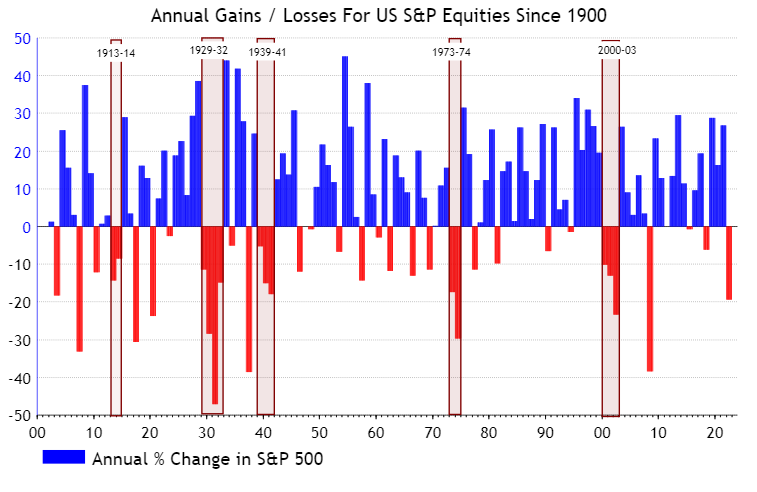

At @asr_london, we believe that you will see another down year for US (and Global) Equities in 2023. Two down years in a row are unusual (outside world wars), but a not unheard of... 1/8

There is no single indicator that has predicted multi-year down markets... apart from World War... but rapidly rising inflation or policy rates have played a role... 2/8

In 1929 rates were raised into slowing inflation; in 1973, rates were raised into rapidly rising inflation but real rates were negative; while in 2000 rates were raised and inflation picked up - but real rates remained positve... 3/8

Multi-year down markets tended to see recessions in both activity and earnings during the second year of the market downturn (exactly what we @asr_london are forecasting for 2023). 4/8

Extended valuations tend to play a role in multi-year down markets... but we find that the detrended Bond/Equity yield ratio seems to give the best signal - but even this appears 'necessary but not sufficient'... 5/8

Extended market cycles (in age and scale) also yield multi-year declines... if we exclude the 'biological' pandemic bear market (short-lived as looser policy extended the cycle), the Bull market ending Jan-2022 lasted almost 13 years and saw a 5-fold rise in Equities 6/8

A final word of warning... previous multi-year bear markets (other than 1913-14) saw the second year deliver larger losses than the first. 7/8

If you are a professional investor and would like to see the in-depth analysis behind why we at @asr_london are suggesting clients are maximum underweight Global Equities and maximum overweight Cash, visit absolute-strategy.com and sign up for a research trial END

• • •

Missing some Tweet in this thread? You can try to

force a refresh