I've written extensively on the habits and lessons of the world's greatest traders/investors:

• Michael Marcus

• Peter Cundill

• Ed Thorp

• George Soros

• Michael Burry

• Allan Mecham

• Li Lu

• Bruce Kovner

• Bill Miller

Here's an entire collection of those threads 👇

• Michael Marcus

• Peter Cundill

• Ed Thorp

• George Soros

• Michael Burry

• Allan Mecham

• Li Lu

• Bruce Kovner

• Bill Miller

Here's an entire collection of those threads 👇

1/ Michael Marcus

Elevator Pitch: Turned $30K into $80M after blowing up a few accounts before finding his edge.

Elevator Pitch: Turned $30K into $80M after blowing up a few accounts before finding his edge.

https://twitter.com/marketplunger1/status/1582803318434197505

2/ Peter Cundill

Elevator Pitch: Arguably Canada's greatest value investor. Compounded capital at 15%/year for 30 years by investing globally in deep value securities.

Elevator Pitch: Arguably Canada's greatest value investor. Compounded capital at 15%/year for 30 years by investing globally in deep value securities.

https://twitter.com/marketplunger1/status/1605945726374133760

3/ Ed Thorp

Elevator Pitch: Godfather of quant investing, created a card-counting system, and compounded capital at 19% annually for 30 years. He's the man for all markets.

Elevator Pitch: Godfather of quant investing, created a card-counting system, and compounded capital at 19% annually for 30 years. He's the man for all markets.

https://twitter.com/marketplunger1/status/1598359015964164096

4/ Allan Mecham

Elevator Pitch: College drop-out turned value investor that generated a 33% CAGR in his first 12 years as a fund manager. Worked above a taco shop.

Elevator Pitch: College drop-out turned value investor that generated a 33% CAGR in his first 12 years as a fund manager. Worked above a taco shop.

https://twitter.com/marketplunger1/status/1602326997413289984

5/ Li Lu

Elevator Pitch: One of the only people Charlie Munger trusts with his capital (outside Buffett). Lu has generated a ~30% CAGR since inception investing in global value stocks.

Elevator Pitch: One of the only people Charlie Munger trusts with his capital (outside Buffett). Lu has generated a ~30% CAGR since inception investing in global value stocks.

https://twitter.com/marketplunger1/status/1599836936465793032

6/ Michael Burry

Elevator Pitch: Deep value investor who created the "Big Short." Invests in roadkill/"ick" stocks and makes a ton of money doing it.

Elevator Pitch: Deep value investor who created the "Big Short." Invests in roadkill/"ick" stocks and makes a ton of money doing it.

https://twitter.com/marketplunger1/status/1589666828162310146

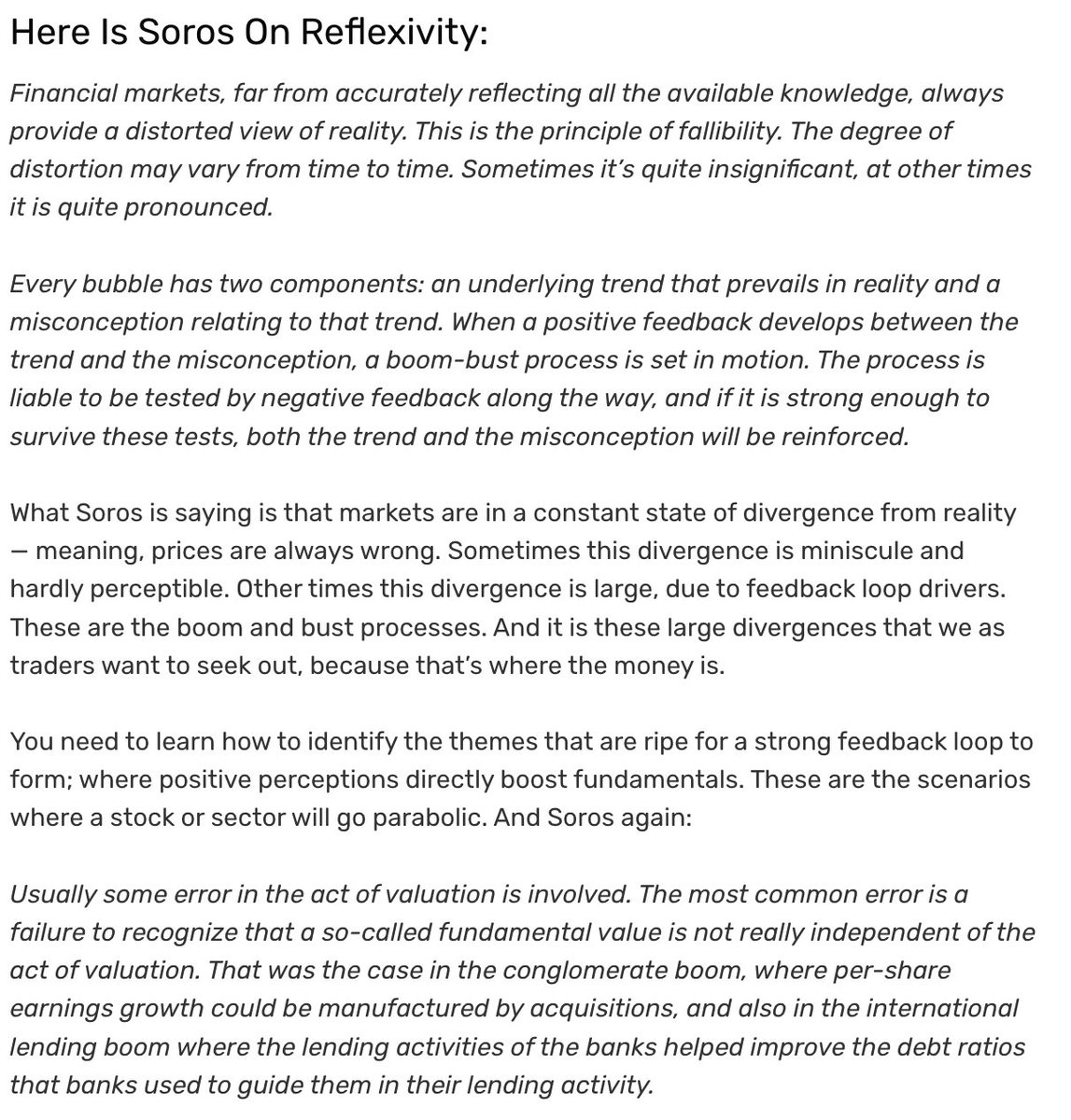

7/ George Soros

Elevator Pitch: Broke the Bank of England. Generated a 32% CAGR for 30 years. Turned $1K of investor's money into $4M by 2000. Makes tons of money when his back hurts.

Elevator Pitch: Broke the Bank of England. Generated a 32% CAGR for 30 years. Turned $1K of investor's money into $4M by 2000. Makes tons of money when his back hurts.

https://twitter.com/marketplunger1/status/1608865389282267139

8/ Bruce Kovner

Elevator Pitch: Former academic turned billionaire trader. Former Market Wizards call him "the best trader I ever knew." Averaged a ~90% CAGR during his 10 years at Commodities Corp.

Elevator Pitch: Former academic turned billionaire trader. Former Market Wizards call him "the best trader I ever knew." Averaged a ~90% CAGR during his 10 years at Commodities Corp.

https://twitter.com/marketplunger1/status/1597258722015051777

9/ Bill Miller

Elevator Pitch: Beat the S&P 500 for 15 straight years. Returned 119% in 2019. Hates investing "labels" and is one of the most independent thinking value investors in the game.

Elevator Pitch: Beat the S&P 500 for 15 straight years. Returned 119% in 2019. Hates investing "labels" and is one of the most independent thinking value investors in the game.

https://twitter.com/marketplunger1/status/1604140066519097344

10/ Recap:

I hope you enjoyed this "meta" thread of all the lessons and threads I've posted on the world's greatest investors.

Stay tuned for more threads like this by liking, RT'ing, and following!

I hope you enjoyed this "meta" thread of all the lessons and threads I've posted on the world's greatest investors.

Stay tuned for more threads like this by liking, RT'ing, and following!

• • •

Missing some Tweet in this thread? You can try to

force a refresh