Inflation as a distributional conflict – a thread 🧵 using UK data, with @JoshMartin_econ.

Inspired by @ojblanchard1, @paulkrugman, @david_glasner, @delong and others, here is some arithmetic (with apologies for some equations!) #EconTwitter

1/13

Inspired by @ojblanchard1, @paulkrugman, @david_glasner, @delong and others, here is some arithmetic (with apologies for some equations!) #EconTwitter

1/13

I’m using UK National Accounts data and identities to decompose UK inflation.

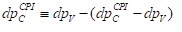

Identity 1: CPI inflation equals GDP inflation plus the wedge between CPI and GDP inflation.

2/13

Identity 1: CPI inflation equals GDP inflation plus the wedge between CPI and GDP inflation.

2/13

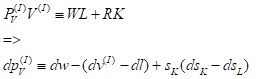

Identity 2: nominal GDP [from the income side] equals nominal payments to labour (L) and capital (K). Ignore taxes and subsidies.

So GDP inflation equals unit labour costs, plus the change in the capital/labour share ratio (weighted by capital-share).

3/13

So GDP inflation equals unit labour costs, plus the change in the capital/labour share ratio (weighted by capital-share).

3/13

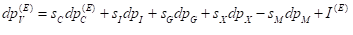

Identity 3: GDP inflation equals inflation in the expenditure components of GDP (e.g. consumption, investment, etc.) times their weights.

(This doesn’t quite add up, so there’s a residual for rounding and index number approximations.)

4/13

(This doesn’t quite add up, so there’s a residual for rounding and index number approximations.)

4/13

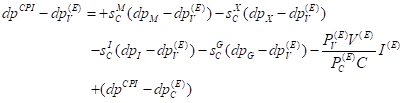

From this, the wedge between CPI and GDP inflation can be expressed as each of the GDP inflation contributions (as above), weighted relative to consumption, plus the difference between consumer expenditure inflation and CPI.

And below we’ll split trade into fuel/non-fuel.

5/13

And below we’ll split trade into fuel/non-fuel.

5/13

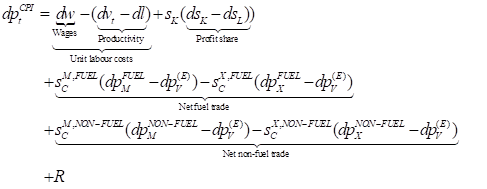

Combine: CPI inflation adds up to:

(a) labour cost inflation net of productivity growth

(b) relative capital/labour shares

(c) inflation from net trade in fuels

(d) inflation from net trade in non-fuels

(e) residual term (usually small)

6/13

(a) labour cost inflation net of productivity growth

(b) relative capital/labour shares

(c) inflation from net trade in fuels

(d) inflation from net trade in non-fuels

(e) residual term (usually small)

6/13

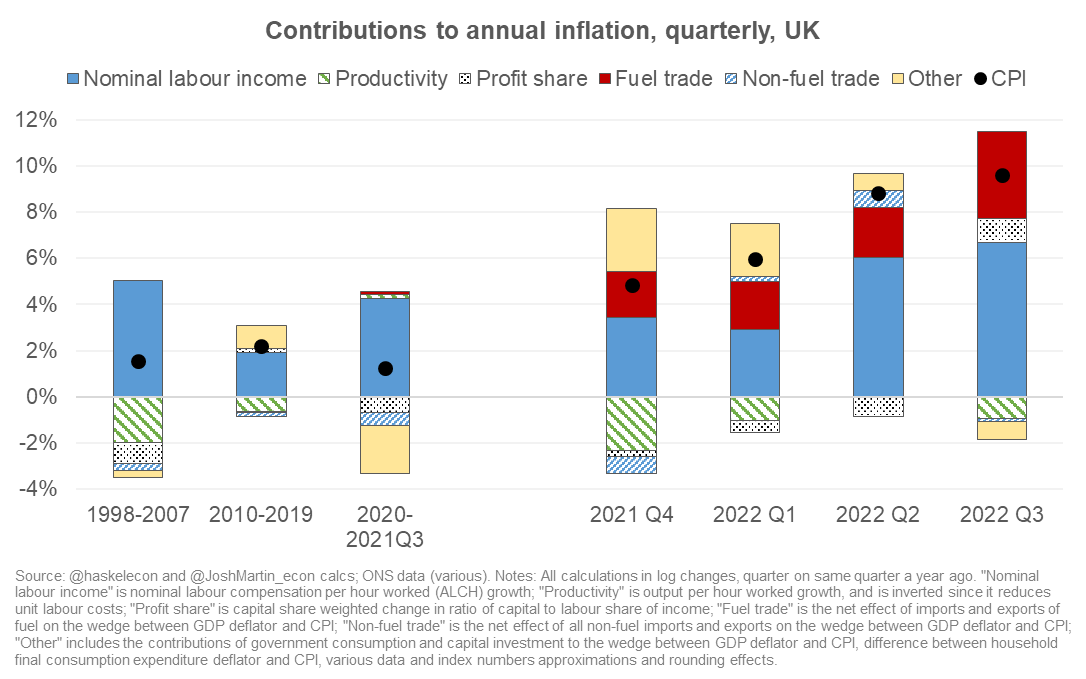

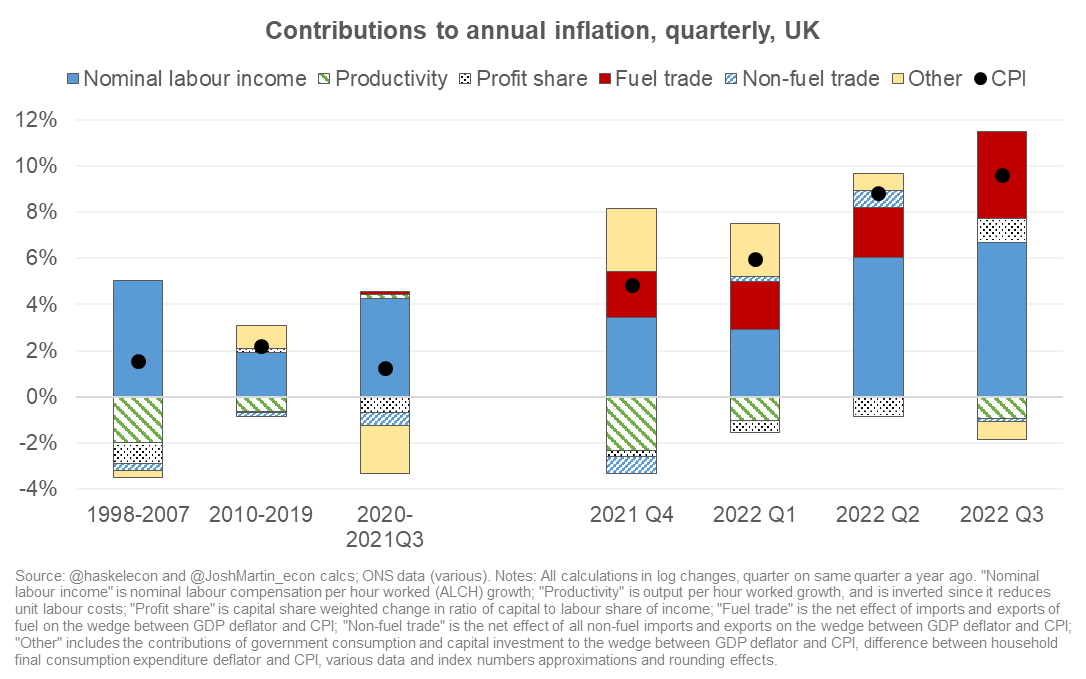

The chart shows UK data for the past and recent quarters.

On average before 2007, inflation from non-fuel trade was slightly negative.

Profit shares changed little. With 2% productivity growth, wage growth was 5%, but inflation was around target (2%).

7/13

On average before 2007, inflation from non-fuel trade was slightly negative.

Profit shares changed little. With 2% productivity growth, wage growth was 5%, but inflation was around target (2%).

7/13

From 2010 to the start of the pandemic, inflation was still around target. Profit shares largely unchanged. With weak productivity growth, nominal wage growth was much lower.

8/13

8/13

Over the height of the pandemic (2020 to 2021 Q3), furlough, other subsidies and government output measurement make the data volatile. Net fuel trade was not yet a big driver of inflation.

9/13

9/13

Since 2021 Q4, inflation is driven, arithmetically, by:

1. Energy inflation via traded fuel (red bars)

2. Slightly rising profit shares in 2022 Q3, but not before (dotted bars)

3. Faster nominal wage growth (blue bars) not offset by productivity gains (green stripes)

10/13

1. Energy inflation via traded fuel (red bars)

2. Slightly rising profit shares in 2022 Q3, but not before (dotted bars)

3. Faster nominal wage growth (blue bars) not offset by productivity gains (green stripes)

10/13

If you want to give this arithmetic a distributional interpretation (overseas, capital, labour), inflation has risen mostly via the rising claims of (mainly overseas) energy producers, somewhat by the rising claims of capital, and somewhat more by labour.

11/13

11/13

The terms of fuel trade have turned against us. So the UK is unavoidably poorer, as others have said:

bankofengland.co.uk/speech/2022/oc…

Viewed through the arithmetic of ‘distributional conflict’, to return inflation to target some group must accept lower claims on real income.

12/13

bankofengland.co.uk/speech/2022/oc…

Viewed through the arithmetic of ‘distributional conflict’, to return inflation to target some group must accept lower claims on real income.

12/13

That could either be labour (lower real wages), capital (lower profit shares), or overseas (lower import prices).

Of course, this pressure would be greatly eased by faster productivity growth...

13/13

Of course, this pressure would be greatly eased by faster productivity growth...

13/13

• • •

Missing some Tweet in this thread? You can try to

force a refresh