In #JPM2023 news, $QSI Quantum-SI also presented on January 12, 2023. The company launched their Platinum protein sequencer a few weeks ago.

The technology is not too dissimilar from the DNA sequencing Ion Torrent technology: a dense array of wells capture the proteins, then single molecule sequencing takes place independently in each well, and the different reactions for the different aminoacids are captured.

These different amino acids can include post-translational modifications (PTMs) which are common in most mammals and it's fair to say that they are little understood compared to fields such as genomics or transcriptomics.

Compared to the traditional Mass Spectrometry approach, where signals from small peptides, constituents of the sample proteins, are matched against a large database of peptides that have been seen before, the $QSI Quantum-SI approach is truly "de novo".

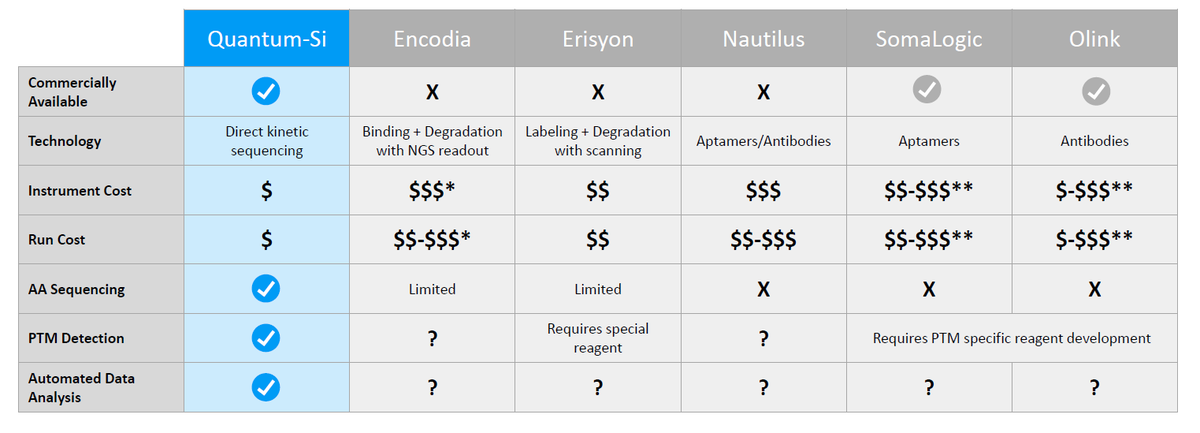

Quantum-SI are not alone in this cohort of new companies encompassing different methods in what we can call #NextGenerationProteomicsSequencing (NGPS), and others like Encodia and Erisyon are putting together de novo protein sequencers with alternative tech.

The rest of the companies in the list, such as $SLGC Somalogic, $OLK Olink, $NAUT Nautilus or $QTRX Quanterix are working on high-throughput identification methods, sometimes limited to small panels.

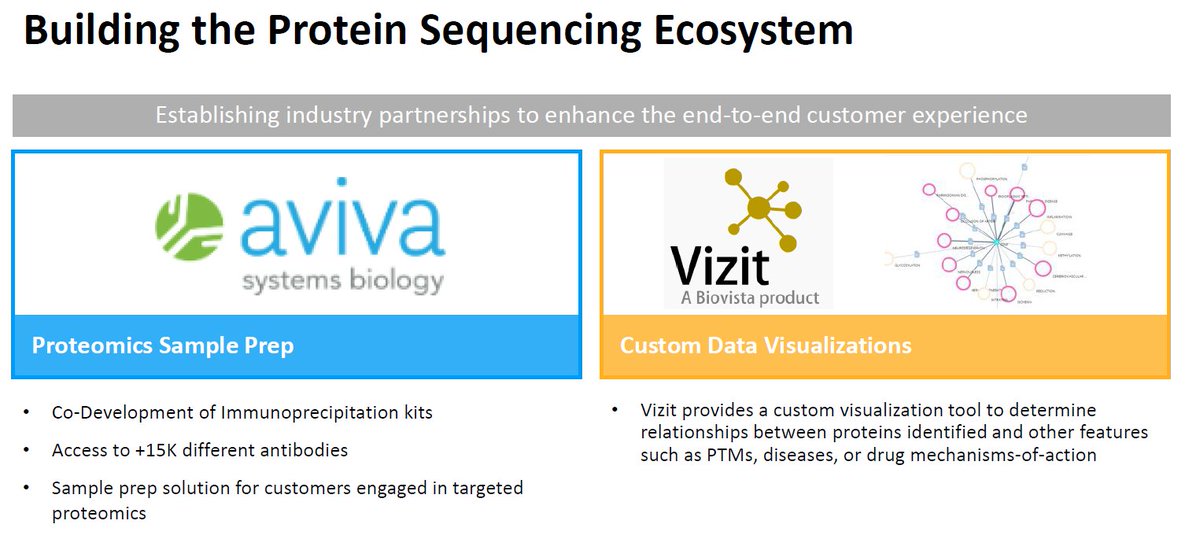

Quantum-SI is partnering with Aviva Systems Biology and Vizit to further delve into the full spectrum of analyzable proteins, and have the tools to understand these in the context of diseases or drug mechanisms-of-action.

Since the instrument is not expensive, there will be labs that may want to try it out. One example user case the company put in a slide deck is the following: you are producing some protein, purify it, run a gel, and there are several bands in the gel. Which one is your

purified protein, and what's in the other bands?

It sounds like a simple question, and there may be very simple legitimate ways to get to the answer with Mass Spec approaches, but undoubtedly, many will want to give Quantum-SI Platinum instrument and methods a try now.

It sounds like a simple question, and there may be very simple legitimate ways to get to the answer with Mass Spec approaches, but undoubtedly, many will want to give Quantum-SI Platinum instrument and methods a try now.

More on NGPS at bit.ly/ngps-slides

• • •

Missing some Tweet in this thread? You can try to

force a refresh