Detailed Analysis on the business of #AjmeraRealty - An undervalued opportunity in India’s Real Estate Segment🏡🏢🏣

CMP - ₹315

Like and retweet for maximum reach!!

CMP - ₹315

Like and retweet for maximum reach!!

1. Company Overview

-Ajmera Realty & Infra India Ltd is a real estate developer with a primary presence in the Mumbai Metropolitan Region (MMR). They also have a presence in other major cities like Bengaluru, Pune and Ahmedabad.

-They are best known for the development of the

-Ajmera Realty & Infra India Ltd is a real estate developer with a primary presence in the Mumbai Metropolitan Region (MMR). They also have a presence in other major cities like Bengaluru, Pune and Ahmedabad.

-They are best known for the development of the

Bhakti Park township in Wadala, Mumbai which consists of 3400 residential units and Ajmera I-Land which consists of 600+ residential units in Aeon, Zeon and Treon.

-Their primary focus is on residential real estate but they have a few commercial real estate projects as well.

-Their primary focus is on residential real estate but they have a few commercial real estate projects as well.

2. Wadala Land Parcel

-The company owned a 100 acre land parcel in Wadala which they have not completely finished developing. Of this 25 acres was sold to the government to develop a garden.

-Of the remaining 75 acres - 25 to 30 acres are available for future development and the

-The company owned a 100 acre land parcel in Wadala which they have not completely finished developing. Of this 25 acres was sold to the government to develop a garden.

-Of the remaining 75 acres - 25 to 30 acres are available for future development and the

rest was used for Bhakti Park and Aeon, Zeon and Treon. They have about 6.5 million square feet of development potential at Wadala.

-They will be demerging 6.5 acres of this land for the development of commercial property. This will eventually be sold to a REIT who will manage

-They will be demerging 6.5 acres of this land for the development of commercial property. This will eventually be sold to a REIT who will manage

the property.

3. Kanjurmarg Land Parcel

-The company also has another big land parcel in Kanjurmarg of 57 acres.

-There has been no development here as there is a dispute for the land for which the court case is pending.

-They have planned a project called Central Mumbai - 1

3. Kanjurmarg Land Parcel

-The company also has another big land parcel in Kanjurmarg of 57 acres.

-There has been no development here as there is a dispute for the land for which the court case is pending.

-They have planned a project called Central Mumbai - 1

which will be launched when the court case has been settled.

4. Ajmera Manhattan

-This is the company’s flagship project located in Wadala. It was launched in April 2022 and 33% of the inventory has already been sold in 8 months.

-It is a compact luxury project with 540 flats

4. Ajmera Manhattan

-This is the company’s flagship project located in Wadala. It was launched in April 2022 and 33% of the inventory has already been sold in 8 months.

-It is a compact luxury project with 540 flats

of 2 & 3 BHK. Realizations for the project are about ₹25,000-30,000 per square foot and the company has about 35-40% EBITDA margins

-The project has a maximum revenue potential of ₹1500 Cr of which ₹108 Cr has been recognized in the books. The rest will be recognized over the

-The project has a maximum revenue potential of ₹1500 Cr of which ₹108 Cr has been recognized in the books. The rest will be recognized over the

next 4 years.

-The company has also planned Manhattan 2 - which will be a project of equal size (₹1500 Cr) and will be launched when 60-70% of the inventory from Manhattan has been sold. So the expected launch would be somewhere around December 2024.

-The company has also planned Manhattan 2 - which will be a project of equal size (₹1500 Cr) and will be launched when 60-70% of the inventory from Manhattan has been sold. So the expected launch would be somewhere around December 2024.

5. Ajmera Greenfinity

-This is their affordable housing project in Wadala consisting of 1 and 1.5 BHK flats.

-It is a ₹192 Cr project. They have already sold ₹142 Cr worth of inventory which is about 74% of the total potential and ₹106 Cr worth of revenue has been

-This is their affordable housing project in Wadala consisting of 1 and 1.5 BHK flats.

-It is a ₹192 Cr project. They have already sold ₹142 Cr worth of inventory which is about 74% of the total potential and ₹106 Cr worth of revenue has been

recognized in the books

6. Ajmera Sikova

-This is the company’s commercial project in Ghatkopar West, consisting of boutique offices.

It is a ₹248 Cr project of which ₹163 Cr (~66%) worth of sales have been done and they have recognized ₹93 Cr of revenues.

6. Ajmera Sikova

-This is the company’s commercial project in Ghatkopar West, consisting of boutique offices.

It is a ₹248 Cr project of which ₹163 Cr (~66%) worth of sales have been done and they have recognized ₹93 Cr of revenues.

-They will be giving possession by March 2023

7. Ajmera Nucleus A, B and C

-This is their mid-market residential project in Bangalore. They have already received the OC for Nucleus A and B whereas Nucleus C is under construction.

-It is a ₹237 Cr project of which ₹180 Cr(~76%)

7. Ajmera Nucleus A, B and C

-This is their mid-market residential project in Bangalore. They have already received the OC for Nucleus A and B whereas Nucleus C is under construction.

-It is a ₹237 Cr project of which ₹180 Cr(~76%)

worth of inventory has been sold and ₹160 Cr has already been recognized in the books

8. Ajmera Nucleus Commercial

-This is their commercial building in the Nucleus Project. The construction has been completed and the OC has been received.

8. Ajmera Nucleus Commercial

-This is their commercial building in the Nucleus Project. The construction has been completed and the OC has been received.

-It is a ₹105 Cr project and the whole building will be sold to a single buyer. So the entire revenue from this project will be recognized in any one quarter

9. Ajmera Lugaano & Florenza

-These are their affordable housing projects in Bengaluru. They are both currently under

9. Ajmera Lugaano & Florenza

-These are their affordable housing projects in Bengaluru. They are both currently under

construction.

-Lugaano is an ₹86 Cr project of which about ₹35 Cr (~41%) of sales have been done.

-Florenza is a ₹105 Cr project of which only ₹8 Cr worth of sales have been done.

-None of the revenue from these projects have been recognized in the books yet.

-Lugaano is an ₹86 Cr project of which about ₹35 Cr (~41%) of sales have been done.

-Florenza is a ₹105 Cr project of which only ₹8 Cr worth of sales have been done.

-None of the revenue from these projects have been recognized in the books yet.

10. UK Projects

-The company has done about four projects in the UK across residential, commercial, affordable and student-housing categories.

-The total repatriation amount is about ₹70-80 Cr of which ₹5 Cr has been received till Q2 of FY23 and the rest is expected to be

-The company has done about four projects in the UK across residential, commercial, affordable and student-housing categories.

-The total repatriation amount is about ₹70-80 Cr of which ₹5 Cr has been received till Q2 of FY23 and the rest is expected to be

received by the end of CY2023

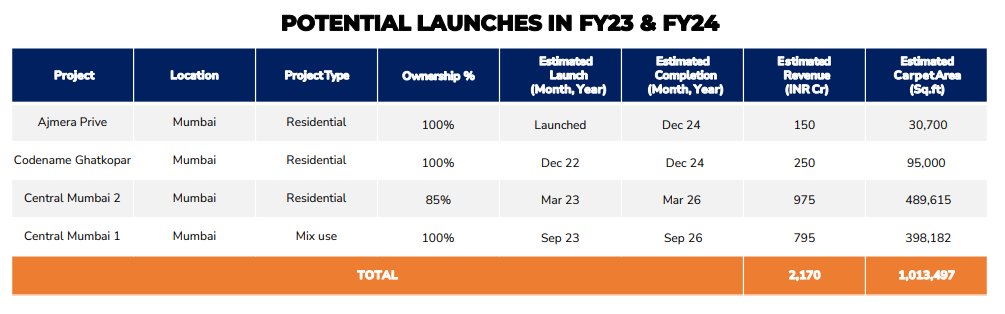

11. Future Launches

-The company has planned 4 projects that will be launched in FY23 and FY24. All of these projects are in Mumbai.

-They have already launched Ajmera Prive and will be launching Codename Ghatkopar, Central Mumbai 1 and

11. Future Launches

-The company has planned 4 projects that will be launched in FY23 and FY24. All of these projects are in Mumbai.

-They have already launched Ajmera Prive and will be launching Codename Ghatkopar, Central Mumbai 1 and

Central Mumbai 2 over the next few quarters

12. Ajmera Prive

-This is the company’s high-end luxury project located in Juhu, Mumbai. It is a redevelopment project which will consist of 3 & 4 BHK residences.

-It has been launched and is a very high value project for the company

12. Ajmera Prive

-This is the company’s high-end luxury project located in Juhu, Mumbai. It is a redevelopment project which will consist of 3 & 4 BHK residences.

-It has been launched and is a very high value project for the company

as the average ticket size for this project is about ₹6 Cr.

-It is a ₹150 Cr project with estimated carpet area of 30,700 square feet. This comes up to about ₹48,000-49,000 per square foot.

-The existing structure has been demolished and construction has begun. The project is

-It is a ₹150 Cr project with estimated carpet area of 30,700 square feet. This comes up to about ₹48,000-49,000 per square foot.

-The existing structure has been demolished and construction has begun. The project is

expected to be completed in December 2024.

13. Codename Ghatkopar

-This will be a residential project in Ghatkopar, Mumbai. It is a ₹250 Cr project which is expected to be launched in Q3 FY23 and complete by December 2024

-It is a half acre land parcel which the company had

13. Codename Ghatkopar

-This will be a residential project in Ghatkopar, Mumbai. It is a ₹250 Cr project which is expected to be launched in Q3 FY23 and complete by December 2024

-It is a half acre land parcel which the company had

acquired from Tata Communications.

13. Central Mumbai 1 & 2

-Central Mumbai 1 will be built on a 57 acre land parcel in Kanjurmarg. It will be a mix of both residential and commercial projects. Expected revenue from this project is about ₹795 Cr

13. Central Mumbai 1 & 2

-Central Mumbai 1 will be built on a 57 acre land parcel in Kanjurmarg. It will be a mix of both residential and commercial projects. Expected revenue from this project is about ₹795 Cr

-Central Mumbai 2 will be a residential project in Bhandup. It is a slum redevelopment project with revenue potential of ₹975 Cr and will be launched in Q4 FY23

14. Moving to asset light model

-The company is looking to move to an asset light model. Until now, they had 100%

14. Moving to asset light model

-The company is looking to move to an asset light model. Until now, they had 100%

ownership of the land parcels that they developed.

-The entire industry is moving to a JV and joint development model as most of the industry players had gone on a land acquiring spree at an elevated cost leading up to 2008 which ended up backfiring.

-The entire industry is moving to a JV and joint development model as most of the industry players had gone on a land acquiring spree at an elevated cost leading up to 2008 which ended up backfiring.

-The Juhu project is the first project under this asset light model and the company is in talks for 10-15 other redevelopment projects

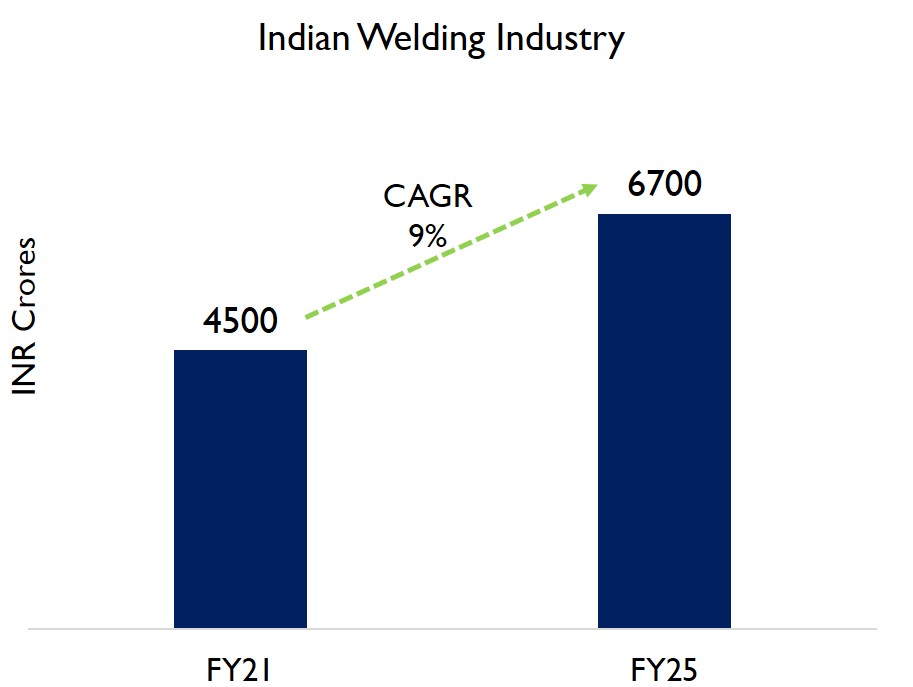

15. Industry tailwinds

-The real estate sector has seen a very good recovery post the pandemic and the inventory has reduced significantly.

15. Industry tailwinds

-The real estate sector has seen a very good recovery post the pandemic and the inventory has reduced significantly.

-There is lots of inventory coming online over the next few years due to high demand.

The Maharashtra government in January 2021 cut construction premiums paid by builders by 50%. Many industry players including Ajmera took advantage of this.

The Maharashtra government in January 2021 cut construction premiums paid by builders by 50%. Many industry players including Ajmera took advantage of this.

-They had to pay about ₹400 Cr worth of premiums for Manhattan which ended up being ₹200 Cr which resulted in a huge cost saving for the company.

16. Financials

-The company had revenues of ₹237.8 Cr for the first half of FY23 which is 2% growth over H1FY22. EBITDA margin for

16. Financials

-The company had revenues of ₹237.8 Cr for the first half of FY23 which is 2% growth over H1FY22. EBITDA margin for

the half year was at 24.28% for H1 FY23.

-The margins are expected to improve due to better product mix as most future launches are in Mumbai where realizations are better.

-The margins are expected to improve due to better product mix as most future launches are in Mumbai where realizations are better.

-The company is showing good sales momentum in FY23. Pre-sales were at ₹694 Cr in 9M FY23 which is 124% increase over the same period last year.

-Collections were at 429 Cr for 9M FY23 which is a 42% increase over the same period last year

-Collections were at 429 Cr for 9M FY23 which is a 42% increase over the same period last year

-They have about ₹890 Cr of debt on their balance sheet. Of this, ₹300-350 Cr is working capital or project finance debt. And the rest is long term debt that the company has taken to invest proactively for future projects.

-They are planning to reduce the long term debt to

-They are planning to reduce the long term debt to

₹50-100 Cr over the next couple of years. The collections from Manhattan and other projects will be used to aggressively pay down the debt.

17. Risks

-The recent hike in interest rates can cause a slow down in home-buying which could adversely affect revenues.

-The rate hike also affects the debt of the company which is already at a high rate of 11-12%. But they have saved more than ₹200 Cr from the 50% premium cut

-The recent hike in interest rates can cause a slow down in home-buying which could adversely affect revenues.

-The rate hike also affects the debt of the company which is already at a high rate of 11-12%. But they have saved more than ₹200 Cr from the 50% premium cut

and the increased interest on the debt is much smaller than the benefit they got.

Micro Cap Club :

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh