In #JPM2023 news, $PACB PacBio presented on January 11, 2023. Christian Henry, President and CEO announcing that Revio already has 76 orders in the books.

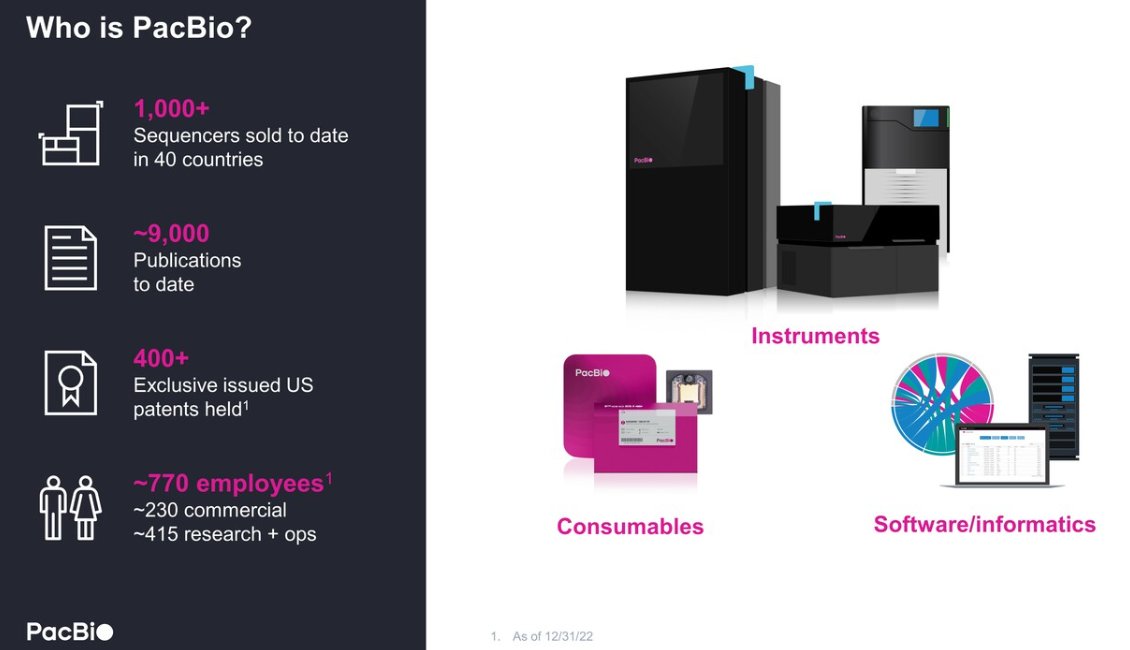

PacBio has already sold more than 1,000 sequencers. I wonder given the turnaround of the technology, if that makes it the biggest NGS company in turn-around of their instruments.

Basic slide explaining how long-read HiFi works, and the Omniome short-read SBB sequencing technology for Q40+ read quality.

A slide describing the different fields and how long-reads and short-reads play different roles in each of them. I wonder how much $ILMN Illumina would have liked to be in this position today: having succeeded in acquiring PacBio HiFi technology as a complement to SBS.

The company has 512 Sequel II/IIe instruments installed, which they will quickly be replaced by the Revio instrument, which has much higher throughput and favourable price per Gb.

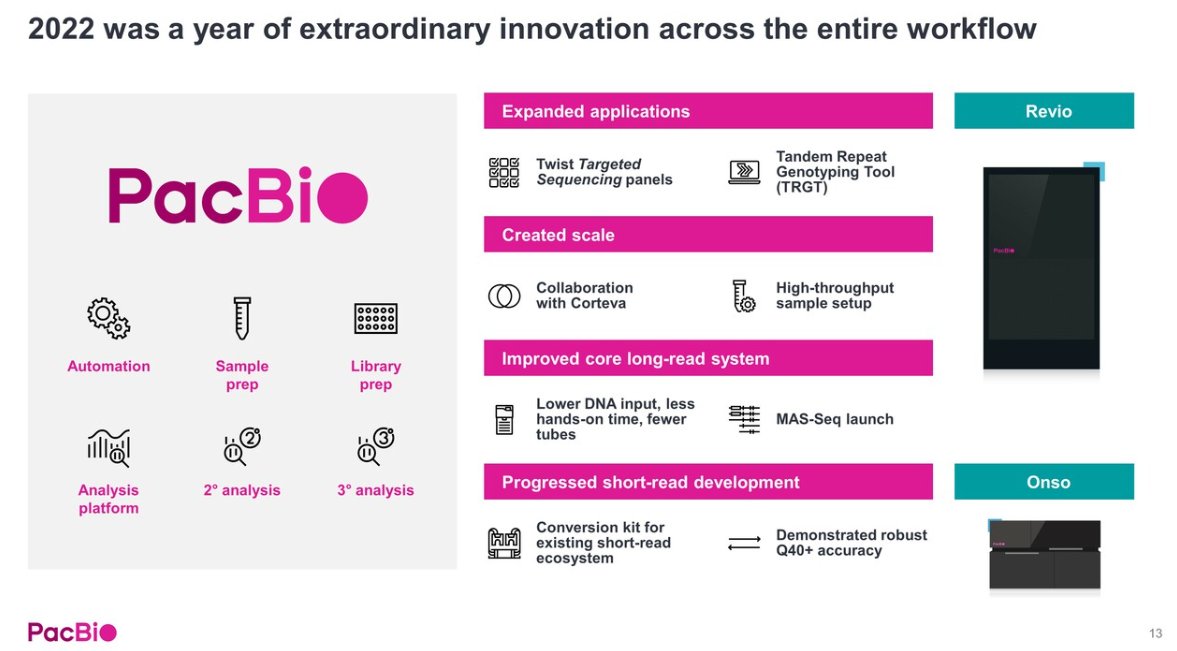

An interesting slide that details some partners in the Revio instrument: Corteva for automated ways to prepare the sample for long-read sequencing. Also $TWST Twist Bio for targeted sequencing panels.

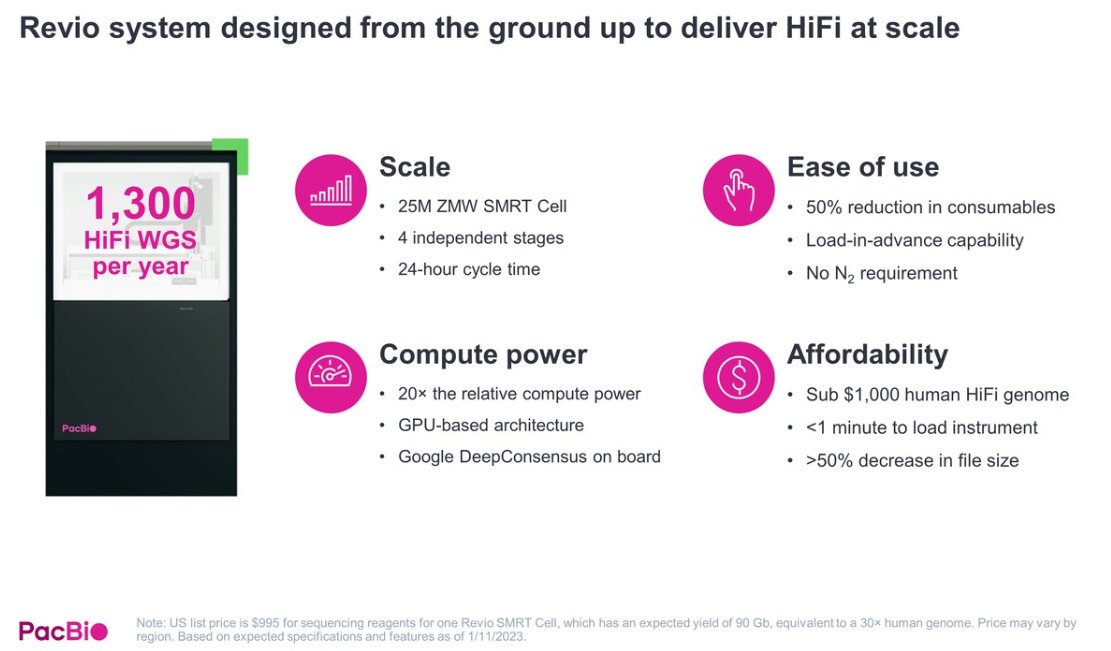

The slide summarising the tech specs for the new Revio long-reads instrument: 1,300 HiFi WGS per year, sub $1,000 human HiFi genome, 25M ZMW SMRT Cell, 24-hour cycle time. Load-in-advance capability that takes less than 1 minute to perform.

Some stats on the Revio performance based on 29 recent internal runs with human, plant, animal, and plasmid samples. Quotes here for greater or equal than Q30 reads, so it seems like the mark for a HiFi read is at Q30, although presumably a fraction of that is above.

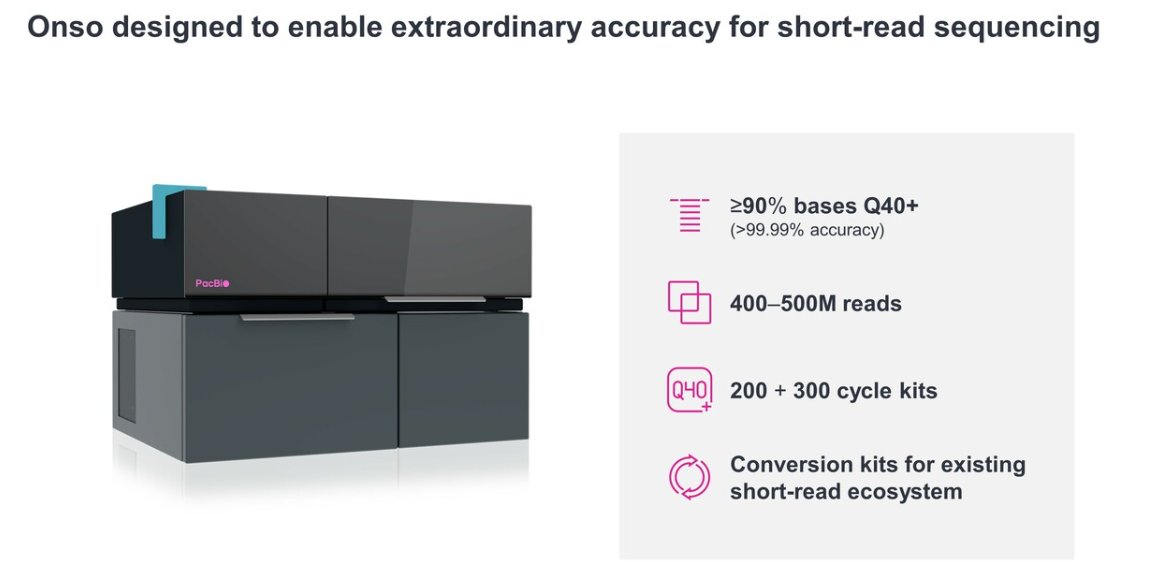

Onso (Omniome SBB technology) expected to ship in Q2 2023, with 200 and 300 cycle kits. Beta program at places like the Broad institute and Corteva. Pricing at $15/Gb, which I believe is the first time this has been publicly listed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh