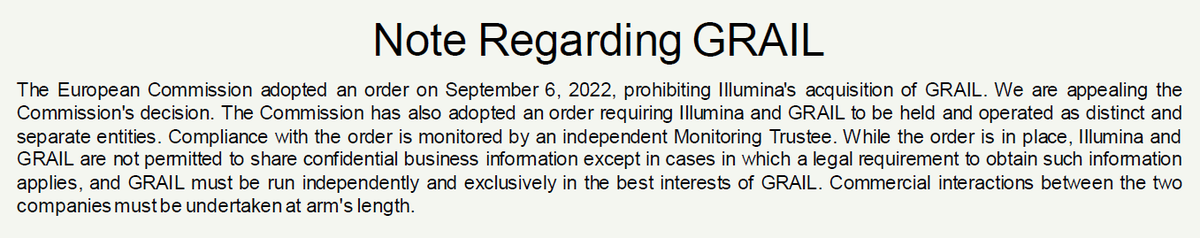

In #JPM2023 news, $ILMN Illumina also presented on Monday 9th January 2023. They have a warning note on the @GrailBio acquisition on slide 1, who knows how this saga is going to end.

Illumina sees an addressable market of $120B by 2027, of which they are only at 7% penetration. If they think GrailBio's Galleri assays can address the cancer screening market, then Guardant's estimate alone for it is $100B already. Big big numbers, lots of growth opportunities.

Their install-base has reached 23,000 instruments, although many of these will be underutilised or awaiting an upgrade. They now see an almost 50/50% split between RUO and Clinical markets.

A more relevant number on install-base is shown in this slide, including pull-through. A NovaSeq 6000 has a >$1M annual pull-through. I wonder if Illumina will become more aggressive with instrument placing given recent announcements by MGI/Complete Genomics.

A slide highlighting the biggest announcement as of late, the NovaSeq X instrument. Possibly the biggest announcement for SBS short-read technology of the last 5-6 years.

Already 140 orders, 40-50 of those expected to ship in 2023 Q1, and an expected total of >300 in 2023. Those 140 instruments alone signify an increase of ~6% in total throughput versus the current NovaSeq 6000 install-base with the 10B flowcells. About 20% with 25B flowcells.

So by the time Illumina has installed 300 NovaSeq X Plus instruments and has the 25B flowcells available, they would have a Max theoretical total output of 2,400,000 Gb per day, or 40% of the ~1820 NovaSeq 6000 install-base. Thus 819 NovaSeq X Plus instruments will have the same

throughput as all the NovaSeq 6000 instruments currently out there. Customers want to sequence more to driver greater discoveries and new applications. Multiomics such as Olink or Somalogic alone could be a driver for growth.

And the diagnostics customers want 3.0x to 4.0x more data, e.g. Guardant, Caris, Foundation Medicine or Tempus.

And if those customers feel safe that Illumina won't go after their market, they just need to continue reading the slide deck for Illumina to show them their intentions in the Clinical Genomics market. A $44B 2027 TAM for Early Detection alone.

Galleri and a planned MRD launch in 2023 from their current GrailBio unit. Will they be able to keep it under the Illumina fold? The regulators don't think so.

More on NGS at bit.ly/ngs-slides

• • •

Missing some Tweet in this thread? You can try to

force a refresh