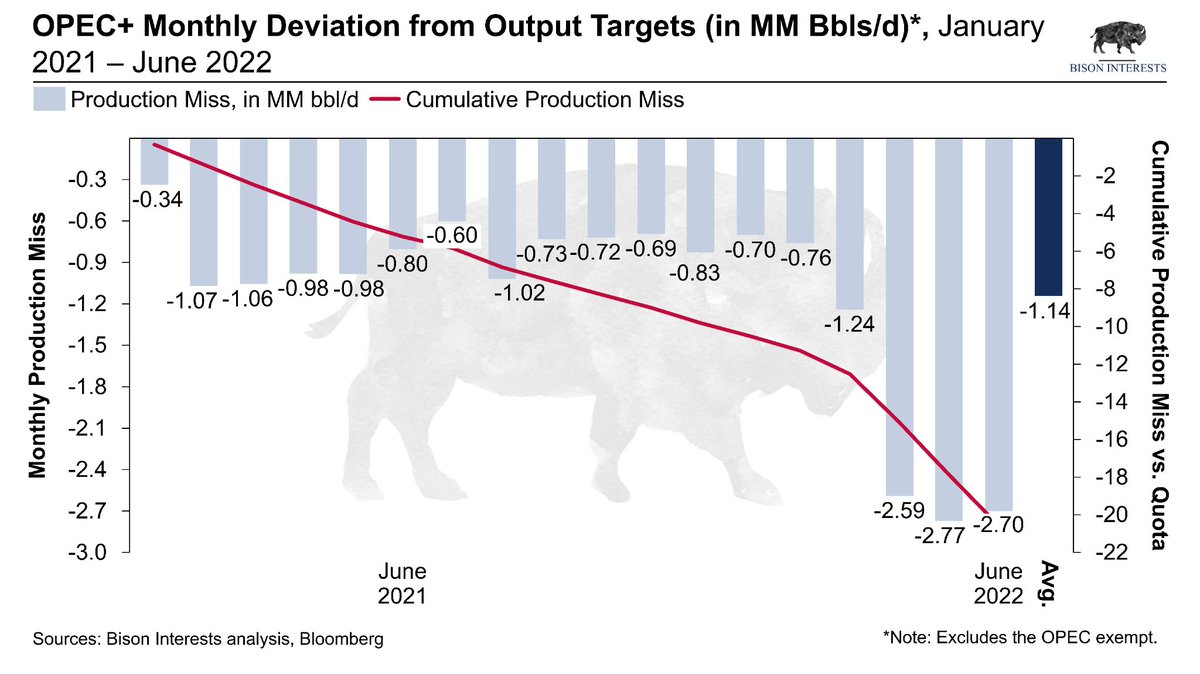

OPEC+ continues to miss oil production quotas, despite a recent cut. Total production for OPEC+ countries (excluding the OPEC exempt) was 38.3, falling short of the 40.1 quota by 1.8 MM bbl/d. Misses vs. quota are getting smaller vs. what they were prior to the cut. #oil #opec

The total cumulative shortfall of oil supplied to market by OPEC+ is almost 1.1B bbls since we started sharing these metrics in January 2021.

Saudi Arabia’s production is down a bit this month, and still below quota. Russian production is down a bit. OPEC 13 production decreased by 0.09 MM bbl/d.

• • •

Missing some Tweet in this thread? You can try to

force a refresh