【GBV 2023 outlook】

1/ 2022 has been tough for everyone. But with volatility and turbulence comes opportunity. Here is our 2023 outlook from @gbvofficial, on the opportunities and challenges we see lying ahead in 2023~

1/ 2022 has been tough for everyone. But with volatility and turbulence comes opportunity. Here is our 2023 outlook from @gbvofficial, on the opportunities and challenges we see lying ahead in 2023~

【Layers 1 and 2】

2/ From 2020 to 2022 we saw an explosion of layer-1s - many with high FDV and low adoption. As we dive deeper in 2023, the shakeout will continue and out of that comes the continued deflation of these layer-1s.

2/ From 2020 to 2022 we saw an explosion of layer-1s - many with high FDV and low adoption. As we dive deeper in 2023, the shakeout will continue and out of that comes the continued deflation of these layer-1s.

3/ We expect to see the sum of all layer 2 TVL flipping the sum of alt layer-1 TVL in 2023, with #Arbitrum to dominate while Optimism does alright.

4/ We think zk(e)vms will all underperform expectations, with starknet underperforming the least as it's most orthogonal to the existing Ethereum dApp ecosystem. Polygon could run into trouble for overspending in the bear market for inorganic partnership acquisition.

5/ We are fans of @CantoPublic - a degen #FPI chain with the same technology as #EVMOS, except with no VC backing. Though early and barren as of this moment, the quasi-fair launch of the chain, lends the chain ample potential to grow organically to become a new degen playground.

【DeFi】

6/ Despite all the technological strides, the problem of Liquidity Rental, whose list of solutions include Pool 2 and Olympus’ (3,3) meme, remains unsolved. The holy grail of a capital efficient, decentralised, and scalable stablecoin, remains elusive.

6/ Despite all the technological strides, the problem of Liquidity Rental, whose list of solutions include Pool 2 and Olympus’ (3,3) meme, remains unsolved. The holy grail of a capital efficient, decentralised, and scalable stablecoin, remains elusive.

7/ There are good reasons to be cautious with exposure to decentralised perp exchanges. Although it is true that decentralised perp exchanges like GNS and GMX are superior to some of the traditional finances liquidity solutions like CFDs in terms of slippage and UX,...

8/ ... and that the explosive success of Robinhood and indeed Crypto in general since 2020 has presented unequivocal proof that gamified finance satisfies a deep market demand, the oversaturated mindshare of these protocols, coupled with suppressed trading volumes now,...

9/ ... have created an environment where pools can get rekt with less dollar value. Furthermore, thanks precisely to the success and the TVL of these protocols, these protocols would be the most popular targets of hacks in the crypto space.

https://twitter.com/GMX_IO/status/1605387463744069632

10/ A convergent evolution of business models in DeFi appearing before us. Instead of deriving revenue directly by charging users of the protocol a fee, protocols like AAVE and Curve are launching stablecoins in which interest payments are all accrued to the protocol itself.

11/ The stablecoin itself serves as the tool for liquidity provision, thereby alleviating the protocol pressure for incentivizing liquidity. Liquidity becomes fully owned and controlled by the protocol.

12/ The inevitable final component, would be Algorithmic Market Operation (AMO) modules, where the mother protocol directly mints its own stablecoin into other pools or protocols to earn fees, thus transforming the protocol from a liquidity renter to a liquidity provider.

13/ #Ponzis will be back in the next bull market. Folks who made it this cycle must retire lest they ruin themselves with excessive degeneracy that ends up on the wrong side. Their retirement dooms us to making the same mistakes again, and breathes liquidity into new ponzis.

【NFTs】

14/ We are confident that NFTs will prove itself to be a superior form of digital goods. The free2play gaming market has generated 23B in 2021 alone, however, those goods are not freely tradable and remain locked on AWS servers.

14/ We are confident that NFTs will prove itself to be a superior form of digital goods. The free2play gaming market has generated 23B in 2021 alone, however, those goods are not freely tradable and remain locked on AWS servers.

15/ NFTs on open blockchain networks offer interoperability and permissionless composability, allowing them to strictly dominate garden-walled digital goods that live on AWS.

16/ NFTs remain the means to flex in crypto. Memetic desires coalesce into price floors for NFTs. Gaming NFTs (skins and in-game weaponry) require their own gaming community to accrue flex value.

17/ Given blockchain games are still at their infancy, we think art and vanilla PFPs are better poised to satisfy the flex market - and this market demands Veblen goods. If it ain’t expensive, it conveyeth no social status.

gbv.capital/insights/blue-…

gbv.capital/insights/blue-…

18/ The NFTFi sector faces multiple challenges for it to gestate its own summer. The prerequisite for an NFTFi summer is composable NFTFi protocols stacking on top of one another.

https://twitter.com/0xminion/status/1562495502377431040

19/ However, an NFT without an associated income stream has limited financialisation potential. Consider the NFT-Fi (protocol) and Metastreet vertical. A NFT is collateralised for loan origination, and these loans are then bundled together for mass purchases and trading.

20/ For NFTFi to really boom, we believe the size of collateralisable NFTs have to be multiples of the current market size and the NFTs themselves need to offer utility and cashflow. The most promising kinds of NFTs that can fulfil this role are likely #gamingNFTs and #musicNFTs.

【GameFi】

21/ We are keeping a keen eye on @gabrielleydon’s @DigiDaigaku.

Instead of selling NFTs or using fungible tokens to pay people to play the game, a gaming studio should give out NFTs, which serves as gaming assets, for free.

21/ We are keeping a keen eye on @gabrielleydon’s @DigiDaigaku.

Instead of selling NFTs or using fungible tokens to pay people to play the game, a gaming studio should give out NFTs, which serves as gaming assets, for free.

22/ The creator-token-contracts released by @limitbreak allows holders to wrap their NFT to enable more specific programmable properties, opens up a backwards-compatible, opt-in system that allows developers to upgrade their collections without sacrificing immutability.

23/ This enables creators to have control over things like resale royalties, rentability, staking rewards, and minimum resale floor prices.

24/ Ignore this innovation at your own peril. With programmable NFT properties, the flow of ETH is seized from marketplaces and reintroduced back into the hands of creators, which opens up a whole new programmable possibility space for incentives, royalties, and game mechanics.

【DeSo】

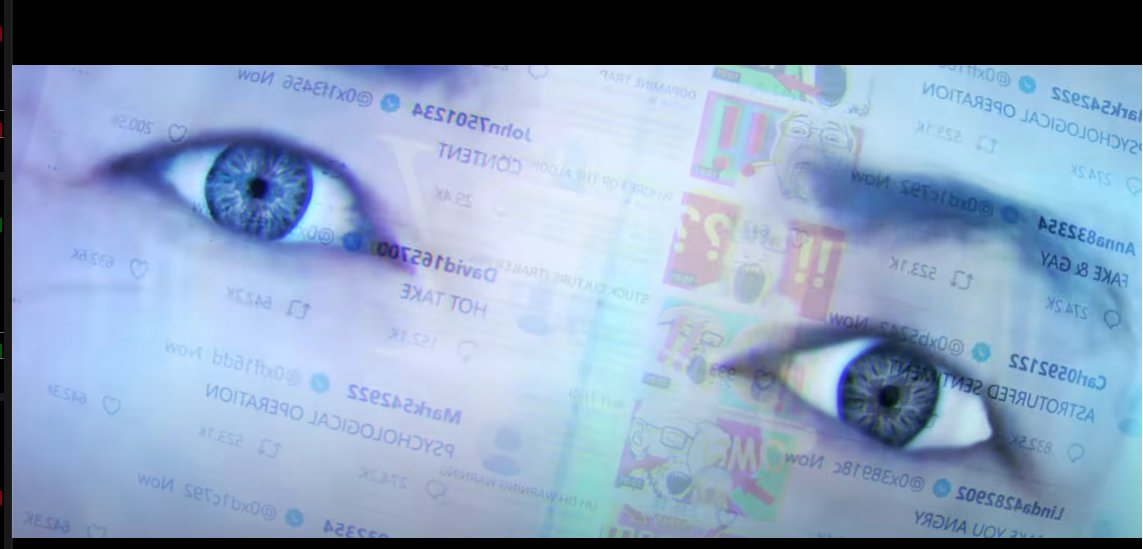

25/ Web2 is becoming increasingly unusable. Google search results are overrun with ads and content farm articles. The tiktokification of everything from Youtube to Instagram threatens to poison the masses with cheap dopamine.

25/ Web2 is becoming increasingly unusable. Google search results are overrun with ads and content farm articles. The tiktokification of everything from Youtube to Instagram threatens to poison the masses with cheap dopamine.

26/ The content degradation forcing folks to add “reddit” or “stackexchange” in googling, deplatforming and censorship, and black swan collapses like Yahoo’s acquisition and decimation of Tumblr, are all potential catalysts for Decentralised Social Media (DeSo).

27/ Amongst the competing web3 projects out there, we keep our eye closest on @farcaster_xyz and @LensProtocol.

28/ Farcaster’s minimalist approach of storing data on-chain and its permissionlessness allows for different developers to query data from Farcaster and build different, custimized apps atop the Farcaster data layer.

29/ Lens in comparison is more complicated as the protocol is not just a data layer but a social graph, complete with asset types that track the relationship between followers and the followed.

30/ We believe the Farcaster’s more minimalist and cautious approach is more likely to prove wise in the longer run as fewer things, and therefore fewer bugs and debt, are hardcoded at the outset.

31/ However the potential for Lens for becoming a social credit rating protocol for undercollateralised lending on @AaveAave is extremely interesting.

32/【Other undercurrents - VC landscape, dev influx from FAANG, Hong Kong】

We expect many VCs to be forced into redemption. Refunds requested en masse and SAFTs on fire-sale like in '19. Plenty of projects burn through their entire runway, others claiming fallout from FTX.

We expect many VCs to be forced into redemption. Refunds requested en masse and SAFTs on fire-sale like in '19. Plenty of projects burn through their entire runway, others claiming fallout from FTX.

33/ VC fundraises will collapse, and many funds will close as they find themselves sitting on illiquid garbage. There is opportunity amidst this calamity.

34/ Bear markets are for building. Going forward, it is going to be more and more difficult to run a crypto fund with no engineering arm. It is not just code literacy - it is also engineering capability and capacity that is going to be required in this space.

35/ Going into 2023, we expect not only a continued flushing out of degen crypto funds, but also an escalation of building competitiveness. As on-chain activity dwindles, searchers and MEV wizards find themselves joining projects, thereby raising the dev space competition.

36/ Mass layoffs at FAANG also threaten to raise the bar higher. One only needs to be reminded that FTX’s whole stack was built by one ex-Google engineer alone.

37/ Regulations will continue to march against crypto in 2023, along with the advent of the dreaded CBDC. More centralized exchange will be under investigation, and the icky dealings that they’ve been hiding in their underbellies will all be exposed.

38/ We do not believe the dominance of #CBDCs and the advent of the #FinancialSingularity are forgone conclusions. We think in most open economies, CBDCs will have to face the market just like any state-led economic action.

39/ We are bullish on Hong Kong’s remergence as a crypto center, for its accommodating regulatory regime, and the influx of Chinese money as they rotate from US assets. #HongKong #GetInFrontNotInBack

【Concluding Remarks】

40/ The 2023 outlook is ripe with potential. A potential rebound from the 2022 bear market, the new developments and applications of Layer 1s and Layer 2s, the advances in DeFi technology - all converge to form a promising year ahead in the crypto markets.

40/ The 2023 outlook is ripe with potential. A potential rebound from the 2022 bear market, the new developments and applications of Layer 1s and Layer 2s, the advances in DeFi technology - all converge to form a promising year ahead in the crypto markets.

Read our full report here!

gbv.capital/insights/gbv-2…

gbv.capital/insights/gbv-2…

Contributions from

@0xNoctemn @dcfpascal_ @LeslieisHODLing @0xArchie @0xdejin @kootsZhin

@0xkkser @0xminion

@sungjae_han @0xProductGal

@0xLight

@0xNoctemn @dcfpascal_ @LeslieisHODLing @0xArchie @0xdejin @kootsZhin

@0xkkser @0xminion

@sungjae_han @0xProductGal

@0xLight

• • •

Missing some Tweet in this thread? You can try to

force a refresh