Detailed Analysis on the business of #GaneshaEcosphere - India's largest PET recycling company♻♻

CMP - ₹896

Like and retweet for maximum reach!!

CMP - ₹896

Like and retweet for maximum reach!!

1. Company Info

-The company is incorporated in the year 1987

-It is the largest PET waste recycling company in India

-The company manufactures recycled PET fibre and recycled PET yarn from pre and post consumer PET scrap

-Company recycles 6 billion plus PET bottles annually

-The company is incorporated in the year 1987

-It is the largest PET waste recycling company in India

-The company manufactures recycled PET fibre and recycled PET yarn from pre and post consumer PET scrap

-Company recycles 6 billion plus PET bottles annually

2. PET Recycling Industry

-Current recycled plastic staple fibre industry size is 600,000 tonnes in India and is growing at 4% CAGR

-The company recycles over 16% of PET bottle scrap generated in India and is aiming to capture ¼ th of Indian PET bottle recycling market

-Current recycled plastic staple fibre industry size is 600,000 tonnes in India and is growing at 4% CAGR

-The company recycles over 16% of PET bottle scrap generated in India and is aiming to capture ¼ th of Indian PET bottle recycling market

-In June 2022, the Indian government issued a mandate usage of at least 30% recycled content in new PET bottles from FY25

-PET bottles can be recycled any number of times. Each time it is recycled there is a little bit of quality degradation, but the main consequence is that it

-PET bottles can be recycled any number of times. Each time it is recycled there is a little bit of quality degradation, but the main consequence is that it

alters the colour of the final product by making it slightly yellower

-Among all plastic wastage, PET bottle scrap is one of the highest paid scraps for rag pickers

-Recycling one tonne of PET reduces CO2 emissions by 1.5 tonnes

-Among all plastic wastage, PET bottle scrap is one of the highest paid scraps for rag pickers

-Recycling one tonne of PET reduces CO2 emissions by 1.5 tonnes

3. Business segments

-The company has 3 business segments

i. Recycled Polyester Staple Fibre (RPSF)

ii. Recycled Polyester Spun Yarn

iii. Dyed & Texturised Filament Yarn

-Recycle polyester staple fibres are used in manufacturing of Textiles (T-shirts, body warmers etc.) ;

-The company has 3 business segments

i. Recycled Polyester Staple Fibre (RPSF)

ii. Recycled Polyester Spun Yarn

iii. Dyed & Texturised Filament Yarn

-Recycle polyester staple fibres are used in manufacturing of Textiles (T-shirts, body warmers etc.) ;

Functional textiles (non woven air filter fabric, geo textiles, carpets, car upholstery) and FIllings (pillows, duvets, toys)

-Recycled yarn is used to manufacture Fabrics, Sarees, Dressing materials, Upholstery, Thermal wear, Carpets, Cords, Sewing thread etc

-Recycled yarn is used to manufacture Fabrics, Sarees, Dressing materials, Upholstery, Thermal wear, Carpets, Cords, Sewing thread etc

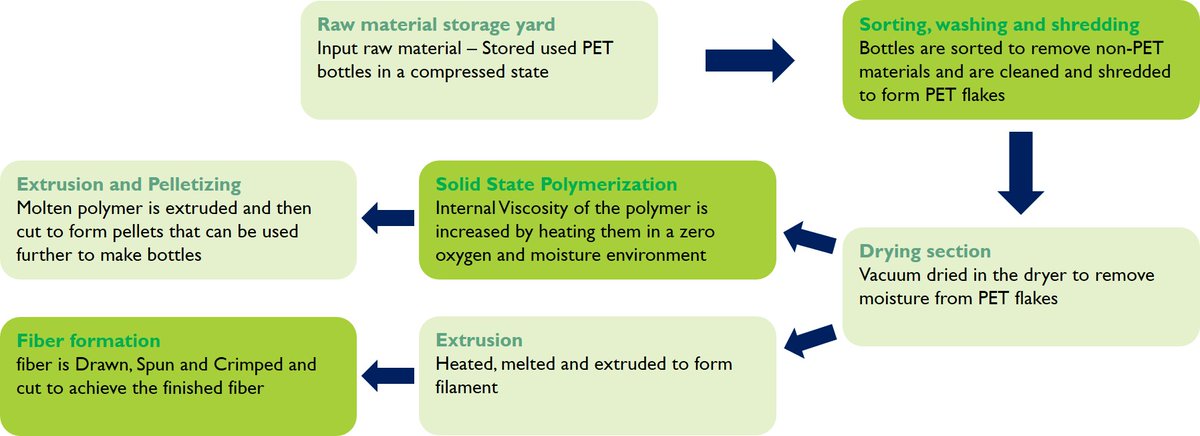

4. Manufacturing Process

-Raw materials are brought from storage yard and are inputted, They are then sorted where the non PET materials are separated. The remaining scrap, which is all PET, gets washed and shredded to form PET flakes

-These shredded PET flakes are vacuum dried

-Raw materials are brought from storage yard and are inputted, They are then sorted where the non PET materials are separated. The remaining scrap, which is all PET, gets washed and shredded to form PET flakes

-These shredded PET flakes are vacuum dried

to remove moisture

-After drying, manufacturing process becomes little different for manufacturing different end products

-For manufacturing of Recycled polyester staple fibre, Extrusion is performed after drying, where the flakes get melted which is then drawn and spun to form

-After drying, manufacturing process becomes little different for manufacturing different end products

-For manufacturing of Recycled polyester staple fibre, Extrusion is performed after drying, where the flakes get melted which is then drawn and spun to form

the final fibre

-To manufacture bottle grade chips, after drying, Solid state polymerisation is carried out, where the dried PET chips are heated in a zero oxygen and moisture environment, this helps in increasing the internal viscosity of the PET polymer

-Later it is extruded

-To manufacture bottle grade chips, after drying, Solid state polymerisation is carried out, where the dried PET chips are heated in a zero oxygen and moisture environment, this helps in increasing the internal viscosity of the PET polymer

-Later it is extruded

5. Manufacturing Facilities

-The company has three manufacturing plants at Kanpur, Rudrapur and Bilaspur (Temra) along with two new plants at Nepal and Warangal which are currently in trial production

-The company has three manufacturing plants at Kanpur, Rudrapur and Bilaspur (Temra) along with two new plants at Nepal and Warangal which are currently in trial production

-Nepal plant is just a washing facility, raw materials (PET bottles) are washed and shredded into PET flakes which are then shipped to India for further processing

-From Warangal plant, the company is going to manufacture value added products

-From Warangal plant, the company is going to manufacture value added products

6. Value Added Products

-Current value added products are 30% of the company’s product portfolio and the company is looking to increase their value added share to 50% by the end of FY24

-Company is developing value added products like

i. Flame retardant fibre - anti flame

-Current value added products are 30% of the company’s product portfolio and the company is looking to increase their value added share to 50% by the end of FY24

-Company is developing value added products like

i. Flame retardant fibre - anti flame

ii. Anti bacteria fibre - kills 99.9% of bacteria on fabric

iii. Biodegradable fibre etc

-The company has recently forayed into manufacturing of Recycled bottle grade chips, these chips can be used directly to manufacture PET bottles. It is higher margin product when compared

iii. Biodegradable fibre etc

-The company has recently forayed into manufacturing of Recycled bottle grade chips, these chips can be used directly to manufacture PET bottles. It is higher margin product when compared

with polyester staple fibre and yarn

-Company is also launching a new brand called “Go Rewise”. Under this brand premium quality products are made, Products are made by high quality recycling throughout the entire process. Also the motive behind the brand name “Go Rewise”

-Company is also launching a new brand called “Go Rewise”. Under this brand premium quality products are made, Products are made by high quality recycling throughout the entire process. Also the motive behind the brand name “Go Rewise”

is to recycle wisely

7. Manufacturing Capacities

-Manufacturing capacities of the company is given below

7. Manufacturing Capacities

-Manufacturing capacities of the company is given below

-New plant at warangal enhances the capacity by 52,000 TPA

-In FY22 annual report, the company has said it is planning to double its manufacturing capacities within 4 years of time

-The company is operating at close to 100% capacity utilization over the past few years

-In FY22 annual report, the company has said it is planning to double its manufacturing capacities within 4 years of time

-The company is operating at close to 100% capacity utilization over the past few years

except for covid i.e FY21

FY19 - 97%

FY20 - 99%

FY22 - 99%

FY19 - 97%

FY20 - 99%

FY22 - 99%

8. Recent Capex

-In FY22 the company had acquired a Nepal plant - The company is expecting 75 Crores of turnover form this plant

-Commercial production of the nepal plant will start from Dec 2022 and ramping up to optimal capacity is expected to complete by Mar 2023

-In FY22 the company had acquired a Nepal plant - The company is expecting 75 Crores of turnover form this plant

-Commercial production of the nepal plant will start from Dec 2022 and ramping up to optimal capacity is expected to complete by Mar 2023

-For the new warangal plant the company has done a capex of 450 crores and is expected to generate 600 crores of revenues, warangal plant will have higher margins than existing plants due to higher value added product mix

-The company owns a 50 acre land in Warangal through 2 wholly owned subsidiaries Ganesha Ecopet Private Ltd (30 acres) and Ganesha Ecotech Pvt Ltd (20 acres). The upcoming facility is spread across 20 acres of area, the balance 30 acres land will be utilized for future expansion

-Warangal plant will generate Recycled bottle grade chips along with the Recycled polyester staple fibre and recycle yarn

-Commercial production of the warangal plant will begin in Q3 FY23 and ramping up to optimal capacity is expected to complete by Q4 FY23

-Commercial production of the warangal plant will begin in Q3 FY23 and ramping up to optimal capacity is expected to complete by Q4 FY23

9. Upcoming Capex

-The Company is doing a greenfield expansion at temra with a capacity of 34,000 spindles to produce yarn from staple fibre, Capex is estimated to cost 230 Crores - At optimum capacity utilization it produces 12000 tonnes of yarn, valuing about 250 Crores

-The Company is doing a greenfield expansion at temra with a capacity of 34,000 spindles to produce yarn from staple fibre, Capex is estimated to cost 230 Crores - At optimum capacity utilization it produces 12000 tonnes of yarn, valuing about 250 Crores

-This greenfield expansion will be completed by Q2 FY24

-The company at kanpur plant is working on a line for recycling of rigid plastic (HDPE, PP, etc) which is currently unstructured and downcycled. Capex for this is 30 Crores, It is currently in the trial phase. Initial

-The company at kanpur plant is working on a line for recycling of rigid plastic (HDPE, PP, etc) which is currently unstructured and downcycled. Capex for this is 30 Crores, It is currently in the trial phase. Initial

capacity of this will be 300 tonnes per month which will be subsequently increased to 1000 tonnes per month

-Company is expecting 90 to 100 crores from this rigid plastic recycling plant at full capacity i.e 1000 tonnes per month

-Company is expecting 90 to 100 crores from this rigid plastic recycling plant at full capacity i.e 1000 tonnes per month

-All the manufacturing plants of Ganesha ecosphere uses mechanical recycling, Currently much of the industry is also using mechanical recycling because chemical recycling is very expensive

11. Product Pricing

-The price of Recycled Polyester Staple Fibre (RPSF) is benchmarked against the prices of virgin PSF, which in turn, is linked to the prices of Poly Terephthalic acid (PTA) and mono ethylene glycol (MEG) (i.e., derivatives of crude oil). RPSF’s prices are at a

-The price of Recycled Polyester Staple Fibre (RPSF) is benchmarked against the prices of virgin PSF, which in turn, is linked to the prices of Poly Terephthalic acid (PTA) and mono ethylene glycol (MEG) (i.e., derivatives of crude oil). RPSF’s prices are at a

discount (approximately 10-15%) to virgin PSF prices. If virgin PSF prices go down, RPSF prices also go down and vice versa. However in times of declining RPSF prices, risk is mitigated to an extent as Polyethylene terephthalate (PET) waste does not have any other significant

usage apart from that in RPSF manufacturing, and hence, RPSF manufacturers have ability to negotiate input raw material prices which helps in maintaining gross margins like in the case of Ganesha Ecosphere

-If there is an increase in raw material prices (scrap prices), the

-If there is an increase in raw material prices (scrap prices), the

company will pass it on to their customers with a time lag

-When the cotton prices increase, polyester yarn gets the benefit in the form of increase in demand as the customer switches from cotton to polyester yarn

-When the cotton prices increase, polyester yarn gets the benefit in the form of increase in demand as the customer switches from cotton to polyester yarn

12. Financials

-EBITDA margins of Ganesha ecosphere are stable throughout at around 12%, the reason for this is when the end product prices fall the company can negotiate with the suppliers i.e scrap dealers to decrease the raw material price

-EBITDA margins of Ganesha ecosphere are stable throughout at around 12%, the reason for this is when the end product prices fall the company can negotiate with the suppliers i.e scrap dealers to decrease the raw material price

-EBITDA margins of company’s products is as follows

i. Recycled Polyester Staple Fibre - 13%

ii. Spun Yarn - 16%

iii. Dyed and Texturised Yarn - 7 to 8%

-The company has given guidance for revenue growth of about 25 to 30% in next four to five years

i. Recycled Polyester Staple Fibre - 13%

ii. Spun Yarn - 16%

iii. Dyed and Texturised Yarn - 7 to 8%

-The company has given guidance for revenue growth of about 25 to 30% in next four to five years

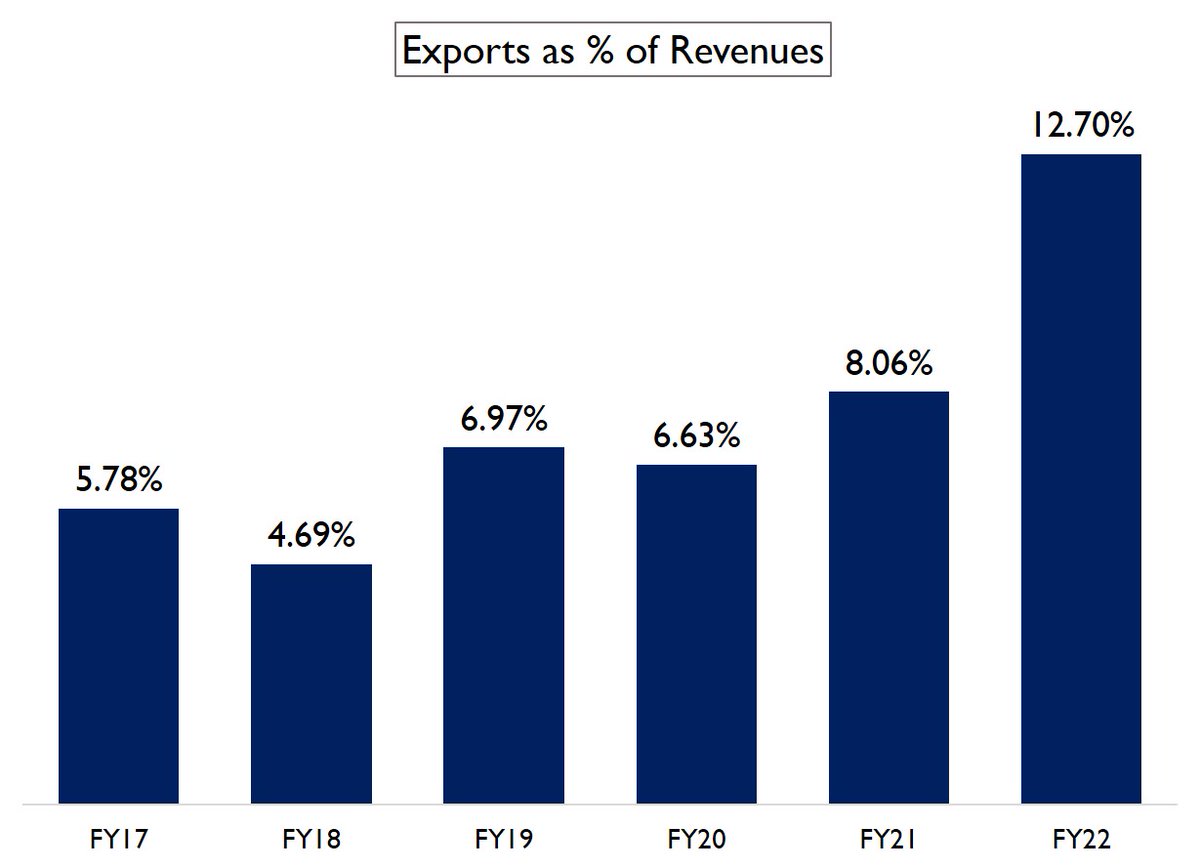

-Company exports to more than 20 countries and has international quality approvals like USFDA and EFSA, so the quality of products produced and exported by the company are of international standards

13. Future Outlook

-In the past recycled yarn was largely prevalent in the international market. However as of late demand for recycled yarn is increasing in India too. So far, recycled yarn was only considered in India when it was inexpensive, but now other factors like

-In the past recycled yarn was largely prevalent in the international market. However as of late demand for recycled yarn is increasing in India too. So far, recycled yarn was only considered in India when it was inexpensive, but now other factors like

sustainability are being prioritised

-Apart from ganesha, only one or two companies manufacture recycled filament yarn. Hence there isn’t much availability. The company plans to supply filament yarn to brands like Zara/Uniqlo to command premium

-Apart from ganesha, only one or two companies manufacture recycled filament yarn. Hence there isn’t much availability. The company plans to supply filament yarn to brands like Zara/Uniqlo to command premium

Watch the detailed analysis:

Check out the New Year Offer on the Micro Cap Club membership:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh