You can generate wealth if you're early to the right crypto narratives.

Here are 13 narratives you should watch in 2023 (and a few to avoid):

Here are 13 narratives you should watch in 2023 (and a few to avoid):

Tokenized Real-World Assets

DeFi needs more sustainable yields.

Tokenizing real-world assets unlocks cashflow that's not affected by Crypto's volatility.

This can improve transparency, capital efficiency, and liquidity in assets.

Think real estate, art, and more.

DeFi needs more sustainable yields.

Tokenizing real-world assets unlocks cashflow that's not affected by Crypto's volatility.

This can improve transparency, capital efficiency, and liquidity in assets.

Think real estate, art, and more.

RWA Protocols

There's progress being made.

Some highlights:

• Maker Protocol has $600 million in real-world asset collateral.

• GoldFinch / Maple Finance are tackling loans.

• Centrifuge's Tinlake has some diversified real world assets

There's progress being made.

Some highlights:

• Maker Protocol has $600 million in real-world asset collateral.

• GoldFinch / Maple Finance are tackling loans.

• Centrifuge's Tinlake has some diversified real world assets

NFT Financialization

The biggest NFT projects have value - BAYC floor prices are around 73 ETH.

DeFi x NFT is about unlocking NFT's liquidity & turning them into productive assets.

The first wave of projects allow you to use your NFTs as collateral, such as NFTfi & BendDao

The biggest NFT projects have value - BAYC floor prices are around 73 ETH.

DeFi x NFT is about unlocking NFT's liquidity & turning them into productive assets.

The first wave of projects allow you to use your NFTs as collateral, such as NFTfi & BendDao

The Next Wave

We're starting to see the next generation of NFT Financialization.

1) nftperp - short or long NFTs /w leverage. It's in beta & has attracted $21m+ of volume.

2) insrt finance - Shard vaults. They fractionalize NFTs and then you can earn yield.

We're starting to see the next generation of NFT Financialization.

1) nftperp - short or long NFTs /w leverage. It's in beta & has attracted $21m+ of volume.

2) insrt finance - Shard vaults. They fractionalize NFTs and then you can earn yield.

Cosmos Chains

Plenty of new chains are being built /w Cosmos.

• Berachain 🐻 ⛓️ - proof of liquidity consensus.

• Kujira 🉐 - an ecosystem built around real yield. They're constantly launching new products.

• Canto - EVM Compatible on Cosmos. Liquidity as a public good.

Plenty of new chains are being built /w Cosmos.

• Berachain 🐻 ⛓️ - proof of liquidity consensus.

• Kujira 🉐 - an ecosystem built around real yield. They're constantly launching new products.

• Canto - EVM Compatible on Cosmos. Liquidity as a public good.

Sei

Sei is a DeFi-specific L1 chain optimized for trading.

CLOBs (central limit order book) are the standard for TradFi.

In Crypto? Only centralized exchanges could use them due to the speed requirements.

(they utilize fast Web 2 technology)

Sei is a DeFi-specific L1 chain optimized for trading.

CLOBs (central limit order book) are the standard for TradFi.

In Crypto? Only centralized exchanges could use them due to the speed requirements.

(they utilize fast Web 2 technology)

New Possibilities

We've been wanting CLOBs due to tighter spreads and lower slippage.

Sei has figured out how to make it decentralized and fast.

(600ms finality, 22k orders per second).

There will be a new generation of DeFi products built on top of Sei's technology.

We've been wanting CLOBs due to tighter spreads and lower slippage.

Sei has figured out how to make it decentralized and fast.

(600ms finality, 22k orders per second).

There will be a new generation of DeFi products built on top of Sei's technology.

Zk-rollups

Ethereum is relying on Layer 2 solutions to scale.

There are 2 types of rollups:

1) Optimistic rollups such as Arbitrum & Optimism

2) Zk-rollups

Optimistic rollups have the 1st mover advantage, but many consider zk-rollups to be the superior tech.

Ethereum is relying on Layer 2 solutions to scale.

There are 2 types of rollups:

1) Optimistic rollups such as Arbitrum & Optimism

2) Zk-rollups

Optimistic rollups have the 1st mover advantage, but many consider zk-rollups to be the superior tech.

The Future

Due to the complexity, it'll take years for zk-Rollups to deploy fully.

Pay attention to the following:

• Scroll

• zkSync

• Starkware

• Aztec Network

• Polygon Miden & Hermez

We'll see more new dapps going live with zk-rollup technology this year.

Due to the complexity, it'll take years for zk-Rollups to deploy fully.

Pay attention to the following:

• Scroll

• zkSync

• Starkware

• Aztec Network

• Polygon Miden & Hermez

We'll see more new dapps going live with zk-rollup technology this year.

Arbitrum

Even though zk-rollups are the future, Arbitrum (Optimistic rollup) is crushing it now.

Every new DeFi innovation I see is happening here, and OG protocols are expanding to Arbitrum.

A lot of TVL from layer 1 chains keep migrating towards Arbitrum.

Even though zk-rollups are the future, Arbitrum (Optimistic rollup) is crushing it now.

Every new DeFi innovation I see is happening here, and OG protocols are expanding to Arbitrum.

A lot of TVL from layer 1 chains keep migrating towards Arbitrum.

Arbitrum Plays

There are two ways to play Arbitrum.

1) Use the top dapps and hope for an airdrop one day.

2) Keep an eye on the new, interesting protocols launching.

I'm constantly monitoring DeFiLlama to find dapps with rapid TVL increases.

There are two ways to play Arbitrum.

1) Use the top dapps and hope for an airdrop one day.

2) Keep an eye on the new, interesting protocols launching.

I'm constantly monitoring DeFiLlama to find dapps with rapid TVL increases.

Celestia

The 1st blockchains were monolithic designs - single blockchains did everything: consensus, execution, & data availability.

This leads to issues with scaling & decentralization.

Modular blockchains take a different approach by separating layers & duties.

The 1st blockchains were monolithic designs - single blockchains did everything: consensus, execution, & data availability.

This leads to issues with scaling & decentralization.

Modular blockchains take a different approach by separating layers & duties.

Celestia's Value

Think of Celestia as the Amazon Web Services of blockchains.

It can lower security costs and make launching a blockchain as simple as deploying a smart contract.

And these blockchains will be customizable & sovereign.

Think of Celestia as the Amazon Web Services of blockchains.

It can lower security costs and make launching a blockchain as simple as deploying a smart contract.

And these blockchains will be customizable & sovereign.

The Perps War

Decentralized perps found product/market fit last year. And FTX's death gave it new life.

Although it feels saturated as a DeFi degen, decentralized perps have barely penetrated the total market.

Plenty of room to grow as they keep innovating.

Decentralized perps found product/market fit last year. And FTX's death gave it new life.

Although it feels saturated as a DeFi degen, decentralized perps have barely penetrated the total market.

Plenty of room to grow as they keep innovating.

The Main Perps Protocols:

• Perp

• GMX

• dYdX

• Gains Network

• Kwenta by Synthetix

• Countless GMX forks

I'll watch how much traction GNS can get on Arbitrum (GMX's territory), and how dydx integrates to its own Cosmos blockchain.

• Perp

• GMX

• dYdX

• Gains Network

• Kwenta by Synthetix

• Countless GMX forks

I'll watch how much traction GNS can get on Arbitrum (GMX's territory), and how dydx integrates to its own Cosmos blockchain.

Decentralized Sports Betting

Crypto degens and sports betting naturally go together.

We are too early as there aren't that many protocols live yet.

Some names that came up in my research:

• Betswap (Backed by Wonderland)

• Frontrunner (injective)

• RektBets (Kujira)

Crypto degens and sports betting naturally go together.

We are too early as there aren't that many protocols live yet.

Some names that came up in my research:

• Betswap (Backed by Wonderland)

• Frontrunner (injective)

• RektBets (Kujira)

Decentralized Social Media

Twitter's going through a chaotic time.

TikTok may be banned in U.S.

There is a desire to own our data and to prevent censorship.

2 Headwinds:

1) UI / UX lags behind Web 2

2) Gaining adoption

Twitter's going through a chaotic time.

TikTok may be banned in U.S.

There is a desire to own our data and to prevent censorship.

2 Headwinds:

1) UI / UX lags behind Web 2

2) Gaining adoption

Decentralized Social Media Protocols

Lens Protocol (Aave team) has the most traction and buzz now.

Some other interesting ones:

• Farcaster

• Orbis

• DeSo

The main problem is gaining network effects - people want to post where others already are.

Lens Protocol (Aave team) has the most traction and buzz now.

Some other interesting ones:

• Farcaster

• Orbis

• DeSo

The main problem is gaining network effects - people want to post where others already are.

Decentralized Stablecoins

Stablecoins are the biggest use case for DeFi, but there are issues around centralization.

1) OFAC sanction on Tornado Cash led Circle to freeze USDC in the TC protocol.

2) USDT has frozen $435m.

There is a rising demand for decentralized stablecoins

Stablecoins are the biggest use case for DeFi, but there are issues around centralization.

1) OFAC sanction on Tornado Cash led Circle to freeze USDC in the TC protocol.

2) USDT has frozen $435m.

There is a rising demand for decentralized stablecoins

What's on the Horizon

Leading decentralized coins now include Dai, LUSD, and Frax.

Protocol stablecoins are coming soon:

• GHO (Aave)

• crvUSD (Curve)

The industry has been weary of algorithmic stablecoins since the UST collapse.

Leading decentralized coins now include Dai, LUSD, and Frax.

Protocol stablecoins are coming soon:

• GHO (Aave)

• crvUSD (Curve)

The industry has been weary of algorithmic stablecoins since the UST collapse.

Big Brands joining Web 3

2022 was a big year for Big Brands to onboard to Web 3 thanks to Polygon.

In 2023:

1) Let's see how Starbucks' Odyssey & Nike's Swoosh NFT efforts perform

2) Momentum - you can expect more big brands to join Web 3

2022 was a big year for Big Brands to onboard to Web 3 thanks to Polygon.

In 2023:

1) Let's see how Starbucks' Odyssey & Nike's Swoosh NFT efforts perform

2) Momentum - you can expect more big brands to join Web 3

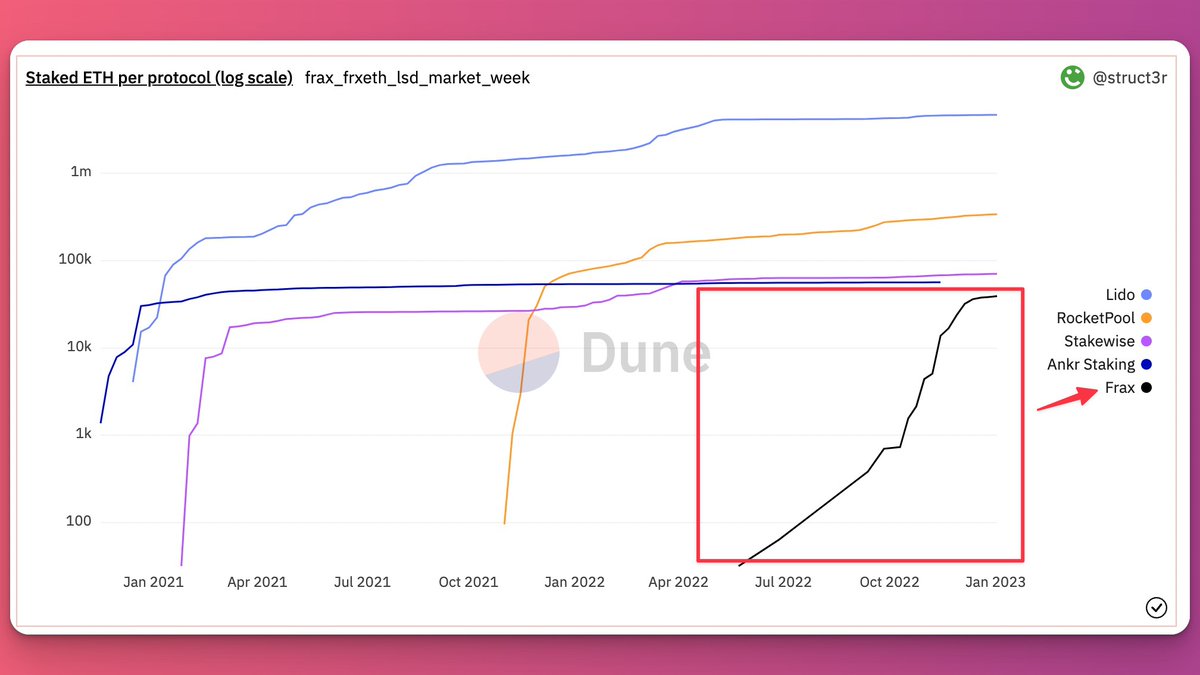

Ethereum Liquid Staking

Ethereum's Shanghai upgrade is due in March - it'll slowly unlock staked ETH.

(~15.9m ETH is staked now)

Once more ETH gets unlocked, this will increase the demand for ETH liquid staking.

Ethereum's Shanghai upgrade is due in March - it'll slowly unlock staked ETH.

(~15.9m ETH is staked now)

Once more ETH gets unlocked, this will increase the demand for ETH liquid staking.

Protocols

Lido dominates the market now but there could be a power shift.

I'm eyeing:

• RocketPool - a focus on decentralization

• FraxETH - Frax has an entire DeFi ecosystem to plug into and is gaining traction.

Lido dominates the market now but there could be a power shift.

I'm eyeing:

• RocketPool - a focus on decentralization

• FraxETH - Frax has an entire DeFi ecosystem to plug into and is gaining traction.

Other Topics I'm Paying Attention to:

• Massive unlocks & dumps this year

• Thorchain - Crosschain swaps

• The new Cosmos proposals

• FTM - Andre's back + FVM

• Web 3 Wallet Wars

A bunch of other stuff that's too degen to mention.

• Massive unlocks & dumps this year

• Thorchain - Crosschain swaps

• The new Cosmos proposals

• FTM - Andre's back + FVM

• Web 3 Wallet Wars

A bunch of other stuff that's too degen to mention.

Bigger Themes

I listed out several narratives, but I noticed several larger themes that tie it all together.

1) Decentralize everything

2) Specialized blockchains

3) Tokenize the real world

4) New approaches solving the Blockchain trilemma

I listed out several narratives, but I noticed several larger themes that tie it all together.

1) Decentralize everything

2) Specialized blockchains

3) Tokenize the real world

4) New approaches solving the Blockchain trilemma

Overrated IMO:

1) GameFi - it's inevitable but we're a few years away from nailing it. Good games take a while to develop.

2) Crypto AI - I'm bullish on AI overall, but anything Crypto AI-related is a money grab now.

3) Solana - Too many L's last year. Horrible optics.

1) GameFi - it's inevitable but we're a few years away from nailing it. Good games take a while to develop.

2) Crypto AI - I'm bullish on AI overall, but anything Crypto AI-related is a money grab now.

3) Solana - Too many L's last year. Horrible optics.

How I'm Thinking About 2023

I'm bearish this year.

The macro's terrible and it'll take time to get the Luna / FTX stench off of the public's mind.

2023 is all about staying engaged, and planting the seeds for 24/25'.

I'm bearish this year.

The macro's terrible and it'll take time to get the Luna / FTX stench off of the public's mind.

2023 is all about staying engaged, and planting the seeds for 24/25'.

Bear Strategy

• 35% low-risk tokens / 50% stables / 15% real-yield narrative.

• DCA'ing monthly into my long term holds

• Ready to deploy more capital if there's an echo bubble.

• I'm not actively trading - I'm ok sitting on my hands in a PVP market. Patience.

• 35% low-risk tokens / 50% stables / 15% real-yield narrative.

• DCA'ing monthly into my long term holds

• Ready to deploy more capital if there's an echo bubble.

• I'm not actively trading - I'm ok sitting on my hands in a PVP market. Patience.

NFA - I Don't Endorse Anything

1) I'm sharing my current thoughts - my thoughts change as I learn.

2) "What about [Blank]?!"

I tried to be concise so I didn't list everything - bro I'm not trying to write a 200 tweet thread.

Forgive me if I forgot to shill your bags.

1) I'm sharing my current thoughts - my thoughts change as I learn.

2) "What about [Blank]?!"

I tried to be concise so I didn't list everything - bro I'm not trying to write a 200 tweet thread.

Forgive me if I forgot to shill your bags.

Final Thoughts

Bear markets are a mental war of attrition.

We're over a year from BTC's peak and survived so many diasters - the hard part is over.

Survive.

Stay engaged.

Know that the builders are working on exciting technology!

Bear markets are a mental war of attrition.

We're over a year from BTC's peak and survived so many diasters - the hard part is over.

Survive.

Stay engaged.

Know that the builders are working on exciting technology!

Whew, this took weeks to research & write.

If you learned anything, please help me by retweeting the 1st tweet linked below.

I want to start the new year with some fresh dopamine hits 🥹.

If you learned anything, please help me by retweeting the 1st tweet linked below.

I want to start the new year with some fresh dopamine hits 🥹.

https://twitter.com/thedefiedge/status/1611001577921445888

If you enjoy tweets like this, check out my weekly newsletter.

I share exclusive content there not featured on Twitter.

It's an easy way to keep up with the latest news & narratives.

Join 26k+ others at TheDeFiEdge.com

I share exclusive content there not featured on Twitter.

It's an easy way to keep up with the latest news & narratives.

Join 26k+ others at TheDeFiEdge.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh