Dear Nigerians,

@MBuhari has asked @nassnigeria to approve the securitization of FG's N22.7tn debt to @cenbank.

Is it legal for @nassnigeria to approve the request of the FG to securitize the Ways & Means, which goes against the CBN Act?

Thread!

@MBuhari has asked @nassnigeria to approve the securitization of FG's N22.7tn debt to @cenbank.

Is it legal for @nassnigeria to approve the request of the FG to securitize the Ways & Means, which goes against the CBN Act?

Thread!

Since 2015, the FG has asked @cenbank to provide advances to fund its fiscal deficit without any requirement for cost-cutting measures/fiscal control. The law stipulates that such advances should be limited to 5% of the previous year's revenues. This law has not been followed.

Also, Section 38 of the CBN Act mandates the FG to repay all advances made by the CBN to it at the end of the financial year in which the advances were received. Failure to repay the advances in full implies that the FG will not be eligible for further advances by the CBN.

While FG has continuously breached the CBN Act, it now seeks the @nassnigeria’s approval to offload N22.7tn debt for 40 years at a 9% interest rate. Findings have shown that it will be difficult to sell such debt at the specified rate.

Currently, the FG has been on a borrowing binge as domestic debt increased from N8.3tn in June 2015 to N21.6tn as of June 2022, & foreign debt rose from $10b in 2015 to $39.66b in 2022.

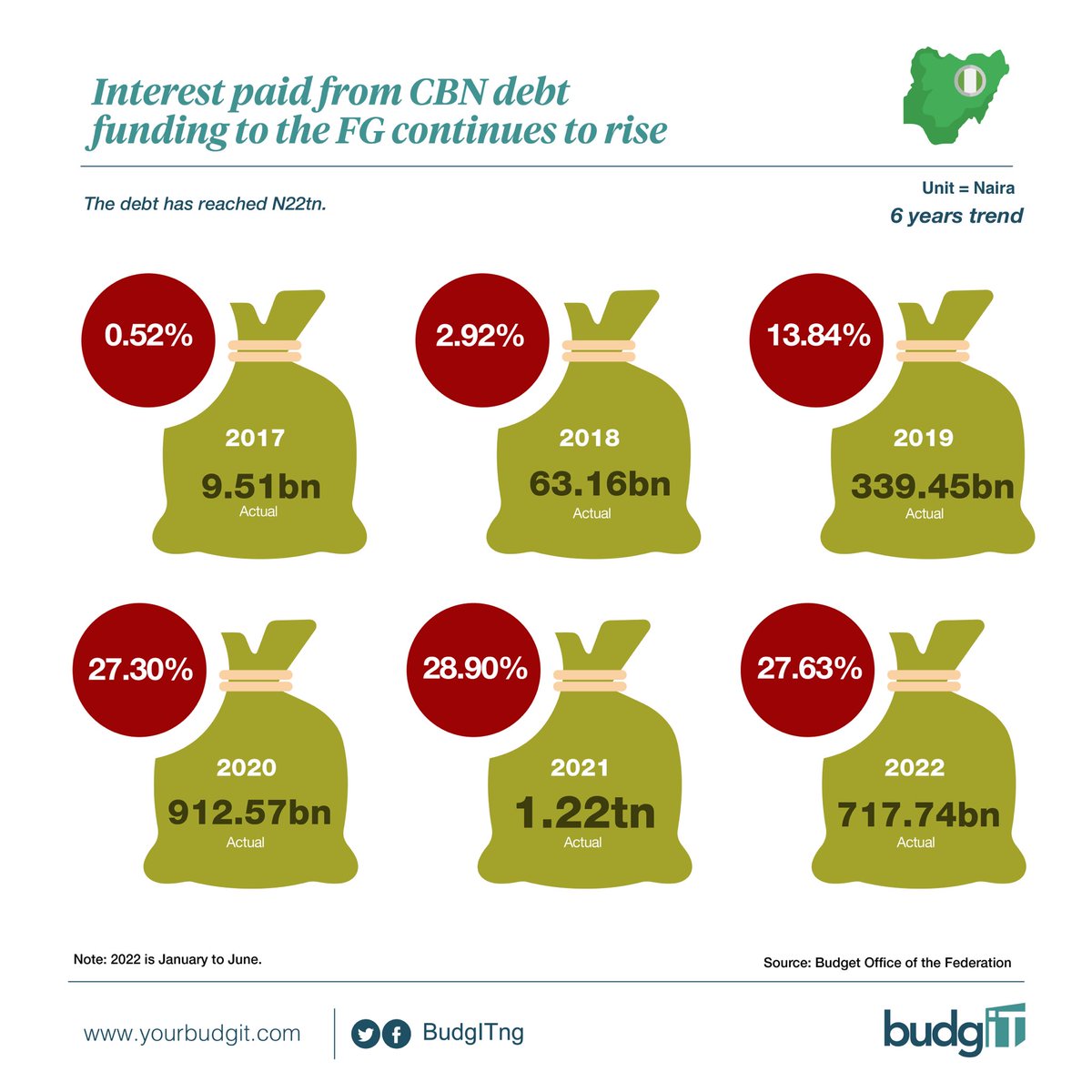

Similarly, interest paid in Ways and Means (CBN Debt to FG) grew from N9.51b in 2017 to N1.22tn in 2021. In the meantime. the CBN's new debt adds at least N2.5tn annually to Nigeria’s debt servicing costs.

According to a recent MTF, Nigeria's debt servicing cost is projected to reach N10tn in 2025. If National Assembly approves this action, FG's public debt will rise from its current state by 59% - from $89.5b to $142b.

In 2021, FG used 91% of its N4.64tn revenue to service public debt. Unless something drastic happens with revenue growth, the FG will spend more on servicing debt. This has implications for inflation, economic confidence, higher interest rates & weakened exchange rates.

Is it legal for the National Assembly to approve the request of the Federal Government to securitise the Ways and Means, which is in clear breach of the CBN Act? More importantly, what were the borrowings used for? #AskQuestion #GetInvolved

• • •

Missing some Tweet in this thread? You can try to

force a refresh