In #JPM2023 news, $ABSI Absci presented on Thursday 12, 2023. Also following the trend of asking AI what they should do, the company's Chief Morale Officer was put to the task of discovering biologics on a computer. Well, DALL-E's interpretation of that was on a slide.

Absci has a slide about the "old paradigm" of drug discovery, focusing on #Antibody discovery. Either phages or mice are used to generate antibodies that bind to targets, and a process of optimization of affinity, toxicity and developability (how to produce large amounts of it)

takes place, until the antibody candidate is decided. Absci rates this at a less than <5% success rate, which is definitely in the ballpark if we take into account phage display for therapeutic antibodies as part of the denominator.

There are companies that avoid such low rates of success, by building mouse platform that generate fully human antibodies. Examples of these are $REGN Regeneron, e.g. the SARS-CoV-2 antibody therapy that was given to an ex-president of the US when he caught COVID19. Another

company with such technology is Sanofi, who acquired Cambridge-based Kymab a couple of years ago, and together with Regeneron is spinning out therapeutic antibodies for human health, for a market that some put at $130B TAM.

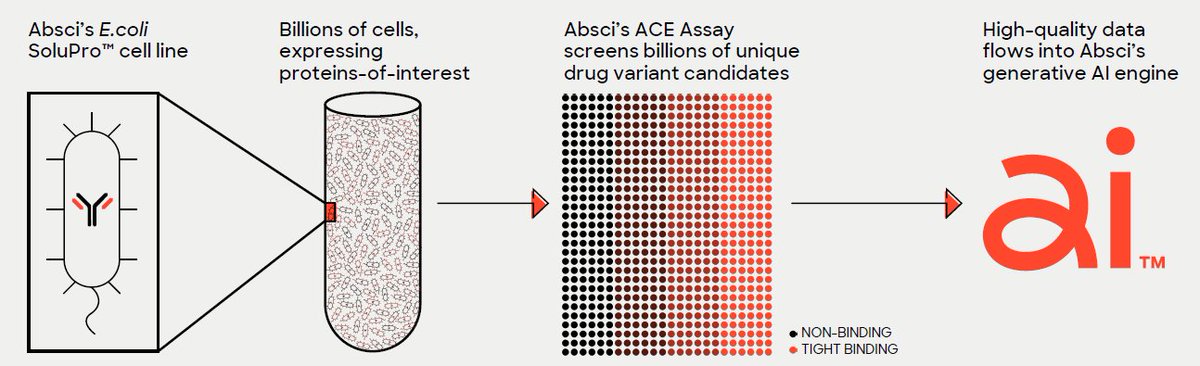

The Absci model is based on being able to do very high throughput E.coli SoluPro cells, expressing the proteins-of-interest, and then being able to perform lots of binding assays (Absci's ACE and SPR Assays) to get a readout of their performance.

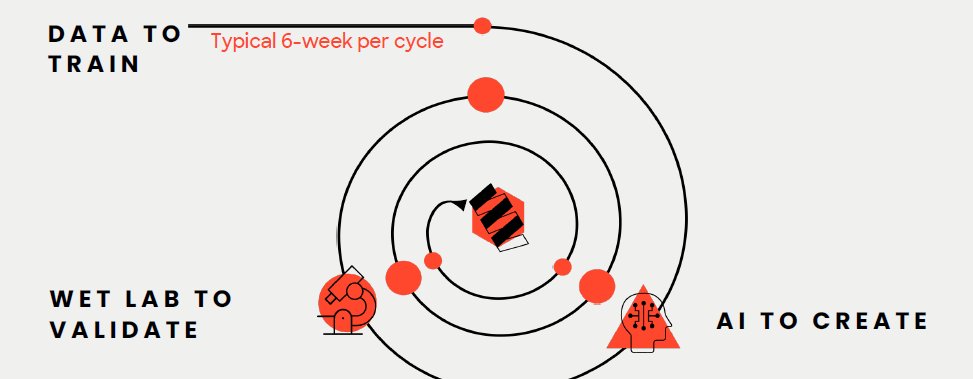

All this information is fed into an AI model, which is generative in that it can propose antibodies never seen in the training dataset, which are then validated in the wet lab in a cycle that can take about 6-weeks.

They can validate how this AI model works with known targets for which there already are good antibody therapeutics, e.g. HER2, VEGF-A, COVID omicron, etc.

Their recent preprint showcasing the generative AI model for HER2, compared to trastuzumab, has recently been made available. The AI model "edits trastuzumab in-silico", and as more editions are added, the measured binding affinity keep improving (down in the plot).

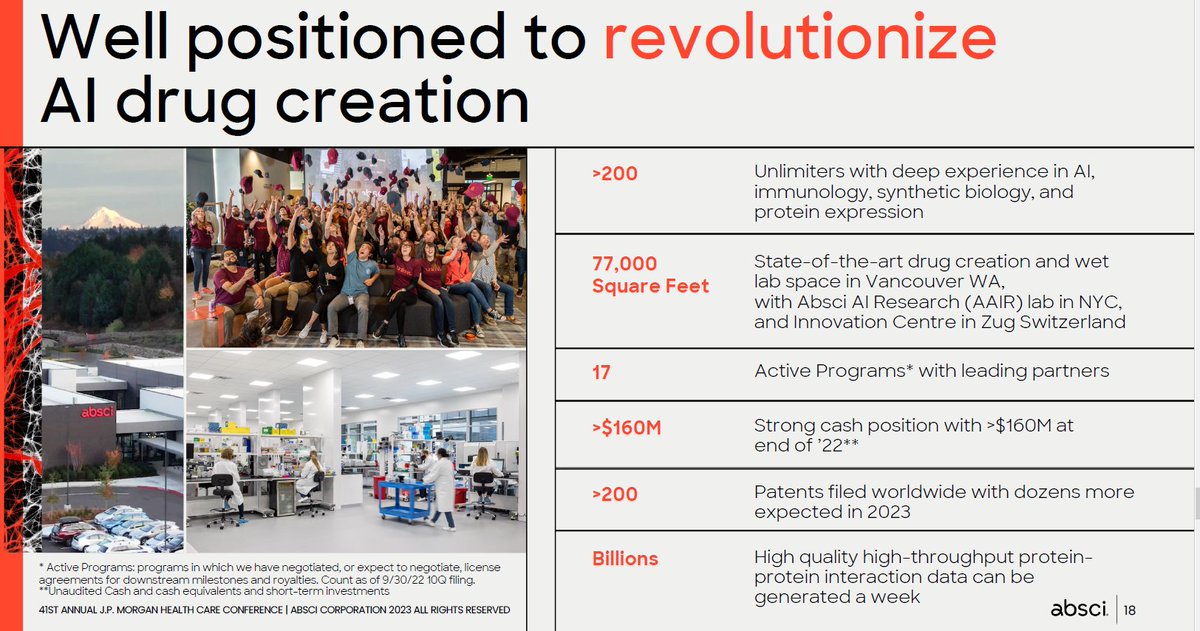

Can Absci generate candidates withing a 2 year span, accelerating timelines by 2-4 years, thus time to clinic? They've signed partnerships with Merck and EQRx to discover and develop new therapies.

$ABSI Absci IPOed not long ago, they still have >$160M cash at end of '22 and 17 active programs with leading partners.

• • •

Missing some Tweet in this thread? You can try to

force a refresh