In #JPM2023 news, $DNA Ginkgo Bioworks also presented in January 11, 2023. Jason Kelly, one of the co-founders and CEO was the one leading the presentation.

An impressive list of customers and partners, big and small. I didn't know that Moderna was one of them. Also a few "Confidential partners" in the different segments.

Emphasis on the flywheel accelerating, generating millions of data points which inform the AI/ML efforts. If you don't have a large proprietary dataset, then your AI/ML outcome will look no different than the guy next door.

"Ginkgo does not develop their own therapeutics", but enabling the customers, Ginkgo can be in any modality, such as Cell Therapy, Gene Therapy, Small molecule, Biologics, Microbiome, RNA Tx and vaccines.

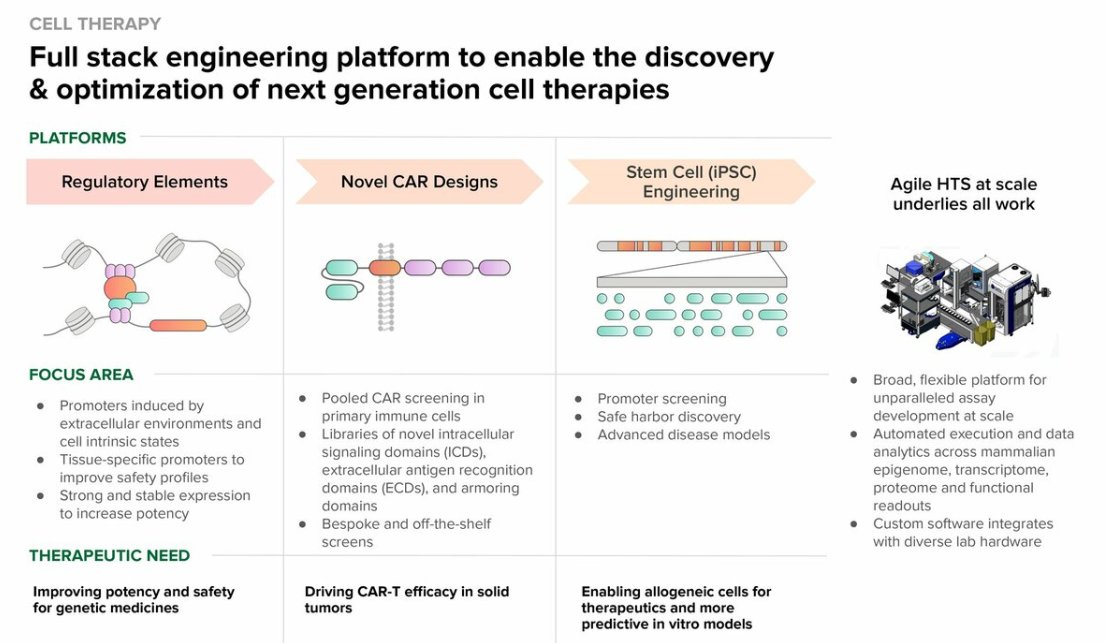

Examples in Cell Therapy, with mammalian and cell engineering investments, e.g. the new facility in Boston.

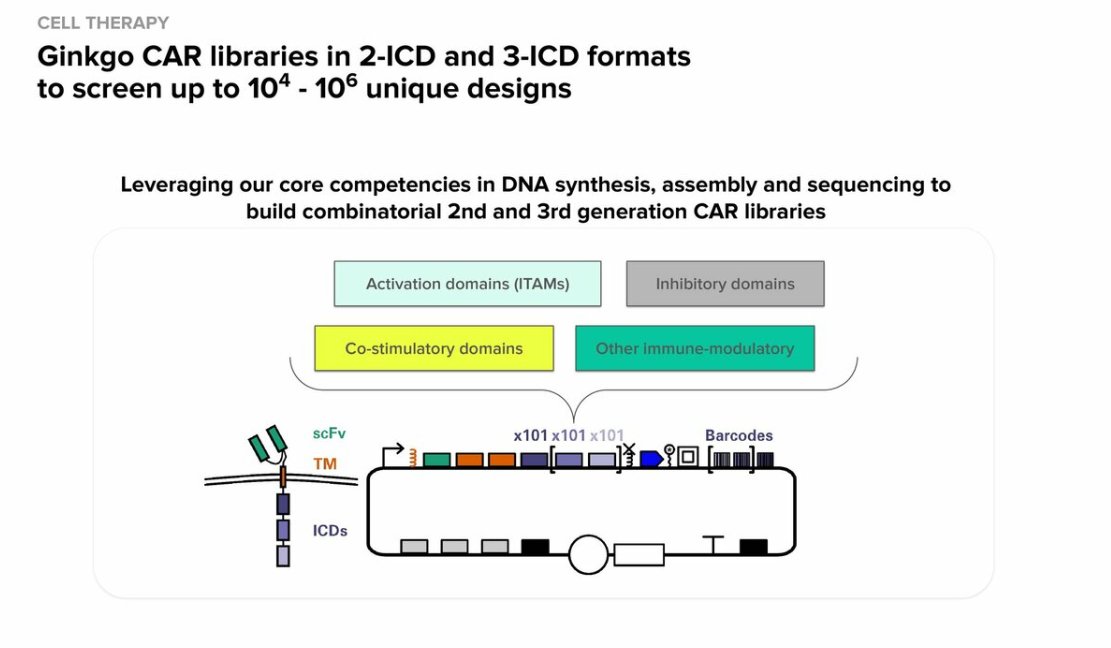

Here CAR libraries with 101x101x101 modules generating millions of possibilities. Enrichment with high affinity and low affinity.

Gene Editing, with a huge microbiome genome collection at Ginkgo. CRISPR-like systems in the public data (NCBI), more than 10x bigger in the Ginkgo database. "Small piece of a lot of pies" model here, CRO, Amazon AWS model, etc.

Enzymes services: turn-key service, includes a Merck deal for biocatalysts (enzymes) improvements. Structural and ML models informed by all the EC data that Ginkgo has been accumulating; better economics, better deals for partners.

Circular RNA (circRNA): acquisitions of Circularis, excited about making RNA delivery stable, dialling up expression, etc. Two methods of circularization: Catalytic introns vs hairpin ribozymes, and how they compare to polyA mRNA.

Biosecurity: Synthetic Biology is a national priority for the US. Some parallelisms with biofoundries and silicon foundries: we are already deep in the "chips war" with the Taiwan/China angle, and the US government things in similar strategic terms with biofoundries.

Also Biosecurity applications such as: look at a sequence of DNA and try to determine if it's been engineered or not. Analogy to satellites and weather forecast: same here for infectious diseases and viral surveillance.

And finally a wink at the generative AI world with asking ChatGPT what's more important: atoms or bits, and here Ginkgo is building the world of atoms (biological entities) for the future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh