In #JPM2023 news, $NSTG NanoString presented on January 11, 2023. Started in single-cell gene expression, now expanding into #SpatialBiology. They see a $3B+$3B market opportunity both on the NGS-based and the Imaging-based tech respectively.

The GeoMx is the NGS-based spatial biology solution, akin to the 10X Genomics Visium (and Visium HD in the future), with 25+ instruments in the pipe. CosMx is the imaging-based equivalent (Xenium in 10x portfolio), with about 80 instruments already in the pipe.

Lots of slides to describe CosMx, which is the newest and fastest growing instrument for $NSTG NanoString. High Plex, up to 1000-plex RNA assay, but also does Protein, FFPE Compatible, Tunable Throughput, Complete Informatics (AtoMx). Now 180 cummulative orders.

Comparison between GeoMx and CosMx, and the idea of zooming into either Areas of Interest (AOIs) or true single cell resolution.

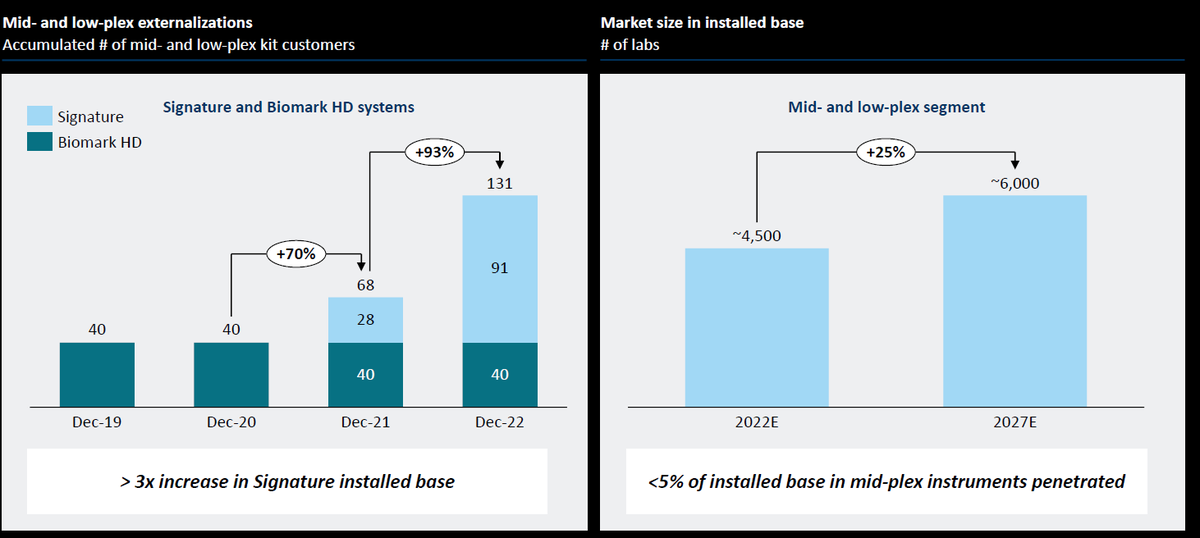

And then a bit about the nCounter, which is the first instrument, now utilization drops as installed base matures.

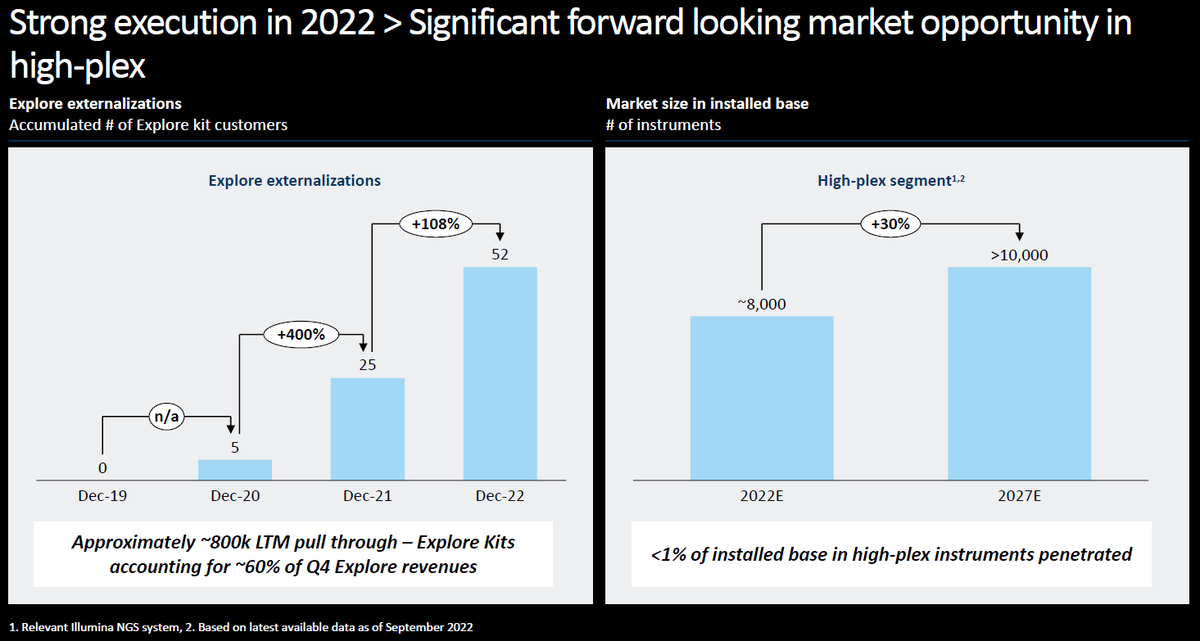

Some market predictions: they see a total TAM for GeoMx and CosMx of a total of 14,000 instruments, if the penetration was 100%, so it means currently about 5% penetration. I wonder if we can extrapolate this numbers by adding up all the #InSituImaging offerings and how quickly

We will reach 7,000 instruments. The GeoMx number is a bit more difficult, as the 10x Genomics alternative is just a small bit of glass rather than an instrument like the GeoMx. Currently #InSitu is around 1,000 of those 7,000 instruments, with 10x Genomics just starting to ship.

• • •

Missing some Tweet in this thread? You can try to

force a refresh