1. Company History

-Ador welding is incorporated in the year 1951

-The company went public in the year 1986

-In 1989, Ador welding began Project Engineering Business which is now known as Flares & Process Equipment Division

-The company is going to merge with Ador fontech in 2023

-Ador welding is incorporated in the year 1951

-The company went public in the year 1986

-In 1989, Ador welding began Project Engineering Business which is now known as Flares & Process Equipment Division

-The company is going to merge with Ador fontech in 2023

2. Welding Industry

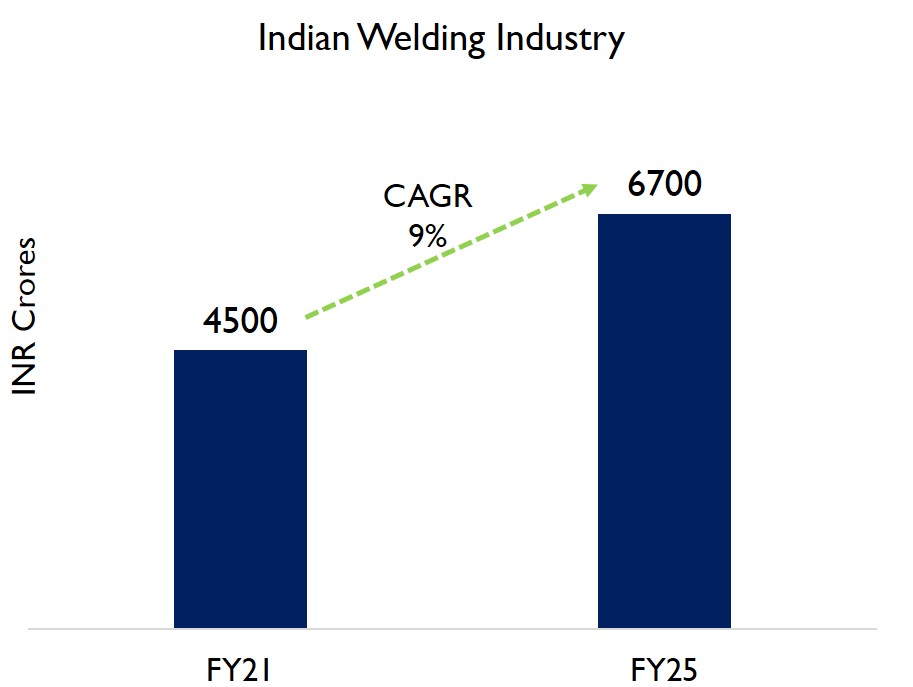

-Indian welding industry size was estimated at 4500 crores in FY21 and is expected to reach 6700 crores by FY25 with a CAGR of 9%

-Indian welding industry size was estimated at 4500 crores in FY21 and is expected to reach 6700 crores by FY25 with a CAGR of 9%

-Majority share of welding applications goes into Heavy engineering and Automotive industry, apart from these welding is also used in Construction, Railways and Ship building Industries.

3. Business Segments

-The company has 3 business segments

Welding Consumables

Equipments & Automation

Flares & Process Equipment Division

-In welding consumables, the company manufactures welding electrodes such as stick electrodes, continuous wire electrodes and

-The company has 3 business segments

Welding Consumables

Equipments & Automation

Flares & Process Equipment Division

-In welding consumables, the company manufactures welding electrodes such as stick electrodes, continuous wire electrodes and

different types of fluxes

-In addition to commonly used welding electrodes such as mild steel, cast iron, stainless steel, aluminium and copper, the company also manufactures custom electrodes

-In Equipment & Automation the company manufactures Welding equipment,

-In addition to commonly used welding electrodes such as mild steel, cast iron, stainless steel, aluminium and copper, the company also manufactures custom electrodes

-In Equipment & Automation the company manufactures Welding equipment,

Automated welding machines and Welding accessories like torches, gas regulators, holders, clamps, helmets, gloves and shoes etc.

-In the Flares & Process Equipment division the company manufactures Flares, and various other huge equipment like Aluminium silos -

-In the Flares & Process Equipment division the company manufactures Flares, and various other huge equipment like Aluminium silos -

which are used for external storage of bulk raw materials in powder or granules form, LPG tanks - which are used to store Liquid petroleum gas etc.

4. Market Share

-Breakdown of the welding industry is as follows

Welding consumables - 70%

Welding equipment - 15%

Cutting - 10%

4. Market Share

-Breakdown of the welding industry is as follows

Welding consumables - 70%

Welding equipment - 15%

Cutting - 10%

Automation - 5%

-Ador welding is 2nd largest player in welding consumables space and the company has a market share of 15% in the organised sector

-Organised market accounts for 70% of total market in welding consumables and remaining 30% is unorganised

-Ador welding is 2nd largest player in welding consumables space and the company has a market share of 15% in the organised sector

-Organised market accounts for 70% of total market in welding consumables and remaining 30% is unorganised

-In welding equipments, the company is the largest manufacturer but only has a market share of 5 to 6% of total equipments market

-The issue with welding equipment is that, despite the fact that Ador welding manufactures its own welding equipments, so many other companies import

-The issue with welding equipment is that, despite the fact that Ador welding manufactures its own welding equipments, so many other companies import

welding from overseas and sell it here, this is the reason why the company has less margins and less market share in welding equipments

-In welding equipments, Organised sector accounts for 65%, while the remaining 35% is unorganised

-In welding equipments, Organised sector accounts for 65%, while the remaining 35% is unorganised

5. Manufacturing Plants

-The company has manufacturing plants at Silvassa, Raipur, Chennai and Chinchwad

-From Silvassa, Raipur and Chennai the company manufactures welding consumables

-And from Chinchwad plant the company manufactures welding equipment's, additionally manages

-The company has manufacturing plants at Silvassa, Raipur, Chennai and Chinchwad

-From Silvassa, Raipur and Chennai the company manufactures welding consumables

-And from Chinchwad plant the company manufactures welding equipment's, additionally manages

project orders related to Flares & Process Equipment Division

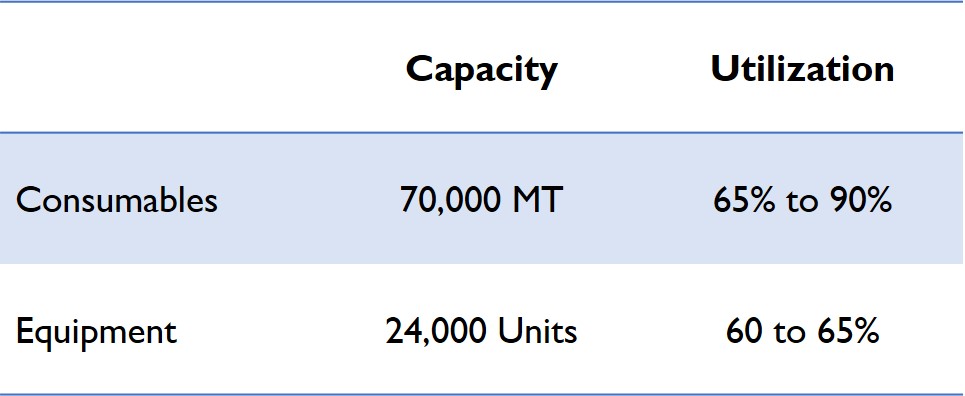

-Current capacity of consumables is 70,000 MT and the current capacity utilization is 65% for commodity products and 90% for higher value consumables

-Current capacity of Equipment's is around 24,000 units,

-Current capacity of consumables is 70,000 MT and the current capacity utilization is 65% for commodity products and 90% for higher value consumables

-Current capacity of Equipment's is around 24,000 units,

6.Raw Materials

-The company uses a variety of metals and minerals in manufacturing of welding consumables. The metals are often steel, nickel, manganese, and iron. The minerals aluminium, magnesium, limestone and titanium dioxide

-The company uses a variety of metals and minerals in manufacturing of welding consumables. The metals are often steel, nickel, manganese, and iron. The minerals aluminium, magnesium, limestone and titanium dioxide

-The majority of raw materials required for manufacturing of welding consumables are locally procured

-In the case of welding equipment, Imported raw material content has been reduced to 17.4% by FY22. All the electrical and electronics parts of the machines are developed

-In the case of welding equipment, Imported raw material content has been reduced to 17.4% by FY22. All the electrical and electronics parts of the machines are developed

in house and are being manufactured locally

7. Financials

-Revenues of the company are shown in the image below. Company had gross margins of 40% in FY11, which were subsequently reduced to roughly 30% in FY22

7. Financials

-Revenues of the company are shown in the image below. Company had gross margins of 40% in FY11, which were subsequently reduced to roughly 30% in FY22

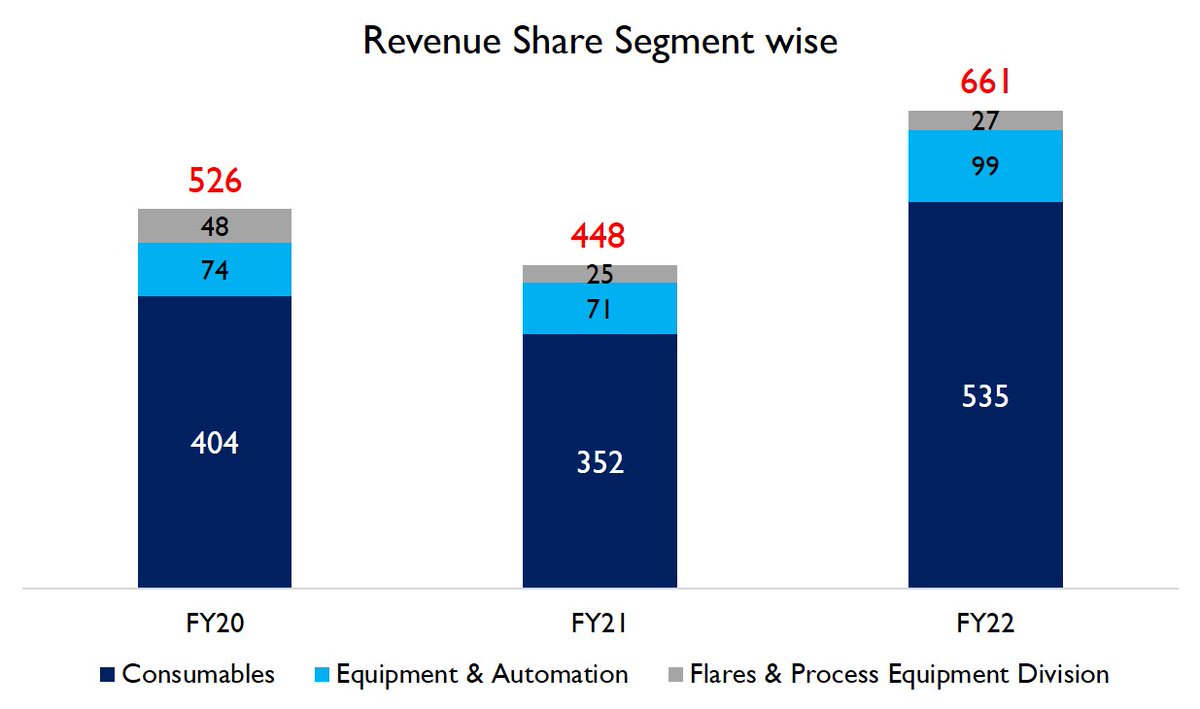

-The majority of the company's revenues come from consumables, which accounted for 80% of revenues in FY22. Segment wise revenue share of each business segment is as follows

-Historical average EBIT margins of Consumables business is around 12.5%

-EBIT margin for Equipment & Automation business is between 3 to 4%

-Flares & Process Engineering Equipment Division is in losses for the past few years

-EBIT margin for Equipment & Automation business is between 3 to 4%

-Flares & Process Engineering Equipment Division is in losses for the past few years

-Company has repaid INR 82 crores of debt from FY20 till FY22, the current debt to equity ratio is nearly zero

8.Merger

-Ador fontech is going to merge with Ador welding, the swap ratio for this merger is 5:46 i.e shareholders of Ador fontech will receive 5 shares of Ador welding for every 46 shares of Ador fontech they own

-Ador fontech is engaged in repair & refurbishment market which

-Ador fontech is going to merge with Ador welding, the swap ratio for this merger is 5:46 i.e shareholders of Ador fontech will receive 5 shares of Ador welding for every 46 shares of Ador fontech they own

-Ador fontech is engaged in repair & refurbishment market which

is approximately 10% of the overall welding market

-Ador welding has received a NOC from the stock exchanges for its merger with Ador fontec, and the company is in the process of filing with NCLT. Management has said NCLT approval may take a year or so in the latest concall

-Ador welding has received a NOC from the stock exchanges for its merger with Ador fontec, and the company is in the process of filing with NCLT. Management has said NCLT approval may take a year or so in the latest concall

9. Future Outlook

-After completion of this merger, Management said on a study state basis, consumables will become a 14 to 15% margin business, equipment business will have margins little less than consumables and flares business will probably be a single digit margin business

-After completion of this merger, Management said on a study state basis, consumables will become a 14 to 15% margin business, equipment business will have margins little less than consumables and flares business will probably be a single digit margin business

-The company recently received a large order from ONGC in the Flares and Process Equipment division worth 145 crores - Timeline for execution of this project is 30 months

-Company’s management has given guidance that exports will grow at 35% annual rate over the next few years.

-Company’s management has given guidance that exports will grow at 35% annual rate over the next few years.

The company has done exports worth 33 crores in FY22

-Additionally, increased infrastructure spending prior to 2024 elections will benefit the company in the short term.

-Additionally, increased infrastructure spending prior to 2024 elections will benefit the company in the short term.

Micro Cap Club :

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh