Nigeria's civic tech organisation, raising the standards of transparency, citizen engagement & accountability most especially in public finance. #AskQuestions

3 subscribers

How to get URL link on X (Twitter) App

Our analysis reveals that 238 projects valued above N5 billion each, with a cumulative value of N2.29 trillion, were inserted with little to no justification.

Our analysis reveals that 238 projects valued above N5 billion each, with a cumulative value of N2.29 trillion, were inserted with little to no justification.

While references have been made to certain revenue sources, no comprehensive data has been released to allow for independent scrutiny.

While references have been made to certain revenue sources, no comprehensive data has been released to allow for independent scrutiny.

The 2025 Proposed Budget also excluded the budgets of over 60 government-owned enterprises (GOEs), including the Nigeria Ports Authority, Nigeria Customs Service, and the Nigerian Maritime Administration and Safety Agency (NIMASA). #AskQuestions

The 2025 Proposed Budget also excluded the budgets of over 60 government-owned enterprises (GOEs), including the Nigeria Ports Authority, Nigeria Customs Service, and the Nigerian Maritime Administration and Safety Agency (NIMASA). #AskQuestions

Where did the revenue come from?

Where did the revenue come from?

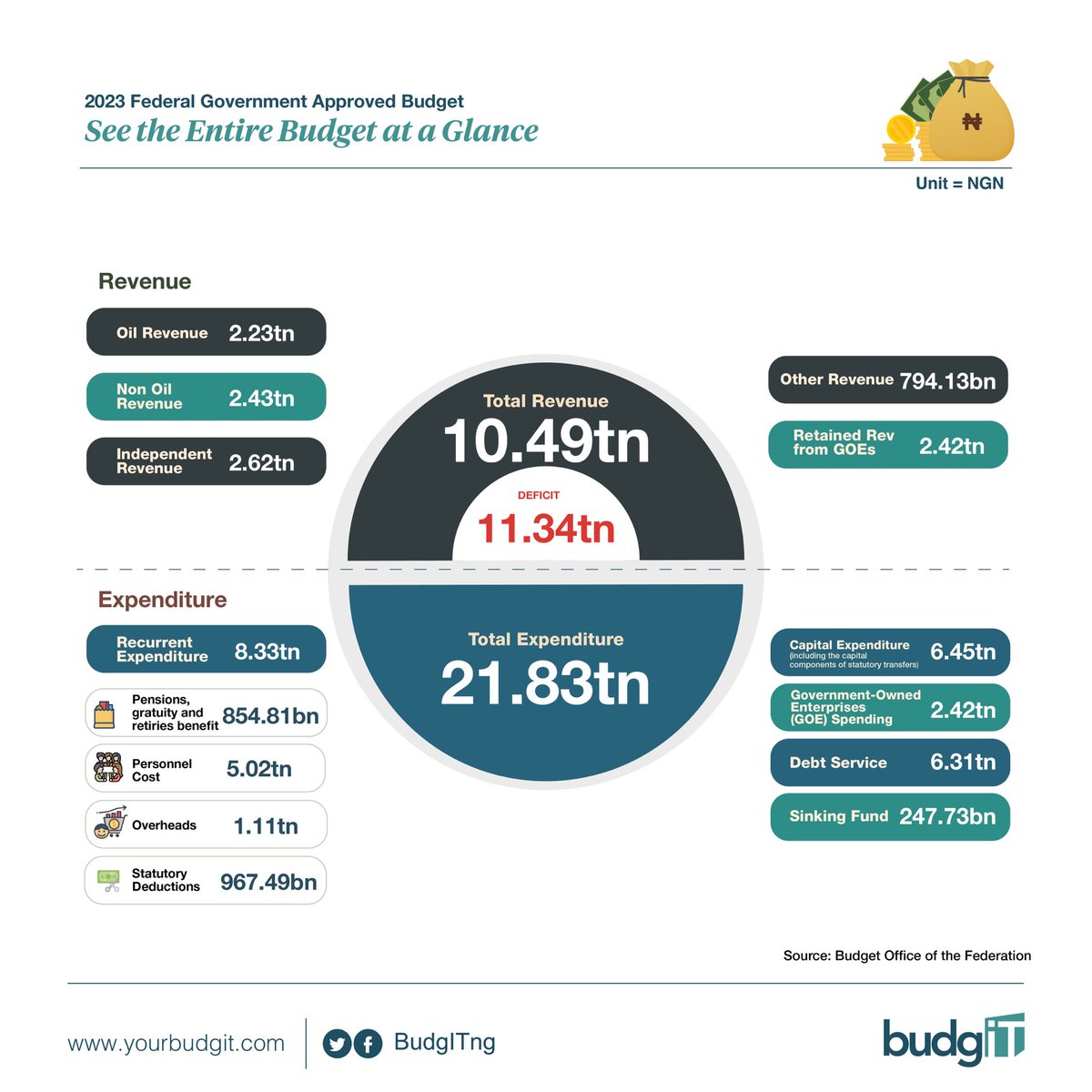

Recall that the 2023 Approved Budget of N21.83 trillion, signed into law by President @MBuhari in January 2023, was designed to run for 12 calendar months from January to December, as is the practice globally.

Recall that the 2023 Approved Budget of N21.83 trillion, signed into law by President @MBuhari in January 2023, was designed to run for 12 calendar months from January to December, as is the practice globally.

The fiscal deficit is currently N9.18tn. The projected deficit represents about 50% of the federal government’s expected revenue and 3.88% of the projected GDP.

The fiscal deficit is currently N9.18tn. The projected deficit represents about 50% of the federal government’s expected revenue and 3.88% of the projected GDP.

…while the comprehensive budget breakdown of GOEs, @nassnigeria, National Judicial Council, Public Complaints Commission, INEC, and TETFUND totaling N3.32tn was excluded from the budget that was passed and published.

…while the comprehensive budget breakdown of GOEs, @nassnigeria, National Judicial Council, Public Complaints Commission, INEC, and TETFUND totaling N3.32tn was excluded from the budget that was passed and published.

BudgIT, under its State Fiscal Transparency League project, has extensively assessed the procurement websites of Nigeria’s 36 states to evaluate the level of transparency and accessibility of procurement-related information to the public. #SFTLProject #AskQuestions

BudgIT, under its State Fiscal Transparency League project, has extensively assessed the procurement websites of Nigeria’s 36 states to evaluate the level of transparency and accessibility of procurement-related information to the public. #SFTLProject #AskQuestions

In August 2023, we itemized ten plagues that the Tinubu administration should avoid in the 2024 budget and budget process to ensure value for money, curb expenditure inefficiency and waste, enforce accountability, and put Nigeria on the pathway of prosperity, economic growth, and development.

In August 2023, we itemized ten plagues that the Tinubu administration should avoid in the 2024 budget and budget process to ensure value for money, curb expenditure inefficiency and waste, enforce accountability, and put Nigeria on the pathway of prosperity, economic growth, and development.

Informal tax collection is one of the major challenges. - @taiwoyedele

Informal tax collection is one of the major challenges. - @taiwoyedele

BudgIT’s Global Director, @seunonigbinde in his introductory remark emphasized that the fiscal business series will set the tone for issues & reforms on the cost of governance, macro economic fundamentals, social spending, & expenditures on health and education in Nigeria.

BudgIT’s Global Director, @seunonigbinde in his introductory remark emphasized that the fiscal business series will set the tone for issues & reforms on the cost of governance, macro economic fundamentals, social spending, & expenditures on health and education in Nigeria.

A total of N81.7b was allocated to the construction of solar street lights in the 2023 FG Capital and Constituency projects. This is higher than the total allocation to schools and primary health centers, which gulp N77.9b and N3.1b, respectively, in the budget. #AskQuestions.

A total of N81.7b was allocated to the construction of solar street lights in the 2023 FG Capital and Constituency projects. This is higher than the total allocation to schools and primary health centers, which gulp N77.9b and N3.1b, respectively, in the budget. #AskQuestions.

From the total revenue of N10.49tn, independent revenue has the highest share of N2.62tn, Non-oil Revenue has N2.43tn, while N2.23tn will be gotten from oil revenue. Retained Revenue from GOEs is N2.42tn, and other revenue will generate N794.13bn. 2/5

From the total revenue of N10.49tn, independent revenue has the highest share of N2.62tn, Non-oil Revenue has N2.43tn, while N2.23tn will be gotten from oil revenue. Retained Revenue from GOEs is N2.42tn, and other revenue will generate N794.13bn. 2/5

1,522 projects with a cumulative cost of N186.61bn were inserted into the #2022budget of @FmardNg. Key allocations to projects that are crucial to achieving the strategic goal of the Nat Devt Plan were drastically reduced to create fiscal space for the @nassnigeria insertions.2/5

1,522 projects with a cumulative cost of N186.61bn were inserted into the #2022budget of @FmardNg. Key allocations to projects that are crucial to achieving the strategic goal of the Nat Devt Plan were drastically reduced to create fiscal space for the @nassnigeria insertions.2/5

Let’s take a step back to understand open contracting!

Let’s take a step back to understand open contracting!

Of the total N20.51tn, debt service has the highest allocation of N6.31trn, while personnel cost and capital expenditure will gulp N4.99tn & N4.93tn, respectively. N744.11b has been earmarked for statutory transfer, of which the @nassnigeria & @njcNig will receive N159b & N150b.

Of the total N20.51tn, debt service has the highest allocation of N6.31trn, while personnel cost and capital expenditure will gulp N4.99tn & N4.93tn, respectively. N744.11b has been earmarked for statutory transfer, of which the @nassnigeria & @njcNig will receive N159b & N150b.

Open contracting is a procurement method that supports feedback and increases competition among potential contractors. It is crucial for transparency purposes and will help prevent fraud and corruption. #FixOurOil

Open contracting is a procurement method that supports feedback and increases competition among potential contractors. It is crucial for transparency purposes and will help prevent fraud and corruption. #FixOurOil

Let's take a step backwards.

Let's take a step backwards.

In our Consultation Memo released in Feb 2022, we highlighted several reform issues bordering on Nigeria’s public financial management that affect the very core of governance, separation of powers, expenditure efficiency, and the livelihoods of millions of Nigerians;

In our Consultation Memo released in Feb 2022, we highlighted several reform issues bordering on Nigeria’s public financial management that affect the very core of governance, separation of powers, expenditure efficiency, and the livelihoods of millions of Nigerians;

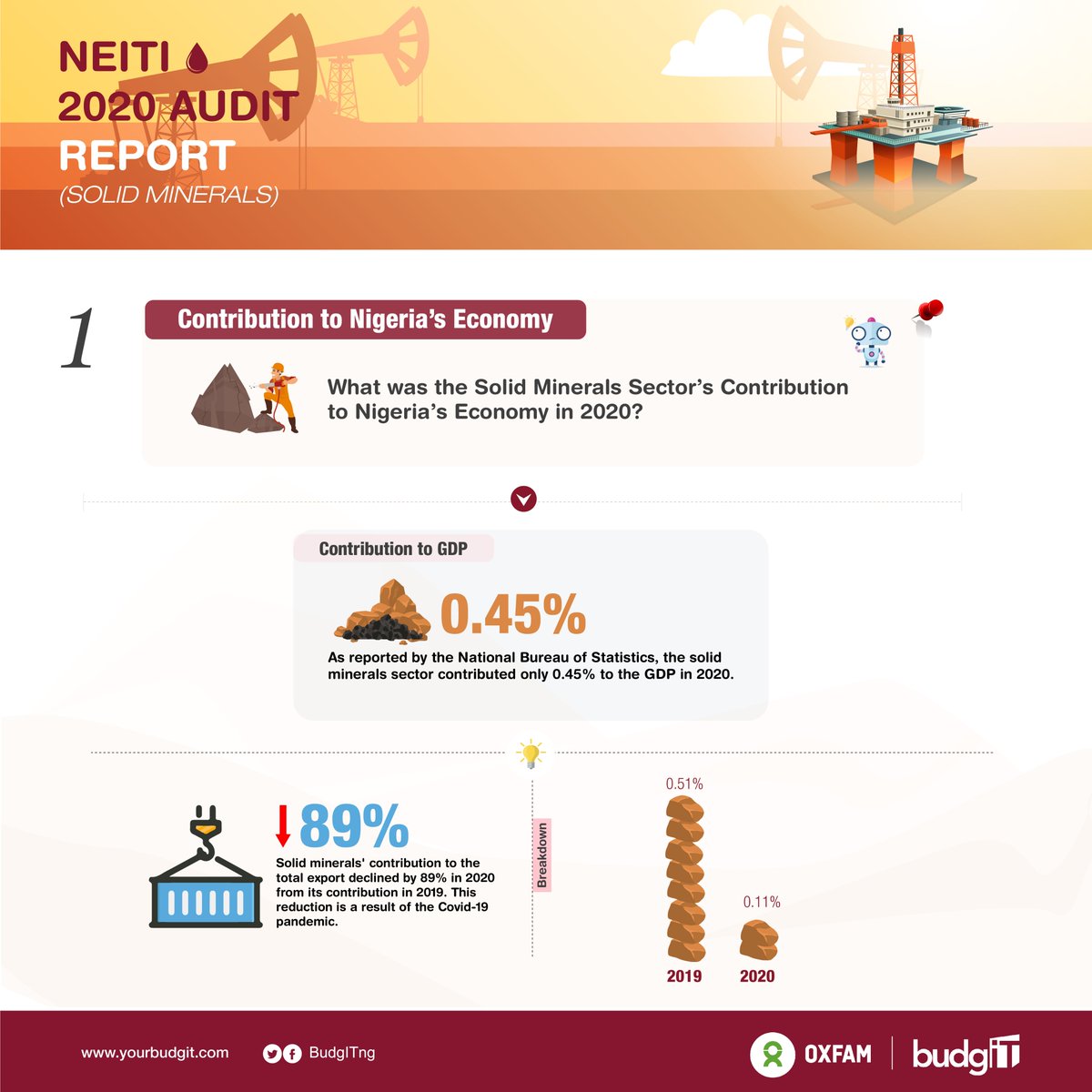

The sector contributed 0.45% to Nigeria’s GDP, while its contribution to the total export declined by 89% in 2020.

The sector contributed 0.45% to Nigeria’s GDP, while its contribution to the total export declined by 89% in 2020.