1/ 2022 Echo Bubble - Full thesis

A thread presenting evidence for a mid term bottom and oncoming "echo bubble" with thorough confluence from technical analysis, onchain data, and exchange/derivatives data

A thread presenting evidence for a mid term bottom and oncoming "echo bubble" with thorough confluence from technical analysis, onchain data, and exchange/derivatives data

/2 From a TA perspective, we have just given every person that considers technicals in their trading/investing reason to start to look for long exposure. $BTC & $ETH have broken above diagonal trendlines & MAs, started weekly momentum crossovers, reclaimed important supports

3/ The most important indicator of an oncoming rally is the weekly RSI crossover from a previous very long period of bearish momentum implying large potential energy for a move higher based on a supply squeeze.

https://twitter.com/Rewkang/status/1614430547702583296

4/ This supply squeeze is shown by various onchain metrics from BTC and ETH on exchanges (fallen past pre-bull run levels) and reduction of sell pressure from miners

5/ A large driver of bearish momentum in 2022 was overlevered miners that turned into forced sellers - needing to sell their BTC rewards & also their stockpiles. The recent trend reversal in network hashrate show that after some major capitulations, miner health has stabilized

6/ Miners no longer have the luxury of the transaction fees of a bull market and this is reflective of the bottoming process of previous cycles

7/ The USD value of supply issuance relative to its 365MA (Puell Multiple) is also in bottom territory indicating that miners able to withstand this sharp cut to their top line are quite hardy

8/ Current overall holders can also be considered extremely hardy given the aggregate holderbase has suffered an extreme amount of drawdown, but as of recent are no longer underwater

9/ Even though aggregate holders are no longer underwater, they still hold a very large amount of stables relative to total crypto market cap which can serve as rocket fuel for a trending move up

FOs, Macro funds, SWFs, Retail, Whales,, crypto funds, etc are all potential buyers

FOs, Macro funds, SWFs, Retail, Whales,, crypto funds, etc are all potential buyers

10/ Historically, we’ve seen that the largest/longest rallies typically follow periods of low volatility. As in turns out, we are at historically low levels of volatility

11/ The current state of derivatives also allow space for a rally given leveraged longs have not yet come in to push the market up. Futures basis is trading near 0, similar to just before the last bull run

12/ It's clear crypto has seen a lack of interest from the general public for quite some time. Search volumes and exchange volumes have finally fallen to 2020 levels

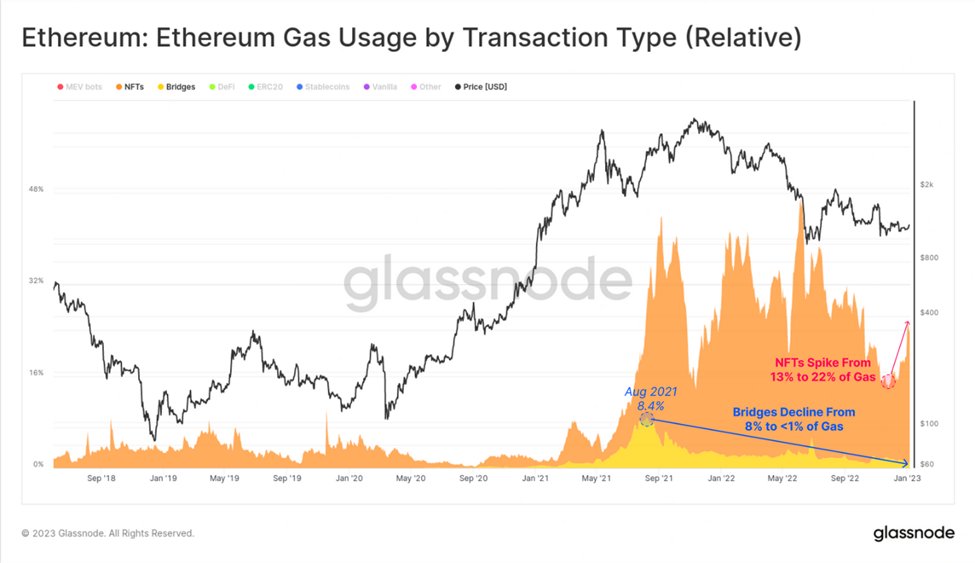

13/ But the recent revival in NFT activity could be the right catalyst to draw interest back into the space. NFT activity has kickstarted onchain activity which fell to local lows as excitement starts to come back to this space

14/ The activity results in potentially an accelerating rate of $ETH burn which compounds the supply side effects of Ethereum’s switch from PoW to PoS

15/ “But what about macro”

last time SPX was at these levels in previous years was around April 2020. At that point, crypto was mid bull run and was trading at $2T market cap, almost 2x current crypto market cap. There is still plenty of liquidity for risk assets

last time SPX was at these levels in previous years was around April 2020. At that point, crypto was mid bull run and was trading at $2T market cap, almost 2x current crypto market cap. There is still plenty of liquidity for risk assets

16/ With Mt Gox release delayed to September, FTX having sold most customer assets, major players liquidated and many other assets tied up in bankruptcy proceedings, supply is significantly reduced

17/ Overall market positioning (very underallocated) sets up the foundation for a large multiweek to multi month echo bubble

Double bubble was meme’d into reality - why can’t echo bubble?

Double bubble was meme’d into reality - why can’t echo bubble?

H/T @GCRClassic for popularizing the Echo Bubble concept for crypto

H/T @WClementeIII @glassnode @coinglass_com @woonomic for data

H/T @WClementeIII @glassnode @coinglass_com @woonomic for data

2023 echo bubble*

• • •

Missing some Tweet in this thread? You can try to

force a refresh