In #JPM2023 news, $TWST Twist Biosciences also presented on Monday, and here are some highlights of their presentation: first slide is the obligatory comparison between Twist 1M oligos per chip technology compared to the plate-based methods.

Their #SynBio revenue is still growing, but proportionally less than the #NextGenerationSequencing segment and the #Biopharma segments.

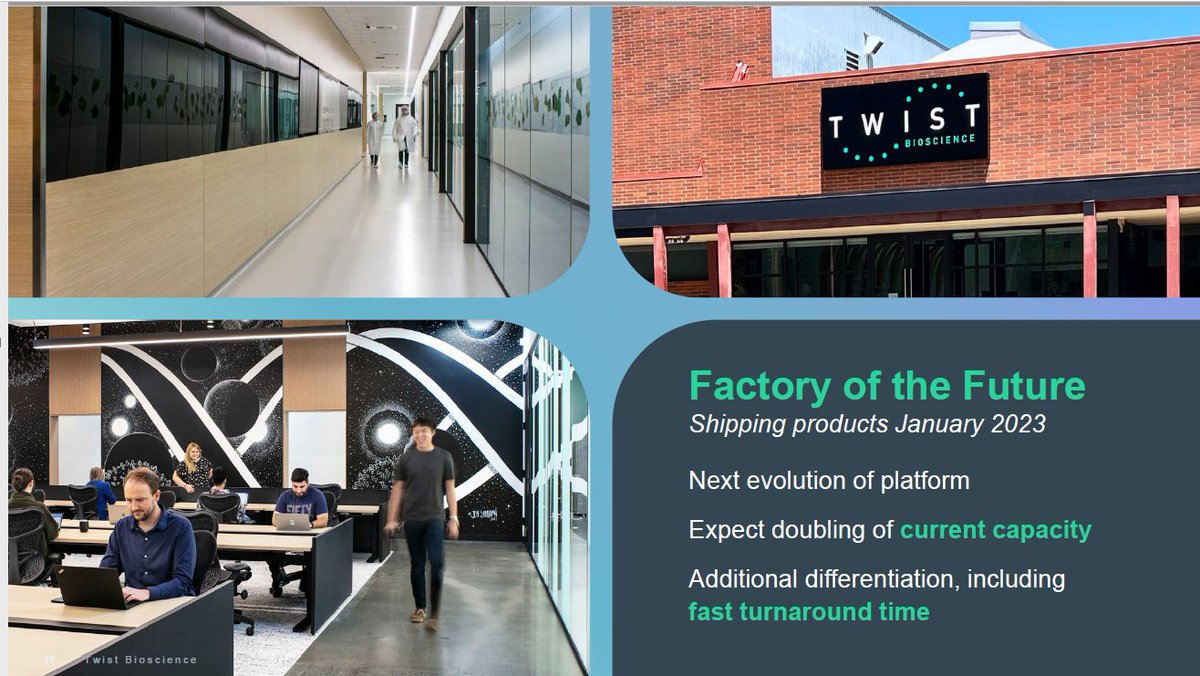

They have a new factory which they expect to start shipping products in January 2023 (now!) and would mean doubling up their current capacity.

Given that $ILMN Illumina recently presented their NovaSeq X Plus technology and $200/genome price point, now Twist has their slide also updated and they see more sample growth in their NGS business given the lower costs of sequencing.

They put a table of the new numbers for exome and cancer panels, pre- and post-NovaSeq X (NovaX). Interesting to see that 50,000x coverage seems to be the norm for cancer panels. Have people settled on this number?

They see Liquid Biopsy and MRD growing rapidly, from their current $0.3B to $2.2B by 2027. A reminder that in previous #JPM2023 threads for both $ILMN Illumina and $GH Guardant Health, we saw some spectacular numbers for TAM in Liquid Biopsy, the largest being the $100B by $GH.

Twist classes their End-to-End #Antibody Discovery Service as a Premium Solution in the Biopharma segment. Will they show premium customer success for this premium solution?

In their #DNAWrite segment, they have a strong plan for terabyte level chips. Their POC Chip at 256M oligos is 256x denser than the 1M production chip. Expected to be road-tested in 2023.

• • •

Missing some Tweet in this thread? You can try to

force a refresh