Top 5 Trading websites that helped me scale up my trading to 2 Cr+

A Thread🧵

A Thread🧵

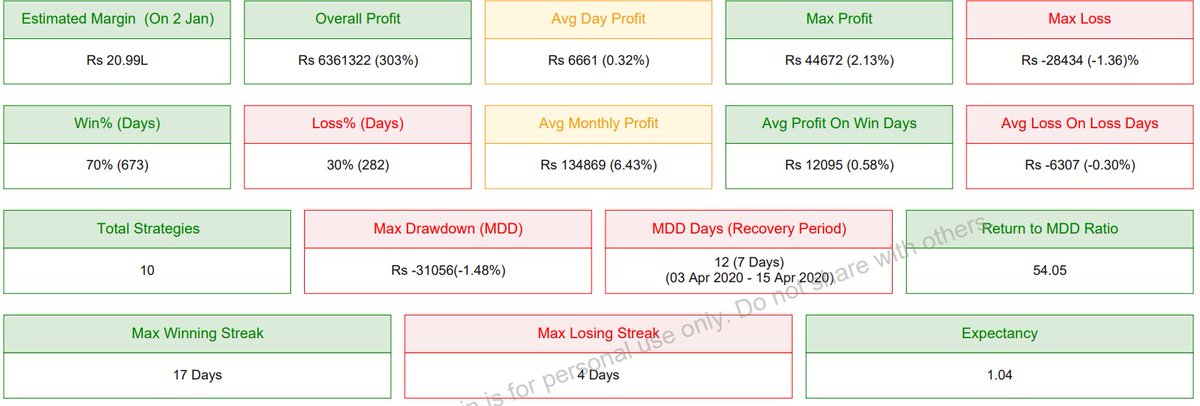

@stockmock_in : For backtesting Index Option Based Strategies

You can Backtest

1. Option Selling

2. Option Buying

3. Positional Option Trading Strategies

You can analyse all the data in excel , as you get stats for the strategies,baskets etc

Link:

stockmock.in/#!/signup?rb=9…

You can Backtest

1. Option Selling

2. Option Buying

3. Positional Option Trading Strategies

You can analyse all the data in excel , as you get stats for the strategies,baskets etc

Link:

stockmock.in/#!/signup?rb=9…

2. @Quantiply :

For Execution of strategies backtested on Stockmock

You can deploy stratgies easily

✔️No code required

✔️Controlled slippages

✔️ Support 24×7

✔️Manage Multiple accounts

Have met the CEO personally.

I deploy 2Cr+ using Quantiply

app.quantiply.tech/auth/signup?re…

For Execution of strategies backtested on Stockmock

You can deploy stratgies easily

✔️No code required

✔️Controlled slippages

✔️ Support 24×7

✔️Manage Multiple accounts

Have met the CEO personally.

I deploy 2Cr+ using Quantiply

app.quantiply.tech/auth/signup?re…

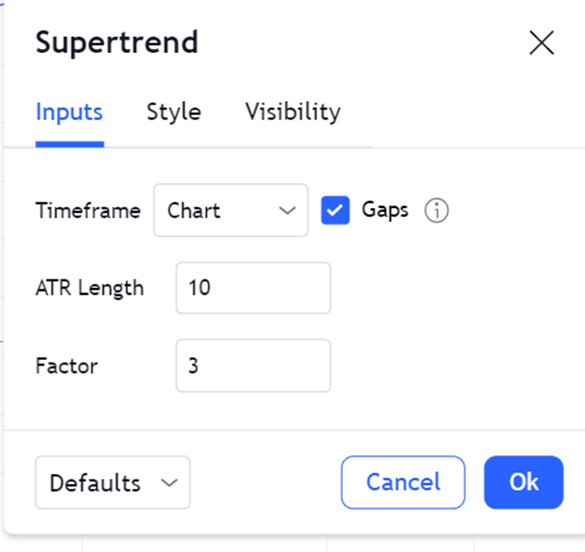

3. @TradingView :

Where the world charts, chats and trades markets.

One stop Solution for Technical Analysis .

You can plot charts , papertrade , create watchlists , set alerts , add indicators , use multiple screens etc

Where the world charts, chats and trades markets.

One stop Solution for Technical Analysis .

You can plot charts , papertrade , create watchlists , set alerts , add indicators , use multiple screens etc

https://twitter.com/JayneshKasliwal/status/1559082915715489792?s=20&t=bpODMS-teY8y9v3M2aBEPg

4. Excel : I use Excel to note my trades , do my post market analysis .

It helps me track my trading stats

Sharing my Trading Journal : docs.google.com/spreadsheets/d…

It helps me track my trading stats

Sharing my Trading Journal : docs.google.com/spreadsheets/d…

5. YouTube : I learnt a lot of things from Youtube and try to impart knowledge through my experience

Watch @Techno_Charts if you really wanna top up your algo trading journey

youtube.com/@TechnoChartss

Watch @Techno_Charts if you really wanna top up your algo trading journey

youtube.com/@TechnoChartss

Link for Videos is shared in Tweet

https://twitter.com/JayneshKasliwal/status/1573662634284847110?s=20&t=bpODMS-teY8y9v3M2aBEPg

Telegram Link : t.me/Techno_charts

You will get Stock Updates , Videos , Learning PDFs etc all for FREE !

You will get Stock Updates , Videos , Learning PDFs etc all for FREE !

How to use the trading journal 👇

https://twitter.com/JayneshKasliwal/status/1612793080503242765?t=G3UiiOzC047oHq20vNkjCw&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh