Veteran macro strategist - Co-founder Absolute Strategy Research - All views are my own and not those of ASR. RT does not mean endorsement

How to get URL link on X (Twitter) App

Relative to the size of the US equity market there is nothing unusual about the amount of cash on the sidelines - for either institutions or private investors 2/5

Relative to the size of the US equity market there is nothing unusual about the amount of cash on the sidelines - for either institutions or private investors 2/5

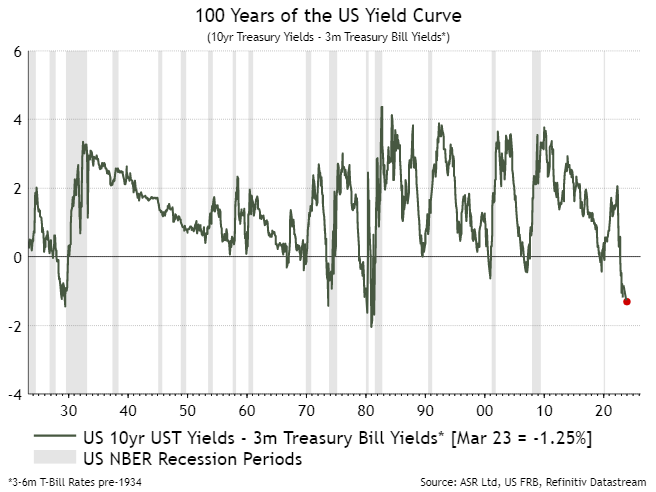

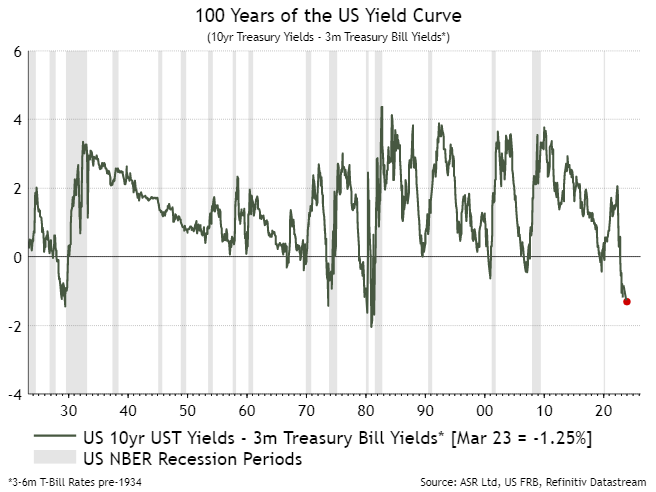

This is what the yield curve vs VIX chart looked like back in 2007. It was signalling that the VIX would likely rise dramatically - and by the middle of the year this process had already started to happen - it also signalled that worse was yet to come... 2/5

This is what the yield curve vs VIX chart looked like back in 2007. It was signalling that the VIX would likely rise dramatically - and by the middle of the year this process had already started to happen - it also signalled that worse was yet to come... 2/5

There is no single indicator that has predicted multi-year down markets... apart from World War... but rapidly rising inflation or policy rates have played a role... 2/8

There is no single indicator that has predicted multi-year down markets... apart from World War... but rapidly rising inflation or policy rates have played a role... 2/8