Hammer Candlestick Pattern. 📈

How should you trade with this pattern to take entry at lowest levels?

A THREAD 🧵

(1/13)

#StockMarketindia #trading #StockMarket

How should you trade with this pattern to take entry at lowest levels?

A THREAD 🧵

(1/13)

#StockMarketindia #trading #StockMarket

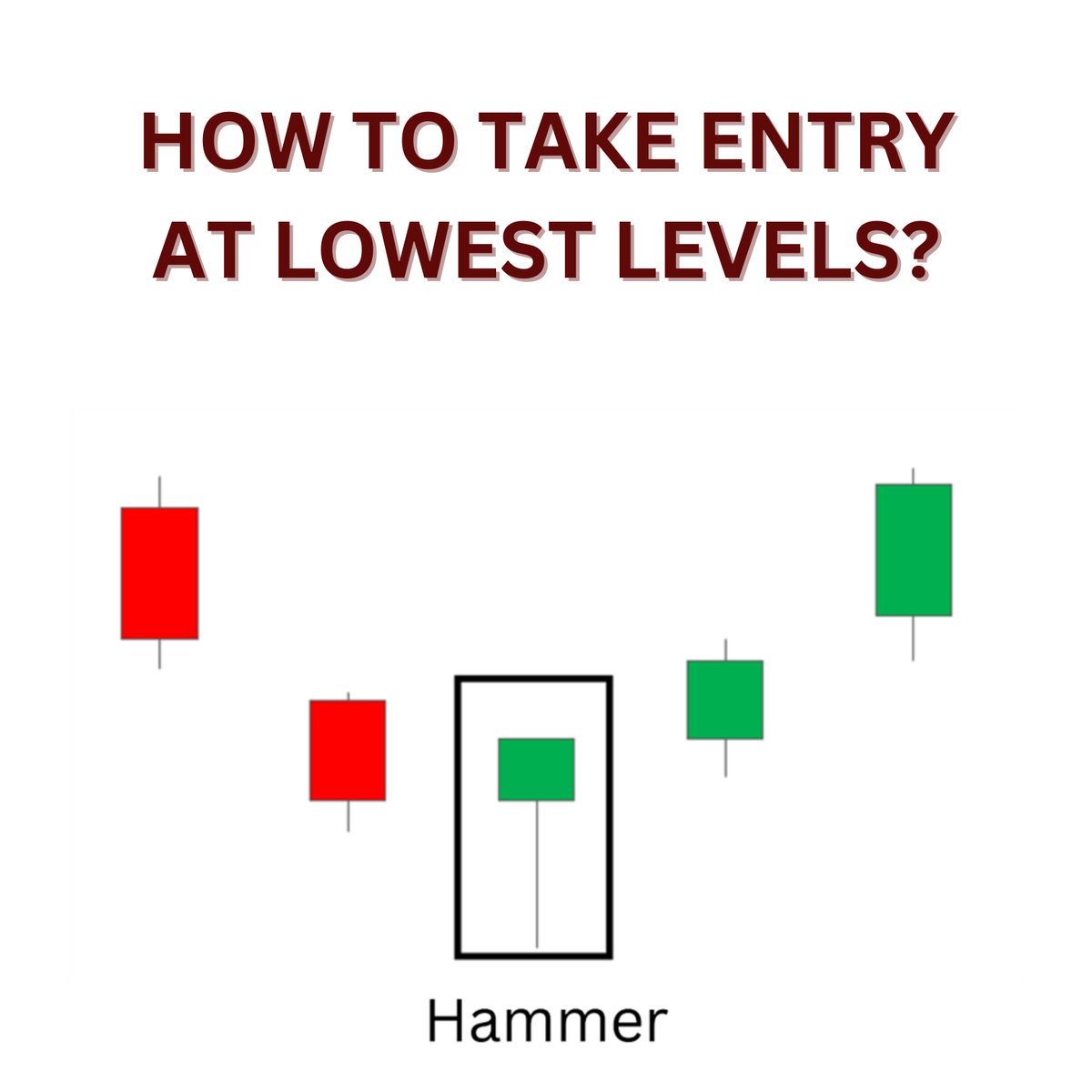

⛏The hammer candlestick is found at the bottom of a downtrend and signals a potential (bullish) reversal in the market.

⛏The hammer candle has a small body, little to no upper wick, and a long lower wick - resembling a ‘hammer’. (2/13)

⛏The hammer candle has a small body, little to no upper wick, and a long lower wick - resembling a ‘hammer’. (2/13)

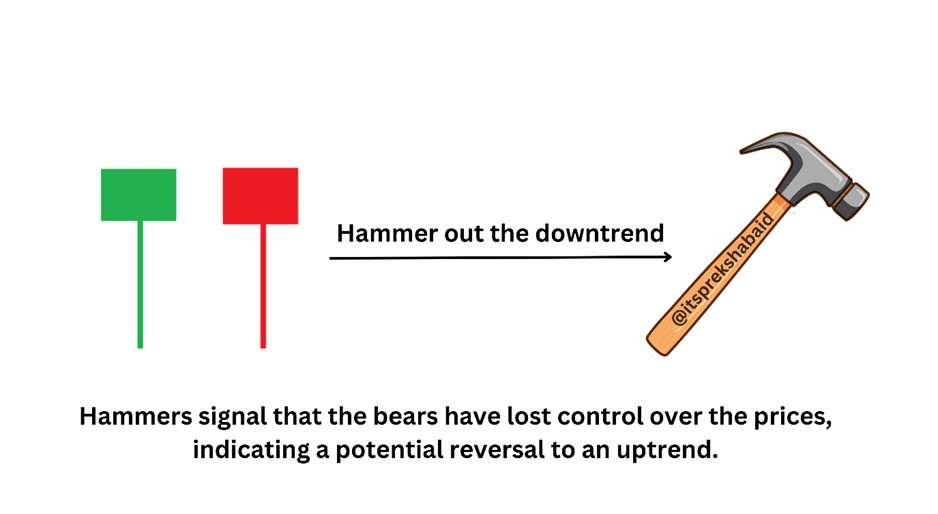

🔨Hammer candle can be of any colour – It can be either of Green or Red colour.

🔨The lower shadow should be at least two times the height of the real body. (3/13)

🔨The lower shadow should be at least two times the height of the real body. (3/13)

Psychology;

This candle pattern indicates that the price dropped to new lows, but subsequent buying pressure forced the price to close higher, hinting at a potential reversal. The extended lower wick is indicative of the rejection of lower prices. (4/13)

This candle pattern indicates that the price dropped to new lows, but subsequent buying pressure forced the price to close higher, hinting at a potential reversal. The extended lower wick is indicative of the rejection of lower prices. (4/13)

•Reversal signal – Entry for Bulls: It indicates the rejection of lower prices.

When found in a downtrend it could signal the end of selling pressure and begin to trade sideways or reverse, after confirmation such pattern can give the best entey to play reversal. (5/13)

When found in a downtrend it could signal the end of selling pressure and begin to trade sideways or reverse, after confirmation such pattern can give the best entey to play reversal. (5/13)

•Exit signal- For Bears: Traders that have an existing sell position, can view the hammer candle as an indication for reversal and they can take exit to existing sell position. (6/13)

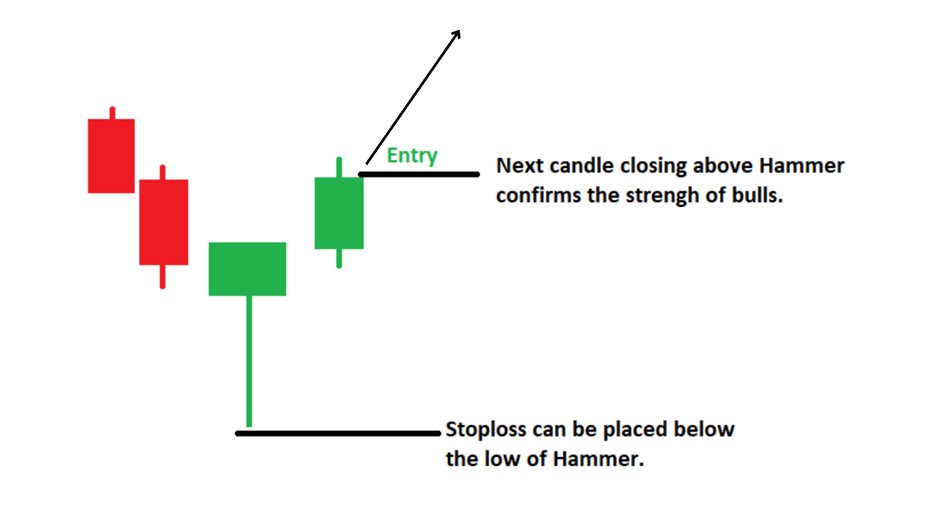

•Confirmation is important :

Entry in any trade should be taken only after the confirmation.

Fomo of entering into a trade without any confirmation can trap you in a wrong trade. (7/13)

Entry in any trade should be taken only after the confirmation.

Fomo of entering into a trade without any confirmation can trap you in a wrong trade. (7/13)

•Stoploss:

Once entered into any trade after the confirmation, stoploss can be placed below the low of hammer candle. (8/13)

Once entered into any trade after the confirmation, stoploss can be placed below the low of hammer candle. (8/13)

Examples

1) TECHM - Stock

•Here we can see the clear downtrend,

•Then formation of hammer candle,

•Next candle gives confirmation and the trend reverse. (9/13)

1) TECHM - Stock

•Here we can see the clear downtrend,

•Then formation of hammer candle,

•Next candle gives confirmation and the trend reverse. (9/13)

2) CHOLAFIN - Stock

•Here we can see the clear downtrend,

•Then formation of hammer candle,

•Next candle gives confirmation and the trend reverse. (10/13)

•Here we can see the clear downtrend,

•Then formation of hammer candle,

•Next candle gives confirmation and the trend reverse. (10/13)

3) NATURAL GAS - Commodity

•Here we can see the clear downtrend,

•Then formation of hammer candle,

•Next candle gives confirmation and the trend reverse. (11/13)

•Here we can see the clear downtrend,

•Then formation of hammer candle,

•Next candle gives confirmation and the trend reverse. (11/13)

•Target/ Exit point –

✔I always follow next resistance level as my target.

✔Always mark strong resistance areas in your chart and use them as a target for a perfect exit. (12/13)

✔I always follow next resistance level as my target.

✔Always mark strong resistance areas in your chart and use them as a target for a perfect exit. (12/13)

♥If you found this thread useful, please RT the first tweet.🔁 (13/13)

A thread: To learn BULLISH ENGULFING candlestick pattern. 👇

https://twitter.com/itsprekshaBaid/status/1611971054347644929?t=8zmv-FB4tQkuul4WgGCdjw&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh