I talked with @africasacountry about the new nonalignment & polycrisis in global south

-policy induced global recession

-breakdown in West-China-Russia relations.

-societies boil coz of inflation

-explosive electoral politics of dollar debt crisis

podcast:africasacountry.com/2023/01/third-…

-policy induced global recession

-breakdown in West-China-Russia relations.

-societies boil coz of inflation

-explosive electoral politics of dollar debt crisis

podcast:africasacountry.com/2023/01/third-…

2/ Thanks to @africasacountry for interviewing me about my Nonalignment article where I argued stance of middle powers is a bargaining chip

Delhi, Jakarta, Brasilia, etc want tech transfer,military hardware etc. They want to play US & China off each other

phenomenalworld.org/analysis/non-a…

Delhi, Jakarta, Brasilia, etc want tech transfer,military hardware etc. They want to play US & China off each other

phenomenalworld.org/analysis/non-a…

3/ Uprising in Sri Lanka illustrates age of "polycrisis"

Mask - Corona crisis.

Bread - Food crisis

Fire - Petrol crisis

Banks - Dollar debt crisis

Thread tracking explosive politics of debt esp in global south @africasacountry

africasacountry.com/2023/01/third-…

Mask - Corona crisis.

Bread - Food crisis

Fire - Petrol crisis

Banks - Dollar debt crisis

Thread tracking explosive politics of debt esp in global south @africasacountry

africasacountry.com/2023/01/third-…

https://twitter.com/70sBachchan/status/1511163700023017476

Debt default is right move for Ghana facing crippling depreciation. Once the success story for foreign investors, as they pull money out to the Core, it is facing Impossible choices between food, electricity & health of its citizens versus bondholders.

https://twitter.com/David_McNair/status/1600949602932633600

5/ Global debt crisis gets worse and worse as Fed hikes interest rates. Private dollar debt holders set to benefit. theguardian.com/world/2022/sep……

Economists write open letter to BlackRock asking them to take a haircut instead of profiting off Zambia’s debt.

debtjustice.org.uk/wp-content/upl…

Economists write open letter to BlackRock asking them to take a haircut instead of profiting off Zambia’s debt.

debtjustice.org.uk/wp-content/upl…

6/ Higher interest rates is blowing up the debt of the 55 most vulnerable countries in the world. Their growth was already whacked by climate & corona crisis.

Who owns their debt? Mainly dollar creditors

@KevinPGallagher @rishirbhandary @GalloglyNelson

bu.edu/gdp/files/2022…

Who owns their debt? Mainly dollar creditors

@KevinPGallagher @rishirbhandary @GalloglyNelson

bu.edu/gdp/files/2022…

7/"We may be entering a period where the growing cost of dollar-denominated capital will force African countries to embark on austerity programs of similar severity to those in the 1980s, which had ruinous results for African societies" ht @Alden_Young phenomenalworld.org/analysis/pessi…

8/ 2023 is going to see a surge og countries defaulting on debt as bond payments come due. Can debtor cartels push IMF to provide liquidity at easy terms?

"if a country is underwater, pouring more water, getting more debt, is not the best way to help"

imf.org/en/News/Articl…

"if a country is underwater, pouring more water, getting more debt, is not the best way to help"

imf.org/en/News/Articl…

9/ Kenya, Ethiopia, Ghana were the most important success stories in Africa. Yet their tax to GDP ratio's bases hardly expanded during boom

Now interest payments are taking almost 60% of govt revenue in Ghana! @adam_tooze reads the 'thunder of history'

adamtooze.substack.com/p/finance-and-…

Now interest payments are taking almost 60% of govt revenue in Ghana! @adam_tooze reads the 'thunder of history'

adamtooze.substack.com/p/finance-and-…

10/ Countries should default on their debt & focus on the interests of people rather than bondholders. Sri Lanka defaulted last year

Ghana has stopped payments on its eurobonds & bonds held by domestic creditors. I discuss politics of debt in interview africasacountry.com/2023/01/third-…

Ghana has stopped payments on its eurobonds & bonds held by domestic creditors. I discuss politics of debt in interview africasacountry.com/2023/01/third-…

11/ In the interview, we discussed how countries in debt crisis are leveraging their nonaligned stance to get better restructuring terms from Western and Chinese creditors. Sri Lanka, Pakistan, Egypt are going to India, China, UAE for credit lines africasacountry.com/2023/01/third-…

12/ In our new Polyrcisis project we track what developing countries are doing to change existing world-order that's against them. They have shortages of money, stuff, technology. West denies them tech to make their own mRNA vaccines or IP-free green tech

https://twitter.com/70sBachchan/status/1608878657178832896

13/ Will dollar hegemony weaken after 2022, asked @africasacountry

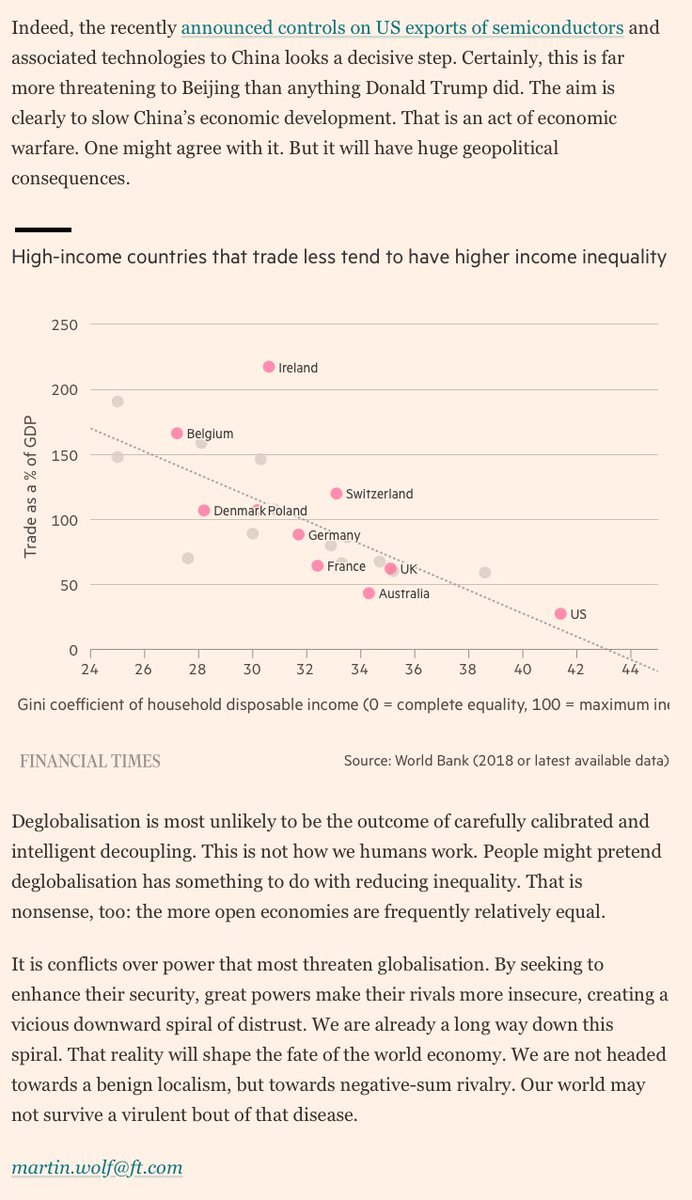

My answer: G7's Financial war on Russia has changed the calculations of every regional power with interests independent of Washington. Investor-blocs in middle powers will choose autonomy versus toeing the line

My answer: G7's Financial war on Russia has changed the calculations of every regional power with interests independent of Washington. Investor-blocs in middle powers will choose autonomy versus toeing the line

14/ Given perfect storm of inflation, monetary tightening, soaring energy and food prices, and debt crisis, we must be prepared for an extended period of global instability.

@leee_harris on the UN report that is being read in non-Western capitals with fear

prospect.org/world/developi…

@leee_harris on the UN report that is being read in non-Western capitals with fear

prospect.org/world/developi…

15/ That US is the worlds largest producer of Oil is well known. That it produces same carbon emissions as all of Africa, much of central Asia,& South America combined is less known.

"The remaining 2C Carbon Budget is a development budget"-@KenCaldeira

"The remaining 2C Carbon Budget is a development budget"-@KenCaldeira

https://twitter.com/70sBachchan/status/1321650569065410560

16/ Societies boil when food prices shoot up. What happened after the last Crash - when over 4 dozen countries were disrupted - is a terrifying preview of the chaos that deregulated Chicago & London commodity markets create.

I reviewed Price Wars :

prospect.org/culture/books/…

I reviewed Price Wars :

prospect.org/culture/books/…

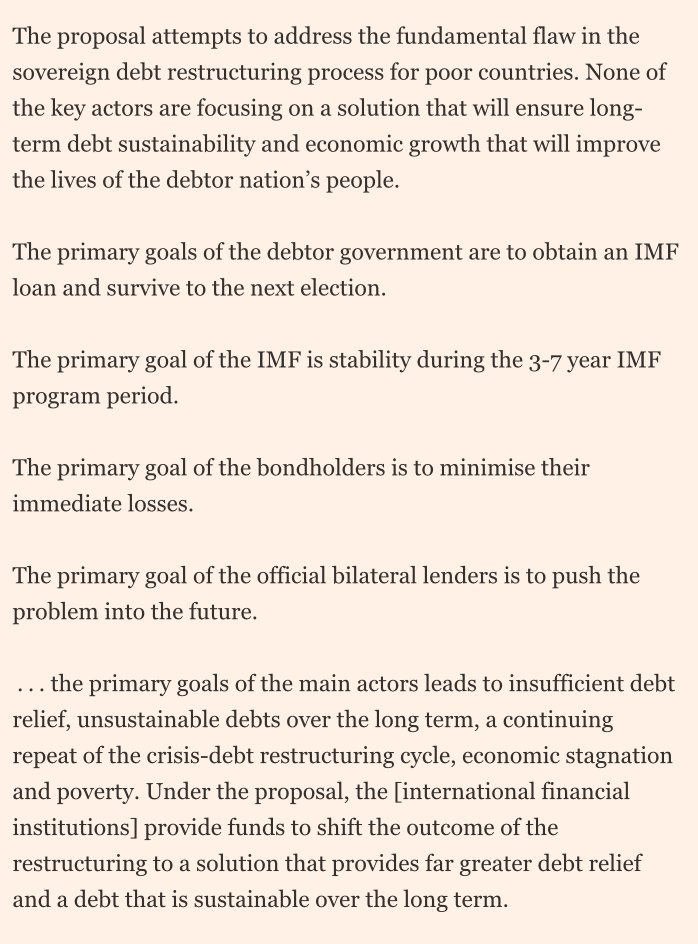

17/ "Countries insist on paying. They insist on paying through pandemics, through famines, through wars" - @AGelpern

Debt Restructuring is a classic Mexican Standoff. Nice article on latest proposals ht @RobinWigg ft.com/content/33ef9a…

Debt Restructuring is a classic Mexican Standoff. Nice article on latest proposals ht @RobinWigg ft.com/content/33ef9a…

18/The answer to "Do you want to contain China with us?" is probably "yes". But the answer to the question, "do you want to contain China AND Russia with us?" is probably "no"

Postcolonial elites who run economies larger than G7 cannot be bullied,we argue phenomenalworld.org/analysis/non-a…

Postcolonial elites who run economies larger than G7 cannot be bullied,we argue phenomenalworld.org/analysis/non-a…

19/ Nonalignment stance has forced G7 to pay attention to ruffled feathers in G77 & compensate with tech/trade/$. In our Polycrisis panel @AvinashPersau15 pointed out that Loss & Damage at COP27 came about coz developing countries stuck together against US

phenomenalworld.org/analysis/money…

phenomenalworld.org/analysis/money…

20/ Yellen is visiting Africa after Chinese FM visit. "Partial debt reductions would allow a country to invest and grow and pay back some of the reduced debt

Lenders would get less if a country "falls into economic chaos" than if it can invest and grow

reuters.com/markets/failur…

Lenders would get less if a country "falls into economic chaos" than if it can invest and grow

reuters.com/markets/failur…

21/ Not just Yellen & China's FM visits. S Africa will hold mil drills with Chinese & Russian navies on February 17". Lavrov will visit Eswatini, Botswana & Angola. He returns in Feb to visit Tunisia, Mauritania, Algeria & Morocco. issafrica.org/iss-today/serg…

https://twitter.com/eleonoratafuro/status/1617471498003922945

22/ Painful. "Monetary policy committees in Nigeria, South Africa and Kenya will likely proceed more gingerly in raising borrowing costs, while Mozambique’s is forecast to stand pat and Angola’s will probably remain an outlier and cut rates." ht @malingha

bloomberg.com/news/newslette…

bloomberg.com/news/newslette…

23/ How to #CancelTheDebt? Most bonds are governed by English or New York law.

@tim_jones6 suggests legislation in UK/NY to compel private bondholders to take part in debt relief for developing countries. Can Western progressives push legislatures?

ft.com/content/889fec…

@tim_jones6 suggests legislation in UK/NY to compel private bondholders to take part in debt relief for developing countries. Can Western progressives push legislatures?

ft.com/content/889fec…

24/ "Two of the world's most powerful finance officials are visiting Zambia this week, a reflection of the growing concern shared by Western officials about how China and other creditors are handling the African country's debt."

reuters.com/world/africa/v…

reuters.com/world/africa/v…

25/ Thirteen outside powers have 47 military bases in Africa. @FofackHippolyte protests how superpowers, view Africa exclusively through the prism of their economic & geopolitical interests. That undermines home grown solutions and regional integration.

project-syndicate.org/commentary/afr…

project-syndicate.org/commentary/afr…

26/ US Treasury to designate Wagner group as transnational criminal org. Next step could be US Sanctions on any country that have asked Russian military help against insurgents. Central African Republic, Libya, Mali, Mozambique... apnews.com/article/united…

https://twitter.com/VFelbabBrown/status/1616514577348395009

27/ An empire by invitation? "Presidents Nyusi of Mozambique, Mohamud of Somalia,& Bazoum of Niger joined African Union Chair Mahamat in appealing for more US security & counterterrorism aid."

Careful what you wish for ht @samar42 theintercept.com/2023/01/19/us-…

Careful what you wish for ht @samar42 theintercept.com/2023/01/19/us-…

https://twitter.com/70sBachchan/status/1451220046571835397

28/ Latest newseltter about to go out on @polycrisis in Africa in minutes. Western-Africa relations, inflation-induced social pressures, debt crises and electoral explosions...

Sign up on the link at the bottom here to get it fresh in your inbox! phenomenalworld.org/series/the-pol…

Sign up on the link at the bottom here to get it fresh in your inbox! phenomenalworld.org/series/the-pol…

29/ What 'scramble to Africa'?

It is a travesty, as @FofackHippolyte the director of African Export-Import bank points out, that Canada got more FDI in 2020 than fifty-four African countries put together

Our newsletter on 'New Cold War' @phenomenalworld phenomenalworld.org/analysis/dont-…

It is a travesty, as @FofackHippolyte the director of African Export-Import bank points out, that Canada got more FDI in 2020 than fifty-four African countries put together

Our newsletter on 'New Cold War' @phenomenalworld phenomenalworld.org/analysis/dont-…

30/ US investment position is dramatically underweight Africa. Despite lawmakers seeing the continent as big player in the next century,& key to reviving sluggish demand, US plans to invest just $55 billion over the next 3 years

phenomenalworld.org/analysis/dont-…

phenomenalworld.org/analysis/dont-…

https://twitter.com/GDP_Center/status/1617892193884336128

31/ Debt crisis gets worse

-Steep interest bill from Central banks raising rates

-Strong dollar means country pay more in weaker currency

-Higher import bills of food & energy

Result? Societies boiling & Political explosions. My chat with @africasacountry

-Steep interest bill from Central banks raising rates

-Strong dollar means country pay more in weaker currency

-Higher import bills of food & energy

Result? Societies boiling & Political explosions. My chat with @africasacountry

32/ "True decolonization means overcoming intra-regional disputes to build lasting regional unity and sovereign integration among the peoples of the Global South ...in the spirit of Bandung" - @ecuarauz

Havana Congress declaration ht @ProgIntl

progressive.international/wire/2023-01-3…

Havana Congress declaration ht @ProgIntl

progressive.international/wire/2023-01-3…

33/ “Dollar power” has also given US governments the ability to use the world’s system of Dollar-denominated reserves to pursue its perceived national geopolitical interests—as seen in the recent decisions to freeze Afghan & Russian Dollar reserves"

Thread

Thread

https://twitter.com/plbds/status/1618637427127746566

34/Africa has a mountain of debt,estimated at $645 billion. Growth needs cancellation.

China has been adamant that multilateral development banks, as well as private creditors like BlackRock, which is the largest owner of Zambian bonds,accept losses too.

phenomenalworld.org/analysis/dont-…

China has been adamant that multilateral development banks, as well as private creditors like BlackRock, which is the largest owner of Zambian bonds,accept losses too.

phenomenalworld.org/analysis/dont-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh