Let's talk about the math of the OGL 1.1's royalty system, because it's really bad.

TL;DR: Unless your profit margins are ABOVE 25%, you are incentivized to stop earning revenue at 750k.

#OpenDnD #DnD

TL;DR: Unless your profit margins are ABOVE 25%, you are incentivized to stop earning revenue at 750k.

#OpenDnD #DnD

From Linda Codega's article on Gizmodo:

"The revenue You make from Your Licensed Works in excess of $750,000 in a single calendar year is considered "Qualifying Revenue" and You are responsible for paying Us 20% or 25% of that Qualifying Revenue."

"The revenue You make from Your Licensed Works in excess of $750,000 in a single calendar year is considered "Qualifying Revenue" and You are responsible for paying Us 20% or 25% of that Qualifying Revenue."

I'll use the 25% number. Let's assume that you're an establish publisher not actively running a Kickstarter. Maybe you KS'ed products last year and they're still selling. We don't know the exact wording yet, but even if we use the 20% number it just shifts things down a bit.

Importantly, it's qualifying REVENUE, not profit. This means it's your "top line" number BEFORE YOU PAY COSTS. So if you make $100 and $90 of it goes to printing, etc., you pay royalties on the $100.

Therein lies the problem.

Therein lies the problem.

I'm going to assume that profit margins per item remain roughly consistent. I know that's not the case due to economies of scale, but it simplifies the math so that we can focus on the issue at hand.

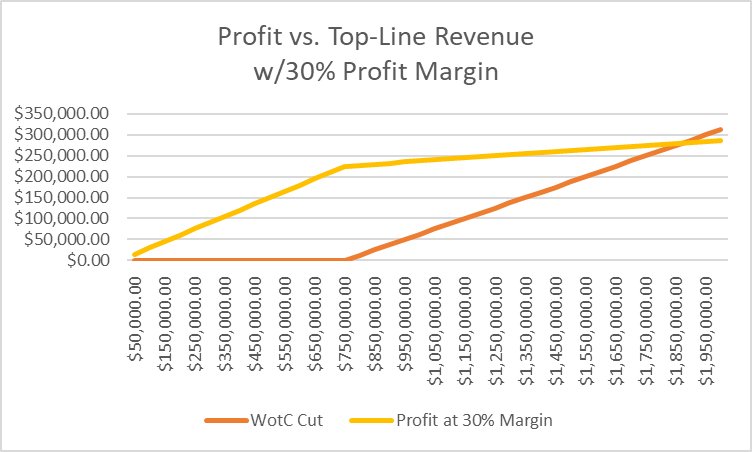

Let's say that you have a 30% profit margin on average. You do super well on the first $750k, then WotC eats most of everything beyond that and eventually makes more off your product than you do if you're lucky enough to approach $2m in revenue.

But you're still in the black.

But you're still in the black.

If you're instead wording at a 25% profit margin, you stop earning profit at precisely $750k and WotC keeps getting more.

This is the inflection point. If you can't beat 25%, just stop at $750k revenue for the year because it only gets worse from here.

This is the inflection point. If you can't beat 25%, just stop at $750k revenue for the year because it only gets worse from here.

Note that If you're using the 20% number, it just shifts the scale a bit and 20% becomes the new number to beat.

But from what little information I have (and it's very little), 20% is still problematically high.

But from what little information I have (and it's very little), 20% is still problematically high.

Recently, MonkeyDM ran a Kickstarter which grossed ~$2.6m. In a r/dndnext post discussing WotC's DnDBeyond post about OGL 1.1., he left some comments.

From one comment:

"I know a few big kickstarters with over $1M raised with only roughly 12% margins."

So let's look at 12%.

From one comment:

"I know a few big kickstarters with over $1M raised with only roughly 12% margins."

So let's look at 12%.

With numbers below 25%, $750k goes from "I no longer earn profit" to "I am actively losing money". You actually go into the red somewhere around $1.4m.

At that point, why would you continue earning revenue past $750k?

At that point, why would you continue earning revenue past $750k?

The OGL 1.1 royalty numbers mean that if you can consistently stay above a 25% profit margin, you'll be fine. If you can't, stop earning revenue at $750k or you're paying WotC out of your own pocket because the royalty is on top-line revenue, not on profit.

This creates a perverse incentive for everyone to stop earning revenue at $750k, which means creators stop growing and WotC never sees a cent of royalties.

Why would they want it to work this way?

Why would they want it to work this way?

My best guess is that this is intended to force big players to negotiate a custom deal. From what I understand, profit margins on TTRPG products are razor thin, so any cut into those profits is a huge problem. You're forced to cut a deal or go bust.

But the custom deals are entirely at WotC's discretion. They can just ignore you and collect your money, and that's likely the best outcome for them in terms of dollars.

WotC has no financial incentive to negotiate a custom deal with you unless you can offer them something better than the 25% cut of your top-line revenue.

To quote MonkeyDM again: "The current terms are beyond a raw deal and would 100% cause me to have to close shop."

And that's when he was assuming a 10% cut of top-line revenue. 10% of $2.6m is $260k.

That would be $370k with the 20% KS rate beyond the first $750k.

And that's when he was assuming a 10% cut of top-line revenue. 10% of $2.6m is $260k.

That would be $370k with the 20% KS rate beyond the first $750k.

Linda Codega's article quoting sections of the leaked OGL 1.1:

MonkeyDM's KS which I referenced above:

kickstarter.com/projects/monke…

MonkeyDM's Reddit comments which I cited:

reddit.com/r/dndnext/comm…

reddit.com/r/dndnext/comm…

https://twitter.com/lincodega/status/1611021447467606016

MonkeyDM's KS which I referenced above:

kickstarter.com/projects/monke…

MonkeyDM's Reddit comments which I cited:

reddit.com/r/dndnext/comm…

reddit.com/r/dndnext/comm…

I don't have good answers here, and I only have the information that everyone else has.

We don't have the new OGL text. I don't know what TTRPG company's financials look like. I've never published an OGL product and I've never run a crowdfunding campaign.

We don't have the new OGL text. I don't know what TTRPG company's financials look like. I've never published an OGL product and I've never run a crowdfunding campaign.

• • •

Missing some Tweet in this thread? You can try to

force a refresh