Next-Generation Sequencing, Single-Cell and Spatial Biology, Next-Generation Proteomics, Synthetic Biology, Liquid Biopsy, Accelerated Compute in Biotech.

3 subscribers

How to get URL link on X (Twitter) App

Rapid ULR. Current record is about 4 megabases.

Rapid ULR. Current record is about 4 megabases.

If I remember correctly, Illumina started with a 600nm diameter for the patterned flowcell, in the HiSeq X and then later on in the evolution of the platform that used these patterned flowcells.

If I remember correctly, Illumina started with a 600nm diameter for the patterned flowcell, in the HiSeq X and then later on in the evolution of the platform that used these patterned flowcells.

https://twitter.com/AlbertVilella/status/1648955206586040320This may lead to a shift in the balance between single-cell and Spatial Biology approaches, with the latter eventually becoming more prevalent.

In recent years, methods for encapsulating individual cells and analysing their DNA, RNA or protein contents have become more established, with commercial support from Biotech and Life Science Tool providers

In recent years, methods for encapsulating individual cells and analysing their DNA, RNA or protein contents have become more established, with commercial support from Biotech and Life Science Tool providers

https://twitter.com/AlbertVilella/status/1624465272496168965There have been many of these institutes come and go, and probably the @broadinstitute (Cambridge, US) and the @sangerinstitute (Cambridge, UK) are the two referents in historical terms and in their magnitude of achievements in #genomics. So if we take them as an example, what do

Those of you that have been reading this account for a while will remember that the Beacon is a multi-million dollar large-fridge/freezer instrument that does high-throughput single-cell phenotyping, and the main product in the product line for Berkeley Lights (PhenomeX).

Those of you that have been reading this account for a while will remember that the Beacon is a multi-million dollar large-fridge/freezer instrument that does high-throughput single-cell phenotyping, and the main product in the product line for Berkeley Lights (PhenomeX).

The interesting detail is that the P2 600 cycles kit gives 300M Reads CPF (Clusters passing filter), compared to the equivalent 300 cycle kit on the same flowcell (400M). So either the diameter of the wells is different, or about 100M Clusters are "lost" in the 600 cycle kit.

The interesting detail is that the P2 600 cycles kit gives 300M Reads CPF (Clusters passing filter), compared to the equivalent 300 cycle kit on the same flowcell (400M). So either the diameter of the wells is different, or about 100M Clusters are "lost" in the 600 cycle kit.

Also first data shared on XLEAP-SBS chemistry for the NextSeq 1000/2000 instruments. Not sure why would anyone buy one of these instruments given the alternatives from @ElemBio and @CompleteGenomic 's G400.

Also first data shared on XLEAP-SBS chemistry for the NextSeq 1000/2000 instruments. Not sure why would anyone buy one of these instruments given the alternatives from @ElemBio and @CompleteGenomic 's G400.

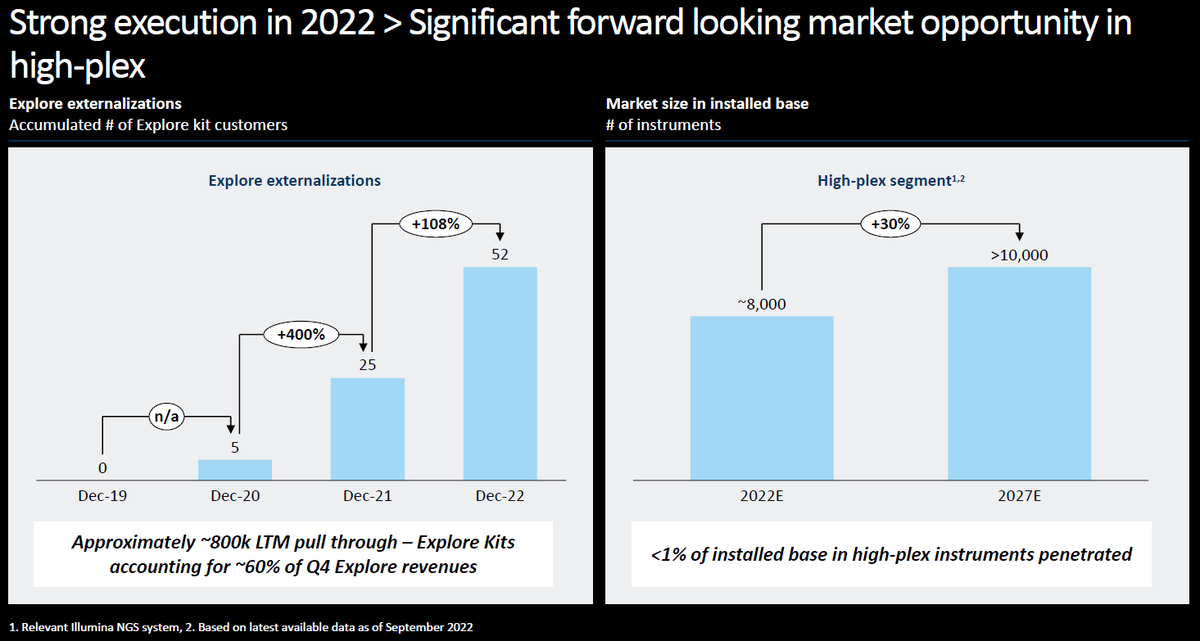

They see a market opportunity of $25B, where 50% would be BioPharma customers, and 20% Academic and Research.

They see a market opportunity of $25B, where 50% would be BioPharma customers, and 20% Academic and Research.

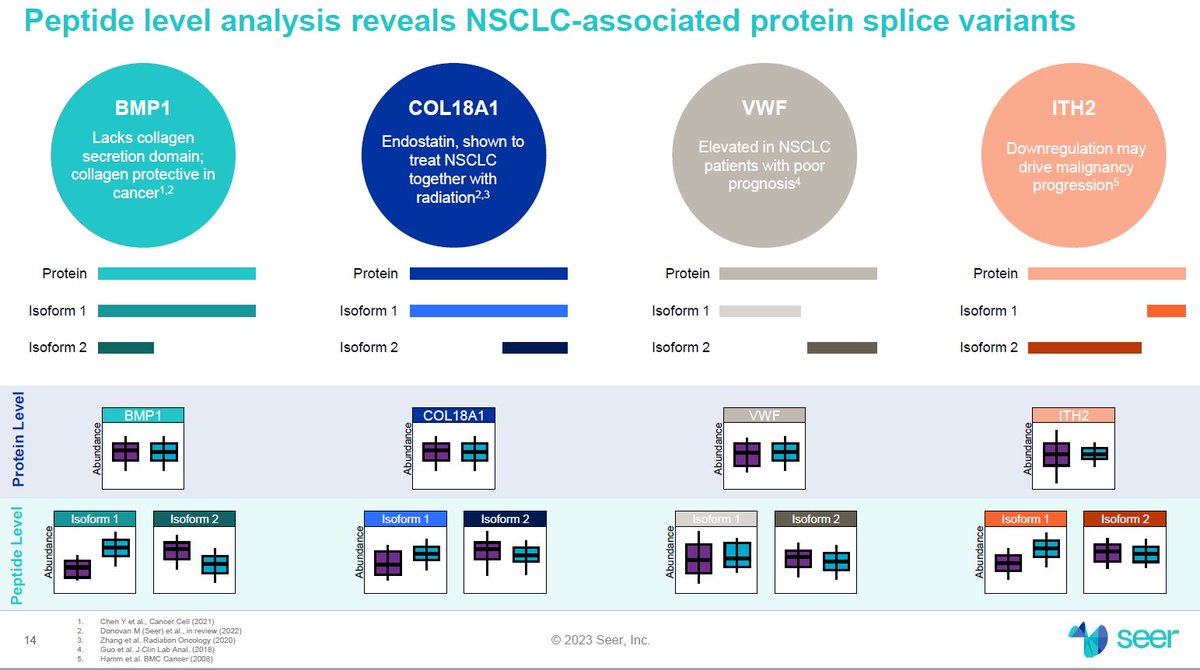

This includes slice variants, where the "Peptide Level" identification allows them to detect meaningful differences where other approaches are not able to.

This includes slice variants, where the "Peptide Level" identification allows them to detect meaningful differences where other approaches are not able to.

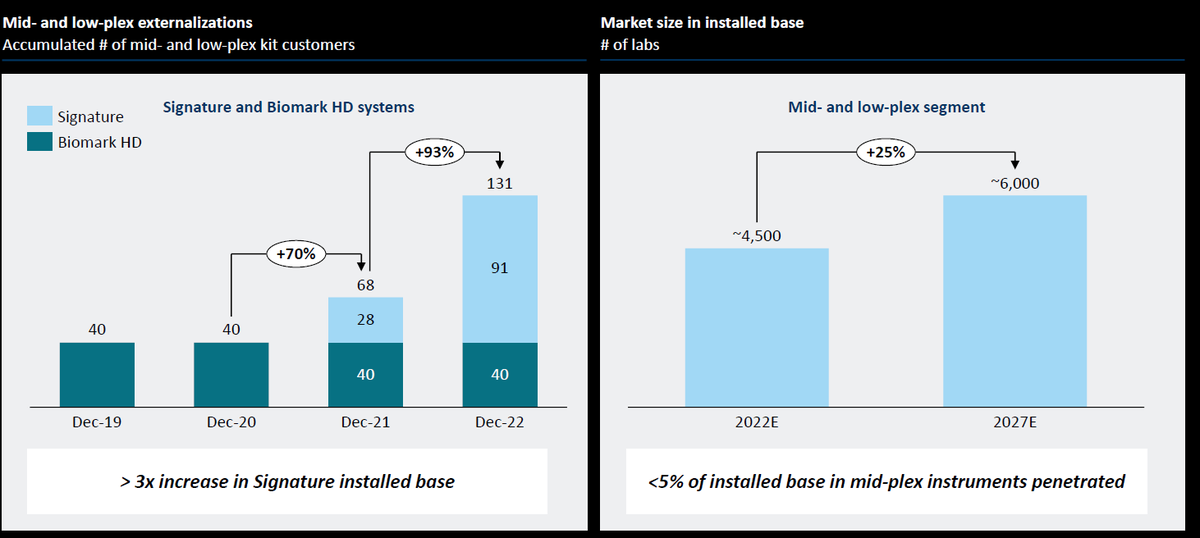

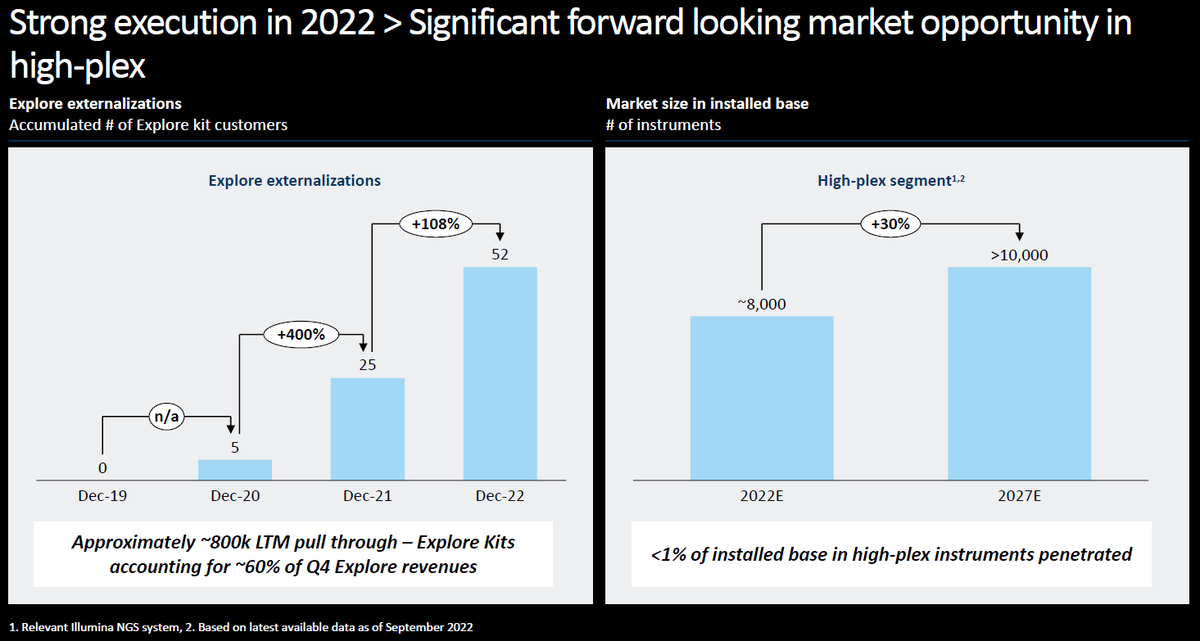

Olink believes they have <5% penetration on the mid-plex TAM

Olink believes they have <5% penetration on the mid-plex TAM