🚀 Introducing the revolutionary Zodiac Roles Modifier! 🚀

This tool is set to create a breakthrough in the way that DAOs can have their treasuries externally managed following a trustless, non-custodial approach.

Read on 👀 to learn the details and understand its potential.

This tool is set to create a breakthrough in the way that DAOs can have their treasuries externally managed following a trustless, non-custodial approach.

Read on 👀 to learn the details and understand its potential.

Before we delve into the specifics of the Roles Modifier, let's take a look at an example to understand the context and need for this tool.

Suppose ExampleDAO currently holds its entire treasury on a @safe multisig wallet that is not currently deploying any DeFi strategy to generate yield.

Members of ExampleDAO are interested in tapping into this opportunity but are not specialists in treasury management.

Members of ExampleDAO are interested in tapping into this opportunity but are not specialists in treasury management.

They'd like to partner with a specialist like @karpatkey but have some concerns about the way it would work.

Their most pressing concern is related to the custody of the funds. It's key for them to never give custody to an external party.

Disclaimer: I am part of @karpatkey.

Their most pressing concern is related to the custody of the funds. It's key for them to never give custody to an external party.

Disclaimer: I am part of @karpatkey.

It's a valid concern.

This is the web3 after all. The programmatic tools that we are all building together don't (or shouldn't) require anyone to trust anyone.

Of course, the Zodiac tools are aligned with this philosophy.

This is the web3 after all. The programmatic tools that we are all building together don't (or shouldn't) require anyone to trust anyone.

Of course, the Zodiac tools are aligned with this philosophy.

What possibilities are available for ExampleDAO to have their treasury managed by an external party in a non-custodial, highly transparent, trust-minimized way?

They could create a specific @safe wallet for this purpose, turning members of the external party into signers of the new multisig but making sure that there's always a need for at least one signer from the DAO to meet the min threshold.

This approach has some problems.

This approach has some problems.

First, it's particularly labor-intensive and time-consuming for the DAO members tasked with this important job.

Deploying a DeFi strategy involves executing myriad transactions on a frequent basis.

There's a need for scheduled execution meetings that can take many hours a week.

Deploying a DeFi strategy involves executing myriad transactions on a frequent basis.

There's a need for scheduled execution meetings that can take many hours a week.

Second, there's a possibility of collusion between the signers of the treasury managing party and the signers of the DAO.

Although there are some available countermeasures, there is a chance for the treasury to be drained at any moment without anyone knowing it.

Although there are some available countermeasures, there is a chance for the treasury to be drained at any moment without anyone knowing it.

Is there an alternative approach?

Yes, there is.

Enter the Zodiac Roles Modifier. 💫

Yes, there is.

Enter the Zodiac Roles Modifier. 💫

What if ExampleDAO could designate a manager for their treasury and give programmatic permission to only execute a set of specific, pre-approved functions within whitelisted contracts?

This is what the Zodiac Roles Modifier allows.

This is what the Zodiac Roles Modifier allows.

Before moving on, let's quickly introduce the Zodiac Tools created by the @GnosisGuild wizards 🎩 .

Zodiac is a collection of composable tools built as an open standard that supports DAOs on the road to progressive decentralization.

More info here: gnosisguild.mirror.xyz/OuhG5s2X5uSVBx…

Zodiac is a collection of composable tools built as an open standard that supports DAOs on the road to progressive decentralization.

More info here: gnosisguild.mirror.xyz/OuhG5s2X5uSVBx…

The Roles Modifier specifically allows the owners of an address, such as the one on which a DAO's treasury sits, to grant granular, role-based, permissions for specific actions that can only be carried out within approved contracts and functions.

More info here: github.com/gnosis/zodiac-…

How can this tool be used?

The treasury manager could outline an intended DeFi strategy for ExampleDAO and ask to have specific protocols, pools and actions whitelisted by its members.

The treasury manager could outline an intended DeFi strategy for ExampleDAO and ask to have specific protocols, pools and actions whitelisted by its members.

Once there is consensus around the protocols, pools and actions to be whitelisted, a series of presets are executed by the signers of the address that holds the funds (called Avatar) and the manager address (called manager) obtains the requested permissions.

Setting up the presets is a one-time transaction and, unless there's a need for a change, no additional transactions by the Avatar are required.

Considering how dynamic DeFi industry is, it's likely there will be a need to apply new presets as time goes by.

Considering how dynamic DeFi industry is, it's likely there will be a need to apply new presets as time goes by.

It's easy to see how this new approach is not subject to the problems outlined before.

There is no need for members of ExampleDAO to sign every transaction and the opportunity for collusion is no longer available.

There is no need for members of ExampleDAO to sign every transaction and the opportunity for collusion is no longer available.

ExampleDAO maintains full custody of the funds and can execute any transaction at any moment, including the removal of the permissions granted to the manager.

Sounds like a superior approach, doesn't it?

Sounds like a superior approach, doesn't it?

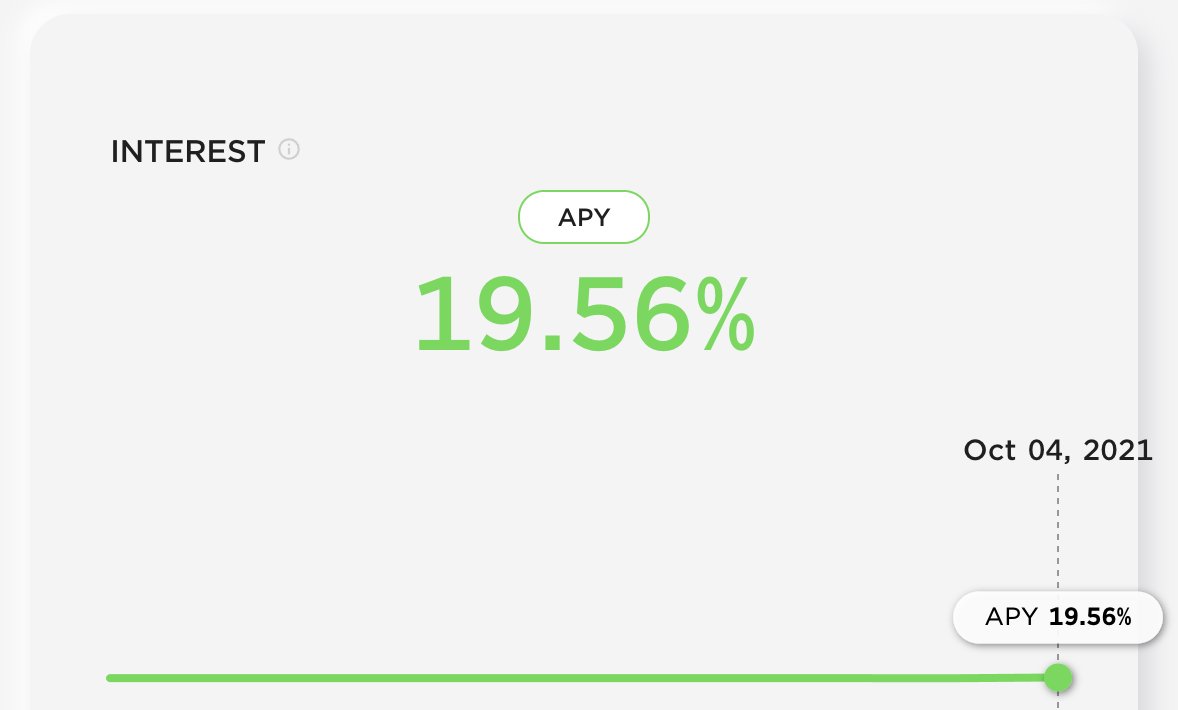

@karpatkey is already using the ZRM to manage the @GnosisDAO's treasury.

In addition, as per the successfully passed proposals on the forums of @Balancer and @ensdomains, @karpatkey will leverage this tool to manage those DAOs' treasuries in a non-custodial manner.

In addition, as per the successfully passed proposals on the forums of @Balancer and @ensdomains, @karpatkey will leverage this tool to manage those DAOs' treasuries in a non-custodial manner.

Sneak peeks 👀:

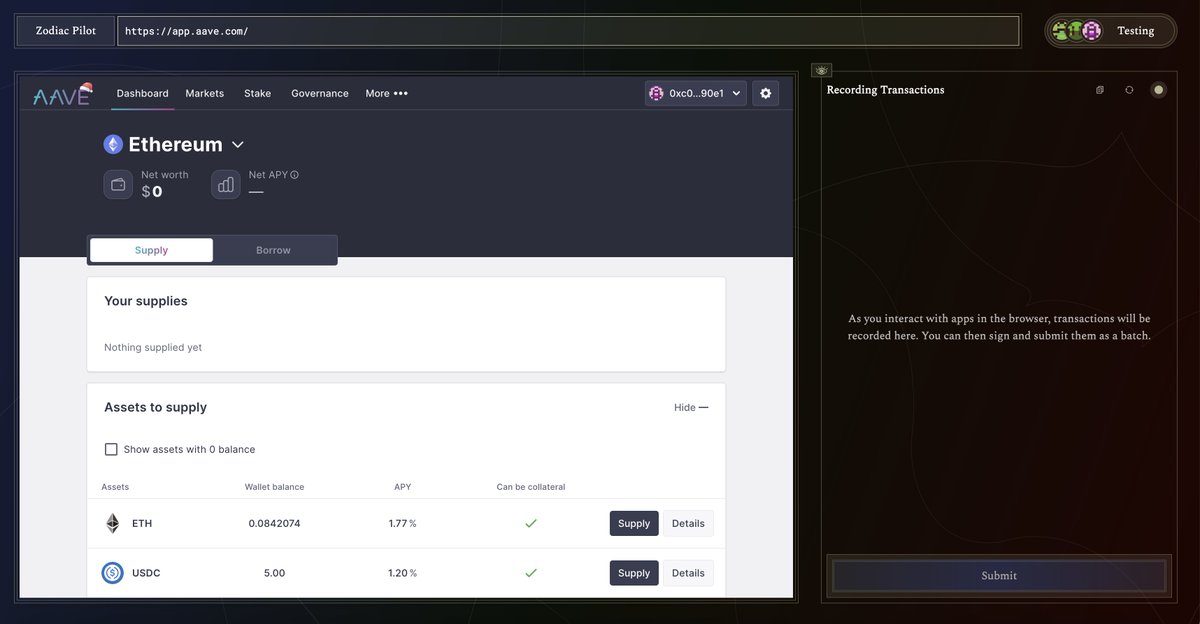

This is how the Zodiac UI looks when connected to @AaveAave.

The connected wallet is the Avatar.

All transactions occur on the Avatar's account.

The manager's role is to create and execute transactions within the whitelisted boundaries on behalf of the Avatar.

This is how the Zodiac UI looks when connected to @AaveAave.

The connected wallet is the Avatar.

All transactions occur on the Avatar's account.

The manager's role is to create and execute transactions within the whitelisted boundaries on behalf of the Avatar.

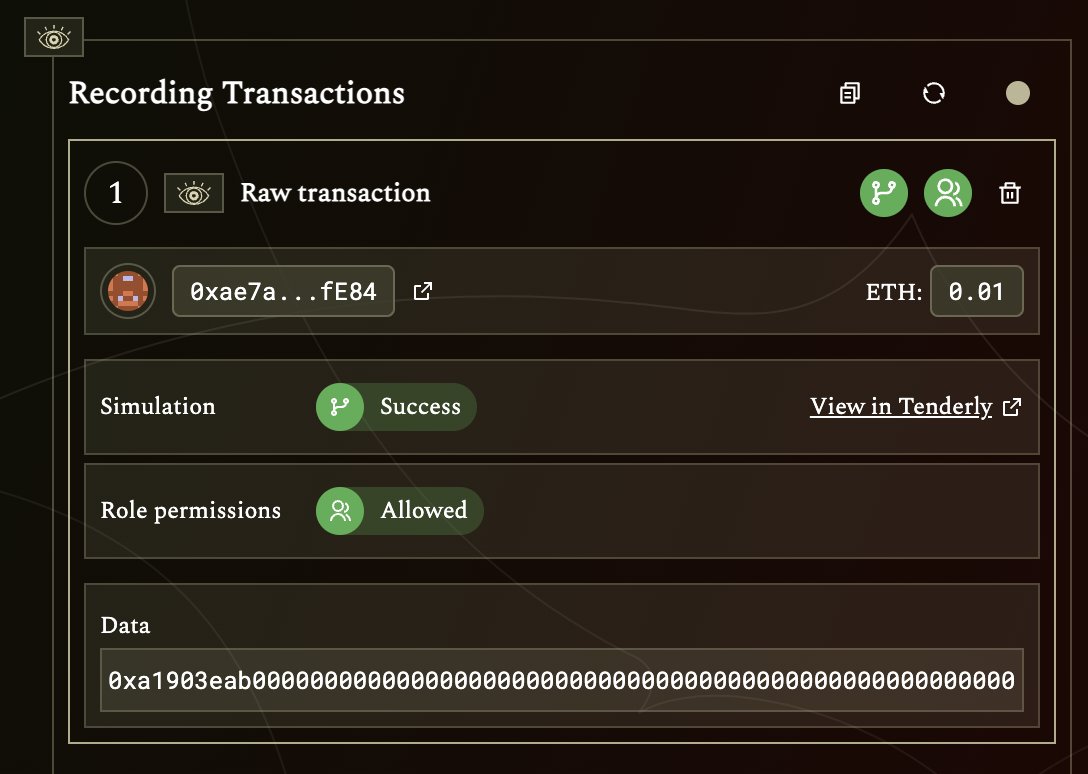

As part of the tests, the #ETH staking function on @LidoFinance has been whitelisted.

When I click submit, the panel on the right shows that I can execute the requested transaction because the role permission has been granted.

When I click submit, the panel on the right shows that I can execute the requested transaction because the role permission has been granted.

What happens if I try to submit a transaction that is not part of the list of whitelisted actions?

The Roles permission shows "Not allowed" so I can't continue.

Here is an example of when I try to add liquidity to the #wstETH-#WETH on @Balancer.

The Roles permission shows "Not allowed" so I can't continue.

Here is an example of when I try to add liquidity to the #wstETH-#WETH on @Balancer.

To wrap up, I believe this tool has a great potential to become an industry standard.

As DAOs mature, the tools to support them also evolve and rise to the challenge.

Bear market? I like to call it Build market. 🔧 🦾

As DAOs mature, the tools to support them also evolve and rise to the challenge.

Bear market? I like to call it Build market. 🔧 🦾

PS: if there's enough interest, it might be a good idea to record a short demo video showcasing the testing process.

• • •

Missing some Tweet in this thread? You can try to

force a refresh