My Ph.D. professors taught me MATLAB during my master's degree.

So I watched 200 YouTube videos to learn Python

96% of them were a complete waste of time.

But these 8 taught me more than all my Ph.D. professors combined.

So I watched 200 YouTube videos to learn Python

96% of them were a complete waste of time.

But these 8 taught me more than all my Ph.D. professors combined.

Algorithmic Trading Using Python

Learn how to perform algorithmic trading using Python in this complete course. Algorithmic trading means using computers to make investment decisions.

Learn how to perform algorithmic trading using Python in this complete course. Algorithmic trading means using computers to make investment decisions.

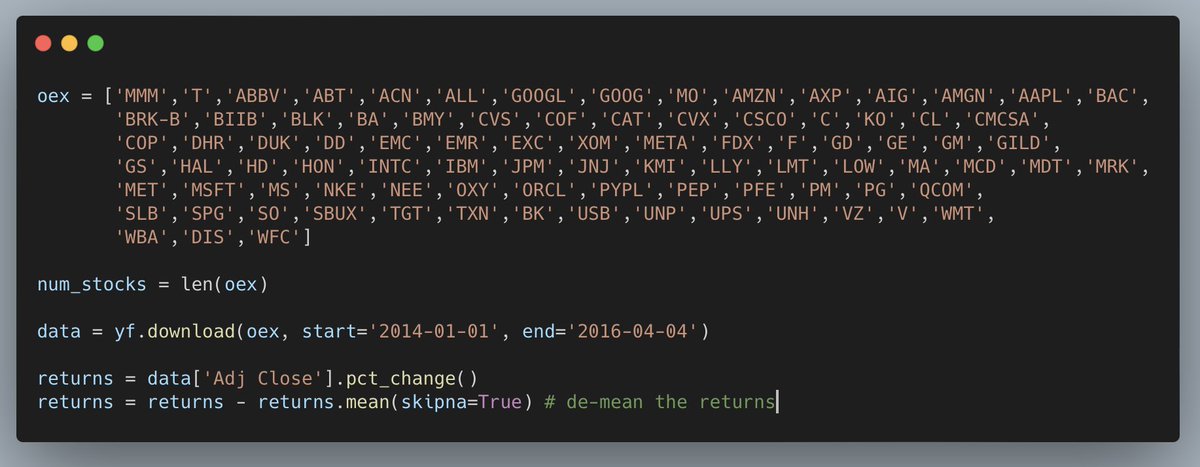

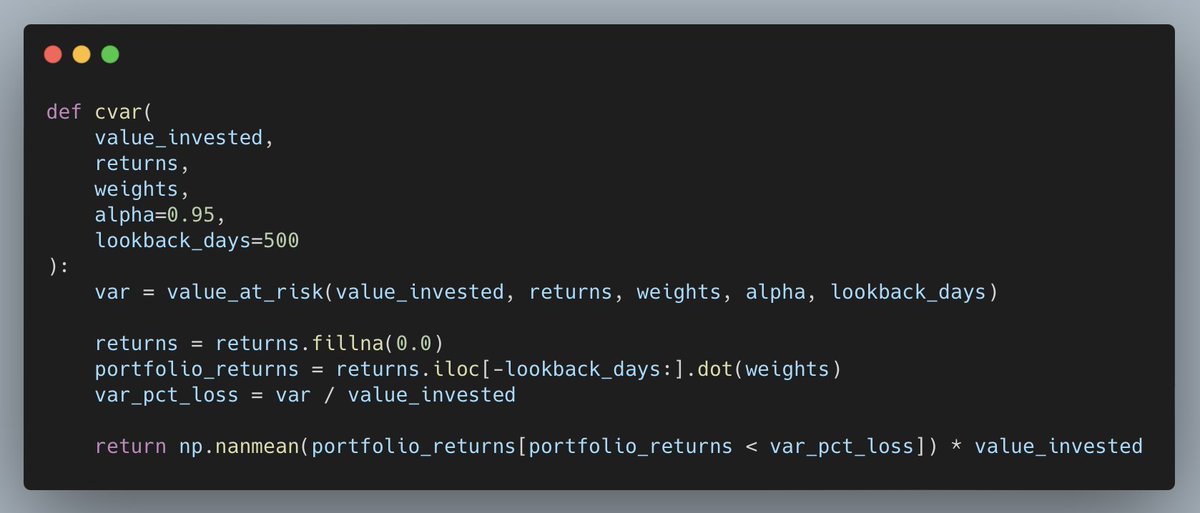

Quantitative Stock Price Analysis with Python

We look at some quantitative analytical methods of stock price changes using Python and pandas.

We look at some quantitative analytical methods of stock price changes using Python and pandas.

How to Create & Test Trading Algorithm in Python

Learn how to download and manipulate data then develop a momentum strategy trading algorithm with Python.

Learn how to download and manipulate data then develop a momentum strategy trading algorithm with Python.

Python for Quant Finance

The talk discusses and illustrates why Python might be the right choice for implementing ambitious quant finance applications and projects.

The talk discusses and illustrates why Python might be the right choice for implementing ambitious quant finance applications and projects.

Algorithmic Trading in Python

The video is a full tutorial which starts from basic installation of python and anaconda all the way to backtesting strategies and creating trading API.

The video is a full tutorial which starts from basic installation of python and anaconda all the way to backtesting strategies and creating trading API.

How to Code a Trading Bot in Python

In this video, we are going to code a python trading algorithm in the QuantConnect platform.

In this video, we are going to code a python trading algorithm in the QuantConnect platform.

Stock Price Prediction Using Python & Machine Learning

In this video, you will learn how to create an artificial neural network called Long Short Term Memory to predict the future price of a stock.

In this video, you will learn how to create an artificial neural network called Long Short Term Memory to predict the future price of a stock.

Estimating a Risk Factor Model for a Stock with Live Data

In this tutorial, we will learn how to estimate the Fama French Carhart four-factor risk model exposures for an arbitrary stock using live data in Python.

In this tutorial, we will learn how to estimate the Fama French Carhart four-factor risk model exposures for an arbitrary stock using live data in Python.

And I have 1 more thing for you.

If you like Tweets about getting started with Python for quant finance, you might enjoy my weekly newsletter: The PyQuant Newsletter.

Join 10,000+ subscribers.

Python code for quantitative analysis you can use.

pyquantnews.com/the-pyquant-ne…

If you like Tweets about getting started with Python for quant finance, you might enjoy my weekly newsletter: The PyQuant Newsletter.

Join 10,000+ subscribers.

Python code for quantitative analysis you can use.

pyquantnews.com/the-pyquant-ne…

There are 675 minutes of video in this thread.

Enough for a week!

If you can't get to it all at once, save this thread and come back later.

Click the link and retweet the top tweet!

Enough for a week!

If you can't get to it all at once, save this thread and come back later.

Click the link and retweet the top tweet!

https://twitter.com/pyquantnews/status/1610808602612178945

Crush imposter syndrome.

Get out of Tutorial Hell.

Go from beginner to up and running with Python for quant finance in 30 days.

• Community

• Frameworks

• Live sessions

• Special guests

• Jupyter Notebooks

January cohort is open - limited spots.

…gstartedwithpythonforquantfinance.com

Get out of Tutorial Hell.

Go from beginner to up and running with Python for quant finance in 30 days.

• Community

• Frameworks

• Live sessions

• Special guests

• Jupyter Notebooks

January cohort is open - limited spots.

…gstartedwithpythonforquantfinance.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh