Price Relationship to Gamma Levels: What does it Mean, How to Watch, & Where Should We Pay Attention?

We know there is considerable noise and confusion regarding gamma, and we work hard to clear the fog for you.

We provide a high-level answer to those questions here in this 🧵

We know there is considerable noise and confusion regarding gamma, and we work hard to clear the fog for you.

We provide a high-level answer to those questions here in this 🧵

1/ By the end of this thread, you'll have answers to the following:

· What is gamma?

· What are some of the key levels tracked by GammaEdge?

· What % of the time are we above/below a given gamma level?

· How do I track these levels and price relationships?

Let's dive in!

· What is gamma?

· What are some of the key levels tracked by GammaEdge?

· What % of the time are we above/below a given gamma level?

· How do I track these levels and price relationships?

Let's dive in!

2/ Gamma is a measure of how fast option delta changes when the price of a stock or ETF changes.

💡Delta can be thought of as shares of a stock or ETF, so if there is a large change in gamma (which directly impacts delta), your exposure to the market changes quickly.

💡Delta can be thought of as shares of a stock or ETF, so if there is a large change in gamma (which directly impacts delta), your exposure to the market changes quickly.

3/ We use gamma levels to understand where these change points exist.

By tracking gamma levels, we know where the market is sensitive to price changes.

These same levels can become support or resistance, which is important if you trade stocks or ETFs.

By tracking gamma levels, we know where the market is sensitive to price changes.

These same levels can become support or resistance, which is important if you trade stocks or ETFs.

4/ Our membership often asks us about the price relationship to various gamma levels that the GammaEdge team tracks.

We recently updated and expanded a 10-year backtest study we initially conducted in April 2022; the new results point to a significant edge we can exploit.

We recently updated and expanded a 10-year backtest study we initially conducted in April 2022; the new results point to a significant edge we can exploit.

5/ To our knowledge, we are the only service capable of rigorously backtesting dominant gamma levels and price behavior over this extended lookback period.

We are deeply grateful to @EdgeRater for our partnership in developing this capability.

It's a game-changer 🔥

We are deeply grateful to @EdgeRater for our partnership in developing this capability.

It's a game-changer 🔥

6/ With this in mind, we often get questions asking "Is there any significance to price being higher or lower than a given gamma level?"

While we will not dive into the nitty-gritty of the details in this 🧵, the high-level results give us insight into potential opportunities:

While we will not dive into the nitty-gritty of the details in this 🧵, the high-level results give us insight into potential opportunities:

7/ The following table shows the results of price closing above or below key levels that GammaEdge tracks:

8/ For those new to GammaEdge, POI and COI are put open interest (OI) and call OI, respectively, and these are simply the strikes in the option complex that have the highest level of put or call OI.

They reflect where the market has dominant bets across all time frames.

They reflect where the market has dominant bets across all time frames.

9/

+/- GEX is dominant gamma exposure (GEX): the strikes with the largest put and call GEX.

As price moves above and below these levels dealer exposure shifts rapidly, so it makes sense to track these levels as they often become support and/or resistance to price.

+/- GEX is dominant gamma exposure (GEX): the strikes with the largest put and call GEX.

As price moves above and below these levels dealer exposure shifts rapidly, so it makes sense to track these levels as they often become support and/or resistance to price.

10/

+/-Trans is unique to GammaEdge.

We created these levels to denote the transition in dominant GEX, whether put-dominated or call-dominated.

This is necessary because contrary to what you may read, there is no single "flip" point for gamma in an option complex.

+/-Trans is unique to GammaEdge.

We created these levels to denote the transition in dominant GEX, whether put-dominated or call-dominated.

This is necessary because contrary to what you may read, there is no single "flip" point for gamma in an option complex.

11/ ZeroGEX is the strike where dealer exposure to GEX is minimum.

The ZeroGEX strike is generally between the +/-Trans strike, but could also be sitting on either +/-Trans level.

We think of it as an area where sentiment begins to change.

The ZeroGEX strike is generally between the +/-Trans strike, but could also be sitting on either +/-Trans level.

We think of it as an area where sentiment begins to change.

13/ Closing prices below -GEX or POI suggest the potential of a reversal upward.

💡Prices below these -GEX or POI GammaEdge levels are associated with extreme market bearishness and may present an upside opportunity.

💡Prices below these -GEX or POI GammaEdge levels are associated with extreme market bearishness and may present an upside opportunity.

14/ On the other side, closing prices above +GEX suggest the potential of a downward reversal.

💡Prices above this +GEX GammaEdge level are associated with extreme market bullishness and may present a downside opportunity.

💡Prices above this +GEX GammaEdge level are associated with extreme market bullishness and may present a downside opportunity.

15/ Additionally, there is information in the % above/below the ZeroGEX strike.

We spend significantly more time above this level than below.

Put another way, if we are below -GEX or POI, we could easily see a reversal to the upside because the market is biased upward.

We spend significantly more time above this level than below.

Put another way, if we are below -GEX or POI, we could easily see a reversal to the upside because the market is biased upward.

16/ Also because of the dominance in the % above ZeroGEX level, if we are above +GEX or COI, we may remain in the uptrend longer.

This may be why the red-boxed levels are higher than the green-boxed levels.

This may be why the red-boxed levels are higher than the green-boxed levels.

17/ While being above/below a level is not a trading system, it does form another data point in your evaluation.

Our @tradingview tools (available to members in our Discord) enable you to track this for a large number of stocks.

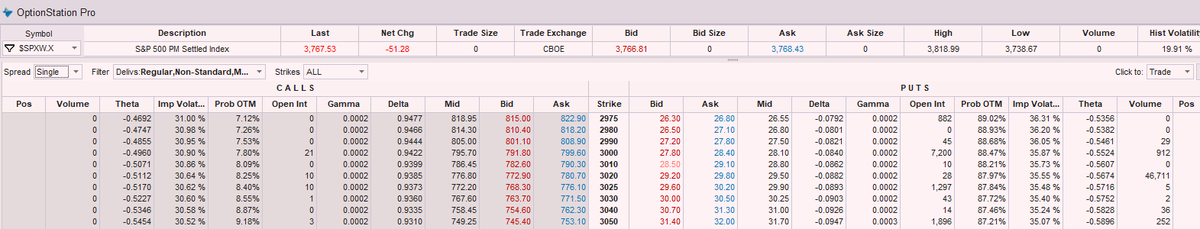

Here is the #SPY as of Friday's 1/7 close:

Our @tradingview tools (available to members in our Discord) enable you to track this for a large number of stocks.

Here is the #SPY as of Friday's 1/7 close:

19/ Once you understand and track gamma levels, the next step is to use the levels as defined risk entry and exit locations.

This will be covered in a separate 🧵, but here is an example of how we use these levels:

This will be covered in a separate 🧵, but here is an example of how we use these levels:

20/ This #GOOGL trade is a very simple day-trading example.

Gamma-level entries/exits can also be used for swing trading too.

Remember: every swing trade starts as a day trade.

As traders, we aim to stack the edges to have a higher probability of profitable trades and equity.

Gamma-level entries/exits can also be used for swing trading too.

Remember: every swing trade starts as a day trade.

As traders, we aim to stack the edges to have a higher probability of profitable trades and equity.

21/ Our focus is not just to spot gamma but to identify various gamma, delta, and moneyness levels within option structures.

👉 We create actionable setups using our market timing model and rigorous backtesting.

We have the tools to help you visualize these setups.

👉 We create actionable setups using our market timing model and rigorous backtesting.

We have the tools to help you visualize these setups.

22/ Our goal with this 🧵 was to answer the following:

✅What is gamma?

✅What are some of the key levels tracked by GammaEdge?

✅What % of the time are we above/below a given gamma level?

✅How do I track these levels and price relationships?

Did we hit the mark?

✅What is gamma?

✅What are some of the key levels tracked by GammaEdge?

✅What % of the time are we above/below a given gamma level?

✅How do I track these levels and price relationships?

Did we hit the mark?

We strive to make gamma actionable for you, and we hope you've found this thread helpful.

Follow us @GammaEdges for more content on the stock market and trading education.

Like/Retweet the first tweet below if you learned something new:

Follow us @GammaEdges for more content on the stock market and trading education.

Like/Retweet the first tweet below if you learned something new:

https://twitter.com/GammaEdges/status/1611784754394984449

• • •

Missing some Tweet in this thread? You can try to

force a refresh