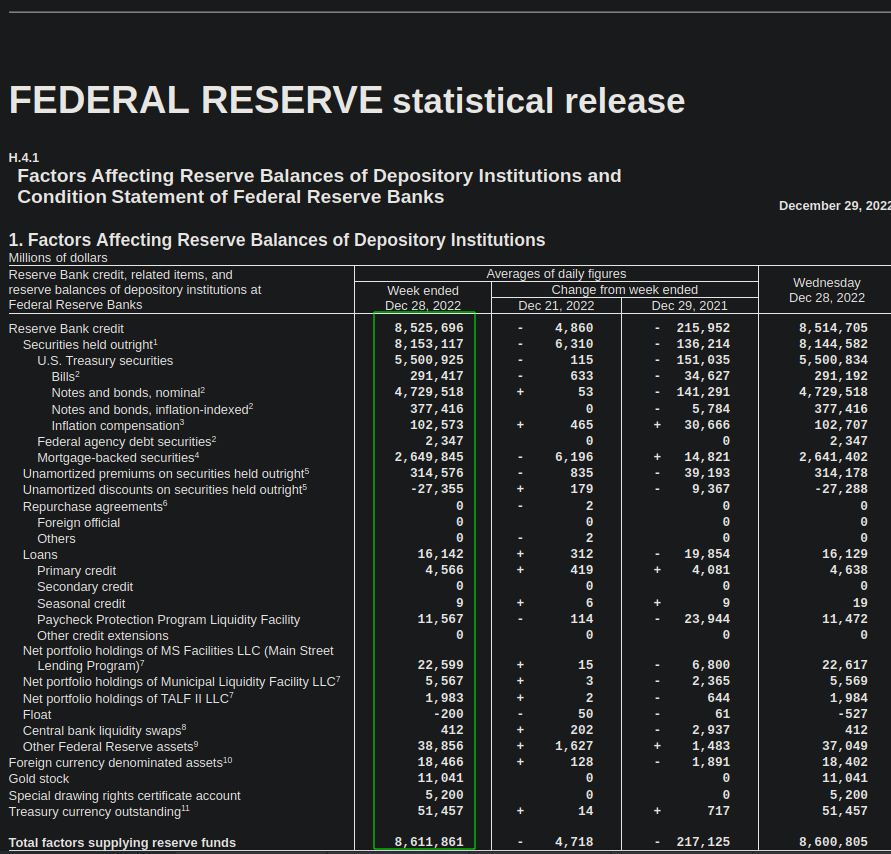

When a CB buys its own dog doo its called "quantative easing" or QE

federalreserve.gov/releases/h41/2…

When a CB buys its own dog doo its called "quantative easing" or QE

federalreserve.gov/releases/h41/2…

But what happens with another central bank sells another central banks currency...by a lot?

Here is jPan since Jan1 in 2022 selling US treasuries.

UUP is like the DXY, but single state (i will talk about this in a minute)

Notice the correlations ...

Here is jPan since Jan1 in 2022 selling US treasuries.

UUP is like the DXY, but single state (i will talk about this in a minute)

Notice the correlations ...

As jPan sold treasuries, bond yields went up, japanesa currency got weaker, USD got stronger.

By design.

By design.

So now you understand how bonds impact currencies

And notice on the tail how jPan started BUYING us Bonds. Yields went down, USD got weaker, and japanesa yen got stronger.

This is the basic mechanics of bonds across countries.

And it matters....

And notice on the tail how jPan started BUYING us Bonds. Yields went down, USD got weaker, and japanesa yen got stronger.

This is the basic mechanics of bonds across countries.

And it matters....

DXY.

I dont use DXY in charts because its flucky. DXY is a "trade weighted basket" of currencies.

I dont use DXY in charts because its flucky. DXY is a "trade weighted basket" of currencies.

so now think about it - if Swiss (CHF) suddenly buy a ton of US treasuries, suddenly it will impact their currency - what do you think happens if they buy a lot of US 30y bonds?

Well, lets take a look...

Over the last week of december, it appears Swiss were selling US treasuries.

Then all of a sudden yesterday they decided (with other CB's) to BUY them back.

Over the last week of december, it appears Swiss were selling US treasuries.

Then all of a sudden yesterday they decided (with other CB's) to BUY them back.

Every currency is a pair - USDJPY, CADEUR, etc.

DXY is different - its a kludgey ratio tht can be gamed.

Look what happened to DXY when swiss bought a ton of treasuries... (in purple)

CURRENCIES MATTER.

DXY is different - its a kludgey ratio tht can be gamed.

Look what happened to DXY when swiss bought a ton of treasuries... (in purple)

CURRENCIES MATTER.

Now lets throw a stonk index on here - QQQ is one of the most sensitive to currencies and bond yields.

Look at that fkr jump around (orange)

Sometimes when i saw "swap" its also CB's dumping or buying bonds, just like this.

Look at that fkr jump around (orange)

Sometimes when i saw "swap" its also CB's dumping or buying bonds, just like this.

The baseball anology - from slide one.

Consider each ball a few BILLION in US treasuries.

If they sell to another CB, It skewes the DXY formula (the ratio is not even between member states).

SOME - like EU- have a MUCH bigger impact to DXY when they buy or sell treasuries.

Consider each ball a few BILLION in US treasuries.

If they sell to another CB, It skewes the DXY formula (the ratio is not even between member states).

SOME - like EU- have a MUCH bigger impact to DXY when they buy or sell treasuries.

If the SWISS were to buy treasuries from everyone, the swiss currency would get SUPER strong relative to every other member state - this would be TERRIBLE for swiss economy as a strong currncy kills your exports.

npr.org/2011/08/11/139…

npr.org/2011/08/11/139…

So what these CB's are doing is COORDINATING;so no 1 member state has a currency that is too strong or too weak - a weak currency creates an unfair advantage

When you go shopping/vacation, you go where the opposing currency is CHEAP relative to your own.

expatica.com/ch/general/sw-…

When you go shopping/vacation, you go where the opposing currency is CHEAP relative to your own.

expatica.com/ch/general/sw-…

Great example this morning

Anyone wanna try to explain this?

Use everything presented above.

Perfect example of how CB's are fighting oil (i mean "inflation")

Anyone wanna try to explain this?

Use everything presented above.

Perfect example of how CB's are fighting oil (i mean "inflation")

Another perspective:

If you hold USD rn you want to go to any of the boxes in red for vacation.

Your vacation, and stuff to buy while you there just got a little cheaper.

Thats what this currency manipulation thru bonds does.

If you hold USD rn you want to go to any of the boxes in red for vacation.

Your vacation, and stuff to buy while you there just got a little cheaper.

Thats what this currency manipulation thru bonds does.

u now know what i know - currencies matter a lot.

DXY has been nuts lately....

lets peel back the onion and see why....

#DESPERATION

DXY has been nuts lately....

lets peel back the onion and see why....

#DESPERATION

• • •

Missing some Tweet in this thread? You can try to

force a refresh