🚨 Hidden opportunity to get Huge Profits in 2023 🚨

A major #Ethereum network upgrade is coming in March 2023 - it's Ethereum Shanghai

🧵What exactly needs to be done to get a profit from it, I propose to consider in the thread👇

A major #Ethereum network upgrade is coming in March 2023 - it's Ethereum Shanghai

🧵What exactly needs to be done to get a profit from it, I propose to consider in the thread👇

1/

To start

The easiest option is to buy tokens like:

$ETH

$RPL

$SWISE

$FRAX

To start

The easiest option is to buy tokens like:

$ETH

$RPL

$SWISE

$FRAX

2/

Why can LSD tokens bring profit?

Liquid Staking protocols allow to participate in #Staking without having 32 $ETH

Since the main amount of staking goes through Liquid Staking providers, their tokens are expected to skyrocket even more

Why can LSD tokens bring profit?

Liquid Staking protocols allow to participate in #Staking without having 32 $ETH

Since the main amount of staking goes through Liquid Staking providers, their tokens are expected to skyrocket even more

3/

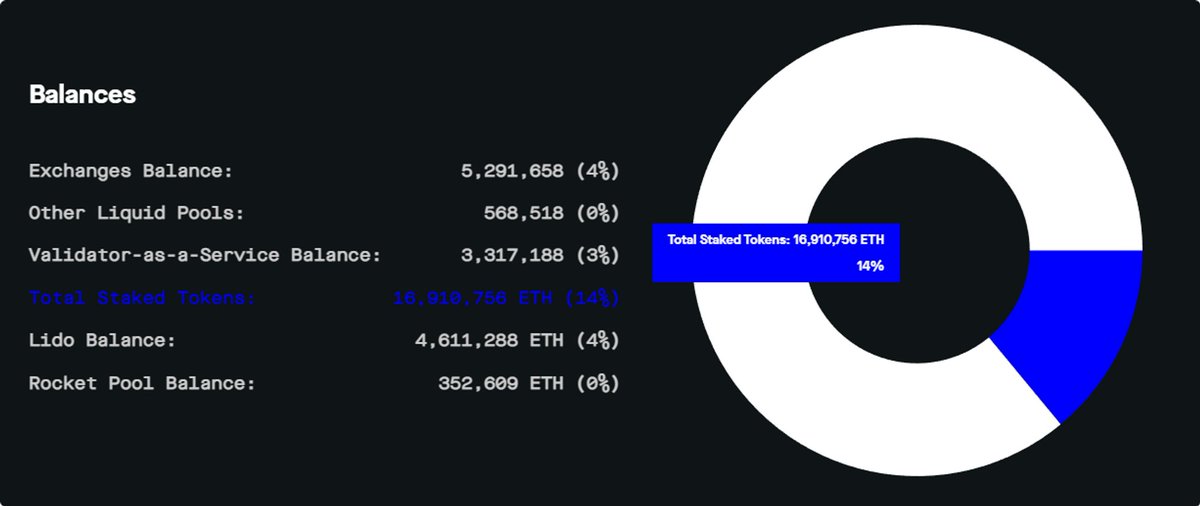

After the Shanghai Eth update, developers expect that by the end of 2023, 80% of the $ETH supply will be staked. At the moment it is only 14%

#Lido currently provides ~25% of all staked ETH

And from here on in, we'll talk about a more complex option to profit

After the Shanghai Eth update, developers expect that by the end of 2023, 80% of the $ETH supply will be staked. At the moment it is only 14%

#Lido currently provides ~25% of all staked ETH

And from here on in, we'll talk about a more complex option to profit

4/

~25% of all staked $ETH is in #Lido, because of the high emission $LDO token (which is a big incentive provider in #Curve for ETH/stETG LP)

Now emission $LDO is ending and will not be able to support incentive in ETH/stETG LP

~25% of all staked $ETH is in #Lido, because of the high emission $LDO token (which is a big incentive provider in #Curve for ETH/stETG LP)

Now emission $LDO is ending and will not be able to support incentive in ETH/stETG LP

5/

There is a high chance that more funds will leave Lido and more money will move into $ETH staking

Where will they go?

❗️To other LSD providers reviewed below 👇

There is a high chance that more funds will leave Lido and more money will move into $ETH staking

Where will they go?

❗️To other LSD providers reviewed below 👇

6/

@Rocket_Pool is a decentralized protocol founded back in 2016 and here are the main benefits:

1️⃣ Rocket Pool's $rETH holds peg better than $stETH

2️⃣ Instead of 32 $ETH users can stake with 8 $ETH

@Rocket_Pool is a decentralized protocol founded back in 2016 and here are the main benefits:

1️⃣ Rocket Pool's $rETH holds peg better than $stETH

2️⃣ Instead of 32 $ETH users can stake with 8 $ETH

7/

@stakewise_io founded in 2018 and has the following advantages:

1⃣ Will sharing part of its profits (earned through commissions) with $SWISE token holders.

2⃣ $SWISE token will be used as an insurance against slashing risk

3⃣ Instead of 32 $ETH users can stake with 4 $ETH

@stakewise_io founded in 2018 and has the following advantages:

1⃣ Will sharing part of its profits (earned through commissions) with $SWISE token holders.

2⃣ $SWISE token will be used as an insurance against slashing risk

3⃣ Instead of 32 $ETH users can stake with 4 $ETH

@stakewise_io 8/

@fraxfinance is the largest DAO in terms of CVX token holdings, therefore it can easily regulate emission into Curve pools, which is essential for LSD when you can't unstake ETH

@fraxfinance is the largest DAO in terms of CVX token holdings, therefore it can easily regulate emission into Curve pools, which is essential for LSD when you can't unstake ETH

• • •

Missing some Tweet in this thread? You can try to

force a refresh